SMS OTP authentication for mobile wallet provisioning will be replaced with Digital Token authentication. Simply set up your Digital Access & Digital Token.

Card services

Make the most out your card today as you explore our services, offered exclusively for UOB Cardmembers only.

Our card services

Card Protection

Add your cards securely to mobile wallet with Digital Token

Payment Plan and Services

Cardmembers Information Center

Find out more about card fee waivers, eStatement and more

Card Protection

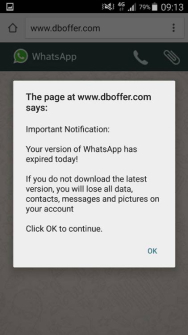

Safeguard your online card transactions with Digital Token

SMS OTP authentication for 3D Secure (3DS) online card transactions will be replaced with Digital Token authentication. Simply set up your Digital Token and enable push notifications for your UOB TMRW app.

Card Application and Usage

UOB Cash Advance

With UOB Cash Advance, never worry about not having enough cash on hand.

Card Application and Usage

Card activation

As a security measure, you will be required to activate your card before usage. To begin, you can activate your card instantly with these easy ways.

Card Application and Usage

Overseas use

The magnetic stripe on all UOB credit, debit and ATM cards are disabled for overseas point-of-sale transactions and ATM access to reduce the risk of unauthorized transactions being effected on the card.

UOB TMRW

Manage your cards with UOB TMRW

Cards management

Reset your PIN, get a temporary credit limit increase, add your card to apps, and even activate it conveniently

SmartPay

Convert your bills bite-sized pieces with interest-free monthly instalments and a one-time low processing fee

Card replacement

Report & block a lost card or replace a damaged one quickly and conveniently on UOB TMRW

Card fee waiver

Request for card fee waiver easily via UOB TMRW

Things you should know

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this service.