1 of 3

What do you need help with?

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

Additional Terms & Conditions governing Accounts and Services has been updated on 28 July 2025.

$0.50 rebate per transaction on up to 60 outgoing FAST per month via UOB Infinity or UOB SME App.

100% rebate on bulk GIRO payroll transaction charges via UOB Infinity or UOB SME App.

$0.20 rebate per transaction on up to 60 GIRO payment & collection transactions per month via UOB Infinity or UOB SME App.

| Feature | Description |

| Account fee savings | Low annual account fee of $35 |

| Free incoming PayNow | Waiver of incoming PayNow transactions until 31 December 2025 |

| Free eAlerts! notifications | Free email alert notifications on your cash and trade transactions |

| Save on Banker’s Guarantee fees | Enjoy $100 fee waiver when you apply for UOB Express Banker’s Guarantee |

| Feature |

| Account fee savings |

| Free incoming PayNow |

| Free eAlerts! notifications |

| Save on Banker’s Guarantee fees |

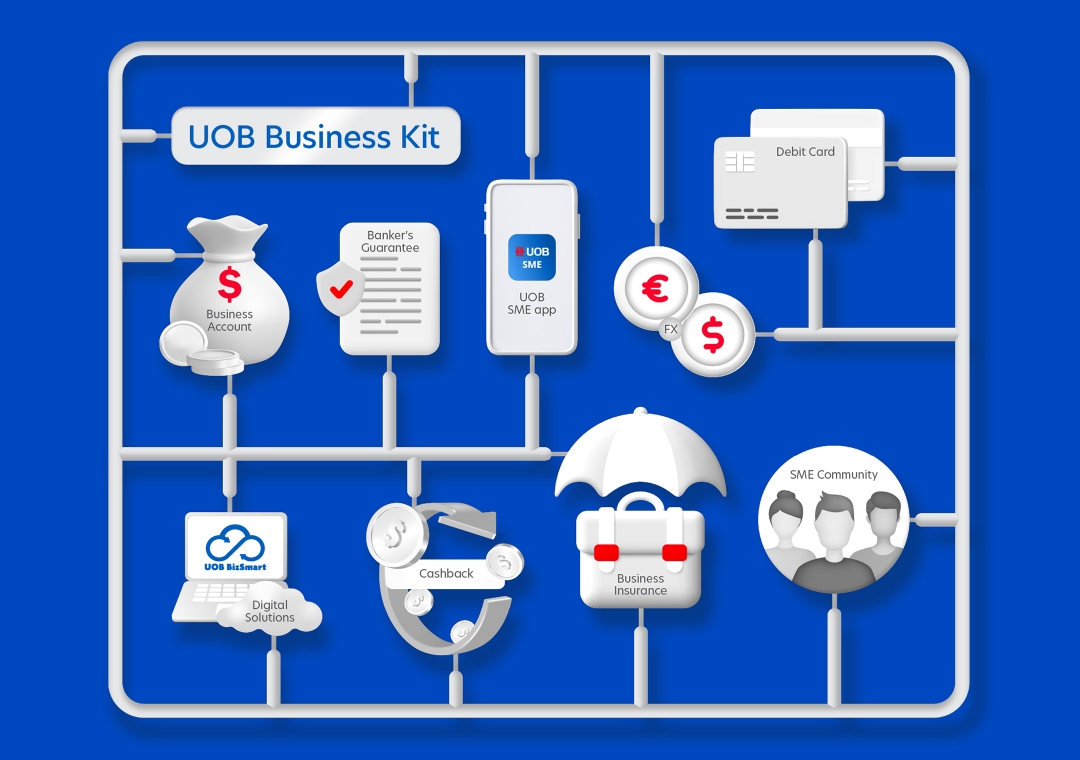

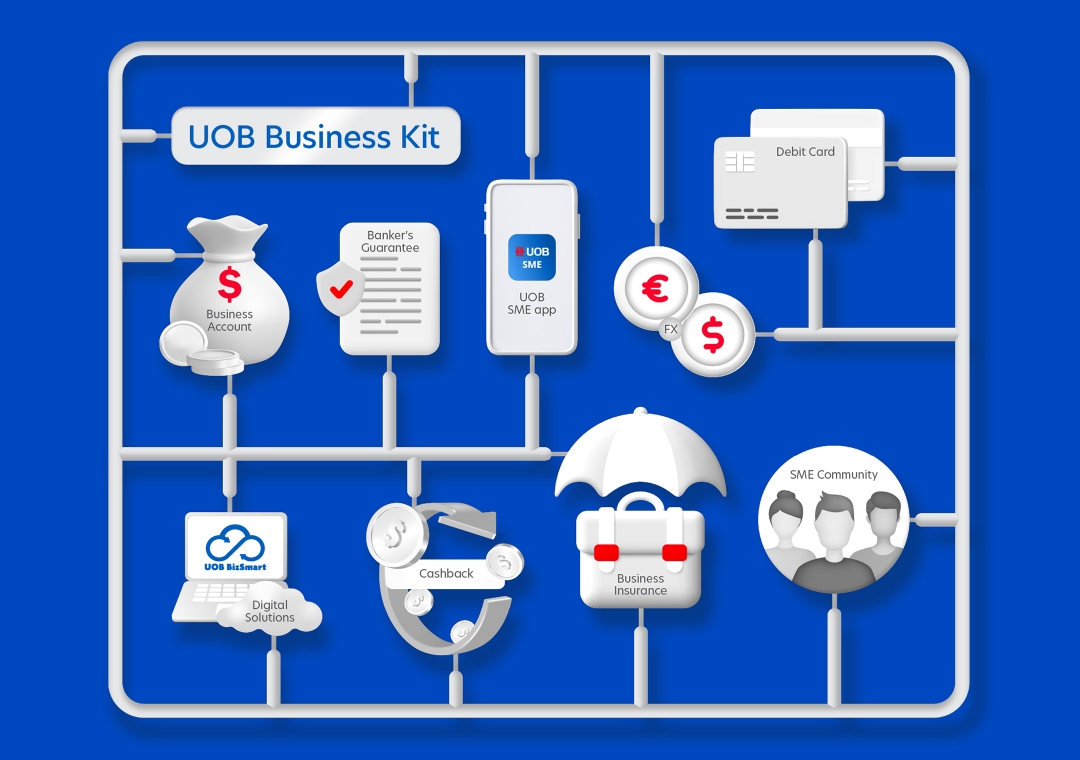

Starting a new business or looking to boost your business growth?

Apply for the UOB eBusiness Account and add on UOB Business Kit solutions to enjoy more savings and benefits.

*T&Cs apply. Insured up to S$100k by SDIC.

