Choose rewards for an unstoppable you

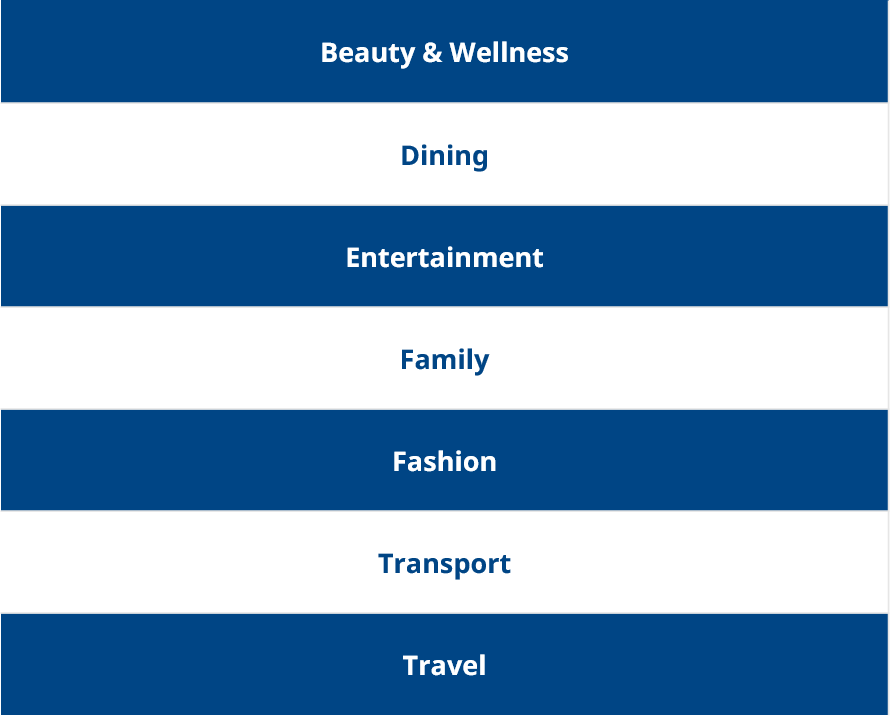

With UOB Lady’s Card, you are free to make the choices that matter. Choose the rewards category(ies) that earns you the most – whether your passion is Fashion, Dining, Travel, Beauty and Wellness, Family, Transport or Entertainment. And feel free to change it every quarter, as your lifestyle and interests evolve – because it’s time to live the life you want.

Choose your preferred rewards category(ies) and earn up to 25X UNI$ (10 miles per S$1)1

Now you can continue to earn up to 25X UNI$ (10 miles per S$1 spend) when you save and spend with UOB Lady’s.

Be it shopping online or in stores, locally or overseas – Earn up to 25X UNI$ for every S$5 spend1 (equiv. to 10 miles per S$1) on your preferred rewards category(ies) with no minimum spend required. What's more, have the freedom to change your category(ies) every quarter.

Here’s how:

Spend on UOB Lady’s Credit Card

Earn 10X UNI$ for every S$5 spent (equiv. to 4 miles per S$1) on your preferred rewards category(ies)

+

Save with UOB Lady’s Savings Account

Earn up to additional 15X Lady’s Savings Bonus UNI$ for every S$5 spent (equiv. to 6 miles per S$1) on your preferred rewards category(ies)

Here’s how your UNI$ add up

The total Bonus UNI$ earned is based on your UOB Lady’s Savings Account Monthly Average Balance (MAB)  in each calendar month. The more you save, the more UNI$ earned!

in each calendar month. The more you save, the more UNI$ earned!

