Earn points by recycling with us and redeem them with sustainable partners across Singapore

Benefits

Own every evolution with the UOB EVOL Card, and get 10% on all online, mobile contactless and overseas in-store FX spend (using your physical card)! Plus, no annual fee.

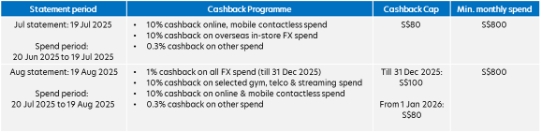

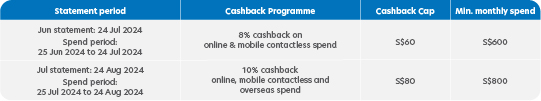

Existing UOB EVOL Cardmembers

To minimize disruptions for existing UOB EVOL Cards issued before 7 Jun 2024, you can enjoy the enhanced benefits from your next statement generated from 7 Aug 2024 if you are an existing cardmember

| UOB EVOL Card existing benefits (statement generated before 7 Aug 2024) |

UOB EVOL Card enhanced benefits (statement generated on and after 7 Aug 2024) |

|

| Cashback programme | • 8% cashback on online spend • 8% cashback on mobile contactless spend • 0.3% cashback on other eligible spend |

• 10% cashback on online and mobile contactless spendENHANCED • 10% cashback on overseas in-store FX spendNEW • 0.3% cashback on other eligible spend |

| Total monthly cashback cap | S$60 (S$20 online, S$20 mobile, S$20 others) |

S$80 (S$30 online & mobile, S$20 overseas, S$30 others) |

| Min. spend | S$600 | S$800 |

Please click here for Frequently Asked Questions

Cashback illustration

See how easy it is to earn cashback on the things you love with a minimum spend of S$800.

- Spend Amount

- Cashback Earned

| Spend | Spend Amount | Cashback Earned |

| Spend | Spend a minimum of S$800 in a month | |

| 10% cashback on online & mobile contactless spend | ||

| Shopping haul from Taobao | S$100 | S$10.00 |

| Grab rides | S$40 | S$4.00 |

| Bus and train rides via SimplyGo with Mobile Pay | S$30 | S$3.00 |

| Dining and café spend via Mobile Pay | S$70 | S$7.00 |

| Purchase from Sephora via Mobile Pay | S$60 | S$6.00 |

| 10% cashback on overseas in-store FX (using your physical card) spendNEW! | ||

| Disneyland Admissions in Tokyo purchased over the counter in JPY | S$150 worth in SGD | S$15.00 |

| Dining and café spend in-store overseas in MYR | S$50 worth in SGD | S$5.00 |

| 0.3% cashback on all other spend | ||

| Recurring payment for phone bills | S$60 | S$0.18 |

| Gym membership | S$100 | S$0.30 |

| New headphone via Visa Paywave (using card) | S$140 | S$0.42 |

| Total | S$800 | S$50.90 |

Online refers to all spend made via the internet. Mobile contactless refers to in-store contactless spend made via Apple Pay, Samsung Pay, Google Pay and other mobile wallet services that accepts UOB EVOL Card. Overseas in-store FX spend refers to spend that is charged overseas in-store, using your physical card, and in foreign currencies. Cashback is capped at S$80 (S$30 on Online and Mobile Contactless spend, S$20 on overseas in-store FX spend, and S$30 on all other spend) for each statement month if you met min. S$800 monthly spend. Exclusions apply.

About UOB EVOL

Sustainability

Show your support and go green with Southeast Asia’s first bio-sourced card – the UOB EVOL Card. Enjoy a variety of sustainable deals, take your carbon footprint to zero with SP Group and more!

Rewards+

Access to Singapore’s personalised rewards programme on UOB TMRW app. Enjoy curated dining, shopping, travel deals and more, plus track and use your cashback and rewards points.

Digital Banking with UOB TMRW

Where’s your money really going? Take stock by using UOB TMRW to track your spending, score deals, invest and more. It’s the Spotify Unwrapped you needed, but for money.

Smart Money

Boost your savings with UOB One Account. What’s more, ease your cashflow when you buy now and pay later with UOB SmartPay.

Promotions

Others

ALBA STEP UP app – Turning Waste into Treasure

Love mother earth?

Be an eco-friend with benefits

Paper statements

See ya never!

Annual fees?

You can officially waive that goodbye.

