The Travel Insider

Southeast Asia's first one-stop travel portal designed for UOB Cardmembers. Inspire, plan, and book your next adventure with UOB Cards.

Find out moreFeatured

Apply for UOB One Account online and get up to S$260 cash

Skip to higher interest of up to 3.4% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out moreCard Privileges

Cross over to your favorite deals in JB with UOB Cards

Tap your way to 0% FX fees, cashback on MYR spend and instant savings with UNI$ redemption.

Find out moreFeatured

Borrow services

Balance Transfer

Get instant cash at 0% interest and low processing fees. Choose from 3, 6 and 12-months tenor.

Find out moreFeatured Solutions

Your access to Private Bank CIO’s expertise

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

UOB TMRW

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

-

you are in Personal Banking

For Individuals

Wealth BankingPrivilege BankingPrivilege ReservePrivate BankingFor Companies

GROUP WHOLESALE BANKINGForeign direct investmentUOB Asean insightsIndustry insightsSUSTAINABLE SOLUTIONSAbout UOB

UOB GroupBranches & ATMsSustainabilityTech Start-Up EcosystemUOB WorldUOB Subsidiaries

UOB asset managementUnited overseas InsuranceUOB travel plannersUOB Venture managementUOB Global capital - SUSTAINABILITY

- Financial Literacy

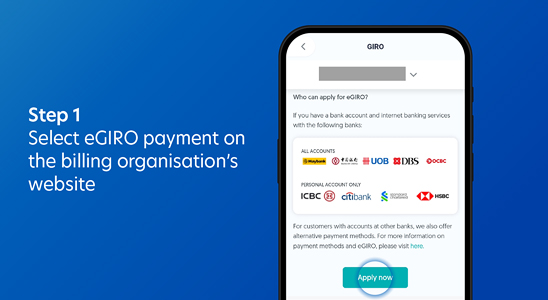

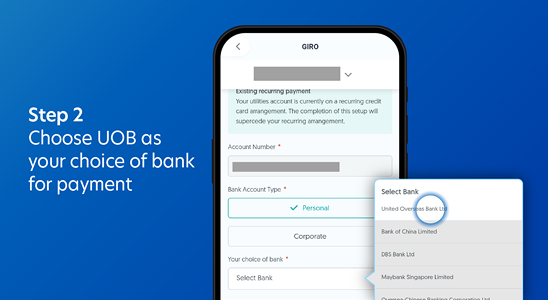

Enjoy hassle-free payment for your bills with GIRO

You can conveniently make regular payments through GIRO for your personal income tax, substantial school and miscellaneous fees, rentals, season parking and more!

Be rewarded when you pay your bills via GIRO with UOB. Check out our promotions today.

Participating eGIRO Billing Organisations

Refer here for the full list of participating eGIRO billing organisations.

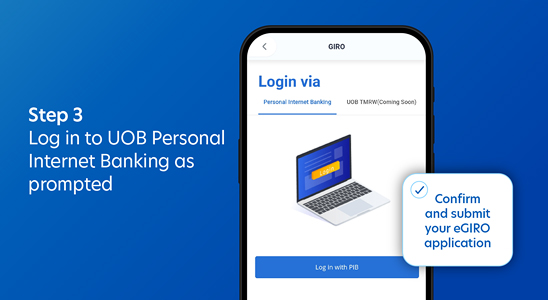

You can also apply for GIRO through UOB Personal Internet Banking

Simply login to your UOB Personal Internet Banking and click on “Apply For” > Select “GIRO Arrangement” > Key in the required details and submit your application.

Apply now

Choose from savings accounts that give you up to 3.4% p.a. interest, up to 25X UNI$ and more.

UOB One Account

Maximise interest in just two steps.

- Get up to 3.4% p.a. interest on your savings (up to S$2,850 in interest a year on up to S$150,000 deposits)

- Spend a min. of S$500 monthly on an eligible UOB Card and credit your salary OR make 3 GIRO transactions per month

- Plus, get up to S$600 rebates when you pay your personal income tax via eGIRO with One Account

UOB Stash Account

It’s so easy to Stash it and let your savings grow – now with up to 2% p.a. interest! ![]()

- Simply maintain or increase your balance every month

- No lock-in period! This means having access to your savings anytime while still earning interest every month.

Subject to qualifying criteria. T&Cs apply.