| When you spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card with no min. spend | When you save with Lady’s Savings Account and spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card | Total UNI$ earned for every S$5 spend in a calendar month | |

| Lady’s Savings Account Monthly Average Balance (MAB) | Lady’s Savings Bonus UNI$ earned [for every S$5 spend] |

||

| Base + Bonus UNI$: 10X UNI$ For every S$5 spend |

< S$10,000 | - | 10X UNI$ (4 miles per S$1) |

| S$10,000 to S$49,999 | 5X UNI$ | 15X UNI$ (6 miles per S$1) |

|

| S$50,000 to S$99,999 | 10X UNI$ | 20X UNI$ (8 miles per S$1) |

|

| S$100,000 & above | 15X UNI$ | 25X UNI$ (10 miIes per S$1) |

|

Illustration:

Jasmine spends S$1,000 on her preferred rewards category with her UOB Lady's Credit Card and maintains S$50,000 MAB in her UOB Lady's Savings Account in a calendar month.

She'll be able to accumulate 4,000 UNI$![]() in a month. Here’s the breakdown:

in a month. Here’s the breakdown:

Base UNI$: S$1,000 / every S$5 spent x 1X UNI$ = 200 UNI$

Bonus UNI$: S$1,000 / every S$5 spent x 9X UNI$ = 1,800 UNI$

Lady’s Savings Bonus UNI$: S$1,000 / every S$5 spent x 10X UNI$ = 2,000 UNI$

If she maintains the MAB and spending for 12 months, she'll be able to earn 48,000 UNI$ in a year!

She can choose to convert the UNI$ into 96,000 KrisFlyer miles![]() .

.

With this, she could redeem a round-trip Business Class ticket to Shanghai, or a round-trip Economy Class ticket to Paris![]() within a year!

within a year!

Alternatively, she can also choose to redeem her UNI$ for rewards across the wide selection of dine, shop and travel merchants on Rewards+.

Important Notice:

Starting 1 August 2025, the maximum Bonus UNI$ you can earn each calendar month with your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card) will be revised to:

New monthly cap: 2,700 UNI$ (equivalent to S$1,500 spending)

(Previously: 3,600 UNI$ which is equivalent to S$2,000 spending)

New rewards category cap: 1,350 UNI$ per category (equivalent to S$750 spending)

The Bonus UNI$ earned on the UOB Lady’s Account will also be capped based on S$1,500 in spending (previously $2,000) and capped at S$750 spend per rewards category when you save with the UOB Lady’s Savings Account and spend on your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card).

Refer to the UOB Lady’s Card Terms and Conditions and the UOB Lady’s Savings Account Reward Program Terms and Conditions for more details.

Lady’s Card and Lady’s Savings Account Calculator

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards category | 1,800 |

| Lady's Card Base 1X UNI$ on other purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards category | 1,000 |

| Total UNI$ earned monthly | 3,040 |

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards categories | 1,800 |

| Lady's Card Base 1X UNI$ on other purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards categories | 1,000 |

| Total UNI$ earned monthly | 3,040 |

How To Choose Your Rewards Category(ies):

Step 1:

Login to uob.com.sg/ladys-enrol

Note:

- If you have already selected your preferred categories, and wish to subsequently change your preferred categories, any change will only take effect from the next calendar quarter. For e.g. If you are enrolled in ‘Fashion’ category for Quarter 2 (April, May, June) and subsequently want to change to ‘Dining’ category on 15 May, your ‘Dining’ category will take effect from Quarter 3 (July, August, September).

- Lady’s Card Cardmembers may choose one (1) preferred rewards category only; Lady’s Solitaire Cardmembers may choose up to two (2) preferred rewards categories.

- For existing UOB Lady’s Card Cardholders who have applied for a Lady’s Solitaire Card, your existing UOB Lady's Card, will be automatically upgraded upon approval of your application. You may select two (2) preferred rewards categories to take effect in the next calendar quarter. T&Cs apply.

