UOB TMRW, the app built around you

Meet UOB TMRW, the all-in-one banking app built around you and your needs. It features AI-driven insights, rewards personalised to you through Rewards+, and investing made simple through our expert wealth solutions.

Our app is optimised for a seamless banking experience anytime, anywhere.

Bank. Invest. Reward. Make TMRW yours. Download now

What's New

Make the most of UOB TMRW mobile banking app with the latest announcements, features and promotions, all in one app.

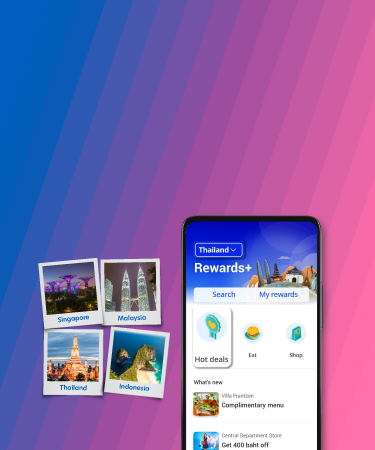

Your passport to over 1,000 deals across the region

Travel with Rewards+ on UOB TMRW to:

- Get quick access to deals while you're overseas

- Browse the hottest regional deals, curated just for you

- Grab exclusive limited-time coupons

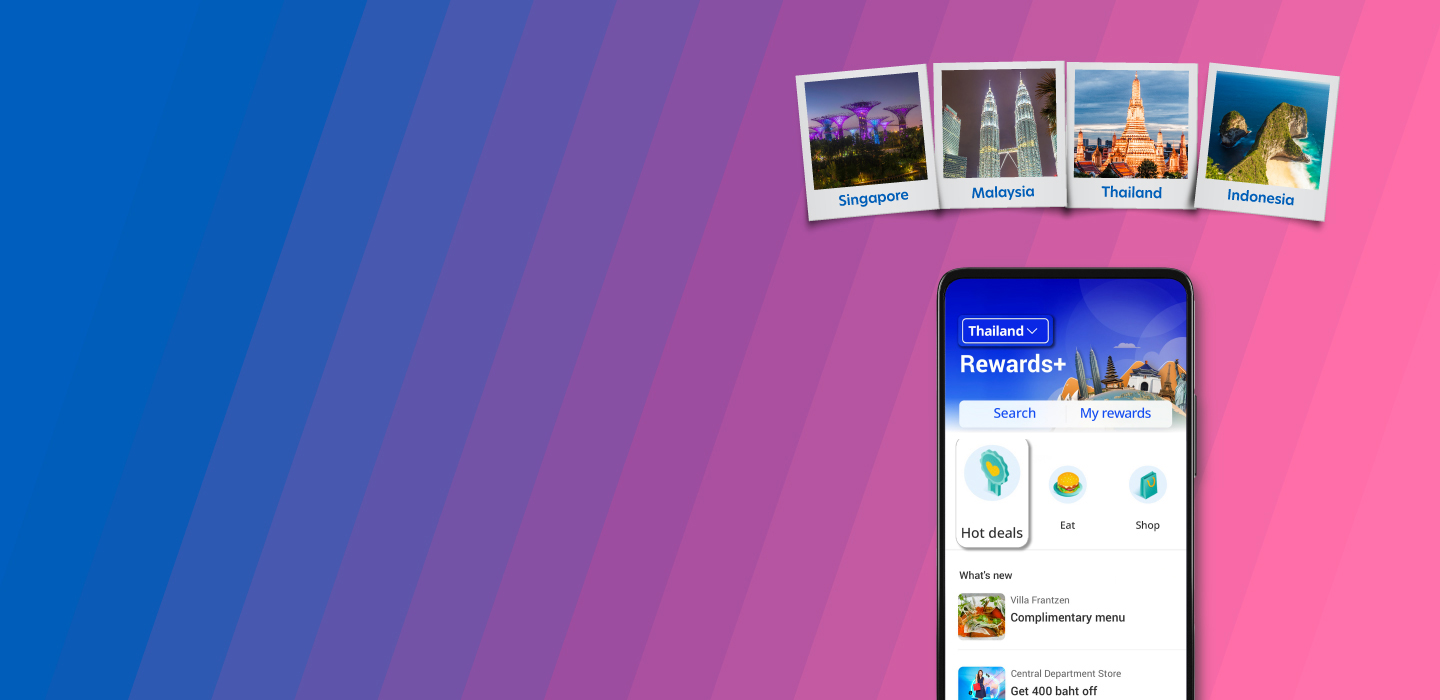

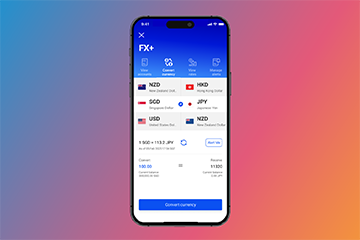

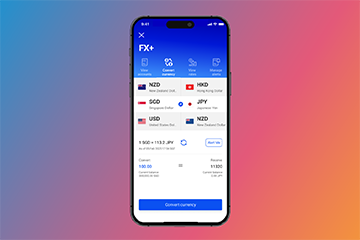

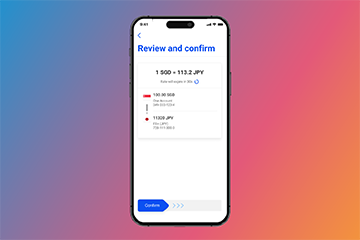

FX+

Convert SGD to JPY, USD (and more!) at rates comparable to Google’s

- Auto-currencies at your preferred rate

- Spend worldwide without FX fees using the FX+ Debit Card

- Complimentary travel insurance coverage, up to USD100k on medical expenses

- Get a JisuLife Handheld Fan Ultra1 (U.P. S$104.90) when you sign up. Promotion till 31 May 2025.

- From 1 March till 30 June 2025, be the top FX+ Debit Card spender of the month and receive a pair of Singapore Airlines Business Class tickets to Paris and Mastercard Priceless™ Experiences

T&Cs apply.

