2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (13) - USD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (13) - USD

Earn total guaranteed minimum interest of 6.900%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (13) – USD*. Get started with a minimum investment of US$5,000*.

- Total Guaranteed Minimum Interest of 6.900%* of the Principal Amount over 2 years (equivalent to an effective interest rate of 3.4406% per annum) if the Structured Deposit is held until maturity

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 2.000%* linked to 4 underlying US listed company shares*

Offer ends 21 November 2022^.

Speak to a UOB banker today

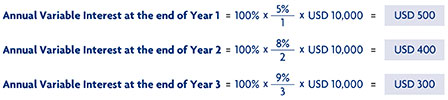

How it works:

Assuming a Principal Amount of US$10,000 is held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.450% | - | 3.450% |

| 2 (at Maturity) | 3.450% | 2.000% | 5.450% |

| Total interest payout | 6.900% | 2.000% | 8.900% |

| Principal + Interest payout | US$10,000 + US$690 + US$200 = US$10,890 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.450% | - | 3.450% |

| 2 (at Maturity) | 3.450% | 0.000% | 3.450% |

| Total interest payout | 6.900% | 0.000% | 6.900% |

| Principal + Interest payout | US$10,000 + US$690+ US$0 = US$10,690 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | United States Dollars (“USD” or “US$”) | ||||||||||

| Tenor | 2 Years | ||||||||||

| Offer Period | 3 Nov 2022 to 21 Nov 2022, or such earlier date as decided by the Bank | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 6.900% |

||||||||||

| Maturity Variable Interest | Interest If Payment Condition is met, Maturity Variable Interest Rate = 2.000%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 6.900%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 6.900% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by United Overseas Bank Limited (“UOB”) to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (13) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (13). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (13) is suitable for you. Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (13) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

November 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (12) - SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (12) - SGD

Earn total guaranteed minimum interest of 9.540%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (12) – SGD*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 9.540%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 3.1771% per annum) if the Structured Deposit is held until maturity

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.000%* linked to 4 underlying Singapore listed company shares*

Offer ends 21 November 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of S$10,000 is held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.180% | - | 3.180% |

| 2 | 3.180% | - | 3.180% |

| 3 (at Maturity) | 3.180% | 1.000% | 4.180% |

| Total interest payout | 9.540% | 1.000% | 10.540% |

| Principal + Interest payout | S$10,000 + S$954 + S$100 = S$11,054 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.180% | - | 3.180% |

| 2 | 3.180% | - | 3.180% |

| 3 (At Maturity) | 3.180% | 0,000% | 3.180% |

| Total interest payout | 9.540% | 0,000% | 9.540% |

| Principal + Interest payout | S$10,000 + S$954 + S$0 = S$10,954 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | Singapore Dollars (“SGD” or “S$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 3 Nov 2022 to 21 Nov 2022, or such earlier date as decided by the Bank | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 9.540% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.000%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 9.540%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 9.540% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by United Overseas Bank Limited (“UOB”) to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (12) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (12). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (12) is suitable for you. Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (12) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

November 2022

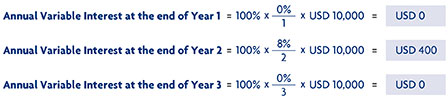

UOB Principal Guaranteed Structured Deposit 2022 - Series (11) - USD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (11) - USD

Earn total guaranteed minimum interest of 10.860%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (11) – USD*. Get started with a minimum investment of US$5,000*.

- Total Guaranteed Minimum Interest of 10.860%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 3.6164% per annum) if the Structured Deposit is held until maturity

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.500%* linked to 4 underlying US listed company shares*

Offer ends 21 October 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of US$10,000 is held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.620% | - | 3.620% |

| 2 | 3.620% | - | 3.620% |

| 3 (at Maturity) | 3.620% | 1.500% | 5.120% |

| Total interest payout | 10.860% | 1.500% | 12.360% |

| Principal + Interest payout | US$10,000 + US$1,086 + US$150 = US$11,236 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 3.620% | - | 3.620% |

| 2 | 3.620% | - | 3.620% |

| 3 (At Maturity) | 3.620% | 0,000% | 3.620% |

| Total interest payout | 10.860% | 0,000% | 10.860% |

| Principal + Interest payout | US$10,000 + US$1,086 + US$0 = US$11,086 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | United States Dollars (“USD” or “US$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 3 Oct 2022 to 21 Oct 2022, or such earlier date as decided by the Bank | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 10.860% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.500%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 10.860%* of the Principal Amount(Being Total Guaranteed Fixed Interest of 10.860% plus minimum Maturity Variable Interest of 0%) | ||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by United Overseas Bank Limited (“UOB”) to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (11) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (11). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (11) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (11) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

October 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (10) - SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (10) - SGD

Earn total guaranteed minimum interest of 8.940%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (10) – SGD*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 8.940%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 2.9771% per annum) if the Structured Deposit is held until maturity

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.000%* linked to 4 underlying Singapore listed company shares*