Pair your UOB Lady’s Credit Card with the UOB Lady’s Savings Account

UOB Lady’s Credit Card + Lady’s Savings Account

Unlock up to 25X UNI$ per S$5 spend (10 miles per S$1)

Earn 10X UNI$ per S$5 spend on up to 2 of your preferred rewards category(ies) with UOB Lady’s Credit Card

Enjoy additional up to 15X UNI$ per S$5 spent on your preferred rewards category(ies) when you save with UOB Lady’s Savings Account

Things you should know

UOB Lady’s Card eligibility and fees

Eligibility

Age: 21 years and above

Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000#

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000#

Documents required: Click here

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$196.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first card

- S$98.10^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a UOB Lady's Card, your existing Lady's Solitaire Card, if any, will be automatically downgraded upon approval of your application. T&Cs apply.

UOB Lady’s Solitaire Card eligibility and fees

Eligibility:

Age: 21 years and aboveSingaporean/PR/Foreigners:

- Minimum annual income of S$120,000 is required OR

- Fixed Deposit collateral of at least S$30,000#.

Documents required: Click here.

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$414.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first 2 cards

- S$196.20^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a Lady's Solitaire Card, your existing UOB Lady's Card, if any, will be automatically upgraded upon approval of your application. T&Cs apply.

For existing UOB Cardmembers, kindly ensure that your annual income as per the bank’s record has been updated to S$120k p.a. and above before proceeding with your application. If you have not done so, please click here to update your income.

UOB Lady’s Debit Card eligibility and fees

Eligibility:

- Age: 16 years and above

Age: 16 years and above

Singaporean/PR/ Foreigners:

- Hold a UOB Savings or Current account

- No minimum income requirement

For existing UOB Lady's Debit Cardmembers, you can adjust your Debit Card Mastercard spending limit. If you wish to adjust, click here to find out more.

Terms and Conditions:

View full UOB Lady's Debit Card Terms and conditions here.

Annual fees:

- With effect from 1 January 2024: S$18.34* yearly (First 3 years card fee waiver^)

- Thereafter, annual fee waiver with at least 12 Mastercard transactions per year.

*Inclusive of Singapore's prevailing Goods and Services Tax (GST).

^First 3 years card fee waiver shall not apply to applicants who have cancelled and reapplied for the same UOB Lady's Debit Card.

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

What’s more, you can digitize your card to enjoy convenience of mobile contactless payment when you receive your card!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

Terms and conditions

W.e.f. 1 October 2024, transactions with the transaction description “AMAZE*” and Merchant Category Codes 5965 Direct marketing –Combination Catalog and Retail Merchants, 5993 Cigar Stores and Stands, 8699 Membership Organizations (Not Elsewhere Classified) and 8999 Professional Services (Not Elsewhere Classified) will be excluded from the awarding of UNI$, cashback, and KrisFlyer Miles. Click here for the full terms and conditions.

With effect from 21 July 2024, transactions with the transaction description “NORWDS*” will be excluded from the awarding of UNI$, cashback, and KrisFlyer Miles.

UOB Lady’s Card Terms and Conditions

1Earn up to 25X UNI$ for every S$5 spent (equivalent to 10 miles per S$1) on your preferred rewards category(ies):

1) Earn 10X UNI$ on your UOB Lady’s Credit Card:

No minimum spend required. Register via uob.com.sg/ladys-enrol and select up to 2 preferred rewards category(ies) for which you will earn 10X UNI$ per S$5 spent in each calendar month. This comprises a base earn rate of UNI$1 for every S$5 spent and a bonus earn rate of 9X UNI$ for every S$5 spent (“Bonus UNI$”) on your selected preferred rewards category(ies). The maximum aggregate amount of Bonus UNI$ you can earn in a calendar month is capped at (a) 1,800 UNI$ which is equivalent to S$1,000 spent, if you are a UOB Lady’s Classic Card, UOB Lady’s Platinum Card or UOB Lady’s World Mastercard Cardmember; or (b) 3,600 UNI$ which is equivalent to S$2,000 spent if you are a UOB Lady’s Solitaire Card# or UOB Lady’s Solitaire Metal Card Cardmember. UNI$ can be converted into air miles at the conversion rate of UNI$1 = 2 miles^. Full Terms and Conditions apply, click here.

