Unlock benefits with SRS

A Supplementary Retirement Scheme (SRS) account helps you save on taxes while saving for your retirement at the same time.

Calculate how much you could save on your taxes

Ways to contribute

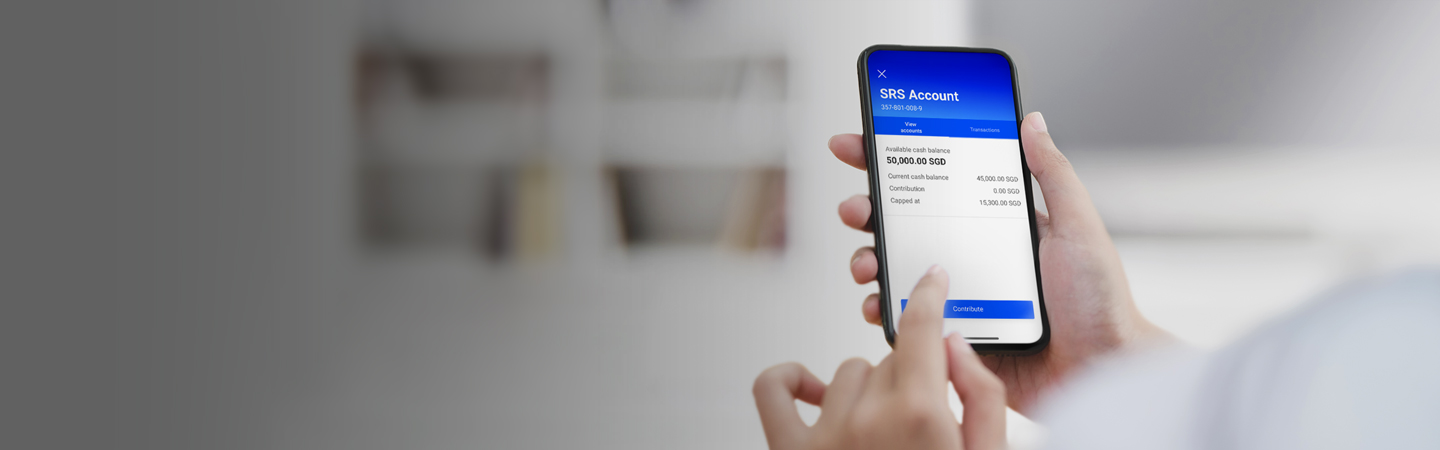

UOB TMRW App

Contribute through TMRW

Important: For customers to be eligible for tax relief in YA 2025, contributions must be before 7pm on Tuesday, 31st December 2024 via UOB TMRW App.

Step by Step guidance:

- Log in to UOB TMRW app with your Touch / Face ID or digibank User ID & PIN.

- Tap on the ‘Accounts’ tab in UOB TMRW

- Select ‘SRS account’ and click on the ‘Contribute’ button.

- Select the Fund Source you wish to contribute from. We only accept SGD for SRS contributions.

- Enter the Amount you wish to contribute and tap ‘Next’.

- Verify the details of the contribution and tap ‘Transfer Now’ to complete the contribution.

Note: Service is only available from Monday to Saturday: 7:00am to 10:00pm. SRS contributions cannot be done via other banks’ internet and mobile banking.

Bank. Invest. Reward. Make TMRW yours. Download now

Personal Internet Banking

Click here to log in

Quick Cheque deposit

Click here to find out where the nearest our Quick Cheque Deposit boxes are.

Branches

Click here to find out where our Branches are.

UOB SRS FAQs

SRS

Can I have more than one SRS account?

No. You may not have more than one SRS account at any point in time. Do note that if you previously had an SRS account, but had withdrawn all the monies in it after having attained the relevant retirement age1 or on medical grounds and then closed it, you will also not be permitted to open a new account. (1The statutory retirement age that was prevailing when you made your first SRS contribution. The current statutory retirement age is at 63.)