Offer ends 21 October 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of S$10,000 is held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.980% | - | 2.980% |

| 2 | 2.980% | - | 2.980% |

| 3 (at Maturity) | 2.980% | 1.000% | 3.980% |

| Total interest payout | 8.940% | 1.000% | 9.940% |

| Principal + Interest payout | S$10,000 + S$894 + S$100 = S$10,994 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.980% | - | 2.980% |

| 2 | 2.980% | - | 2.980% |

| 3 (At Maturity) | 2.980% | 0,000% | 3.980% |

| Total interest payout | 8.940% | 0,000% | 8.940% |

| Principal + Interest payout | S$10,000 + S$894 + S$0 = S$10,894 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | Singapore Dollars (“SGD” or “S$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 3 Oct 2022 to 21 Oct 2022, or such earlier date as decided by the Bank | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 8.940% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.000%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 8.940%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 8.940% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by United Overseas Bank Limited (“UOB”) to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (10) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (10). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (10) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (10) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

October 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (9) - AUD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 - Series (9) - AUD

Earn total guaranteed minimum interest of 7.125%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (9) – AUD*. Get started with a minimum investment of A$5,000*.

- Total Guaranteed Minimum Interest of 7.125%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 2.3727% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.425%* linked to 4 underlying Company Shares*

Offer ends 26 August 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of A$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.375% | - | 2.375% |

| 2 | 2.375% | - | 2.375% |

| 3 (at Maturity) | 2.375% | 1.425% | 3.800% |

| Total interest payout | 7.125% | 1.425% | 8.550% |

| Principal + Interest payout | A$10,000 + A$712.50 + A$142.50 = A$10,855 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.375% | - | 2.375% |

| 2 | 2.375% | - | 2.375% |

| 3 (At Maturity) | 2.375% | 0,000% | 2.375% |

| Total interest payout | 7.125% | 0,000% | 7.125% |

| Principal + Interest payout | A$10,000 + A$712.50 + A$0 = US$10,712.50 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | Australia Dollars (“AUD” or “A$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 17 Aug 2022 to 26 Aug 2022, or such earlier date as decided by the Bank | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 7.125% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.425%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 7.125%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 7.125% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (9) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (9). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (9) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (9) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

August 2022

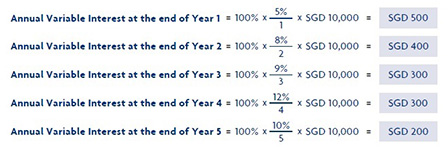

UOB Principal Guaranteed Structured Deposit 2022 - Series (8) – SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 - Series (8) – SGD

Earn total guaranteed minimum interest of 11.00%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (8) – SGD*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 11.00%* of the Principal Amount over 5 years (equivalent to an effective interest rate of 2.1987% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.40%* linked to 4 underlying Singapore Company Shares*

Offer ends 26 August 2022^.

Speak to a UOB banker today

How it works:

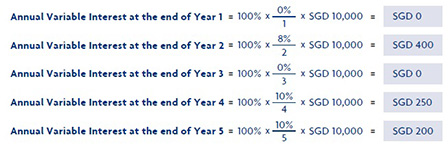

Assuming a Principal Amount of S$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.20% | - | 2.20% |

| 2 | 2.20% | - | 2.20% |

| 3 | 2.20% | - | 2.20% |

| 4 | 2.20% | - | 2.20% |

| 5 (at Maturity) | 2.20% | 1.40% | 3.60% |

| Total interest payout | 11.00% | 1.40% | 12.40% |

| Principal + Interest payout | S$10,000 + S$1,100 + S$140 = S$11,240 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.20% | - | 2.20% |

| 2 | 2.20% | - | 2.20% |

| 3 | 2.20% | - | 2.20% |

| 4 | 2.20% | - | 2.20% |

| 5 (at Maturity) | 2.20% | 0% | 2.20% |

| Total interest payout | 11.00% | 0% | 11.00% |

| Principal + Interest payout | S$10,000 + S$1,100+ S$0 = S$11,100 | ||

At a Glance

| Category | Details | ||||||||||||

| Investment Currency | Singapore Dollars (“SGD” or “S$”) | ||||||||||||

| Tenor | 5 Years | ||||||||||||

| Offer Period | 17 Aug 2022 to 26 Aug 2022, or such earlier date as decided by the Bank | ||||||||||||

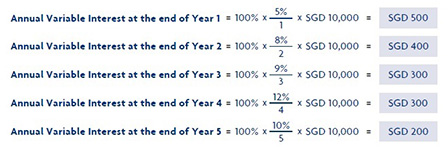

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 11.00% |

||||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.40%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||||

| Total Guaranteed Minimum Interest | 11.00%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 11.00% plus minimum Maturity Variable Interest of 0%) |

||||||||||||

| Shares in Underlying Basket |

|

||||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (8) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (8). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (8) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (8) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

August 2022

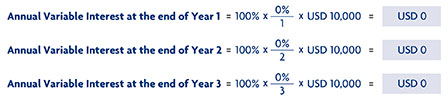

UOB Principal Guaranteed Structured Deposit 2022 - Series (7) - USD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 - Series (7) – USD

Earn total guaranteed minimum interest of 7.20%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (7) – USD*. Get started with a minimum investment of US$5,000*.