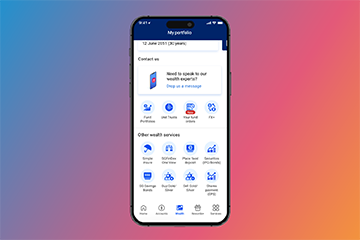

A wealth experience designed around you

With UOB TMRW app, you can:

- View and manage your portfolio in one place

- Capture timely investment opportunities with relevant insights

- Buy and sell funds seamlessly to build your own portfolio

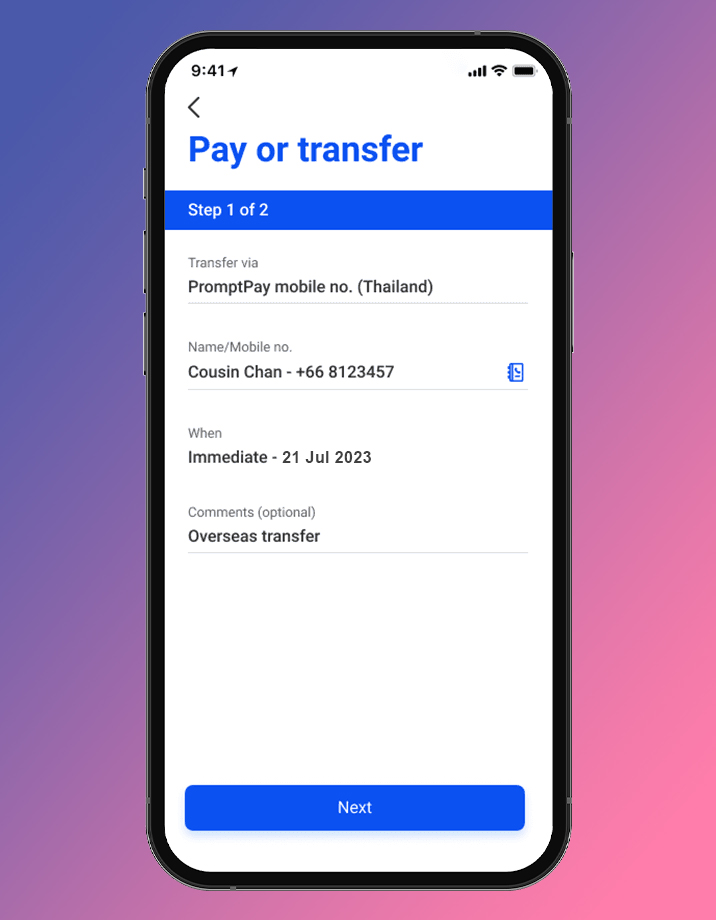

Send money overseas instantly

All you’ll need are UOB TMRW and your recipient’s phone number to make instant, secure transfers to loved ones in Malaysia (with DuitNow) or Thailand (with PromptPay). No fuss, no fees.

It’s easy to get more when you save with UOB

Choose from savings accounts that gives you up to 5.3% p.a. interest, up to 25X UNI$ and more.

Visit go.uob.com/online-exclusive for the latest sign-up offer!

T&Cs apply. Insured up to S$100k by SDIC.

(Promo has ended) Win a trip to Tokyo and more when you send an e-Hongbao

Transact, play and win with UOB TMRW. Prizes include flights to Tokyo and Bangkok, plus up to S$888 cashback every week.

Your passport to over 1,000 deals across the region

Travel with Rewards+ on UOB TMRW to:

- Get quick access to deals while you're overseas

- Browse the hottest regional deals, curated just for you

- Grab exclusive limited-time coupons

FX+

Convert SGD to JPY, USD (and more!) at rates comparable to Google’s

- Auto-currencies at your preferred rate

- Spend worldwide without FX fees using the FX+ Debit Card

- Complimentary travel insurance coverage, up to USD100k on medical expenses

- Get a JisuLife Handheld Fan Ultra1 (U.P. S$104.90) when you sign up. Promotion till 31 May 2025.

- From 1 March till 30 June 2025, be the top FX+ Debit Card spender of the month and receive a pair of Singapore Airlines Business Class tickets to Paris and Mastercard Priceless™ Experiences

T&Cs apply.

A wealth experience designed around you

With UOB TMRW app, you can:

- View and manage your portfolio in one place

- Capture timely investment opportunities with relevant insights

- Buy and sell funds seamlessly to build your own portfolio

Send money overseas instantly

All you’ll need are UOB TMRW and your recipient’s phone number to make instant, secure transfers to loved ones in Malaysia (with DuitNow) or Thailand (with PromptPay). No fuss, no fees.

It’s easy to get more when you save with UOB

Choose from savings accounts that gives you up to 5.3% p.a. interest, up to 25X UNI$ and more.

Visit go.uob.com/online-exclusive for the latest sign-up offer!

T&Cs apply. Insured up to S$100k by SDIC.

(Promo has ended) Win a trip to Tokyo and more when you send an e-Hongbao

Transact, play and win with UOB TMRW. Prizes include flights to Tokyo and Bangkok, plus up to S$888 cashback every week.

3 ways to switch colour themes:

• Access before you log in to the app

• Access via your dashboard

• Access via Services

Limited to the first 1,000 customers monthly.

*To be eligible for the S$10 Cash Credit, you must be among the first 1,000 customers to successfully log in to your UOB TMRW App and register for PayNow and perform a PayNow transaction of min S$10 during the period commencing from (i) 10 to 31 Oct 2022, (ii) 1 to 30 Nov, or (iii) 1 to 31 Dec 2022 respectively (each a “Campaign Period”), must not have PayNow registered with UOB prior to the start of the relevant Campaign Period, and must not have logged in to both your UOB Personal Internet Banking and UOB TMRW App in the last 6 months before the start of the relevant Campaign Period i.e. from 8 Apr to 9 Oct 2022 for the Oct 2022 Campaign Period, from 1 May to 31 Oct 2022 for the Nov 2022 Campaign Period, and from 1 Jun to 30 Nov 2022 for the Dec 2022 Campaign Period. Eligible customers will receive the S$10 Cash Credit in the same account used for the PayNow transaction by 28 Feb 2023.Please click here for the T&Cs.

