News and announcements

Scam Alerts

Scam alert: 17 Apr, 1 Jul and 10 Dec 2025 and 23 Jan 2026

Beware of impersonation scams

Victims are instructed to assist with investigations on “suspected financial activities” or “misuse of identity”. They are transferred to ‘government agencies’ where they must provide their account balance over video call screensharing or photo screenshots.

Oftentimes, the victims are also made to transfer funds or withdraw cash, buy gold bars from UOB Bullion or other jewellery merchants with their Bank Card, or issue blank cheques to be passed to the alleged scammer.

To bolster their credibility or pressure victims, alleged scammers may be attired in fake police uniforms during video calls. The alleged scammer may also produce forged warrant cards and send forged fake court orders or arrest warrants containing the victim’s personal information.

Stay vigilant and stay safe! Call our Fraud Hotline 62550160 if unsure. Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawal from being made on your account.

Scam alert: 26 Nov 2025 and 6 Jan 2026

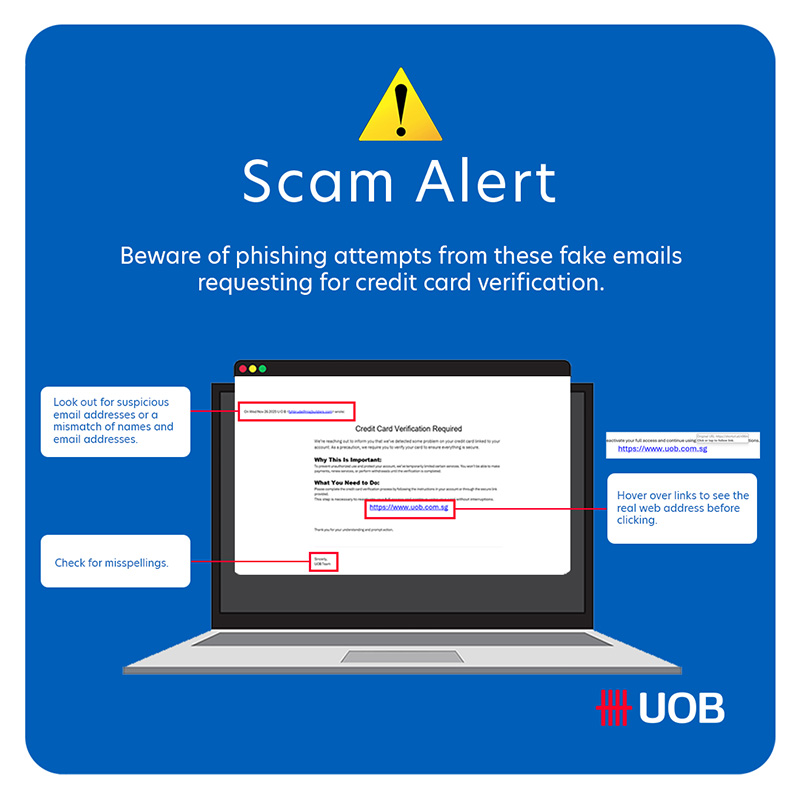

Phishing Scam

Scam alert: 04 Feb and 22 Dec 2025

Phishing Scam

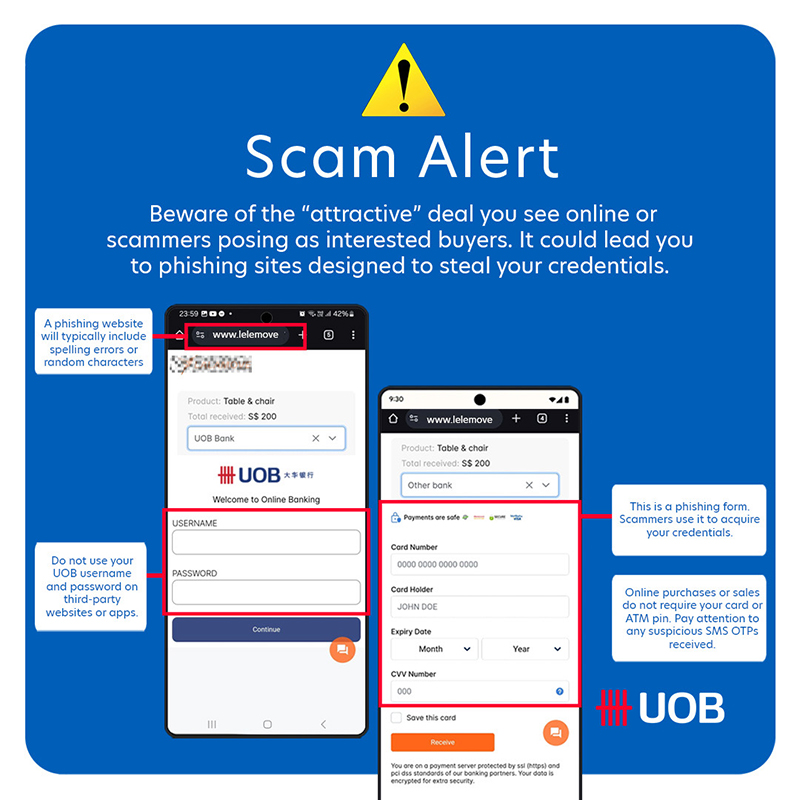

Be on high alert for scammers who typically offer “attractive” deals to phish your personal banking information using fake payment websites or through social media messages. Sometimes, scammers may impersonate interested buyers or government officials to phish your personal banking information.

Sharing online banking credentials such as credit card details, OTPs, card or ATM Pin could potentially expose you to unauthorised banking transactions including ATM withdrawals.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 62550160. Listen carefully and select the appropriate option to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking/ UOB TMRW app or Credit & Debit Cards or Both.