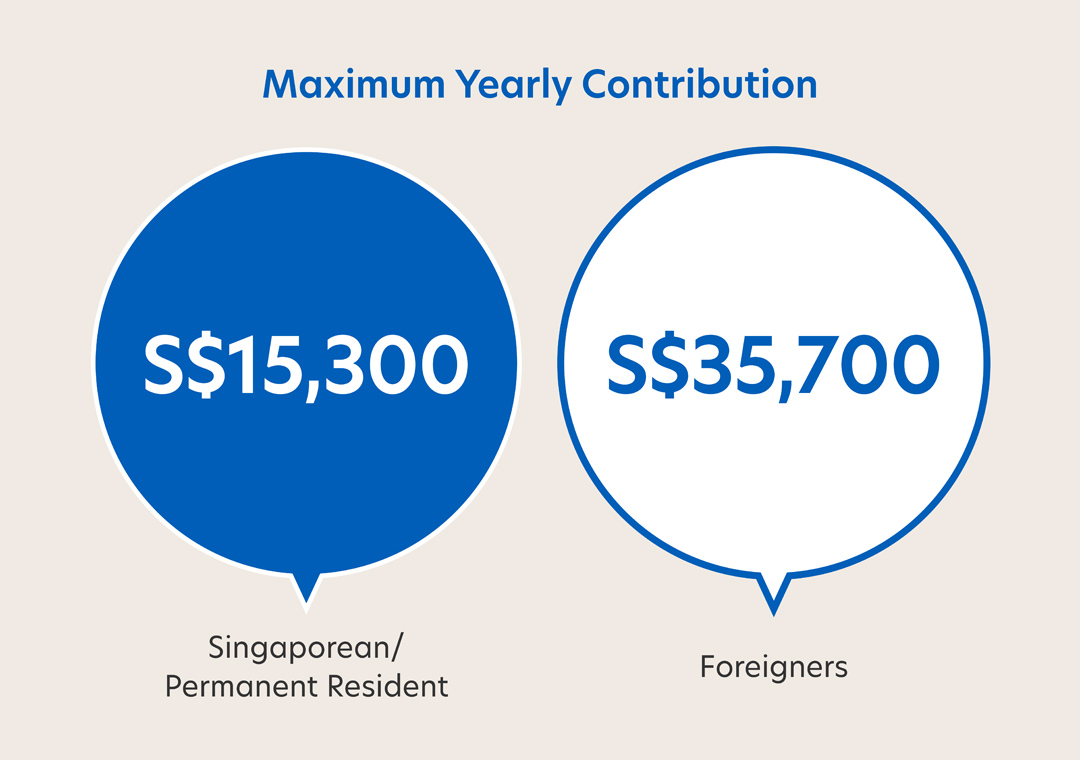

What is the amount I can contribute to SRS?

You may contribute any amount to your SRS account up to your SRS contribution cap of S$15,300 for Singaporeans and PRs, and S$35,700 for foreigners.

Why should I contribute to SRS?

