Manage your business finances with UOB eBusiness account. With zero account fees* for the first 12 months, plus a debit card that comes with 3-year free waiver to help you save on day-to-day business costs.

Connecting start-ups to growth

At UOB Business Banking, we have been voted as The Asian Banker’s Best SME Bank in Singapore and Asia Pacific. We have proven expertise in supporting SMEs through our comprehensive franchise both in Singapore and across ASEAN, digitalisation platforms that allow you to bank on the go and solutions that help your business achieve operational efficiency – underpinned by deep knowledge of industries spanning F&B, Retail, Wholesale, Trade, Manufacturing, and more.

As your gateway to business, UOB can connect you to the right opportunities both in Singapore and the region, so that you may capture growth opportunities

UOB Start-up Connections Pack

Accounts And Transact

UOB eBusiness Account

Go Digital

UOB BizSmart

Digitalise your business operations with an exclusive package from UOB BizSmart – an integrated suite of business management tools curated by the bank. In particular, UOB BizSmart’s Start Digital collaboration with IMDA can provide up to savings of up to S$600 for your company.

Digital Banking

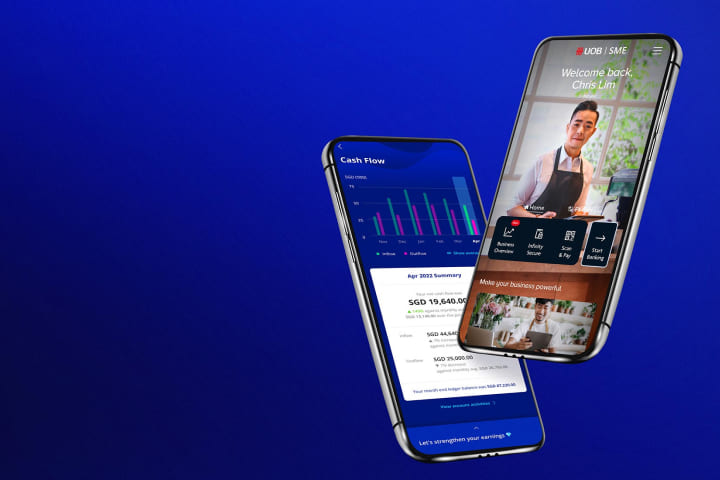

UOB SME app

View your cash flow with an interactive dashboard, get customised insights and events based on your industry. You can book your preferred FX rate instantly through personalised alerts to meet your business needs.

- Bank on-the-go

- Make or approve transaction

- Set up transaction alerts

- Apply for loan or accounts

Loans

UOB Start-up Business Loan

Get S$10,000 in financing^ when you are in business for a minimum of 6 months.

- No documents required

- No collateral needed

- 1-day response

- 12-month loan servicing

UOB SME Hub

UOB SME Hub

Learn the latest business insights and tips through the UOB SME Hub, a curated content portal hosting industry-specific content. Plus, network with industry peers through our events.

Payment And Collections

Commercial Credit & Debit Cards

Tailored card programme for your business needs

- Savings and exclusive privileges

- Efficiencies and control to enhance productivity

- Scalable virtual payment solutions

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.