Remember these tips to help you #BeCyberSavvy:

- Always verify the legitimacy of information by checking with official source.

- Always verify the website that you are browsing. Lookout from misspellings or unusual domain.

- Check out the reviews of the ecommerce seller / buyer.

- Do not accede to ecommerce seller / buyer’s request to click on links or sideload application into your device.

- Do not disclose your personal or banking information (card details, OTPs, credit card or ATM Pin) to anyone.

- Card or ATM pin is not needed for online purchases.

- Pay attention to any suspicious SMS OTPs received.

- Report any fraudulent transactions to your bank immediately.

- Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

Scam alert: 28 Aug 2025

Impersonation Scam

To bolster their credibility or pressure victims, alleged scammers may be attired in fake police uniforms during video calls. The alleged scammer may also produce forged warrant cards and send forged fake court orders or arrest warrants containing victims' personal information.

Stay vigilant and stay safe! Call our 24/7 Fraud Hotline 6255 0160 if unsure. Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawal from being made on your account.

Scam alert: 1 Aug

Phishing Scam

Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 62550160. Listen carefully and select the appropriate option to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking/ UOB TMRW app or Credit & Debit Cards or Both.

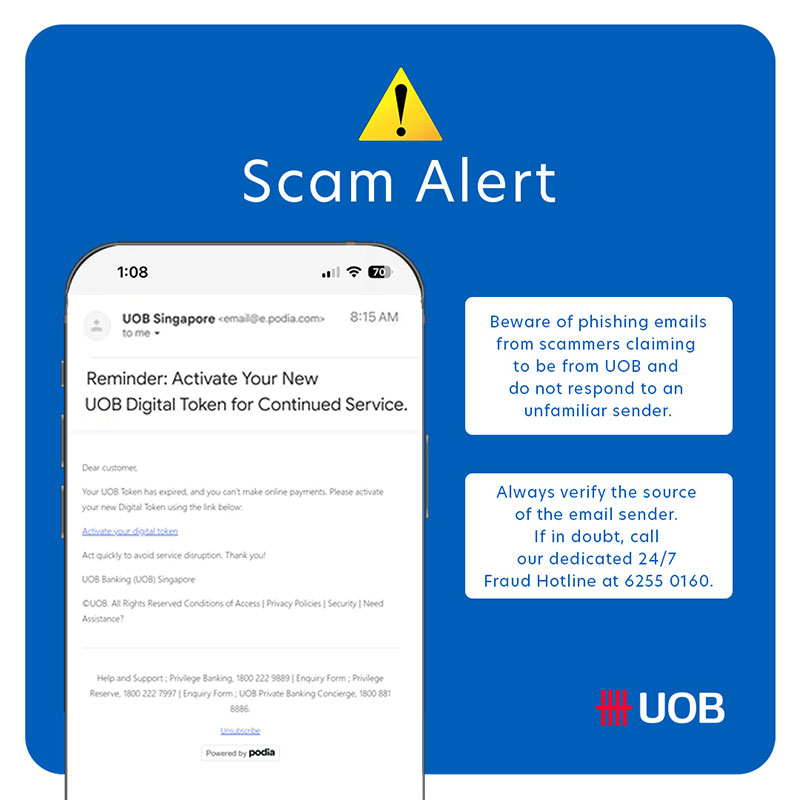

Scam alert: 14 Jan, 27 Jun and 4 Aug 2025

Phishing Scam

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. As scammers may be spoofing our UOB official email address to trick you into clicking on the phishing link, ensure that you verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address.