KrisFlyer UOB Debit Card and Account

The debit card and account that are miles ahead.

- For every S$1 spend:

- Earn 1 mile on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

- Earn 0.4 miles on all other spend

- Plus, get up to additional 6 miles per S$1 spend when you spend and save with KrisFlyer UOB Account.

- Get S$10 off ChangiWifi

and Grab rides to or from the Airport

and Grab rides to or from the Airport

- Exclusive benefits from Scoot (via flyscoot.com/KrisFlyerUOB) such as priority check-in and boarding, additional baggage allowance and more!

Subject to qualifying criteria. T&Cs apply.

UOB Lady’s Savings Account

The only savings account that gives you unstoppable rewards

- Earn up to 25X UNI$ per S$5 spend (equivalent to 10 miles per S$1) on your preferred rewards category(ies) when you save with UOB Lady’s Savings Account and spend on UOB Lady’s Credit Card

- Earn up to 10% instant cashback with UOB$ programme for UOB Lady’s Debit Cardholders.

Subject to qualifying criteria. T&Cs apply.

Apply now

Choose from savings accounts that give you up to 3.4% p.a. interest, up to 25X UNI$ and more.

UOB One Account

Maximise interest in just two steps.

- Get up to 3.4% p.a. interest on your savings (up to S$2,850 in interest a year on up to S$150,000 deposits)

- Spend a min. of S$500 monthly on an eligible UOB Card and credit your salary OR make 3 GIRO transactions per month

- Plus, get up to S$600 rebates when you pay your personal income tax via eGIRO with One Account

UOB Stash Account

It’s so easy to Stash it and let your savings grow – now with up to 2% p.a. interest! ![]()

- Simply maintain or increase your balance every month

- No lock-in period! This means having access to your savings anytime while still earning interest every month.

Subject to qualifying criteria. T&Cs apply.

KrisFlyer UOB Debit Card and Account

The debit card and account that are miles ahead.

- For every S$1 spend:

- Earn 1 mile on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

- Earn 0.4 miles on all other spend

- Plus, get up to additional 6 miles per S$1 spend when you spend and save with KrisFlyer UOB Account.

- Get S$10 off ChangiWifi

and Grab rides to or from the Airport

and Grab rides to or from the Airport

- Exclusive benefits from Scoot (via flyscoot.com/KrisFlyerUOB) such as priority check-in and boarding, additional baggage allowance and more!

Subject to qualifying criteria. T&Cs apply.

UOB Lady’s Savings Account

The only savings account that gives you unstoppable rewards

- Earn up to 25X UNI$ per S$5 spend (equivalent to 10 miles per S$1) on your preferred rewards category(ies) when you save with UOB Lady’s Savings Account and spend on UOB Lady’s Credit Card

- Earn up to 10% instant cashback with UOB$ programme for UOB Lady’s Debit Cardholders.

Subject to qualifying criteria. T&Cs apply.

Total interest is equivalent to Base Interest plus Bonus Interest; where current Base Interest is 0.05% p.a., Bonus Interest is paid up to S$150,000 in your One Account. Base Interest is calculated at the end of each day based on each day-end balance and Bonus Interest is calculated at the end of each calendar month based on the monthly average balance. Monthly average balance is the summation of each day end balance for each month divided by the number of calendar days for that month.

Maximum effective interest rate (EIR) on the One Account is 0.65% p.a. for deposits of S$75,000, provided customers meet criterion of S$500 eligible card spend in each calendar month. Maximum effective interest rate (EIR) on the One Account is 1.40% p.a. for deposits of S$125,000, provided customers meet both criteria of S$500 eligible card spend AND 3 GIRO debit transactions in each calendar month. Maximum effective interest rate (EIR) on the One Account is 1.90% p.a. for deposits of S$150,000, provided customers meet both criteria of S$500 eligible card spend AND a min. S$1,600 salary credit via GIRO/PAYNOW (with the transaction reference “SALA” / “PAYNOW SALA”) in each calendar month.

Maximum Effective Interest Rate (EIR) on the Stash Account is 1.50% p.a. for deposits of S$100,000, provided the customer’s Monthly Average Balance (MAB) for the present calendar month is equal to or more than the MAB for the preceding calendar month. Terms and Conditions apply.

Find out more at KrisFlyer UOB Debit Card & Account.