*For T&Cs, click here

Click here for the FAQs.

Enjoy the following benefits:

- Public Conveyance Personal Accident coverage of up to S$300,000

- Emergency Medical Assistance, Evacuation & Repatriation of up to S$50,000 due to an accident or illness.

- Medical Expenses due to accident and illness of up to S$2,000

- Luggage Delay of up to S$200 for each full 6 hours while overseas

- Travel Delay of up to S$200 for each full 6 hours while overseas

The specific details applicable to this insurance are set out in the Insurance Certificate and Agreement which is the operative document. Terms, conditions and exclusions apply. Please seek advice from a qualified advisor if in doubt.

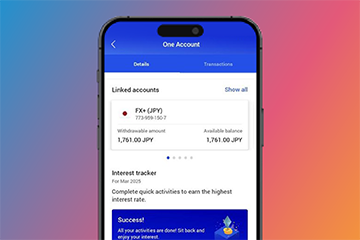

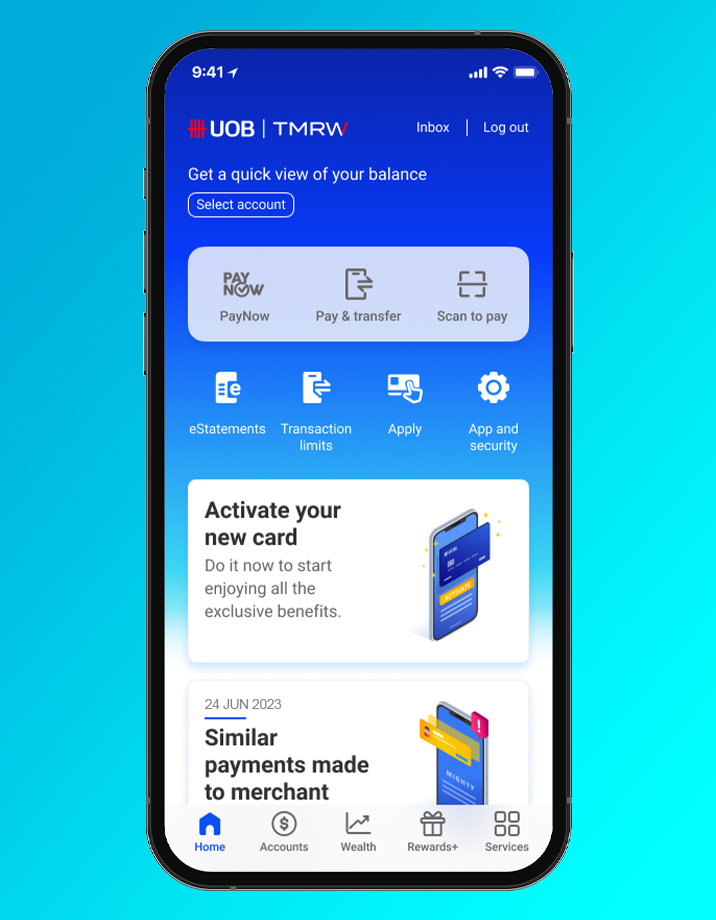

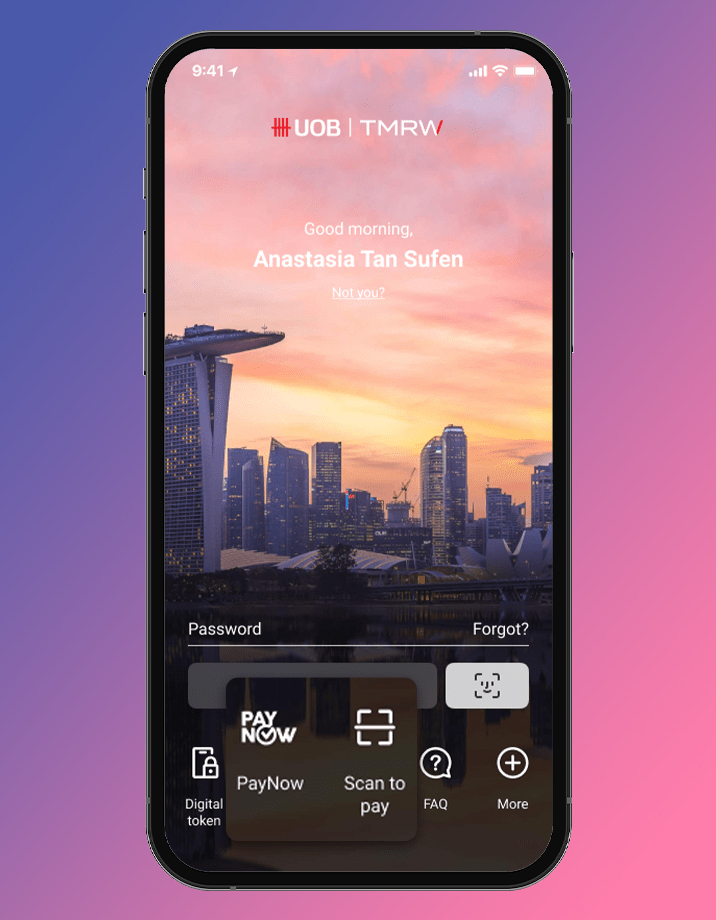

Bank with ease

Everything at a glance

The new app has never been more user-friendly, with one-tap access to your most used features.

Manage your accounts and transactions on the go

Get quick account updates on your deposits, bonus interests, investments, credit cards' deals and rewards.

Effortless payments

Easier access to your daily payments with PayNow on UOB TMRW

Conveniently make purchases or payments securely and receive earlier government payouts when you register for PayNow on UOB TMRW with your NRIC/FIN.