- Total Guaranteed Minimum Interest of 7.20%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 2.3977% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 2.00%* linked to 4 underlying United States Company Shares*

Offer ends 29 July 2022^.

Speak to a UOB banker today

How it works:

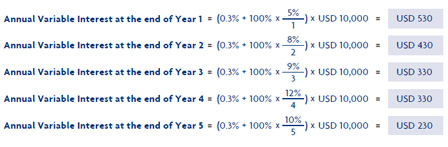

Assuming a Principal Amount of US$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.40% | - | 2.40% |

| 2 | 2.40% | - | 2.40% |

| 3 (at Maturity) | 2.40% | 2.00% | 4.40% |

| Total interest payout | 7.20% | 2.00% | 9.20% |

| Principal + Interest payout | US$10,000 + US$720 + US$200 = S$10,920 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.40% | - | 2.40% |

| 2 | 2.40% | - | 2.40% |

| 3 (at Maturity) | 2.40% | 0% | 2.40% |

| Total interest payout | 7.20% | 0% | 7.20% |

| Principal + Interest payout | US$10,000 + US$720 + US$0 = US$10,720 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | United States Dollars (“USD” or “US$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 14 July 2022 to 29 July 2022, or such earlier date as decided by the Bank | ||||||||||

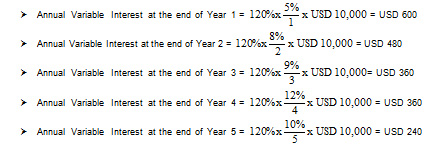

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 7.20% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 2.00%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 7.20%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 7.20% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (7) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (7). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (7) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (7) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

July 2022

UOB Principal Guaranteed, Structured Deposit 2022 - Series (6) – SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (6)

Earn total guaranteed minimum interest of 11.50%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (6) - SGD*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 11.50%* of the Principal Amount over 5 years (equivalent to an effective interest rate of 2.2986% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.40%* linked to 4 underlying United States Company Shares*

Offer ends 29 July 2022^.

Speak to a UOB banker today

How it works:

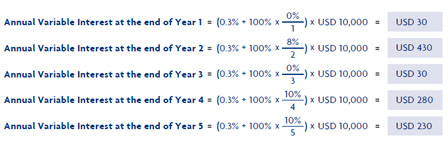

Assuming a Principal Amount of S$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.30% | - | 2.30% |

| 2 | 2.30% | - | 2.30% |

| 3 | 2.30% | - | 2.30% |

| 4 | 2.30% | - | 2.30% |

| 5 (at Maturity) | 2.30% | 1.40% | 3.70% |

| Total interest payout | 11.50% | 1.40% | 12.90% |

| Principal + Interest payout | S$10,000 + S$1,150 + S$140 = S$11,290 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.30% | - | 2.30% |

| 2 | 2.30% | - | 2.30% |

| 3 | 2.30% | - | 2.30% |

| 4 | 2.30% | - | 2.30% |

| 5 (at Maturity) | 2.30% | 0.000% | 2.30% |

| Total interest payout | 11.50% | 0.000% | 11.50% |

| Principal + Interest payout | S$10,000 + S$1,150+ S$0 = S$11,150 | ||

At a Glance

| Category | Details | ||||||||||||

| Investment Currency | Singapore Dollars (“SGD” or “S$”) | ||||||||||||

| Tenor | 5 Years | ||||||||||||

| Offer Period | 14 July 2022 to 29 July 2022, or such earlier date as decided by the Bank | ||||||||||||

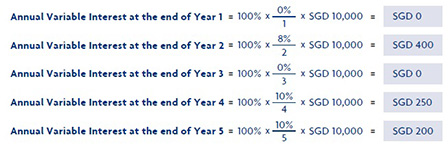

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 11.50% |

||||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.40%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||||

| Total Guaranteed Minimum Interest | 11.50%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 11.50% plus minimum Maturity Variable Interest of 0%) |

||||||||||||

| Shares in Underlying Basket |

|

||||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (6) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (6). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (6) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (6) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

July 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (5) - USD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (5)

Earn total guaranteed minimum interest of 6.90%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (5) - USD*. Get started with a minimum investment of US$5,000*.

- Total Guaranteed Minimum Interest of 6.90%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 2.2978% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.00%* linked to 4 underlying US Shares*

Offer ends 30 June 2022^.