Stay connected on your travels with extra savings on ChangiWiFi.

- SMS KFUOB‹space›16 digits card number to 77862 to get a unique e-Cash redemption code.

- To redeem the e-Cash redemption code, simply present the SMS together with your ChangiWiFi booking upon payment at the Changi Recommends Counter.

Payment must be made with KrisFlyer UOB Debit Card at Changi Recommends counter. Limited to one redemption per calendar year per cardmember. Offer is subject to WiFi router availability.

Enjoy savings on airport transfers with S$10 off Grab rides to or from the airport with promo code: KFUOB

Valid for Grab ride to or from Singapore Changi Airport with promo code KFUOB. Payment for the ride must be made with a KrisFlyer UOB Debit Card via the Grab mobile application. Valid on all Grab rides except GrabShuttle and GrabHitch. Limited to one redemption per half yearly per cardmember.

Frequently Asked Questions

What is GIRO?

GIRO is an automated electronic payment service. It allows you to make hassle-free monthly recurring payments to your billing organisations simply with a one-time sign-up.

What is the difference between GIRO and Bill Payment?

GIRO provides an avenue for you to make automated monthly recurring payments to your billing organisations. For Bill Payment, it provides the convenience for you to make a one-time payment instantly and securely through UOB TMRW. You may also schedule your payment date to pay immediately or preset to avoid incurring late fees.

How do I check on my application status for GIRO?

You may contact your billing organisation(s) to check on the status of your GIRO application.

When will my GIRO arrangement start?

For all GIRO application through UOB Personal Internet Banking, it will be verified by the Bank and forwarded to the respective billing organisation(s) for processing. For eGIRO submission via the billing organisation, application will be processed within 7 working days from date of receipt from the billing organisation.

Please be advised to continue paying your bills via alternative payment options until you have been notified by your billing organisation on the successful GIRO application.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.

For customers who participate in the UOB SalaryPlus Promotion (1 April 2025 to 30 June 2025) by successfully submitting an online participation form (available at the official UOB website) between 1 April 2025 to 30 June 2025, both dates inclusive, to receive the following cash reward:

S$30 cash credit for customers who successfully perform a bill payment of min. S$30 per transaction from their designated Eligible UOB savings account in this Promotion via GIRO, or/and who successfully perform a loan repayment transaction for their UOB car loan^ or UOB home loan^ from their designated Eligible UOB savings account for this Promotion, in each case, within the next two calendar months from the date of submission of the online participation form.

Eligible UOB savings account: UOB Passbook Savings Account, UOB Uniplus Account, UOB Stash Account, UOB One Account, UOB Lady’s Savings Account or KrisFlyer UOB Account.

Customers who qualified for any reward (whether in the form of cash credit or otherwise) awarded in connection with any past salary credit, GIRO or dividend credit promotions organised by UOB, or had any salary crediting, GIRO bill payment, UOB loan repayment or CDP crediting transactions made using any of their UOB current or savings account during the period between 1 October 2024 to 31 March 2025, will not be eligible to participate in this Promotion.

Full terms and conditions apply and can be accessed here.

^Repayment of your UOB car and home loan instalment must be reflected with the transaction description “Misc Debit” and bank reference of "Trf. Wd. Loans” to be eligible.

eGIRO is a nationwide initiative that digitises the GIRO application process with the aim of significantly reducing turnaround time through an efficient and secured platform. You can now apply for eGIRO in real time via any participating billing organisation’s website. Access to eGIRO payment arrangement to close to 300 billing organisations.

A 6% tax payment rebate is applicable to personal taxes paid between 1 April 2025 and 31 March 2026, provided that customers (i) hold a One Account as the primary accountholder with minimum monthly average balance (MAB) of S$30,000, (ii) register their mobile number for PayNow, (iii) setup money lock (minimum amount of $1) as the primary accountholder, and (iv) pay their IRAS personal income and/or property taxes through monthly GIRO from their One Account. For customers holding a UOB Child Development Account in addition to meeting the above criteria, the tax payment rebate is 6.5%. The tax payment rebate is capped at S$10, S$25 and S$50 per month, based on minimum One Account MAB of S$30,000, S$75,000 and S$150,000 respectively. Customers can enjoy a maximum of S$600 tax payment rebate over 12 months. Full terms and conditions apply.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.