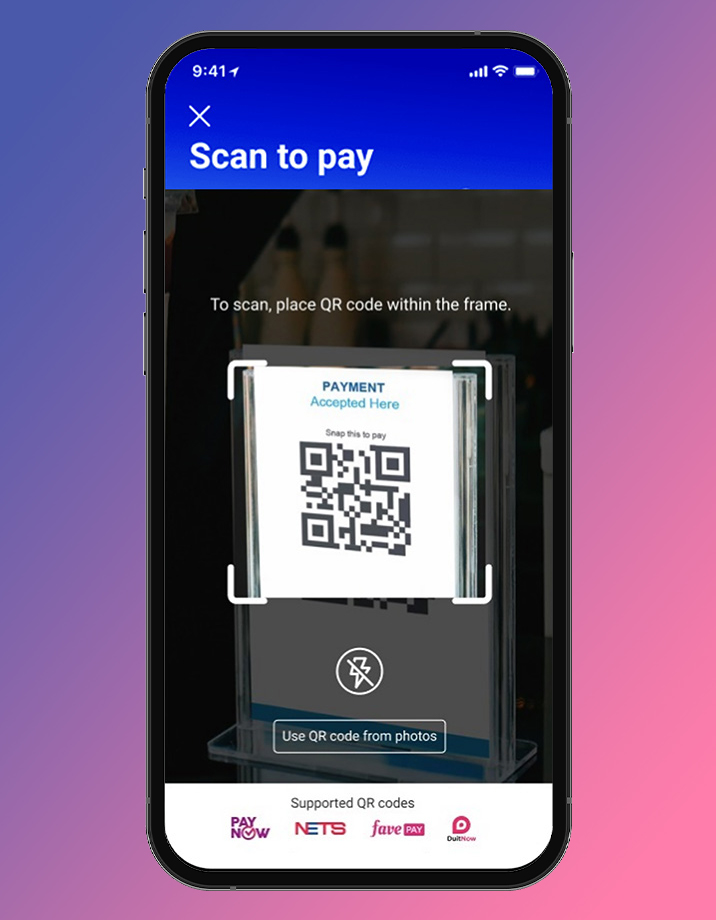

Easy payments with Scan To Pay

Pay at hawker centres, convenience stores and retail shops easily with Scan To Pay. Supported QR codes: PayNow QR, NETS QR, FavePay QR locally and DuitNow QR in Malaysia.

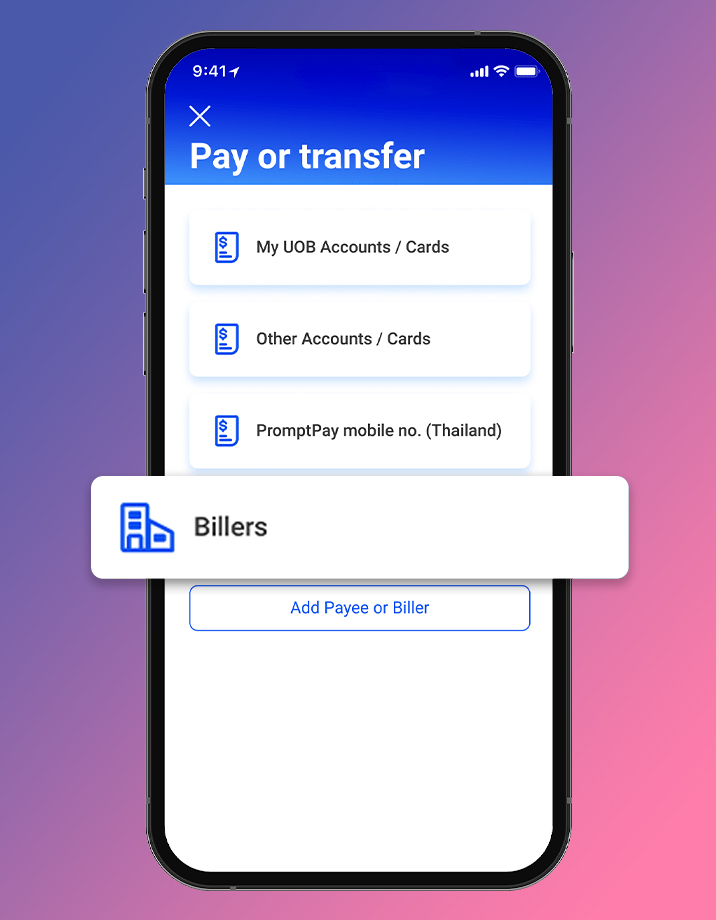

Pay anyone via mobile locally and in Thailand

Send and receive funds easily using a mobile number or NRIC via PayNow. Have friends in Thailand? You can now send money easily via PromptPay.

Pay bills easily

With our extensive list of close to 200 billing organisations, pay your bills instantly and securely. Add them as billers so you need not input the bill details each time you pay.

