Exclusive privileges on Scoot

Enjoy a range of complimentary perks like priority check-in and boarding, additional baggage allowance, standard seat selection and Booking Flexibility Waiver. Click here for more details.![]()

How many miles you can earn

- Example 1

- Example 2

- Example 3

- Example 4

| Example 1 | Example 2 | Example 3 | Example 4 | |

| Monthly Card Spend^ | $200 | $400 | $1,000 | $2,500 |

| Monthly Average Balance^ | $15,000 | $15,000 | $100,000 | $350,000 |

| 5% MAB cap on Bonus KrisFlyer miles | $15,000 x 5% = 750 miles | $15,000 x 5% = 750 miles | $100,000 x 5% = 5,000 miles | $350,000 x 5% = 17,500 miles |

| Salary Credit | Y | N | Y | N |

| Base KrisFlyer miles | $200 x 0.4 = 80 | $400 x 0.4 = 160 | $1,000 x 0.4 = 400 | $2,500 x 0.4 = 1,000 |

| Bonus KrisFlyer miles | $200 x 6 = 1,200 (cap at 750 miles) |

$400 x 5 = 2,000 (cap at 750 miles) |

$1,000 x 6 = 6,000 (cap at 5,000 miles) |

$2,500 x 5 = 12,500 (cap at 17,500 miles) |

| Total KrisFlyer miles | 80 + 750 = 830 miles | 160 + 750 = 910 miles | 400 + 5,000 = 5,400 miles | 1,000 + 12,500 = 13,500 miles |

| Effective Miles earn rate | 4.15 miles | 2.28 miles | 5.4 miles | 5.4 miles |

Promotion

Earn up to 180,000 miles with your KrisFlyer UOB Account!

Top up fresh funds into your KrisFlyer UOB Deposit Account^ and maintain funds over a period of 4 months to earn KrisFlyer miles. Offer ends 30 June 2024.

Get 12,000 KrisFlyer miles for a

S$30,000

deposit

• To register, SMS KFA30‹space›10

digit KrisFlyer UOB A/C

number to 77862

(eg. KFA30 1234567890)

Get 50,000 KrisFlyer miles for a

S$100,000 deposit

• To register, SMS KFA100‹space›10

digit KrisFlyer UOB A/C

number to 77862

(eg. KFA100 1234567890)

Get 180,000 KrisFlyer miles for a

S$300,000 deposit

• To register, SMS KFA300‹space›10

digit KrisFlyer UOB A/C

number to 77862

(eg. KFA300 1234567890)

^T&Cs apply, click here.

Things you should know

Eligibility and fees

Minimum Age

18 years old and aboveFall-below Fee

S$2 per month (for below S$1,000 balance)Early Account Closure Fee

S$30Within 6 months from opening

Cheque Book

S$10 per cheque book (50 leaves)Issued upon request

KrisFlyer UOB Debit Card Annual Fee

S$54.50 (inclusive of GST)The annual fee for the first year will be waived.

Actions or documents required

You can open an account online, get approval within minutes and start transacting instantly (where applicable).

You have an account with us or are an existing principal credit cardholder (For Singaporeans, PRs and Foreigners):

You can now apply using existing bank details or via Myinfo, where forms are prefilled with no submission of documents needed. You will require:

- UOB Internet Banking or UOB Mighty Login; or

- Card no. and Pin; or

- SingPass Login

You are new to UOB (For Singaporeans and PRs)

You can now apply via Myinfo, where forms are prefilled with no submission of documents needed. You will require:

- SingPass Login

You are new to UOB (For Foreigners)

Proceed to any UOB Branch for application. You will require:

- Passport

- Proof of Residential Address

- Employment Pass/S Pass/Dependent Pass

Frequently asked questions (FAQs)

1) I do not have an existing KrisFlyer membership, what should I do?

We will assign and create a KrisFlyer membership account number for you. All you need to do is to provide your First Name and Last Name for your KrisFlyer membership account.

2) How are miles awarded?

KrisFlyer UOB Debit and Credit Cards

- Base KrisFlyer miles earned will be credited to your KrisFlyer membership account directly every month.

- Base KrisFlyer miles will be credited with first 7 working days of each month, for the miles earned in the preceding month.

Eligible UOB Credit Cards (UOB PRVI Miles Card, UOB Privilege Banking Card, UOB Visa Infinite Card, UOB Reserve Card):

- Cardmembers will earn miles in the form of UNI$ which will be credited to your UOB card account.

- Cardmembers may choose to convert into KrisFlyer miles. Click here for more information.