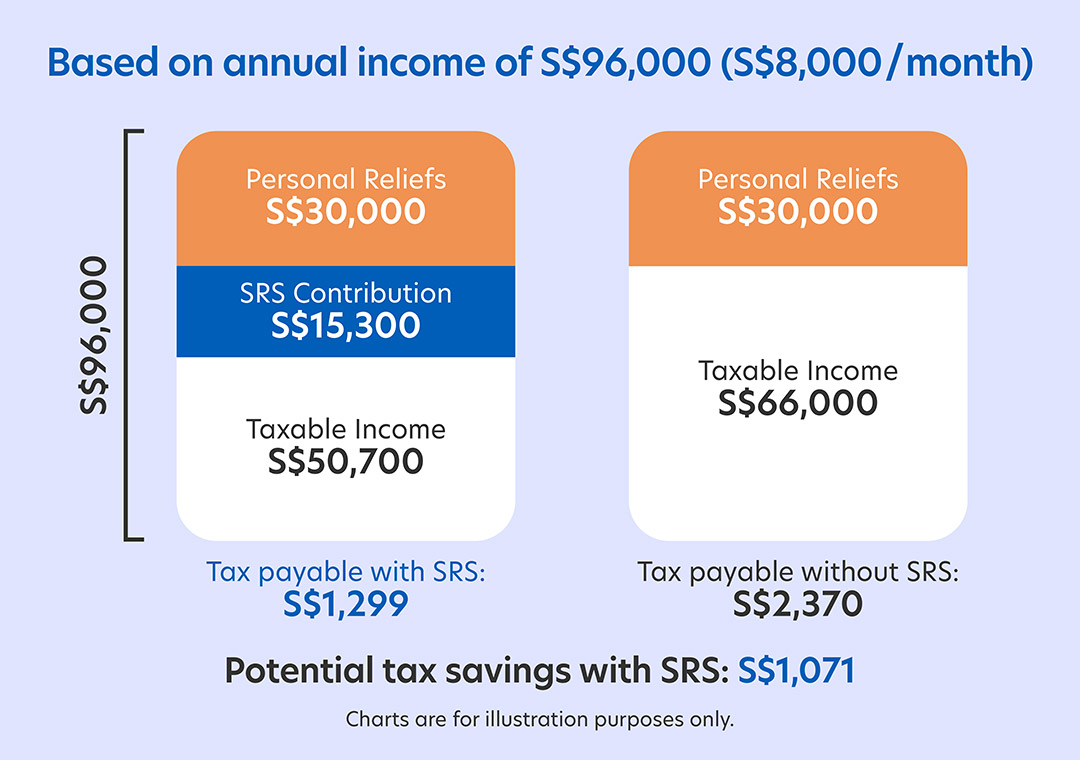

Besides the benefit of having more savings to draw on when you retire, you will enjoy the following tax benefits on contributions to SRS:

You can claim tax relief for contributions made to your SRS account. SRS contributions made on or after 1 Jan 2017 are subject to a cap on personal income tax relief of $80,000 per Year of Assessment (YA) from YA 2018. From YA 2018, each dollar of SRS contribution will reduce your income chargeable to tax by a dollar, if your personal income tax relief (including the SRS relief) does not exceed $80,000 per YA.

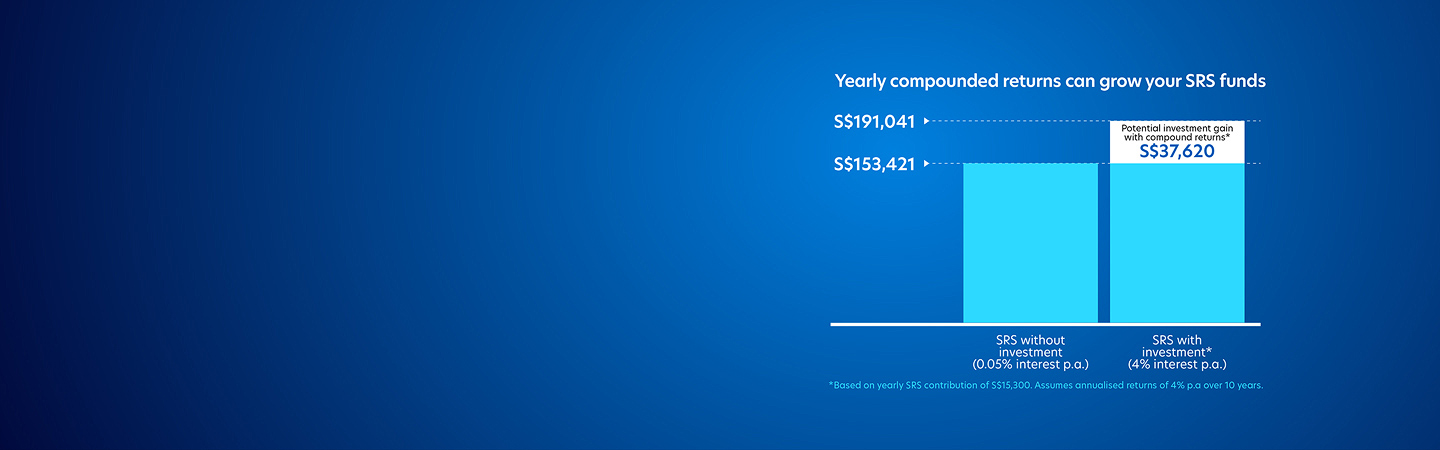

Investment gains will accumulate tax-free in SRS.

Tax will be payable only when you withdraw your SRS savings (comprising both your SRS contributions and gains on investments). If you withdraw your SRS savings upon retirement2, only 50% of the savings withdrawn will be subject to tax. If you purchase an annuity, this concession applies for as long as you receive the annuity stream. Otherwise, you may spread your withdrawals over a period of up to 10 years to meet your financial needs. Spreading out your withdrawals will generally result in greater tax savings.

(2Upon reaching the statutory retirement age that was prevailing when you made your first SRS contribution.)

How do I contribute to my SRS Account?

You can do so via Personal Internet Banking or at the branch. SRS contributions cannot be done via other banks’ internet and mobile banking. You do not need to make a claim in your tax return as it will be allowed automatically based on information provided by us to IRAS.

Can I invest with you if my SRS Account is with another bank?

Yes, you can speak to us on how you can maximise your SRS funds.

Open Account Online

I have submitted an online application for an SRS account through UOB. How would I know if it is being processed?

