You are now reading:

A guide to cash flow management for new entrepreneurs

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

You are now reading:

A guide to cash flow management for new entrepreneurs

Healthy cash flow is key to any successful business – every company needs sufficient liquidity to pay suppliers and fund day-to-day operations. This is especially so for new entrepreneurs, who might incur more capital expenditure in order to kickstart their new ventures.

In the UOB Business (SME & Large Enterprises) Outlook Study 2023, Singapore businesses cited reducing costs and managing their cash flow as priorities amidst higher inflation. And in the recent Singapore Budget 2023, the Government has introduced schemes to help businesses access capital and drive growth.

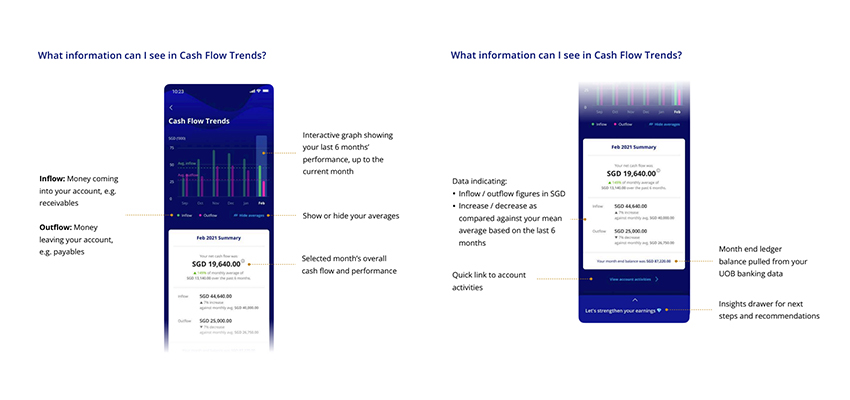

In understanding businesses’ need for stronger support, UOB has also designed offering such as the UOB SME app, an app that helps entrepreneurs stay on top of their business on the go, including features such as an interactive dashboard that allows business owners to view their cash flow in real-time, and for the last six months.

To help you manage your cash flow more efficiently, we have structured business cash flow management tips into four main areas of focus.

Manage your cash flow with more confidence with these five actionable tips:

To avoid overspending during periods with more cash and running into a cash crunch, it is important to stick to a lean, disciplined budget based on your business goals.

A good budget should serve as a roadmap to your long-term business plan, helping you find a strategic balance between spending and saving.

To set a realistic budget, you can start by analysing financial data from previous months to estimate your expenditure and earnings, as well as identify cost-cutting opportunities.

In understanding the needs of SMEs, the UOB SME app offers a useful tool for managing your budget by providing an overview of your financial performance. Through the interactive dashboard, you can track your cash inflows and outflows over the last six months at a glance, and even get personalised recommendations for improving your cash flow.

Chances are that if you’re a business owner, you are already keeping a sharp eye on your monthly account balance, but this may not suffice for effective cash flow management.

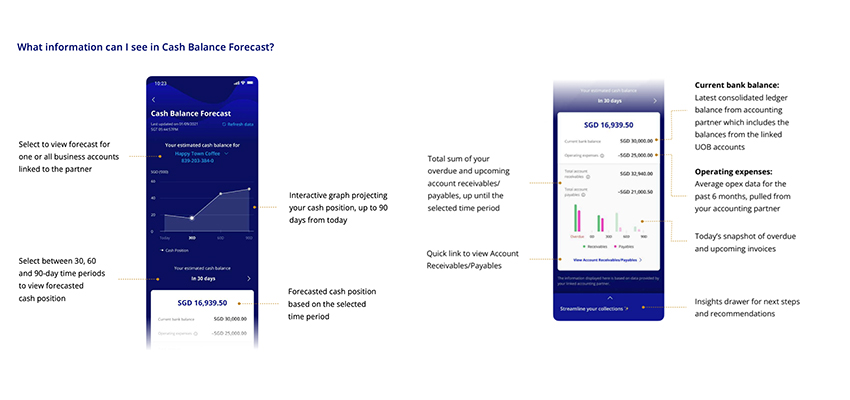

Rather than just checking your current cash position, you should also forecast your cash position in months ahead for a fuller picture of your financial health.

You can count on digital tools within the UOB SME app to perform cash balance forecasting at a tap. By linking your banking data with UOB’s accounting partners, get a personalised Cash Balance Forecast of your cash position up to 90 days into the future based on factors affecting your cashflow, such as account receivables and payables and average operating expenses.

Having a clear forecast empowers you to take action before potential cash gaps derail your business growth. For instance, you can consider securing a business loan to gain more working capital. Government-assisted loans like the SME Working Capital Loan offer preferential interest rates with no collaterals required, enabling you to bridge your cash flow gap simpler and faster.

One strategy to manage potential cash gaps is by planning your payments and expenses prudently. While it might seem convenient to settle all your payables on the same day each month, this is seldom ideal for cash flow management.

If you foresee a short-term cash bottleneck ahead, it may be possible to negotiate extended payment terms with your suppliers and spread out your expenses.

On the other hand, if your cash flow forecast is looking healthy, you can check with your suppliers for early payment discounts and achieve cost savings.

Overdue invoices are a common cause of cash flow disruption, leaving businesses struggling to cover operational expenses and pay suppliers on time. This points to the importance of smarter invoice management for a healthy cash flow, from invoicing your customers promptly to using progress billing. Digital tools can take the pain out of your invoicing process by automating invoice creation, sending personalised reminders, and making it simple to track payment schedules.

Through the UOB SME app, SMEs can tap into UOB BizSmart’s suite of digital solutions, including accounting software designed to help small businesses work efficiently.

The app displays top customers and suppliers who are your critical business partners, to help you stay on top of invoicing matters.

Poor inventory management often leaves your cash tied up in excess or wasted goods, impairing cash flow and saddling you with unnecessary costs. By tracking your inventory levels in real-time, you can order products only when necessary and maintain efficient turnover, freeing up your cash for other business needs.

Entrepreneurs can tap into smart tools to automate many inventory management processes, such as monitoring stock across multiple channels and forecasting customer demand.

The good news: you’ll find inventory management software among UOB BizSmart’s arsenal of digital solutions as well, enabling you to manage multiple business processes in one seamless platform.

Cash flow poses a complex challenge for first-time entrepreneurs, but you can leverage digital tools to keep your cash flow positive. Get started by downloading the UOB SME app here.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results.

The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. This publication is not an offer, recommendation, solicitation or advice to buy or sell any product or enter into any transaction and nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any transaction/ investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

This publication has not been reviewed by the Monetary Authority of Singapore.

Start your UOB eBusiness account today, and enjoy zero fees* and more than S$500 of annual savings on FAST and GIRO transaction fees.

20 Nov 2025 • 5 mins read

12 Aug 2025 • 7 mins read

30 May 2025 • 3 mins read

29 Apr 2025 • 3 mins read