Speak to a UOB banker today

How it works:

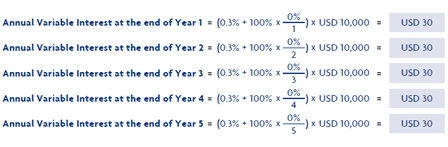

Assuming a Principal Amount of US$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.30% | - | 2.30% |

| 2 | 2.30% | - | 2.30% |

| At Maturity | 2.30% | 1.00% | 3.30% |

| Total interest payout | 6.90% | 1.00% | 7.90% |

| Principal + Interest payout | US$10,000 + US$690 + US$100 = US$10,790 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.30% | - | 2.30% |

| 2 | 2.30% | - | 2.30% |

| At Maturity | 2.30% | 0.000% | 2.30% |

| Total interest payout | 6.90% | - | 6.90% |

| Principal + Interest payout | US$10,000 + S$690 + US$0 = US$10,690 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | United States Dollars (“USD” or “US$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 17 June 2022 to 30 June 2022, or such earlier date as decided by the Bank. | ||||||||||

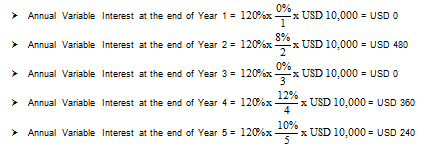

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 6.90% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.00%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 6.90%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 6.90% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (5) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (5). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (5) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (5) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

June 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (3) - SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (3)

Earn total guaranteed minimum interest of 10.00%* with UOB Structured Deposits

Boost your returns with UOB Principal Guaranteed Structured Deposit 2022 – Series (3) - SGD*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 10.00%* of the Principal Amount over 5 years (equivalent to an effective interest rate of 1.9988% per annum)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 1.20%* linked to 4 underlying US Shares*

Offer ends 30 June 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of S$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.00% | - | 2.00% |

| 2 | 2.00% | - | 2.00% |

| 3 | 2.00% | - | 2.00% |

| 4 | 2.00% | - | 2.00% |

| At Maturity | 2.00% | 1.20% | 2.00% |

| Total interest payout | 10.0% | 1.20% | 11.20% |

| Principal + Interest payout | S$10,000 + S$1,000 + S$120 = S$11,120 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.00% | - | 2.00% |

| 2 | 2.00% | - | 2.00% |

| 3 | 2.00% | - | 2.00% |

| 4 | 2.00% | - | 2.00% |

| At Maturity | 2.00% | 0% | 2.00% |

| Total interest payout | 10.0% | 0% | 10.0% |

| Principal + Interest payout | S$10,000 + S$1,000 + S$0 = S$11,000 | ||

At a Glance

| Category | Details | ||||||||||||

| Investment Currency | Singapore Dollars (“SGD” or “S$”) | ||||||||||||

| Tenor | 5 Years | ||||||||||||

| Offer Period | 17 June 2022 to 30 June 2022, or such earlier date as decided by the Bank. | ||||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 10.00% |

||||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 1.20%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||||

| Total Guaranteed Minimum Interest | 10.00%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 10.00% plus minimum Maturity Variable Interest of 0%) |

||||||||||||

| Shares in Underlying Basket |

|

||||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (3) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (3). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (3) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (3) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

June 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (2) - USD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (2)

Earn total guaranteed minimum interest of 6.60%* with UOB Structured Deposits

Now you can make your money work as hard as you do with UOB Principal Guaranteed Structured Deposit 2022 – Series (2)*. Get started with a minimum investment of US$5,000*.

- Total Guaranteed Minimum Interest of 6.60%* of the Principal Amount over 3 years (equivalent to an effective interest rate of 2.1940% a year)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 0.60%* linked to 4 United States Company Shares*

Offer ends 30 May 2022^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of US$10,000, held until maturity:

Best-Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.20% | - | 2.20% |

| 2 | 2.20% | - | 2.20% |

| At Maturity | 2.20% | 0.60% | 2.80% |

| Total interest payout | 6.60% | 0.60% | 7.20% |

| Principal + Interest payout | US$10,000 + US$660 + US$60 = US$10,720 | ||

Worst-Case Scenario (Maximum interest payable, where not all shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 2.20% | - | 2.20% |

| 2 | 2.20% | - | 2.20% |

| At Maturity | 2.20% | 0% | 2.20% |

| Total interest payout | 6.60% | 0% | 6.60% |

| Principal + Interest payout | US$10,000 + US$660 + US$0 = US$10,660 | ||

At a Glance

| Category | Details | ||||||||||

| Investment Currency | United States Dollars (“USD” or “US$”) | ||||||||||

| Tenor | 3 Years | ||||||||||

| Offer Period | 09 May 2022 to 31 May 2022, or such earlier date as decided by the Bank^. | ||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 6.60% |

||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 0.60%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||

| Total Guaranteed Minimum Interest | 6.60%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 6.60% plus minimum Maturity Variable Interest of 0%) |

||||||||||

| Shares in Underlying Basket |

|

||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited (“UOB”) branch.

**Bloomberg ticker is provided for reference only.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (2) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (2). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (2) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (2) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

May 2022

UOB Principal Guaranteed Structured Deposit 2022 - Series (1) - SGD

Monitor / View Past Performance

UOB Principal Guaranteed Structured Deposit 2022 – Series (1)

Earn total guaranteed minimum interest of 9.50%* with UOB Structured Deposits

Now you can make your money work as hard as you do with UOB Principal Guaranteed Structured Deposit 2022 – Series (1)*. Get started with a minimum investment of S$5,000*.

- Total Guaranteed Minimum Interest of 9.50%* of the Principal Amount over 5 years (equivalent to an effective interest rate of 1.8989% a year)

- 100% Principal Amount guaranteed when held to maturity

- Maturity Variable Interest of up to 2.00%* linked to 4 Singapore Company Shares*

Offer ends 31 May 2022 ^.