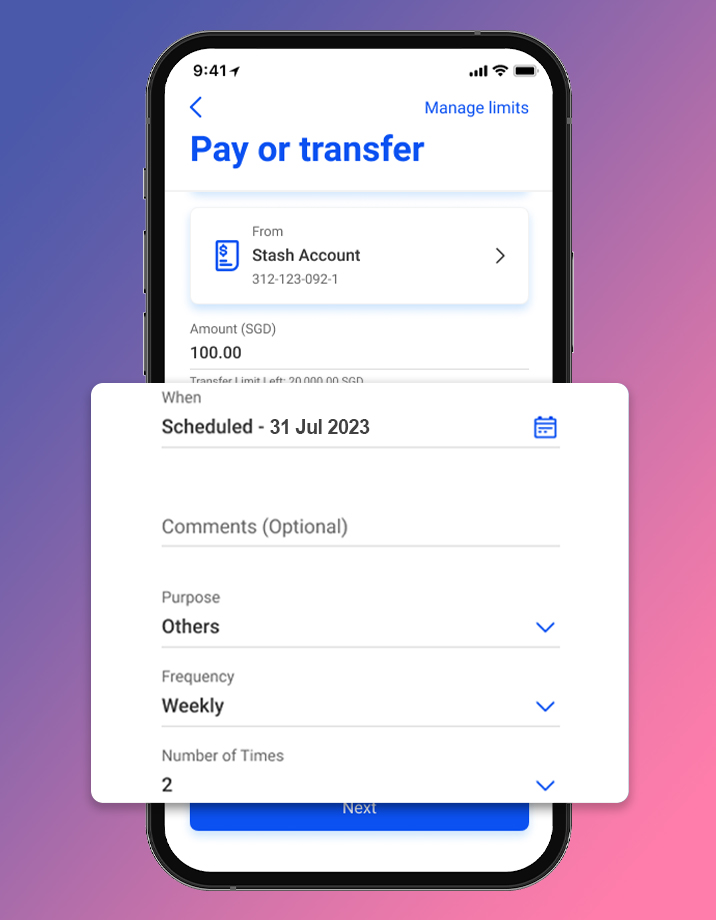

Never miss a scheduled transfer

With scheduled funds transfer, you can setup a recurring fund transfer based on amount, date and frequency of transfer.

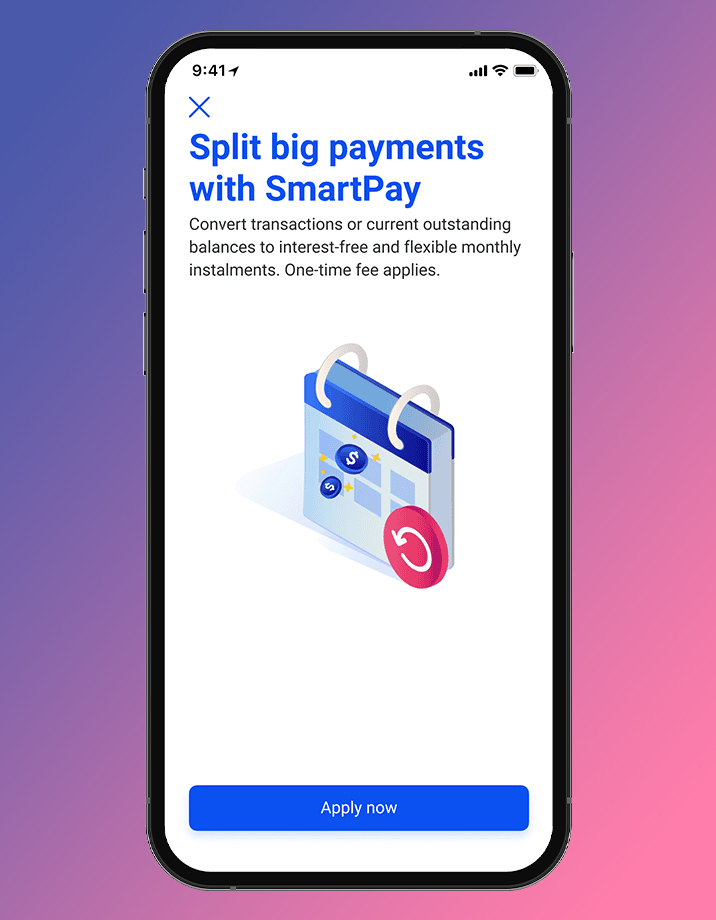

Buy now, pay later with UOB SmartPay

Split your bills into bite-sized payments on UOB TMRW. Enjoy interest-free monthly instalment with 1-time low processing fee and flexible payments over 3, 6, 12 months with UOB SmartPay.

One App For All Your Banking Needs

With UOB Insights, digital banking is now easier, smarter, and more personalised. We serve you the most relevant insights by analysing your habits and preferences.

Access a world of rewards at your fingertips with Rewards+

Get personalised and exclusive deals on dining, shopping, travel and more. Plus, view, track and redeem your cashback and rewards points.

Here’s how to access your Rewards:

Step 1: Go to Rewards+ tab on UOB TMRW

Step 2: Tap on “My Rewards”

Step 3: Manage your available rewards at a glance!

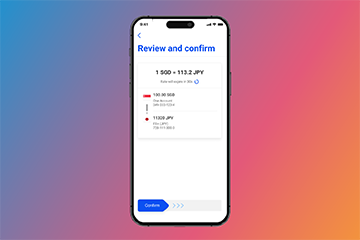

Lock in rates comparable to Google's with FX+

Take advantage of favourable rates by converting currencies in advance on UOB TMRW! When travelling overseas, pay directly in the local currency with your UOB FX+ Debit Card.

Log in to UOB TMRW and tap on Wealth > FX+

Choose your base and required currency

Input the amount to be converted and tap on Convert currency

Slide to confirm

Lock in rates comparable to Google's with FX+

Take advantage of favourable rates by converting currencies in advance on UOB TMRW! When travelling overseas, pay directly in the local currency with your UOB FX+ Debit Card.

Log in to UOB TMRW and tap on Wealth > FX+

Choose your base and required currency

Input the amount to be converted and tap on Convert currency

Slide to confirm

Other UOB TMRW Services

Discover more of what TMRW brings

- Make quick transactions via PayNow with just the Company Unique Entity Number (UEN) or Virtual Payment Address (VPA)

- Check your balance, pay bills and transfer funds

- Manage your pay and transfer limits

Bank Securely

Your online banking security is our top priority. We are committed to protecting your personal information and keeping you updated on the latest security tips and information. Learn more about the latest measures that UOB has put in place to protect you.

Digital Banking and Cards

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions.![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Note: Ensure you have the latest app version of UOB TMRW for the latest updates.

Digital Banking

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Digital Banking

12-hour cooling period for transfer limit change NEW!

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Note: Customers will need to update to new app version of UOB TMRW 17.18.0 and above to see the new changes.

