1 of 3

What do you need help with?

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

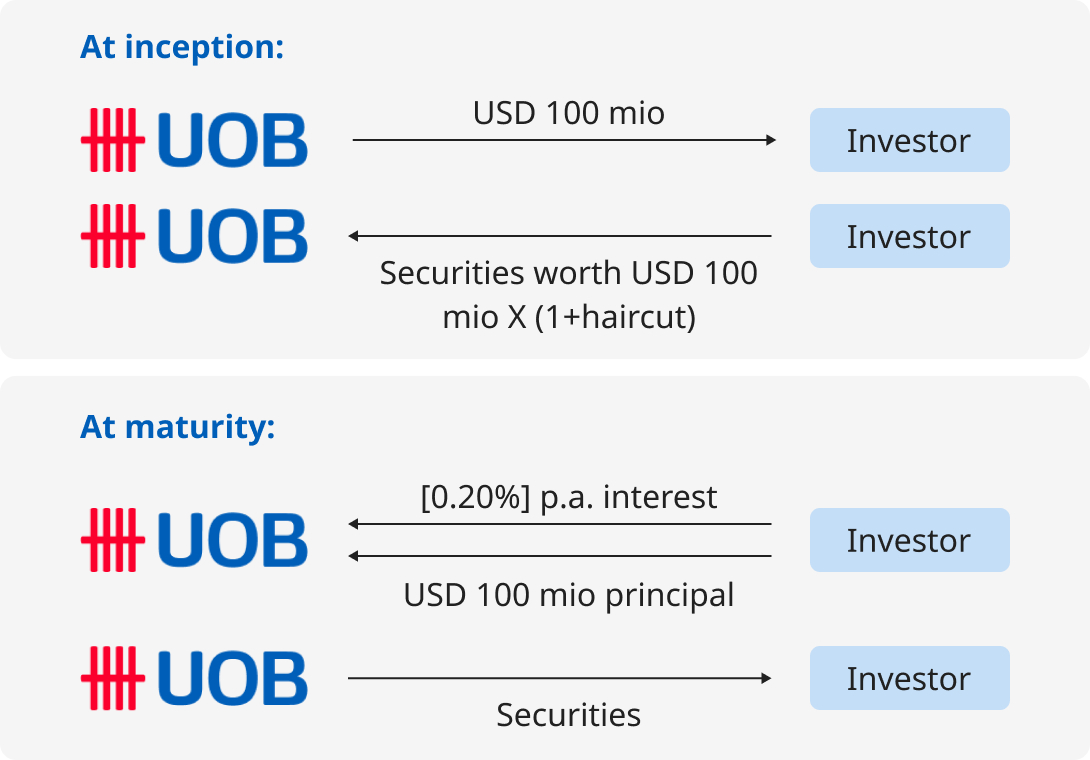

Under a repo transaction, customers can sell securities to UOB with a simultaneous agreement that UOB will repurchase the equivalent securities from the customer at a future date for a pre-determined price.

Product types include repo, reverse repo, and cross-currency repo.

Document(s) required:

Risks involved:

Entity selling securities to the other party for cash before repurchasing the equivalent securities at a future date

Entity purchasing securities from the other party using cash before selling the equivalent securities at a future date

Generally, among the Asian market participants, the widely used securities in repo transactions are sovereign credit (e.g. U.S. Treasuries and Agencies, European Sovereigns, Asian Sovereigns) and investment grade corporate bonds.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.