Speak to a UOB banker today

How it works:

Assuming a Principal Amount of S$10,000 held until maturity:

Best Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 1.90% | - | 1.90% |

| 2 | 1.90% | - | 1.90% |

| 3 | 1.90% | - | 1.90% |

| 4 | 1.90% | - | 1.90% |

| At Maturity | 1.90% | 2.00% | 3.90% |

| Total interest payout | 9.50% | 2.00% | 11.50% |

| Principal + Interest payout | S$10,000 + S$950 + S$200 = S$11,150 | ||

Worst Case Scenario (Minimum interest payable, where not all Shares close at or above 100% of their respective Initial Prices on Final Observation Date.)

| End of Year | Guaranteed Fixed Interest Rate on Principal Amount | Maturity Variable Interest Rate on Principal Amount | Total Interest Payable |

| 1 | 1.90% | - | 1.90% |

| 2 | 1.90% | - | 1.90% |

| 3 | 1.90% | - | 1.90% |

| 4 | 1.90% | - | 1.90% |

| At Maturity | 1.90% | 0% | 1.90% |

| Total interest payout | 9.50% | 0% | 9.50% |

| Principal + Interest payout | S$10,000 + S$950 + S$0 = S$10,950 | ||

At a Glance

| Category | Details | ||||||||||||

| Investment Currency | Singapore Dollars (S$) | ||||||||||||

| Tenor | 5 Years | ||||||||||||

| Offer Period | 09 May 2022 to 31 May 2022, or such earlier date as decided by the Bank.^ | ||||||||||||

| Guaranteed Fixed Interest | Payable at the end of:

Total Guaranteed Fixed Interest = 9.50% |

||||||||||||

| Maturity Variable Interest | If Payment Condition is met, Maturity Variable Interest Rate = 2.00%; Otherwise, Maturity Variable Interest Rate = 0% Payment Condition shall be deemed to have been met if the Closing Prices of all Shares are at or above 100.00% of their respective Initial Prices on the Final Observation Date. |

||||||||||||

| Total Guaranteed Minimum Interest | 9.50%* of the Principal Amount (Being Total Guaranteed Fixed Interest of 9.50% plus minimum Maturity Variable Interest of 0%) |

||||||||||||

| Shares in Underlying Basket |

|

||||||||||||

| Key Product Risks For The Investor |

|

^Subject to changes, please refer to Indicative Term Sheet for full details.

*Note: Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited (“UOB”) branch.

Important Notes

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2022 – Series (1) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2022 – Series (1). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2022 – Series (1) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2022 – Series (1) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

United Overseas Bank Limited Co. Reg. No. 193500026Z

May 2022

2021

UOB Structured Deposit 2021 - Series (1)

Monitor / View Past Performance

• UOB Principal Guaranteed Structured Deposit 2021 – Series (1)

Participate in the Global Healthcare Megatrend with our principal guaranteed Structured Deposit (USD)

Benefits

The COVID-19 pandemic has supercharged innovation in the healthcare industry, accelerating research and development geared towards discovering new treatments for diseases. This makes global healthcare an attractive investment theme that can potentially offer stellar returns.

Participate in the growth of the Global Healthcare industry through our UOB Structured Deposit 2021 – Series (1) – a five-year USD-denominated structured deposit, with returns linked to the share price performance of three leading healthcare companies: Pfizer, Moderna and Johnson & Johnson.1

Get started with a minimum investment of US$5,000.1

- 100% principal guaranteed when held to maturity

- Total guaranteed fixed interest of 3.75%1 of the principal amount over 5 years

(equivalent to an effective interest rate of 0.7496% a year) - Potentially receive up to 5%1 more in interest – Variable interest at maturity if payment condition is met2.

This structured deposit is available from now till 29 October 2021.

Speak to a UOB banker today

How it works

Assuming you invest US$10,000 in the UOB Structured Deposit 2021 - Series (1) and hold your investment until maturity:

The payment condition is met2 when all 3 companies' underlying share prices close at or above their respective initial prices on the final observation date. If this happens, you will receive:

- a total interest rate of 8.75% of the principal amount over 5 years

(comprising the total guaranteed fixed interest rate of 3.75% + maturity variable interest rate of 5%)

| If the payment condition is met2 | Amount |

| Principal | US$10,000 |

| Total guaranteed fixed interest of 3.75% | US$375 |

| Maturity variable interest of 5% | US$500 |

| Total payout at maturity | US$10,875 |

The payment condition is not met3 when not all 3 companies' underlying share prices close at or above their respective initial prices on the final observation date. If this happens, you will receive:

