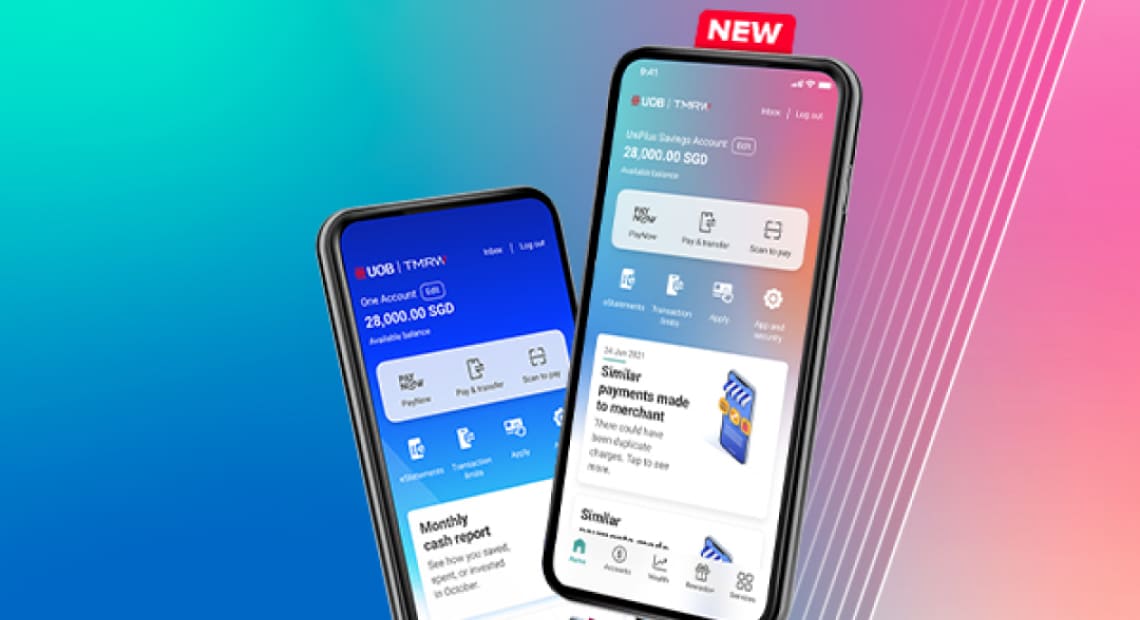

Decode your financial habits with UOB TMRW

Wonder where your money goes sometimes? Keep track of your finances easily with personalised insights based on your spending habits.

- Refund notification

Lets you know when you receive a refund for a transaction you’ve made - Duplicate transaction notification

Shop without fear with alerts in the event of duplicate transactions - Purchase analysis

Track and manage your spending to stay on top of your budget - Monthly cash flow

Plan for the month ahead with these insights so you won’t have to worry or feel guilty about overspending - Subscription alert

Informs you of possible subscriptions you may have made to a merchant - Personalised deals and offers

Zero in on specials curated for you based on your spending habits

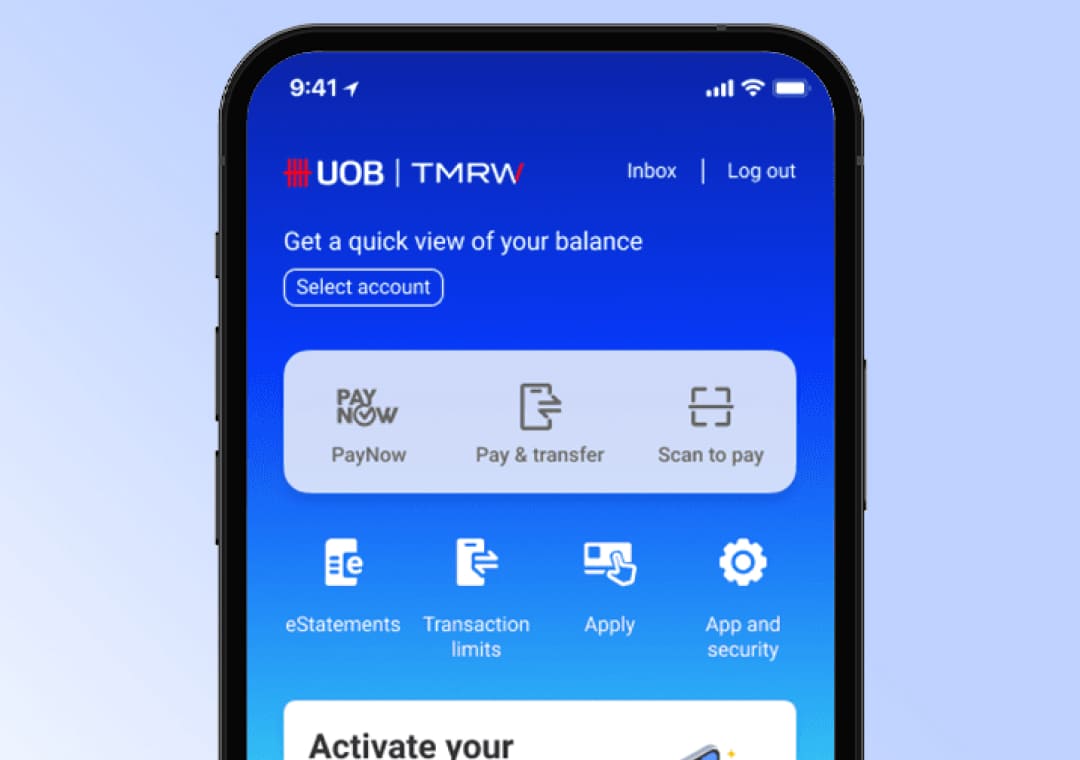

Manage your cards and bank on the go 24/7

UOB TMRW never sleeps. Access your account balance, pay bills, transfer fund and change your transaction limits anytime, anywhere.