Things you should know

Eligibility and fees

Eligibility

Age: 21 years and aboveSingaporean/PR:

- Instant Card approval via Myinfo

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000^^

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000^^

^^Terms and conditions apply. Please visit UOB branches for more information on secured card applications.

Documents required: Click here.

Annual Fees:

- Enjoy no annual fee2 on your Principal Card when you make min. 3 transactions per month for 12 consecutive months prior to your card anniversary date

- Applicable for annual fee on your following card anniversary date from 1 Jan 2023 onwards

- With effect from 1 January 2024:

- Principal card: S$196.20

- 1st Supplementary Card: Free

- 2nd Supplementary Card onwards: S$98.10

Already an existing UOB Credit Cardholder?

Alternative, if you are already a Principal UOB Credit Card Holder, you can send an SMS application to 77672:

<YesEVOL>space<Last 4 digits of existing UOB Card>space<NRIC#>

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

What’s more, you can digitize your card to enjoy convenience of mobile contactless payment when you receive your card!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

For existing Principal UOB Credit Card holders

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77862:

‹YesEVOL›space‹Last 4 digits of existing UOB Card›space‹NRIC#›

SMS T&Cs apply.

Terms and Conditions

*The first 200 new-to-UOB credit card customers in May 2025 who successfully apply for an eligible UOB Credit Card between 1 May 2025 and 31 May 2025 (both dates inclusive) and spend a min. of S$1,000 per month for 2 consecutive months from their card approval date, will receive S$350 cash credit.

Click here for full terms and conditions

Apply & Pay within minutes is only valid for New-to-Bank applicants who use Myinfo to retrieve personal details and income information, pass all screening steps and income checks. Applications must be submitted from 7am - 8pm. You will be able to receive your physical card 5 working days upon card approval.

Please refer here for full FAQs for the UOB EVOL Card.

+Get Up to S$260 cash credit comprising:

1) Either S$100 or S$60 or S$30 cash credit

AND

2) up to S$160 cash credit

1) UOB Online Account Opening Weekly Promotion (1 April to 30 June 2025)

Valid from 1 April to 30 June 2025 (“Promotion Period”). Limited to the first 100 customers of each Promotion Week, namely the week between 1 and 6 April 2025 and every calendar week between 7 April 2025 and 30 June 2025, (i) who submit an online account opening application during a Promotion Week for a new Eligible UOB Account, and (ii) whose application is successfully approved during the Promotion Period, and (iii) deposit min. S$5,000 of Fresh Funds into their new Eligible UOB Account within the same calendar month as their new account opening calendar month, and (iv) maintain a balance of at least S$5,000 in their new Eligible UOB Account till the end of the following calendar month. For existing UOB deposit customers, the Fresh Funds deposited into their new Eligible UOB Account must result in a corresponding increase of at least S$5,000 when compared against the total month-end balance of all their other UOB current accounts and/or savings accounts as at 29 March 2025 and such increase must also be maintained till the end of the following calendar month. Eligible new-to-UOB customers will be eligible to receive S$100 cash credit, eligible new-to-UOB deposit customers will be eligible to receive S$60 cash credit, and eligible existing-to-UOB deposit customers will be eligible to receive S$30 cash credit. “Fresh Funds” means funds (a) in the form of non-UOB cheques or non-UOB cashier’s order; (b) that are not transferred from any existing UOB current/savings or fixed deposit account; and (c) that are not withdrawn from any existing UOB current/savings or fixed deposit account and re-deposited (whether part or all of the amounts withdrawn) into the new Eligible UOB Account at any time during the Promotion Period. T&Cs apply. Click here for full terms and conditions.

Eligible UOB Account means: (i) for the period commencing from 1 April 2025 to 30 April 2025 (both dates inclusive), a UOB Stash Account, UOB Uniplus Account, KrisFlyer UOB Account or UOB One Account; and (ii) for the period commencing from 1 May 2025 to 30 June 2025 (both dates inclusive), a UOB Stash Account, UOB Uniplus Account, KrisFlyer UOB Account, UOB Lady’s Savings Account or UOB One Account.