Remember these tips to help you #BeCyberSavvy:

1. Do not click on suspicious links provided in unsolicited emails.

2. If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

3. Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

4. The Bank will not send email or clickable link to activate or reactivate digital token.

5. Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Scam alert: 16 July 2025

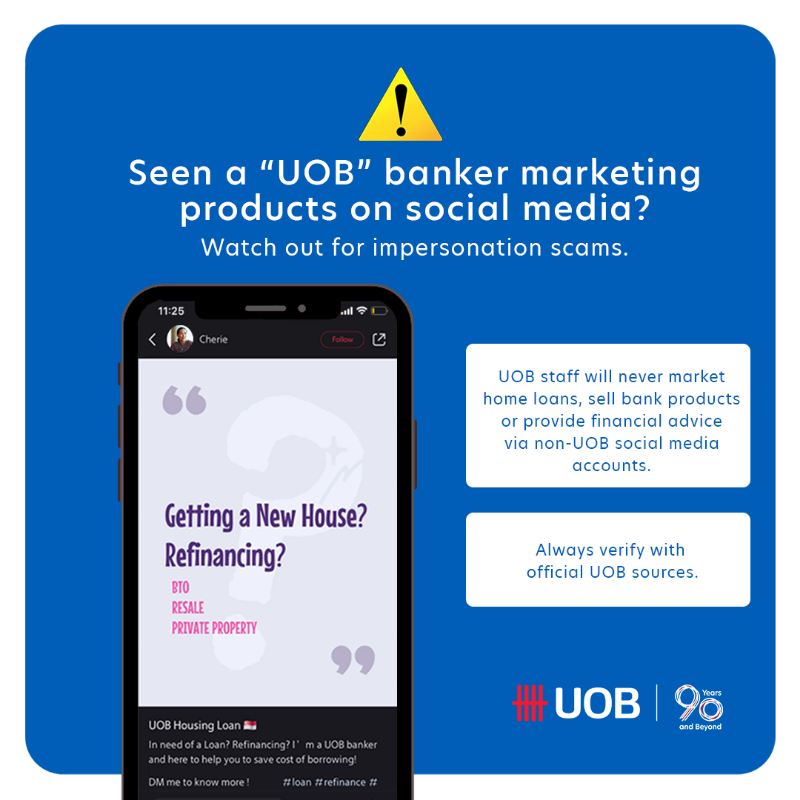

Impersonation Scam

Sharing online banking credentials such as debit or credit card details, OTPs, card or ATM Pin could potentially expose you to unauthorised banking transactions including ATM withdrawals.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 62550160. Listen carefully and select the appropriate option to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking/ UOB TMRW app or Credit & Debit Cards or Both.

Scam alert: 12 July 2025

Investment Scam

Red flags of an Investment Scam

- Promises of high returns at low or no risk.

- Involvement of pressure tactics (e.g. time-limited promotion)

- Dubious and unverified track record (i.e., not listed on MAS’s listing of registered financial institutions, representative and investor alert list).

- Offer of commissions and early profits as incentive to pursue investment opportunities.

Remember these tips to help you #BeCyberSavvy:

- Verify the investment opportunity.

- Check that the entity is regulated by referring to resources from MAS (e.g., Financial Institutions Directory, Register of Representatives, Investor Alert List).

- Do not immediately act on requests for sensitive and personal information without prior verification.

- Beware of unsolicited offers.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Scam alert: 17 Apr 2025 and 1 July 2025

Impersonation Scam

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 62550160. Listen carefully and select the appropriate option to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking/ UOB TMRW app or Credit & Debit Cards or Both.

Remember these tips to help you #BeCyberSavvy:

- Always verify the legitimacy of information by checking with official source.

- Always verify the website that you are browsing. Lookout from misspellings or unusual domain.

- Check out the reviews of the ecommerce seller / buyer.

- Do not accede to ecommerce seller / buyer’s request to click on links or sideload application into your device.

- Do not disclose your personal or banking information (card details, OTPs, credit card or ATM Pin) to anyone.

- Card or ATM pin is not needed for online purchases.

- Pay attention to any suspicious SMS OTPs received.

- Report any fraudulent transactions to your bank immediately.

- Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

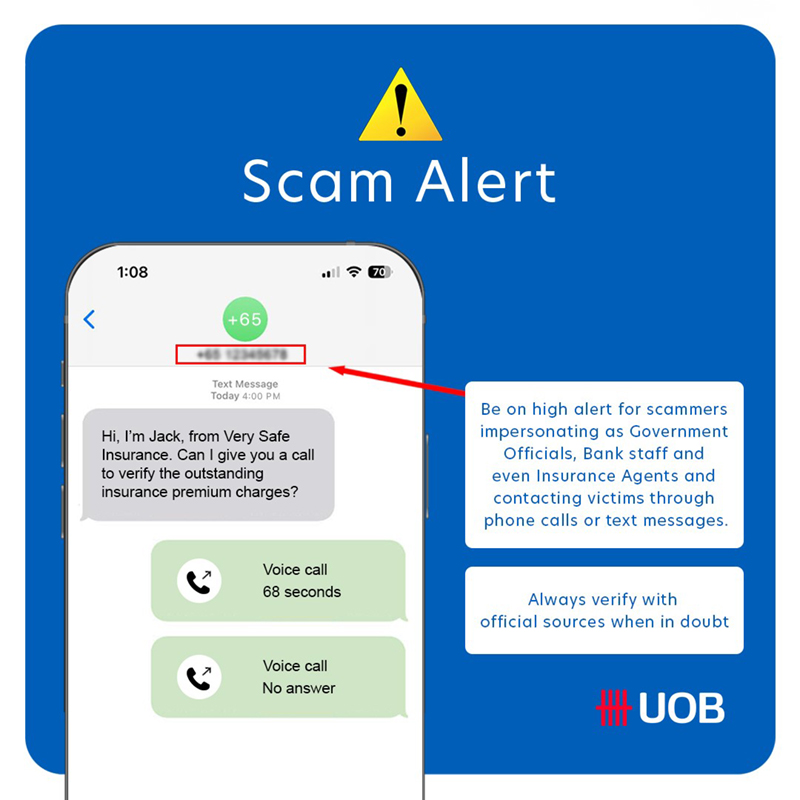

Scam alert: 30 Aug 2024 and 20 Mar 2025

Impersonation Scam

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails. You can download the ScamShield App on your mobile app to detect scam SMSes and calls.

- If in doubt, verify the authenticity of the information with the official website or sources of the authorities, UOB or the organization represented to you.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

- Stay calm and cease any communication with the suspected party immediately.

- Contact UOB Fraud Hotline or visit the nearest police station for assistance.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or visit go.uob.com/reportscam for immediate steps to take to prevent further losses.

Scam alert: 08 Nov 2024

Chinese digital subscription services Impersonation Scam

The Singapore Police Force advises the public to be on high alert for scammers impersonating as staff from Chinese services such as Tencent, WeChat or UnionPay. Such scams involve free trial subscriptions which victims may have signed up for (e.g insurance coverage, in-app anti-harassment functions, WeChat subscriptions)

Scammers would typically ask victims to verify their identities and bank accounts, by requiring them to provide their personal information and to make monetary transfers to various bank accounts. The victims were assured that their monies would be refunded upon successful verification. In some of the cases, the scammer would guide the victim through WhatsApp's screen sharing function to increase the bank transaction limit and perform the bank transfers.

Avoid falling for such impersonation scams through these tips to #BeCyberSavvy:

- Add the ScamShield app and set security features (e.g. set up transaction limits for internet banking transactions, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks and e-wallets).

- Do not send money to anyone you do not know or have not met in person before. Do not disclose your personal information, bank/card details and One-Time Passwords (OTPs) to anyone.

- Check for scam signs with official sources (e.g. call the Anti-Scam Helpline on 1799 or visit www.scamalert.sg), or with someone you trust.

- Look out for tell-tale signs of a phishing website. Do not click on dubious URL links provided by anyone you do not know or have not met in person before.

- Tell the authorities, family, and friends about scams. Report any fraudulent transactions to your bank immediately.

- Activate Money Lock to protect your account balances by restricting unauthorised withdrawals from being made on your account.