- a total interest rate of 3.75% over 5 years

(comprising the total guaranteed fixed interest rate of 3.75% + maturity variable interest rate of 0%)

| If the payment condition is not met3 | Amount |

| Principal | US$10,000 |

| Total guaranteed fixed interest of 3.75% | US$375 |

| Maturity variable interest of 5% | US$0 |

| Total payout at maturity | US$10,375 |

At a glance

| Category | Details |

| Investment Currency | US Dollar (USD) |

| Tenor | 5 Years |

| Guaranteed fixed interest | Year 1: 0.75% Year 2: 0.75% Year 3: 0.75% Year 4: 0.75% Year 5: 0.75% |

| Maturity variable interest | Payable upon maturity: If payment condition is met, maturity variable interest rate is 5.00% Otherwise, maturity variable interest rate is 0% |

| Minimum effective interest rate | 0.7496% per annum (Based on total guaranteed minimum interest of 3.75% of the principal amount if held to maturity.) |

| Shares in underlying basket | Moderna (MRNA UQ) + Pfizer (PFE UN) + Johnson & Johnson (JNJ UN) |

| Key product risks for the investor | • The credit risk of UOB • A tenor of 5 years • In the worst-case scenario, the total minimum interest payable is 3.75%1 of the principal amount if the structured deposit is held until maturity. • An illiquid secondary market for the structured deposit, should the investor seek to unwind this structured deposit before the maturity date. Potential loss of the principal amount if the investment is not held to maturity. |

Important Notes

1Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited (“UOB”) branch.

2An example of payment condition met:

| Share | Initial Price | Closing Price on Final Observation Date |

| Johnson & Johnson (JNJ UN) | 169.00 | 171.00 |

| Moderna (MRNA UQ) | 430.00 | 435.00 |

| Pfizer (PFE UN) | 43.90 | 44.50 |

| All 3 shares ≥ Initial Price? | Yes | |

| Maturity variable interest rate | 5.00% | |

3An example of payment condition not met:

| Share | Initial Price | Closing Price on Final Observation Date |

| Johnson & Johnson (JNJ UN) | 169.00 | 171.00 |

| Moderna (MRNA UQ) | 430.00 | 425.00 |

| Pfizer (PFE UN) | 43.90 | 44.50 |

| All 3 shares ≥ Initial Price? | No | |

| Maturity variable interest rate | 0% | |

Disclaimers

The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2021 – Series (1) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2021 – Series (1). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2021 – Series (1) is suitable for you. Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2021 – Series (1) has risk and investment elements and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners’ Protection Schemes Act (Chapter 77B). This advertisement has not been reviewed by the Monetary Authority of Singapore.

2019

UOB Principal Guaranteed Structured Deposit 2019 - Series (5)

Monitor / View Past Performance

• UOB Principal Guaranteed Structured Deposit 2019 – Series (5)

Breathe life into your savings with UOB Structured Deposits

Make your money work as hard as you do with UOB Principal Guaranteed Structured Deposit 2019 – Series (5). Get started with a minimum investment of S$5,000.

- 3%^ p.a Bonus Interest (or a minimum of 0.5%^ p.a) with a 3-year investment term (Annual Bonus Interest is linked to the performance of 3 Singapore company shares)

- 100% of Principal Amounts Guaranteed when held to maturity

How it works

Assuming an investment amount of S$10,000, held till maturity:

Best Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on each Annual Observation Date.)

From the end of the 1st year onwards, Bonus Interest will be paid depending on the performance of the Shares.

Assuming the Initial Price and the Closing Price of the Shares on each Observation Date are as follows:

| Share | Initial Price | 100% of Initial Price | Observation Date (1) | Observation Date (2) | Observation Date (3) |

| DBS | 25.00 | 25.00 | 26.50 | 25.80 | 27.00 |

| OCBC | 10.80 | 10.80 | 11.50 | 11.80 | 12.00 |

| ST | 3.20 | 3.20 | 3.50 | 3.60 | 3.40 |

| All Shares ≥ 100.00% of Initial Price? | Yes | Yes | Yes | ||

| Bonus Interest Rate | 3.0% | 3.0% | 3.0% | ||

From the above table:

Since all Shares close at or above 100% of their respective Initial Prices on all Observation Dates, Bonus Interest of 3% of Principal Amount will be paid on all 3 Interest Payment Dates.

Total Bonus Interest = (3 × 3.0%) × SGD 10,000 = SGD 900

In this example, for a Principal Amount of SGD 10,000, the investor will get a total interest of SGD 900 (i.e. SGD 900 (being the Total Bonus Interest) for 3 years.

Worst Case Scenario (Minimum interest payable, where not all Shares close at or above 100% of their respective Initial Prices on each Annual Observation Date.)

From the end of the 1st year onwards, Bonus Interest will be paid depending on the performance of the Shares.

Assuming the Initial Price and the Closing Price of the Shares on each Observation Date are as follows:

| Share | Initial Price | 100% of Initial Price | Observation Date (1) | Observation Date (2) | Observation Date (3) |

| DBS | 25.00 | 25.00 | 24.80 | 25.20 | 24.50 |

| OCBC | 10.80 | 10.80 | 10.60 | 11.00 | 10.00 |

| ST | 3.20 | 3.20 | 3.00 | 2.90 | 3.10 |

| All Shares ≥ 100.00% of Initial Price? | Yes | Yes | Yes | ||

| Bonus Interest Rate | 0.50% | 0.50% | 0.50% | ||

From the above table:

Since not all Shares close at or above 100% of their respective Initial Prices on all Observation Dates, Bonus Interest of 0.5% of Principal Amount will be paid on all 3 Interest Payment Dates.

