Smishing Scams (Fixed Deposit Promotions)

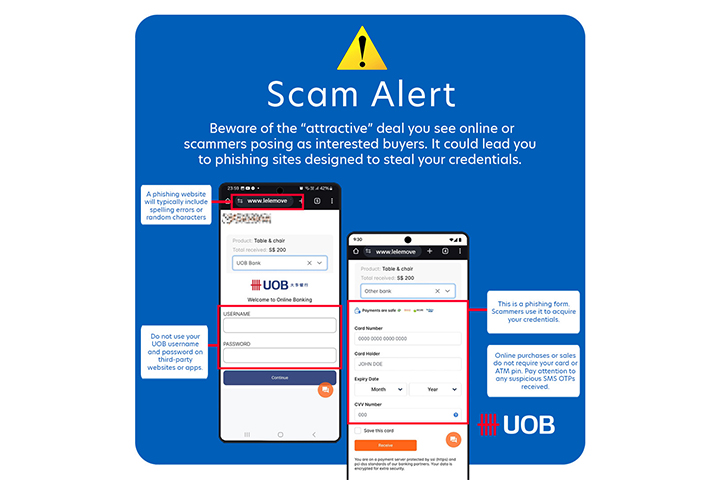

"Smishing" is a common scam attack that involves text messages impersonating a bank or an organisation. These scammers will try different means to capture your attention and acquire your personal information. Some will even go to the extent of spoofing the sender's name, phone number or both to trick you. For example, a recent scam involves SMS messages sent from the sender name "TMRW" and "UOBTRMW", which resembles the UOB TMRW app name, informing recipients about unusual activity in their accounts. That link will lead you to a scam website.

Remember, UOB does not send SMSes with clickable links.

What can you do to protect yourself?

A sample of the phishing SMS sent by scammers.

Do NOT call the number in the unsolicited SMS

- UOB will never send you an SMS message that requires you to call a phone number to get details for a promotion. Stay vigilant and do not call the number stated on the SMS.

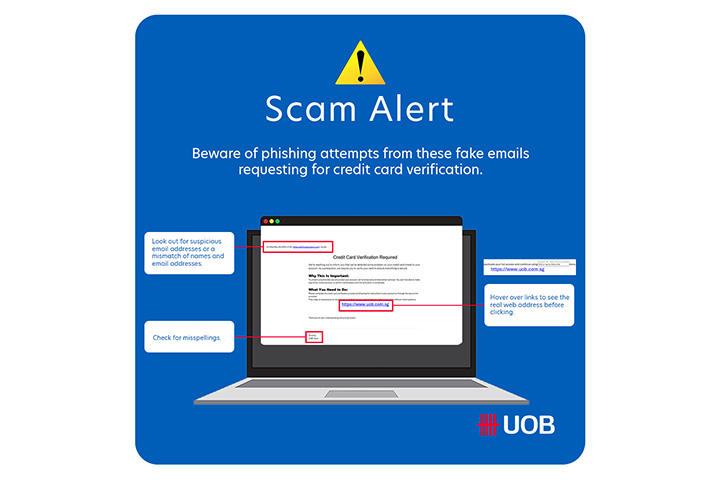

- Do not click on dubious links and always examine the links when presented in an email or SMS.

- Hover over links to check the destination of the URL. Check for any typos or misspelt words in the URL. When verifying links using mobile phones, press and hold the link to display the actual URL.

- Always visit the legitimate website bookmarked in your browser or found via a Google search.

- Ensure that you do not overlook the spelling mistakes when inspecting the website URL.

- UOB will never send an SMS to inform customers about account closures or being locked out of their account, or to reactivate accounts.

- Do not share any personal or internet banking details such as your full name, mailing address, password or OTP.

- Do not transfer funds to any account directed by anyone who claims to be a UOB staff.

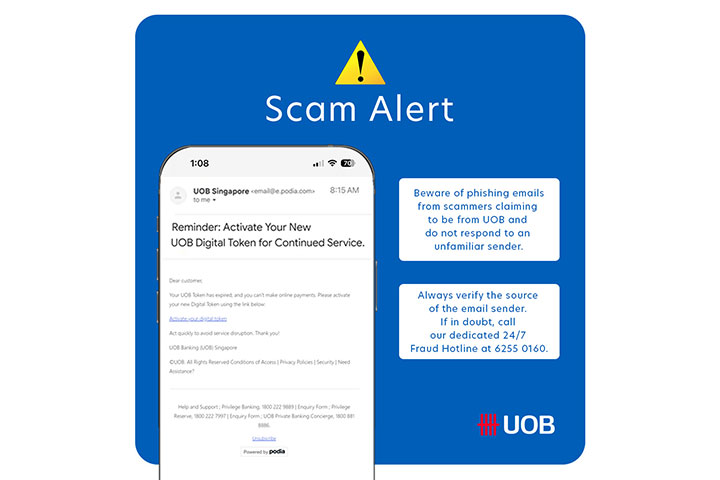

If you spot a phishing SMS or suspect that you might have been scammed, please call our dedicated 24/7 Fraud Hotline at 6255 0160 and press '1' to report a case or '2' to activate our emergency self-service Kill Switch feature.

![]()