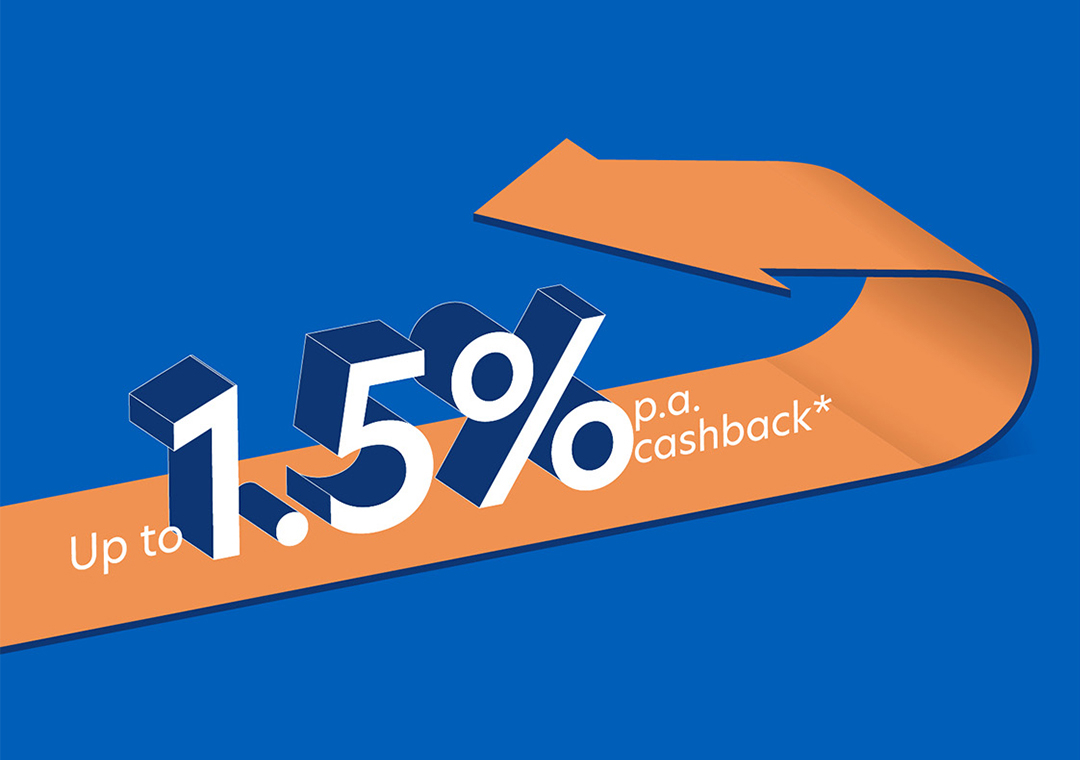

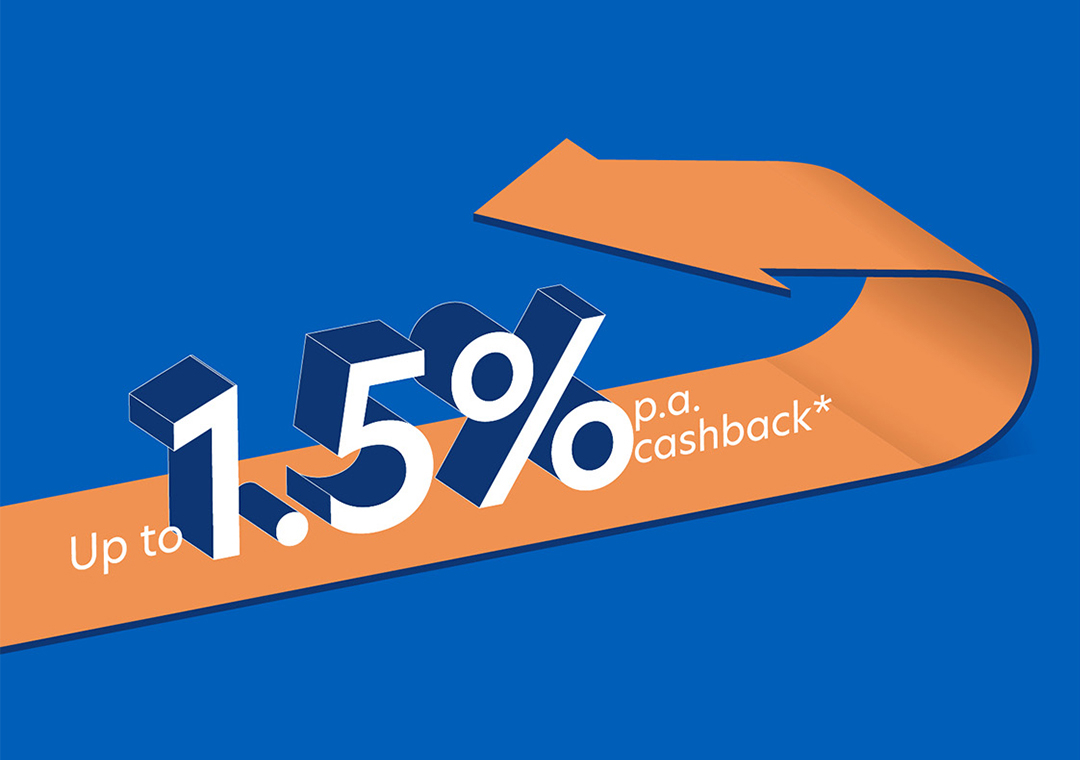

From 14 September 2023 to 31 March 2026, earn up to 1.5% p.a. cashback* when you perform online transactions via UOB Infinity or UOB SME app.

*T&Cs apply. Insured up to S$100,000 by SDIC.

Starting a new business or looking to boost your business growth?

Apply for the UOB eBusiness Account and add on UOB Business Kit solutions to enjoy more savings and benefits.

*T&Cs apply. Insured up to S$100k by SDIC.

From 14 September 2023 to 31 March 2026, earn up to 1.5% p.a. cashback* when you perform online transactions via UOB Infinity or UOB SME app.

*T&Cs apply. Insured up to S$100,000 by SDIC.

| Feature | Details |

| Minimum initial deposit | S$1,000 |

| Minimum average daily balance | S$5,000 |

| Annual account fee | S$35 |

| Monthly fall-below fee | S$15 (For average daily balance below S$5,000. Waived for the account opening month and subsequent 11 months1). |

| Over-the-counter deposit / withdrawal | S$20 per transaction |

| Cheque clearing fee | S$0.75 per cheque |

| Early closure fee | S$50 (for closure within 12 months of account opening) |

| Cheque book charge | S$25 per cheque book (with effect from 1 April 2024) |

| Feature |

| Minimum initial deposit |

| Minimum average daily balance |

| Annual account fee |

| Monthly fall-below fee |

| Over-the-counter deposit / withdrawal |

| Cheque clearing fee |

| Early closure fee |

| Cheque book charge |

Note: For Foreign Incorporated Companies, Account Setup Fee of minimum S$500 applies.

Checklist of documents required for Sole Proprietor:

*Mandatory document for declaration of U.S. or Non U.S. persons.

Note: Visit our Forms page to download the detailed checklist of documents required. Hardcopy application forms can also be downloaded for submission if you do not wish to apply online.

Checklist of documents required for Partnership:

*Mandatory document for declaration of U.S. or Non U.S. persons.