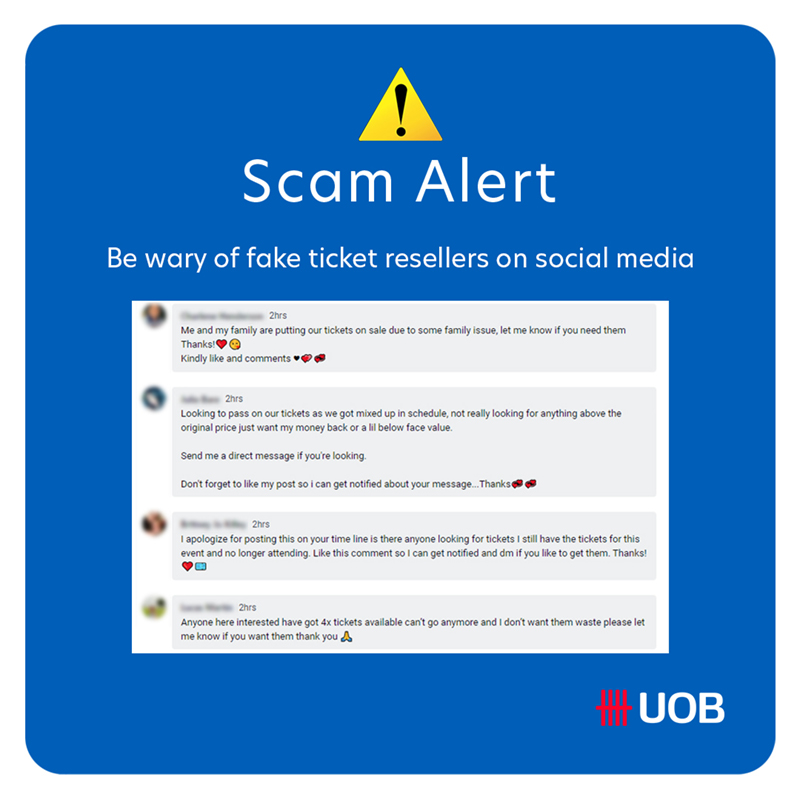

Scam alert: 15 Aug 2024

Fake Tickets E-commerce Scam

- Use payment options that only release payment to sellers upon delivery.

- Avoid making advance payments or direct bank transfers - this does not offer any protection to buyers.

- Arrange for physical meet-up with sellers to verify the authenticity of the physical tickets. Bear in mind that the party you are dealing with online is a stranger.

- Report the fraudulent advertisements to the social media and e-commerce platforms.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Subscribe to our UOB Facebook page for the latest updates and advice on scams

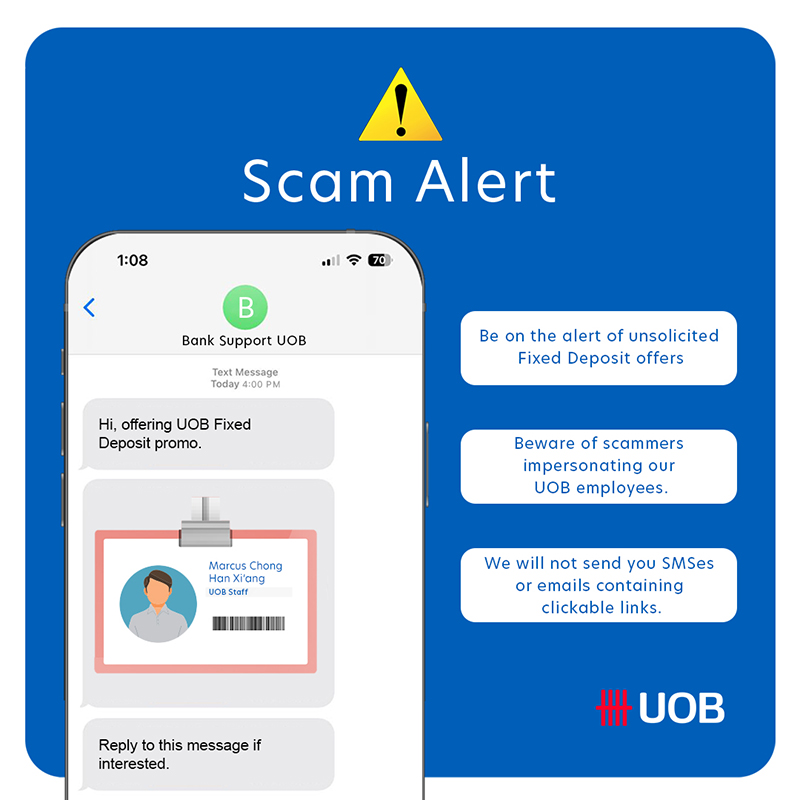

Scam alert: 05 Apr and 27 May 2024

Is this an authentic fixed deposit promotion from UOB?