Total Bonus Interest = (3 × 0.5%) × SGD 10,000 = SGD 150

In this example, for a Principal Amount of SGD 10,000, the investor will get a total interest of SGD 150 (i.e. SGD 150 (being the Total Bonus Interest) for 3 years.

At a glance

| Category | Details |

| Investment Currency | Singapore Dollars (SGD) |

| Tenor | 3 Years |

| Offer Period | 10 June 2019 to 20 June 2019# |

| Annual Bonus Interest | Minimum at 0.5% p.a of the Principal Amount and maximum at 3.00% p.a of the Principal Amount |

| Total Guaranteed Minimum Interest | 1.50%~ of the Principal Amount (Being Total Minimum Bonus Interest of 1.50% across 3 years) |

| Minimum Effective Interest rate | 0.4995% per annum (Based on Total Guaranteed Minimum Interest of 1.50%~ of the Principal Amount.) |

| Shares in underlying basket | • DBS Group Holdings Limited (“DBS”) • Oversea-Chinese Banking Corporation Limited (“OCBC”) • Singapore Telecommunications Limited (“ST”) |

| Key Product Risks For The Investor | • The credit risk of UOB • The worst case scenario of 1.50%~ of the Principal Amount over 3 years if the Structured Deposit is held until maturity • An illiquid secondary market for the Structured Deposit, should the investor seek to unwind this Structured Deposit before the maturity date. Potential loss of the Principal Amount if the investment is not held to maturity. |

^3.00% p.a Bonus Interest of the Principal Amount is only payable if the Payment Condition is met; otherwise, the investor shall receive a Minimum Bonus Interest of 0.50% p.a of the Principal Amount instead. Equivalent to a minimum effective interest rate of 0.4995%+ p.a (based on the total guaranteed minimum interest of 1.50% payable across 3 years) or equivalent to a potential effective interest rate of 2.9969%+ p.a (based on the total guaranteed minimum interest of 9.00% payable across 3 years) if this Structured Product is held to maturity.

~The total guaranteed minimum interest of 1.50% (being Total minimum Bonus Interest of 1.50% of the Principal Amount payable over the 3-year Tenor is equivalent to an effective interest rate of 0.4995% per annum if this Structured Deposit is held until maturity.

#Subject to changes, please refer to Indicative Term Sheet for full details.

+Only for existing UOB Personal Internet Banking (PIB) customers with a fixed deposit account. Online purchase is subject to passing the Customer Knowledge Assessment (CKA) on UOB PIB.

*Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited (“UOB”) branch.

Important – Please note: The above is for general information only and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction. The amount placed in the UOB Principal Guaranteed Structured Deposit 2019 – Series (5) is principal guaranteed only if held until the maturity date. Investing in a structured deposit entails certain risks, including potential loss of the principal sum invested if the investment is not held to maturity. Please refer to the Indicative Term Sheet for full product details. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase UOB Principal Guaranteed Structured Deposit 2019 – Series (5). In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should consider carefully whether UOB Principal Guaranteed Structured Deposit 2019 – Series (5) is suitable for you.

Structured deposits are not fixed deposits. Unlike traditional deposits, the UOB Principal Guaranteed Structured Deposit 2019 – Series (5) has risk and investment elements, and is not an insured deposit within the meaning of the Deposit Insurance and Policy Owners’ Protection Schemes Act (Chapter 77B).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

More Information

Structured deposits which have risk and investment elements, are not conventional deposits and accordingly, are not insured deposits for the purposes of the Deposit Insurance Act (Chapter 77A).

In addition, structured deposits are not covered under the Singapore Government's guarantee on all Singapore Dollar and foreign currency deposits of individual and non-bank customers in banks, finance companies and merchant banks licensed by the MAS (which is in effect until 31 December 2010).

Provided that the whole amount of the Principal Amount is held with the Bank up to the Maturity Date, 100% of the Principal Amount shall be guaranteed and payable by the Bank to the investor on the Maturity Date.

UOB Principal Guaranteed Structured Deposit 2019 - Series (3)

Monitor / View Past Performance

• UOB Principal Guaranteed Structured Deposit 2019 – Series (3)

Breathe life into your savings with UOB Structured Deposits

Make your money work as hard as you do with UOB Principal Guaranteed Structured Deposit 2019 – Series (3). Get started with a minimum investment of S$5,000.

- Get up to 3%^ p.a Bonus Interest (or a minimum of 0.5%^ p.a) with a 3-year investment term (Annual Bonus Interest is linked to the performance of 3 Singapore company shares).

- 100% of Principal Amounts Guaranteed when held to maturity

Speak to a UOB Personal Banker for more details.

Buy Online+

(for cash investment only)

How it works

Assuming an investment amount of S$10,000, held till maturity:

Best Case Scenario (Maximum interest payable, where all Shares close at or above 100% of their respective Initial Prices on each Annual Observation Date.)

From the end of the 1st year onwards, Bonus Interest will be paid depending on the performance of the Shares.