Digital Banking

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

General Banking

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest (up to 5.3% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Digital Banking and Cards

Kill Switch (Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how.

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.

If you wish to re-enable all your UOB Debit/Credit cards, please unblock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

General Banking

Changes to your Notification Alerts for early fraud detection

To ensure you stay informed about your transactions, please be informed that the unsubscribe option for selected outgoing payment alerts![]() will be disabled from end July 2024 onwards. Instead, you will either receive email or SMS notification for the relevant transaction.

will be disabled from end July 2024 onwards. Instead, you will either receive email or SMS notification for the relevant transaction.

Click on the button below for the list of transaction alerts that UOB is currently offering and the transaction alert default setting, which you will also have the option to subscribe to selected alerts. It is important to subscribe to transaction alerts to be alerted of any potential fraudulent activity.

Digital Banking

Enhanced Protection for your Digital banking login

As part of the latest industry move to protect you from phishing scams, from end July 2024 onwards, customers on Digital Token can no longer use SMS OTP or Digital token generated OTP to authenticate their login request to UOB Personal Internet Banking (PIB). Instead, you will need to use Digital Token to authenticate your login.

Missed the Digital Token notification?

Simply tap on “Digital token” icon on the login screen of your UOB TMRW app to retrieve the notification.

General Banking

Get extra protection for your money

Digital scams are on the rise. Give your savings an added layer of security with the all-new UOB LockAway AccountTM and transfer in money to keep it locked away from digital scams.

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to. Any withdrawal of funds must be done in-person at any of our UOB branches in Singapore.![]()

Lock away any amount. No minimum, no maximum, no fall-below fees.

Insured up to S$100k by SDIC.

Cards

Replace or block your card

No more waiting on hold. You can now report a lost card, request for a replacement card or temporarily/permanently block your card. If you have temporarily blocked your card, you will be able to unblock your card later on UOB TMRW.

For lost card

Simply log in to UOB TMRW and tap on "Accounts" > Select the affected card > Tap on "Lost card" to proceed. For full step-by-step guide, please click here.

For fraudulent transactions

If you wish to block your card for fraudulent transactions, please log in to UOB TMRW and tap on "Accounts" > Select the affected card > Tap on "Fraud" to block your card > Contact UOB Fraud 6255 0160 to report on your fraudulent transactions. For full step-by-step guide, please click here.

If you wish to unblock your card, please contact UOB Customer Service Hotline at 1800 222 2121 for assistance.

Digital Banking

Protecting your transactions on Personal Internet Banking and UOB TMRW

From 13 December 2022, we will be implementing an extra layer of authentication by sending a One-Time Password (OTP) to your registered email to complete selected high-risk transactions on Personal Internet Banking and TMRW![]() .

.

Digital Banking

Revision of funds transfer limit

With effect from 4 November 2023, the maximum transfer limit had been revised to S$200,000 for all customers. This applies to fund transfers to other UOB accounts, other bank accounts, eNETS and Bill Payment. The default limit for funds transfers remains at S$5,000, which you can manage your limits via UOB Personal Internet Banking or the UOB TMRW app, or set lower limits to safeguard your banking transactions. Click on below button for the step-by-step guide. ![]()

Cards

UniAlerts

Keeps you informed of your transactions.

Avoid late payment of your UOB Credit Card bills and get instant updates of your account activities via UniAlerts.

Login to UOB Personal Internet Banking here and click on Account Services > Manage Alerts to subscribe – make sure your contact details are updated.

Digital Banking

Default transaction notification set at S$100

You may still customise your transaction notification threshold via UOB Personal Internet Banking.

Digital Banking

Additional transaction signing required for transfers above $5,000 to added payees

This measure caps the amount that a scammer may pilfer without phishing for your transaction signing code.

Digital Banking

12-hour cooling period transfers to all new payees

This measure prevents scammers from adding new payees and performing funds transfers immediately. You will be notified via SMS when adding new payees.

Digital Banking

12-hour cooling period on activation of new Digital Token

If you are alerted to an unauthorised token activation, please call our Fraud Hotline immediately.

General Banking

Removal of clickable phone numbers in bank-sent emails and SMSes

We had removed all clickable phone numbers in our emails and SMSes to you as our additional measure to protect you from scammers. Any SMS or email claiming to be from UOB that contains a link in the phone number will likely be a scammer. Do not click.

Digital Banking

Receive 'New Device Login' alerts

Alerts are sent via email when signing in from a different device or browser for the first time. If you detect any unauthorised logins, please contact the Fraud Hotline immediately.

Digital Banking

Automatic Logout Feature

Inactive Internet Banking sessions will be detected by our system and you will automatically be logged out to ensure your account details are not compromised.

Digital Banking

Unique Login Credentials

Access your Internet Banking account with a unique Username and Password that cannot be used by anyone else.

Bank Securely

Your online banking security is our top priority. We are committed to protecting your personal information and keeping you updated on the latest security tips and information. Learn more about the latest measures that UOB has put in place to protect you.

Digital Banking and Cards

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions.![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Note: Ensure you have the latest app version of UOB TMRW for the latest updates.

Digital Banking

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Digital Banking

12-hour cooling period for transfer limit change NEW!

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Note: Customers will need to update to new app version of UOB TMRW 17.18.0 and above to see the new changes.

Digital Banking

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

General Banking

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest (up to 5.3% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Digital Banking and Cards

Kill Switch (Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how.

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.

If you wish to re-enable all your UOB Debit/Credit cards, please unblock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

General Banking

Changes to your Notification Alerts for early fraud detection

To ensure you stay informed about your transactions, please be informed that the unsubscribe option for selected outgoing payment alerts![]() will be disabled from end July 2024 onwards. Instead, you will either receive email or SMS notification for the relevant transaction.

will be disabled from end July 2024 onwards. Instead, you will either receive email or SMS notification for the relevant transaction.