- Cards management

Reset your PIN, get a temporary credit limit increase, add your card to apps, and even activate it conveniently - Credit card payments

Pay your bills easily whenever you want to avoid late payment charges - Instant card activation

Activate your card once you receive it so you can use it immediately - Personal details

Update your personal details such as email address and mobile number conveniently and instantly - SmartPay

Convert your bills into bite-sized pieces with interest-free monthly instalments and a one-time low processing fee

Pay on the go

Experience the freedom of going cardless and cashless with mobile payments at your fingertips.

- Be cash-free and cards-free with Scan To Pay and PayNow

- Top up your e-wallets instantly with UOB TMRW

- - FAST: Grab, Singtel, Liquid Pay, TransferWise, Matchmove and Razer Pay

- PayNow: Grab, Singtel, LiquidPay - Contactless cash withdrawal at UOB ATMs with a tap of your mobile

- Add your cards securely to mobile wallet with Digital Token

Smart money management on the go

Get a bird’s eye view of your finances across multiple bank accounts and government agencies with SGFinDex, so it’s easier to keep track of your finances and budgeting.

Financial information on SGFinDex includes details from:

- 7 participating banks (Citibank, DBS/POSB, HSBC, Maybank, Standard Chartered Bank, OCBC)

- CPF

- IRAS

- Credit Cards

- Loans

- Investments and more

Bank with a peace of mind wherever you are

Your personalized digital token that allows you to bank anywhere and everywhere securely and safely.

Setting up your unique 6-digit digital token for transactions is:

- Fast and convenient

Log into both UOB Personal Internet Banking and UOB TMRW seamlessly – no more OTPs - Access anywhere

Add new payees and make funds transfers above your defined threshold on the go - Secured transactions

Verify and confirm your online purchases and transactions with push notifications from UOB TMRW

You might be interested in

Sustainability

Show your support and go green with Southeast Asia’s first bio-sourced card – the UOB EVOL Card.

Smart Money

Being able to grow your savings without doing a thing? Now we’re talking. Save when you spend with UOB One Account.

Deals

Unlock an epic suite of rewards, no matter your fancy, with over 1,000 deals covering from fashion to dining. You’ll also get access to Rewards+, Singapore’s newest and biggest rewards programme on UOB TMRW.

Things you should know

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Terms and Conditions

Subject to qualifying criteria. T&Cs apply.

Apply & Pay within minutes is only valid for New-to-Bank applicants who use Myinfo to retrieve personal details and income information, pass all screening steps and income checks. Applications must be submitted from 7am - 8pm. You will be able to receive your physical card 5 working days upon card approval.

1EVOL Card benefits will be enhanced from 19 June 2025: You do not need to meet the min. spend of S$800 per statement month to enjoy 0% FX Fees on all your Overseas Foreign Currency Spend. FX Fees are administrative fees applied on transactions in foreign currencies. Exclusions and other terms and conditions apply.

2EVOL Card benefits will be enhanced from 19 Jun 2025: To enjoy 10% cashback on Selected Gym, Telco, and Streaming Spend, Local Online Spend and Mobile Contactless Spend, a min. spend of S$800 per statement month on your card is required. If the min. spend is not met, only the base 0.3% cashback on Selected Gym, Telco, and Streaming Spend, Local Online Spend and Mobile Contactless Spend will be awarded. Cashback is capped at S$80 per statement month (S$20 cap for Selected Gym, Telco and Streaming Spend; S$30 cap for Local Online and Mobile Contactless Spend; and S$30 on all Other Spend). Exclusions and other terms and conditions apply.

3Enjoy 3% cashback on all your Overseas Foreign Currency Spend (capped at S$40 per statement month) and an additional 7% cashback on in-person mobile contactless MYR spend in Malaysia from 1 November 2025 till 31 January 2026 (capped at S$20 per statement month). Minimum spend of S$800 required on all transactions in a statement month. Exclusions and other terms and conditions apply.

4Enjoy no annual fees when you make min 3 transactions on your UOB EVOL Card every month for 12 consecutive months prior to your card annual fee charge date.

To minimise disruptions for existing cardmembers, cardmembers with UOB EVOL Cards issued before 19 June 2025 will enjoy the cashback benefits will be updated from their on or after 19 August 2025, please click here for Frequently Asked Questions.

The maximum annual interest for deposits of S$150,000 in the One Account is S$3,750 and is calculated based on the maximum effective interest rate (EIR) of 2.50% p.a., provided customers meet both criteria of S$500 eligible card spend AND a min. S$1,600 salary credit via GIRO/PAYNOW (with the transaction reference "SALA"/ "PAYNOW SALA") in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 0.65% p.a. for deposits of S$75,000, provided customers meet criterion of S$500 eligible card spend in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 1.40% p.a. for deposits of S$125,000, provided customers meet both criteria of S$500 eligible card spend AND 3 GIRO debit transactions in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 2.50% p.a. for deposits of S$150,000, provided customers meet both criteria of S$500 eligible card spend AND a min. S$1,600 salary credit via GIRO/PAYNOW (with the transaction reference "SALA"/"PAYNOW SALA") in each calendar month.

With effect from 21 July 2024, transactions with the transaction description “NORWDS*” will be excluded from the awarding of cashback. Please click here for the full terms and conditions.

Apply & Pay within minutes is only valid for New-to-Bank applicants who use Myinfo to retrieve personal details and income information, pass all screening steps and income checks. Applications must be submitted from 7am - 8pm. You will be able to receive your physical card 5 working days upon card approval.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.