Assuming the Initial Price and the Closing Price of the Shares on each Observation Date are as follows:

| Share | Initial Price | 100% of Initial Price | Observation Date (1) | Observation Date (2) | Observation Date (3) |

| DBS | 27.41 | 27.41 | 27.50 | 27.80 | 28.20 |

| OCBC | 11.81 | 11.81 | 11.90 | 11.95 | 12.05 |

| ST | 3.13 | 3.13 | 3.85 | 4.50 | 4.65 |

| All Shares ≥ 100.00% of Initial Price? | Yes | Yes | Yes | ||

| Bonus Interest Rate | 3.0% | 3.0% | 3.0% | ||

From the above table:

Since all Shares close at or above 100% of their respective Initial Prices on all Observation Dates, Bonus Interest of 3% of Principal Amount will be paid on all 3 Interest Payment Dates.

Total Bonus Interest = (3 × 3.0%) × SGD 10,000 = SGD 900

In this example, for a Principal Amount of SGD 10,000, the investor will get a total interest of SGD 900 (i.e. SGD 900 (being the Total Bonus Interest) for 3 years.

Worst Case Scenario (Minimum interest payable, where not all Shares close at or above 100% of their respective Initial Prices on each Annual Observation Date.)

From the end of the 1st year onwards, Bonus Interest will be paid depending on the performance of the Shares.

Assuming the Initial Price and the Closing Price of the Shares on each Observation Date are as follows:

| Share | Initial Price | 100% of Initial Price | Observation Date (1) | Observation Date (2) | Observation Date (3) |

| DBS | 27.41 | 27.41 | 27.29 | 27.00 | 27.10 |

| OCBC | 11.81 | 11.81 | 11.50 | 11.45 | 12.92 |

| ST | 3.13 | 3.13 | 3.85 | 4.50 | 4.65 |

| All Shares ≥ 100.00% of Initial Price? | No | No | No | ||

| Bonus Interest Rate | 0.50% | 0.50% | 0.50% | ||

From the above table:

Since not all Shares close at or above 100% of their respective Initial Prices on all Observation Dates, Bonus Interest of 0.5% of Principal Amount will be paid on all 3 Interest Payment Dates.

Total Bonus Interest = (3 × 0.5%) × SGD 10,000 = SGD 150

In this example, for a Principal Amount of SGD 10,000, the investor will get a total interest of SGD 150 (i.e. SGD 150 (being the Total Bonus Interest) for 3 years.

At a glance

| Category | Details |

| Investment Currency | Singapore Dollars (SGD) |

| Tenor | 3 Years |

| Offer Period | 06 May 2019 to 23 May 2019# |

| Annual Bonus Interest | Minimum at 0.5% p.a of the Principal Amount and maximum at 3.00% p.a of the Principal Amount |

| Total Guaranteed Minimum Interest | 1.50%~ of the Principal Amount (Being Total Minimum Bonus Interest of 1.50% across 3 years) |

| Minimum Effective Interest rate | 0.4995% per annum (Based on Total Guaranteed Minimum Interest of 1.50%~ of the Principal Amount.) |

| Shares in underlying basket | • DBS Group Holdings Limited (“DBS”) • Oversea-Chinese Banking Corporation Limited (“OCBC”) • Singapore Telecommunications Limited (“ST”) |

| Key Product Risks For The Investor | • The credit risk of UOB • The worst case scenario of 1.50%~ of the Principal Amount over 3 years if the Structured Deposit is held until maturity • An illiquid secondary market for the Structured Deposit, should the investor seek to unwind this Structured Deposit before the maturity date. Potential loss of the Principal Amount if the investment is not held to maturity. |

^3.00% p.a Bonus Interest of the Principal Amount is only payable if the Payment Condition is met; otherwise, the investor shall receive a Minimum Bonus Interest of 0.50% p.a of the Principal Amount instead. Equivalent to a minimum effective interest rate of 0.4995% p.a (based on the total guaranteed minimum interest of 1.50% payable across 3 years) or equivalent to a potential effective interest rate of 2.9968% p.a (based on the total guaranteed minimum interest of 9.00% payable across 3 years) if this Structured Product is held to maturity.

#Subject to changes, please refer to Indicative Term Sheet for full details.

+Only for existing UOB Personal Internet Banking (PIB) customers with a fixed deposit account. Online purchase is subject to passing the Customer Knowledge Assessment (CKA) on UOB PIB.

~The total guaranteed minimum interest of 1.50% (being Total minimum Bonus Interest of 1.50% of the Principal Amount payable over the 3-year Tenor is equivalent to an effective interest rate of 0.4995% per annum if this Structured Deposit is held until maturity.

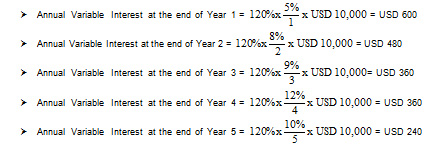

*Product terms and conditions apply. Please refer to the Indicative Term Sheet for more details. A copy of the Indicative Term Sheet is available at the point of sale or at any United Overseas Bank Limited (“UOB”) branch.