Click on the button below for the list of transaction alerts that UOB is currently offering and the transaction alert default setting, which you will also have the option to subscribe to selected alerts. It is important to subscribe to transaction alerts to be alerted of any potential fraudulent activity.

Digital Banking

Enhanced Protection for your Digital banking login

As part of the latest industry move to protect you from phishing scams, from end July 2024 onwards, customers on Digital Token can no longer use SMS OTP or Digital token generated OTP to authenticate their login request to UOB Personal Internet Banking (PIB). Instead, you will need to use Digital Token to authenticate your login.

Missed the Digital Token notification?

Simply tap on “Digital token” icon on the login screen of your UOB TMRW app to retrieve the notification.

General Banking

Get extra protection for your money

Digital scams are on the rise. Give your savings an added layer of security with the all-new UOB LockAway AccountTM and transfer in money to keep it locked away from digital scams.

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to. Any withdrawal of funds must be done in-person at any of our UOB branches in Singapore.![]()

Lock away any amount. No minimum, no maximum, no fall-below fees.

Insured up to S$100k by SDIC.

Cards

Replace or block your card

No more waiting on hold. You can now report a lost card, request for a replacement card or temporarily/permanently block your card. If you have temporarily blocked your card, you will be able to unblock your card later on UOB TMRW.

For lost card

Simply log in to UOB TMRW and tap on "Accounts" > Select the affected card > Tap on "Lost card" to proceed. For full step-by-step guide, please click here.

For fraudulent transactions

If you wish to block your card for fraudulent transactions, please log in to UOB TMRW and tap on "Accounts" > Select the affected card > Tap on "Fraud" to block your card > Contact UOB Fraud 6255 0160 to report on your fraudulent transactions. For full step-by-step guide, please click here.

If you wish to unblock your card, please contact UOB Customer Service Hotline at 1800 222 2121 for assistance.

Digital Banking

Protecting your transactions on Personal Internet Banking and UOB TMRW

From 13 December 2022, we will be implementing an extra layer of authentication by sending a One-Time Password (OTP) to your registered email to complete selected high-risk transactions on Personal Internet Banking and TMRW![]() .

.

Digital Banking

Revision of funds transfer limit

With effect from 4 November 2023, the maximum transfer limit had been revised to S$200,000 for all customers. This applies to fund transfers to other UOB accounts, other bank accounts, eNETS and Bill Payment. The default limit for funds transfers remains at S$5,000, which you can manage your limits via UOB Personal Internet Banking or the UOB TMRW app, or set lower limits to safeguard your banking transactions. Click on below button for the step-by-step guide. ![]()

Cards

UniAlerts

Keeps you informed of your transactions.

Avoid late payment of your UOB Credit Card bills and get instant updates of your account activities via UniAlerts.

Login to UOB Personal Internet Banking here and click on Account Services > Manage Alerts to subscribe – make sure your contact details are updated.

Digital Banking

Default transaction notification set at S$100

You may still customise your transaction notification threshold via UOB Personal Internet Banking.

Digital Banking

Additional transaction signing required for transfers above $5,000 to added payees

This measure caps the amount that a scammer may pilfer without phishing for your transaction signing code.

Digital Banking

12-hour cooling period transfers to all new payees

This measure prevents scammers from adding new payees and performing funds transfers immediately. You will be notified via SMS when adding new payees.

Digital Banking

12-hour cooling period on activation of new Digital Token

If you are alerted to an unauthorised token activation, please call our Fraud Hotline immediately.

General Banking

Removal of clickable phone numbers in bank-sent emails and SMSes

We had removed all clickable phone numbers in our emails and SMSes to you as our additional measure to protect you from scammers. Any SMS or email claiming to be from UOB that contains a link in the phone number will likely be a scammer. Do not click.

Digital Banking

Receive 'New Device Login' alerts

Alerts are sent via email when signing in from a different device or browser for the first time. If you detect any unauthorised logins, please contact the Fraud Hotline immediately.

Digital Banking

Automatic Logout Feature

Inactive Internet Banking sessions will be detected by our system and you will automatically be logged out to ensure your account details are not compromised.

Digital Banking

Unique Login Credentials

Access your Internet Banking account with a unique Username and Password that cannot be used by anyone else.

Funds from the UOB LockAway Account can only be withdrawn in person and not by any other means, including but not limited to online transactions, Personal Internet Banking, Mobile Services, cheque, ATM withdrawals and debit instructions given through the Call Centre Service. For the avoidance of doubt, debit instructions will only be accepted for the UOB LockAway Account if you provide the debit instruction in person at any of our branches in Singapore. Watch this space for more information and refer to our FAQs

Stay updated on your incoming PayNow transactions

From 1 Mar 2023, we will phase out SMS notifications for incoming PayNow transactions. Customers will be notified via email and push notifications on UOB TMRW. To ensure your PayNow transactions notifications are not disrupted, please enable your push notification on your phone settings and update your email address today. Visit here for more information.

Protecting your transactions on Personal Internet Banking and UOB TMRW

From 13 December 2022, we will be implementing an extra layer of authentication by sending a One-Time Password (OTP) to your registered email to complete selected high-risk transactions on Personal Internet Banking and TMRW.

If you have not provided/updated your email address with us, a SMS OTP will be sent to your mobile number as a temporary alternative.

To ensure your online transactions are not disrupted, update your email address today. Login to your UOB TMRW app and select Services > Contact details or UOB Personal Internet Banking and select My Profile under your name.

Alerts for your GIRO transactions

We are committed to ensure that you have a safe and secure banking experience without compromising on convenience. With effect from 22 October 2022, you will no longer receive any alerts of GIRO debit transactions unless you have made a preferred SMS or email alerts through UOB Personal Internet Banking before this date. To update or review your personalised GIRO alert options, please log in to UOB Personal Internet Banking.