Note: Visit our Forms page to download the detailed checklist of documents required. Hardcopy application forms can also be downloaded for submission if you do not wish to apply online.

Checklist of documents required for Private Limited Company:

*Mandatory document for declaration of U.S. or Non U.S. persons.

Note: Visit our Forms page to download the detailed checklist of documents required. Hardcopy application forms can also be downloaded for submission if you do not wish to apply online.

Checklist of documents required for Society / Club / Association / Clan:

Note: Visit our Forms page to download the detailed checklist of documents and application form required for submission.

Checklist of documents required for Foreign Incorporated Company:

*Mandatory document for declaration of U.S or Non U.S. persons

Note: Visit our Forms page to download the detailed checklist of documents and application form required for submission.

Checklist of documents required for Professional Practice:

*Mandatory document for declaration of U.S or Non U.S. persons

Note: Visit our Forms page to download the detailed checklist of documents and application form required for submission.

Checklist of documents required for Management Corporation Strata Title (MCST)

*Mandatory document for declaration of U.S or Non U.S. persons

Note: Visit our Forms page to download the detailed checklist of documents and application form required for submission.

Note: For account opening at our branches, please bring along the completed account opening form and necessary documents. Visit our Forms page to download the detailed checklist of documents and application form required for submission.

Your bank account should be for your own use and you are responsible for all transactions made through your bank account.

Please click here for the full Advisory from the Singapore Police Force – Warning.

1Applicable to NEW accounts opened from 1 April 2021 onwards.

2Note:

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.