- Please refer to the respective credit cards pages for more information.

KrisFlyer UOB Account:

- Bonus KrisFlyer miles earned will be capped at 5% of the Monthly Average Balance in KrisFlyer UOB Account.

- Bonus KrisFlyer miles earned will be credited to your KrisFlyer membership account directly every month.

- Bonus KrisFlyer miles will be credited with first 7 working days of each month, for the miles earned in the preceding month.

- Please refer to full terms and conditions for details.

3) How do I compute my monthly average balance (MAB)?

MAB is the summation of each day-end balance in KrisFlyer UOB Account for each month divided by the number of calendar days for that month.

The following illustrates the calculation of the Monthly Average Balance (MAB).

- Date

- Each Day End Account Balance

| Date | Each Day End Account Balance |

| 1 - 15 June 2023 | S$100,000 |

| 16 - 30 June 2023 | S$200,000 |

| Sum of day-end Account Balances in June 2023 | (S$100,000 x 15 days) + (S$200,000 x 15 days) = S$4,500,000 |

| No. of calendar days in June 2023 | 30 |

| Monthly Average Balance of June 2023 | S$4,500,000 / 30 days = S$150,000 |

For more FAQs, refer to the full list here.

Important notice

Important information on the use of UOB Accounts and Services

View the full Terms and Conditions.

With effect from 1 Oct 2016, we are ceasing cheque book delivery to overseas mailing addresses.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts/products that are covered under the Scheme.

Ready to apply? Open and transact with your account instantly.

Ready to apply? Open and transact with your account instantly.

*Online Account Opening Exclusive: Get up to S$210 cash when you open a KrisFlyer UOB Account online.

You may also open your account on UOB TMRW or visit one of our branches today.

Bundle up for even more benefits

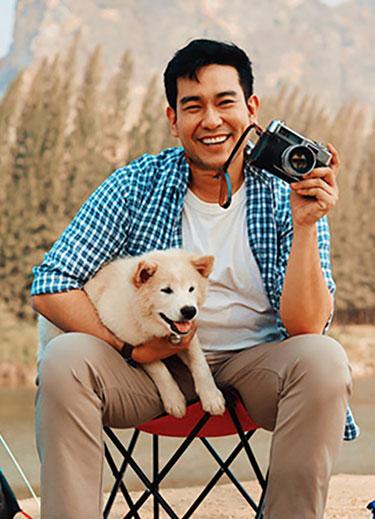

KrisFlyer UOB Account with KrisFlyer UOB Credit Card

Let your daily spend leads to experiences – on repeat

- 3 KrisFlyer miles per S$1 spend on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

- Up to 3 KrisFlyer miles per $1 spend on selected everyday spend categories, with min. S$800 annual spend on Singapore Airlines, Scoot and KrisShop

- 1.2 miles per S$1 spend on all other eligible spend

- Exclusive benefits with Scoot, KrisShop, Grab rides and more

- Terms and conditions apply.

KrisFlyer UOB Account with Mighty FX

Earn miles on your overseas spends without transaction fees.![]()

- 24/7 access to 10 major foreign currencies at competitive rates

- Convert anytime on your phone and use your KrisFlyer UOB Debit Card to pay for overseas purchases to skip admin fees

- Enjoy a low flat-fee of S$5 or foreign currency equivalent when you withdraw cash at any overseas Mastercard-enabled ATMs

Make banking simpler with these services

Get deeper insight into your travel expenses

Leave the hassle to us! We’ll send you a summary of purchases and withdrawals made during your travels.

Withdraw cash via your phone

With Contactless Cash Withdrawals, you can now travel light and withdraw cash with a quick tap on your phone.

Make payments simpler

Register for PayNow with your mobile number to send and receive money instantly. Use Scan to Pay at more than 25,000 merchant outlets, including hawkers and shops.

Enjoy the deals you love with UOB Rewards+

Enjoy over 1,000 deals, cashback and rewards across over 20,000 locations islandwide with Singapore's biggest rewards programme.

Here’s something else you may like

UOB Stash Account

Accumulate even more savings with up to 5.0% p.a. interest when you maintain or increase your Monthly Average Balance.

UOB Lady's Savings Account

The only savings account that gives you unstoppable rewards – earn up to 25X UNI$ (10 miles per S$1) on your preferred rewards category(ies) when you pair your UOB Lady’s Savings Account with UOB Lady’s Credit CardNEW! Plus, enjoy free female cancer coverage of up to S$200,000 as you save.