Upon successfully submitting an online application for an SRS account, an application ID number will be issued to you. You will also receive an email with the application ID number to confirm that the online application has been received.

If you would like to check with UOB on your application status, please quote the application ID number.

Please refer to the next question on how long it would take for the SRS account application to be processed.

If you were not presented with a “Successful Submission” page with the application ID number or did not receive an email with the application ID number, you might not have completed the application. Please login to submit your application again.

How long does it take to process my online application?

It will typically take 4 working days to process the SRS account online application.

How will I be notified of the status?

You will receive an email notification once your SRS account is opened. However, the account number will not be provided in the email for security purposes but will be mailed to your UOB-registered mailing address within 7 working days.

You can also obtain your account details from any of the following:-

UOB Personal Internet Banking/UOB TMRW (If you are an existing UOB Personal Internet Banking/UOB TMRW user).

24-hour Phone Banking at 1800 222 2121

Any UOB branch

How do I check on my SRS account online application status?

You may contact us via one of the following channels and quote your application ID number received during the online application.

24-hour Phone Banking at 1800 222 2121

Contact Us page^

^Please quote your application ID number in the description/comments to enable us to check on the status before contacting you

What do I need to do if my online SRS application was unsuccessful?

Please note that the online application will no longer be valid, and you will have to visit a UOB branch with your physical NRIC and complete the application as we need more information.

Are foreigners able to apply for an SRS account online?

Foreigners are not able to apply online as MyInfo is unable to provide all the verified data required during the SRS account application.

Eligibility and Fees

Eligibility

Eligibility

- Singaporean, Permanent Resident (PR) or foreigner

- 18 years old and above

- Not an undischarged bankrupt

- Do not have existing SRS Account with another bank

- Have no pending SRS account application with another bank

Fees

Withdrawing from SRS

Are there any penalties involved if I were to withdraw before retirement?

Please refer to IRAS webpage on Tax on SRS withdrawals to find out which scenario applies to you and the relevant penalties and taxation.

Things you should know

Important Notice & Disclaimers

*Personal income tax relief cap of S$80,000 applies from Year of Assessment 2018 to SRS contributions made on or after 1 Jan 2017. This cap applies to the total amount of all tax reliefs claimed, including any relief on SRS contributions. Refer to full terms & conditions here:

- Additional Terms and Conditions Governing SRS (Effective 01 Feb 2020)

- Notice of Revision of Additional Terms and Conditions Governing SRS

Important Information

For Unit Trusts

You may wish to seek advice from a financial adviser before purchasing units in any unit trust (the “Fund”). In the event that you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund in question is suitable for you. Past performance of the Fund or the manager of the Fund (the "Fund Manager"), and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the Fund or the Fund Manager. The value of units in the Fund, and any income accruing to the units from the Fund, may fall or rise. You should note that your investment is exposed to fluctuations in exchange rates if the Base Currency of the Fund and/or underlying investment is different from the currency of your investment. You should read the prospectus, available from the respective Fund Manager or its distributors, before deciding to subscribe for or purchase units in the Fund. Applications for units of the Fund must be made on the application forms accompanying the prospectus. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by UOB, Fund Manager or any subsidiary or associate of UOB or any of their affiliates, or by any distributors of the Fund, and are subject to risks, including the possible loss of the principal amount invested.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

For Insurance

Buying a life insurance policy is a long term commitment. An early termination of the policy usually involves high costs and the surrender value payable (if any) may be less than the total premiums paid. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units, and the income accruing to the units, if any, may fall or rise. This marketing material is for reference only and is not a contract of assurance nor is it intended as an offer or recommendation with respect to the purchase or sale of the products stated herein. The precise terms and conditions, specific details and exclusions applicable to these insurance products stated herein are specified in the respective policy documents. The above is for general information only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You are recommended to read the policy documents and to seek advice from a financial adviser with regards to your specific investment objectives, financial situation and any of your particular needs before making a commitment to purchase any insurance products. In the event that you choose not to seek advice from a financial adviser, you should consider carefully whether any of the insurance products is/are suitable for you. United Overseas Bank Limited does not hold itself out to be an insurer or insurance broker. The insurance products stated herein are provided by Prudential Assurance Company Singapore (Pte) Limited.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Policy Owner’s Protection Scheme

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This publication is for general information and general circulation only and does not have any regard to the specific investment objectives, financial situation and particular needs of any specific person. This publication shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.