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

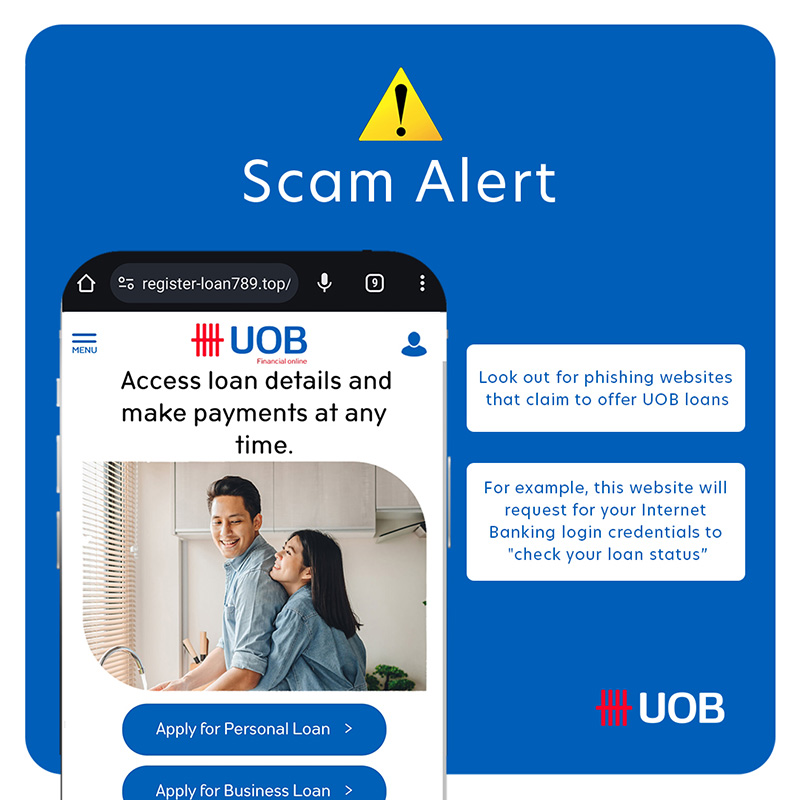

Scam alert: 14 May 2024

Fake Loans Platform Phishing Scam

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest updates and advice on scams

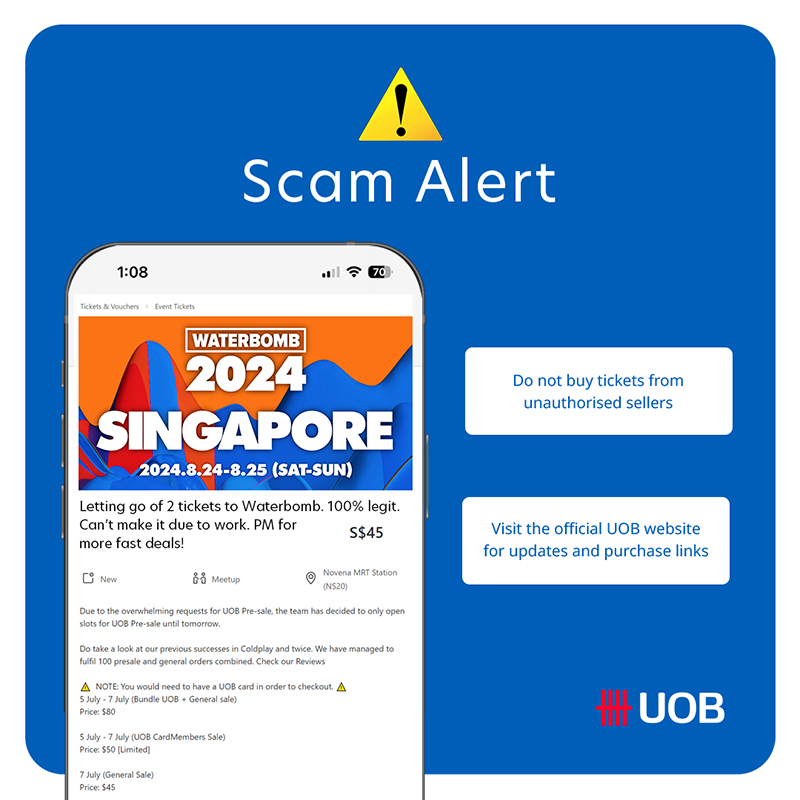

Scam alert: 2 May 2024

Fake Concert Tickets E-commerce Scam

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest updates and advice on scams.