Mandating transaction alert for Cashier's order and Demand Draft

For security reasons, we have mandated transaction alerts for Cashier’s Orders and Demand Drafts. The unsubscribe option of the transaction alerts will no longer be available. For customers who have previously unsubscribed, we will automatically subscribe you back to the SMS option with the default alert trigger amount of S$1,000. To customise the alert mode and trigger amount, log in to UOB Personal Internet Banking to select the alert mode and new amount.

Revision of funds transfer limit

If you have not made any changes to your transfer limit before, your transfer limit will remain at the default limit of S$5,000.

To update your transfer limit, please have your digital token code ready and click here for the step-by-step guide.

With the UOB TMRW mobile banking app, you’re able to bank whenever and however you want. It’s loaded with features that allow you to pay bills, schedule fund transfers, and instantly withdraw cash from the comforts of your home.

Mobile banking saves significant amounts of time and energy. Imagine going to a nearby bank branch. You have to make preparations to go out, drive, and possibly wait when you get to the bank. There’s no need for any of this with online banking.

You’re more secure using our online banking app than you are going out with physical cards. With extra security options like multi factor authentication, your money will be safe and inaccessible to anyone but yourself.

Additionally, digital banking gives you the ability to go cashless. Physical cash, both coins and paper, can carry germs and viruses. It can also easily be stolen. Going cashless significantly reduces your risk of harm.

Mobile banking gives you more control over your finances. Our banking app gives you real time access to your money and allows you to easily manage your investments. This is also without any of the restrictions physical banking has when you can perform tasks like moving money between accounts.

| Affected Transaction alerts | Can I unsubscribe? | What will happen after July 2024? |

| UOB card bill payment | N | The unsubscribe option will be disabled. Customer will receive the default email or SMS notification on the relevant transaction. If you wish to select your preferred alert mode and threshold amount, log in to UOB Personal Internet Banking for the selection. |

| Funds transfer to your own UOB account/using the ATM to another bank account | ||

| Cash Advance to own UOB account | ||

| Mobile cash transaction | ||

| Securities Application | ||

| NETS contactless or online payment/In-store payment using NETS | ||

| Cashcard/Nets Flashpay top-up | ||

| Rights/SSB/SGS/T-Bills Application | ||

| EPS payment |

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Choose the coupon you wish to grab

- Step 3: Use grabbed coupon immediately or view all coupons in the Rewards+ tab

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Select the country you’re travelling to

- Step 3: Browse the list of deals available in the country

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Tap on “My Rewards”

- Step 3: Manage your available rewards and redeem rewards points at your favourite merchants.

| Category | Impacted Transactions | Default notification mode | Default Threshold (S$) |

| Online transfers and payments | Digital transactions including all types of fund transfer, telegraphic transfer, QR payment (local and overseas), bill payments, online cash advance, eNETs payments | Push notification and email | 100 |

| Adding of payee, biller or beneficiary | No threshold | ||

| GIRO setup approval | SMS and Email | No threshold | |

| GIRO payments and standing orders (including Electronic Direct Debit Authorisation) | Unsubscribe | 1,000 | |

| No threshold | |||

| Upcoming GIRO payments and standing orders reminders (including Electronic Direct Debit Authorisation) | |||

| Card activity* | Card charges (includes payments and cash advances) | SMS and email | 500 |

| SmartPay, LuxePay, Instalment Payment Plan and UOB Personal Loan monthly instalments | 1,000 | ||

| NETS chip payments | 1,000 | ||

| NETS contactless and online payments | 1,000 | ||

| NETS transaction made on the CDA account | 0.1 | ||

| Low credit limit reminder | Unsubscribe | No threshold | |

| Upcoming card bill payment reminders | |||

| Confirmation of card bill payments received | |||

| Investments, fixed deposits and insurance | Instructions for securities, bonds, unit trusts and insurance products (includes Electronic Payment for Shares (EPS) and Share payments via ATMs) | Push notification and email | No threshold |

| Fixed or structured deposits placements | |||

| CPF or SRS accounts top-ups. | |||

| Buy/sell gold and silver | 1 | ||

| Securities and bonds allocation and redemption updates | Unsubscribe | No threshold | |

| eStatement | eStatement is ready for viewing | Push notification and email | No threshold |

| Security and money lock | Transfer and payment limit updates | Push notification and email | No threshold |

| Money lock limits update | |||

| When available balance is lower than money lock limit, and when transactions fail due to money lock | |||

| Mailing address update | |||

| ATM | Cash withdrawal in Singapore and Overseas | SMS and email | 500 |

| ATM transactions - funds transfer, bill payment | 1,000 | ||

| Top-ups to CashCards or NETS FlashPay cards/ Apply rights application/Apply SGS/Apply SSB/Apply T-bills | No threshold | ||

| Cheques, cashier's orders and demand drafts | Demand drafts and cashier’s orders | Push notification and email | 1,000 |

| Adding of beneficiary for cashier’s orders and demand drafts. | No threshold | ||

| When cheques are cashed in | SMS and email | 1,000 | |

| Others | Certain payments, refunds, and payment reversals made outside of UOB TMRW and Personal Internet Banking | Unsubscribe | 1,000 |

* For Card activity alerts, customers’ preferred alert mode of “SMS” or “Email” will be upgraded to “SMS and Email”, Customers’ preferred alert threshold, where applicable, will be retained.

Below is the list of transaction alerts which customers are unable to change their notification mode.

| Impacted Transactions | New notification mode (after 19 April 2025) |

| FX+ currency conversion (via UOB TMRW) | Push notification and email |

| Contact details update (via UOB PIB and UOB TMRW) | Push notification and SMS |

| Unsubscribe from GIRO and Standing Order alert, and certain payments alert via PIB/TMRW | Push notification and email |

| Change eStatement subscription | Push notification and SMS |

| 1 |

Push notification, SMS and email |

| Block/Unblock card (via UOB TMRW) | Push notification and email |

| Kill Switch (disable digital access and block cards) | SMS and email |

Link FX+ to any of these eligible SGD accounts:

- One Account

- Wealth Premium Account

- Privilege Account

- iAccount

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.