And

2) Up to S$160 cash credit for customers who participate in the UOB SalaryPlus Promotion (1 April 2025 to 30 June 2025) by successfully submitting an online participation form (available at the official UOB website) between 1 April 2025 to 30 June 2025, both dates inclusive, to receive the following cash rewards:

*Participate in the UOB SalaryPlus Promotion (1 April 2025 to 30 June 2025) by successfully submitting an online participation form (available at the official UOB website) between 1 April 2025 to 30 June 2025, both dates inclusive, to receive the following cash rewards:

(i) S$30 cash credit for customers who successfully perform a bill payment of min. S$30 per transaction from their designated Eligible UOB savings account in this Promotion via GIRO, or/and who successfully perform a loan repayment transaction for their UOB car loana or UOB home loana from their designated Eligible UOB savings account for this Promotion, in each case, within the next two calendar months from the date of submission of the online participation form.;

(ii) S$80 cash credit for customers who successfully credit their monthly salary of min. S$1,600 (for all customers other than full time National Serviceman) or at least S$500 (for customers who are full time National Serviceman) into their designated Eligible UOB savings account for this Promotion via GIRO or PayNowc within the next two calendar months from the date of submission of the online participation form; and

(iii) S$50 cash credit for customers who successfully credit their CDP dividends of min. S$50 per transaction into their designated Eligible UOB savings account for this Promotion via Direct Credit Serviceb within the next two calendar months from the date of submission of the online participation form.

Eligible UOB savings account: UOB Passbook Savings Account, UOB Uniplus Account, UOB Stash Account, UOB One Account, UOB Lady’s Savings Account or KrisFlyer UOB Account.

Customers must not have received any prior reward (whether in the form of cash credit or otherwise) in similar UOB promotions, or have the respective transaction history in any UOB current or savings account during the period between 1 October 2024 to 31 March 2025.

Full terms and conditions apply and can be accessed here.

aRepayment of your UOB car and home loan instalment must be reflected with the transaction description “Misc Debit” and bank reference of "Trf. Wd. Loans” to be eligible.

bCDP dividends must be credited from the Central Depository with the transaction description “CDP Dividend” to be eligible.

cSalary must be credited with the transaction description as "GIRO-SALA" or "PAYNOW SALA" to be eligible.

Insured up to S$100k by SDIC.

1EVOL Card benefits will be enhanced from 7 June 2024: To enjoy 10% cashback on online, mobile and overseas in-store FX spend, a min. spend of S$800 per statement month on your card is required. If the min. spend is not met, only the base 0.3% cashback on your online, mobile contactless and overseas in-store FX spend will be awarded. Cashback is capped at S$80 per statement month (S$30 cap for Online and Mobile Contactless; S$20 cap for overseas in-store FX spend; and S$30 on all other Spend). Exclusions and other terms and conditions apply.

Please take note that overseas in-store FX spend would have to be made using your physical card.

To minimize disruptions for existing UOB EVOL Cards issued before 7 June 2024, the existing cardmembers can enjoy the enhanced benefits from the next statement cycle from 7 August 2024, please click here for Frequently Asked Questions.

2Enjoy no annual fees when you make min 3 transactions on your UOB EVOL Card every month for 12 consecutive months prior to your card annual fee charge date.

With effect from 21 July 2024, transactions with the transaction description “NORWDS*” will be excluded from the awarding of cashback. Please click here for the full terms and conditions.

W.e.f. 1 October 2024, transactions with the transaction description “AMAZE*” and Merchant Category Codes 5965 Direct marketing –Combination Catalog and Retail Merchants, 5993 Cigar Stores and Stands, 8699 Organizations, Membership-Not Elsewhere Classified (Labor Union) and 8999 Professional Services (Not Elsewhere Classified) will be excluded from the awarding of cashback. Click here for the full terms and conditions.

^You will be given My Green CreditsTM valued at 1% of your SP Utilities bill amount. These My Green CreditsTM by SP Group are provided to you free of charge, and can offset up to 100% of your electricity carbon footprint. A minimum SP Utilities bill amount of S$100 is required for conversion to My Green CreditsTM. My Green CreditsTM prices are dependent on the REC selling prices offered by each developer to UOB. These prices may change from time to time, depending on market factors. As of 12 October 2023, My Green CreditsTM are purchased by UOB at S$0.12 per 25 kWh. Click here for FAQs.

Bundle up for even more benefits

Earn higher interest on your savings with One Account – up to 5.3% p.a. in just two steps

Skip to the good part with UOB One Account. Simply spend min. S$500 monthly on your UOB EVOL Card AND credit your salary, OR make 3 GIRO transactions monthly.![]()

Enjoy more privileges when you pair the UOB One Account with UOB EVOL Card. Visit go.uob.com/online-exclusive for the latest sign-up offer!

Apply online and get up to S$260 cash credit+

Find out more.

Other useful links

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.