2) Earn up to additional 15X UNI$ when you save with UOB Lady’s Savings Account:

You shall be eligible to earn the following Lady’s Savings Bonus UNI$ in a calendar month in accordance with the Monthly Average Balance (“MAB”) in your UOB Lady’s Savings Account if you (1) are a principal UOB Lady’s Credit Cardholder and a primary UOB Lady’s Savings Accountholder, (2) maintain a minimum MAB of S$10,000 in your UOB Lady’s Savings Account in a calendar month and (3) selected your Preferred Rewards Category(ies). The Lady’s Savings Bonus UNI$ you can earn in a calendar month is capped at S$1,000 spent on your preferred category if you are a UOB Lady’s Classic Card, UOB Lady’s Platinum Card or UOB Lady’s World Mastercard Cardmember; or (b) S$2,000 spent on your preferred categories if you are a UOB Lady’s Solitaire Card# or UOB Lady’s Solitaire Metal Card Cardmember. Full Terms and Conditions apply, click here.

Important Notice:

#Starting 1 August 2025, the maximum Bonus UNI$ you can earn each calendar month with your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card) will be revised to:

New monthly cap: 2,700 UNI$ (equivalent to S$1,500 spending)

(Previously: 3,600 UNI$ which is equivalent to S$2,000 spending)

New rewards category cap: 1,350 UNI$ per category (equivalent to S$750 spending)

The Bonus UNI$ earned on the UOB Lady’s Account will also be capped based on S$1,500 in spending (previously $2,000) and capped at S$750 spend per rewards category when you save with the UOB Lady’s Savings Account and spend on your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card).

Refer to the UOB Lady’s Card Terms and Conditions and the UOB Lady’s Savings Account Reward Program Terms and Conditions for more details.

^Please refer to UOB Rewards Programme Terms and Conditions here.

If you have already selected your preferred rewards category(ies), and wish to subsequently change your rewards category(ies), any change will only take effect from the next quarter and the bank will take the last entry of categories for the new quarter Bonus UNI$ awarding. If you have not selected your preferred rewards category(ies), your selection will only take effect as of date of enrolment.

Debit Card Campaign Terms and Conditions

Terms and Conditions governing the UOB Debit S$5 GrabFood Voucher Promotion, please click here.

For existing UOB Principal Credit Cardholders

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77672:

Note:

- Please be reminded to choose your preferred rewards category(ies) to earn up to 25X UNI$ (10 miles per S$1) upon receiving your newly approved UOB Lady's Card.

- For existing UOB Lady's Card Cardholders who have applied for a Lady's Solitaire Card, your existing UOB Lady's Card, will be automatically upgraded upon approval of your application. You may select two (2) preferred rewards categories to take effect in the next calendar quarter. T&Cs apply.

- Lady’s Card Products

- SMS

| Lady’s Card Products | SMS |

| UOB Lady’s Card | ‹Yeslady›space‹Last 4 digits of existing UOB Card›space‹NRIC#› |

| UOB Lady’s Solitaire Card | ‹YesSolitaire›space‹Last 4 digits of existing UOB Card›space‹NRIC#› |

Limited edition UOB Lady's Solitaire Metal Card featuring an elegant red rose design

The ultimate definition of luxe and splendour with confidence. By exclusive invitation only.

UOB Lady’s Card + UOB One Account

Earn higher interest on your savings with One Account – up to 5.3% p.a. in just two steps

Skip to the good part with UOB One Account. Get up to 5.3% p.a. interest when you spend min. S$500 monthly on your UOB Lady’s Card AND credit your salary OR make 3 GIRO transactions monthly.![]()

Promotion

Enjoy more privileges when you pair the UOB One Account with UOB Lady's Card. Visit go.uob.com/online-exclusive for the latest sign-up offer!

UOB Lady’s Card FAQs: Things you should know

1. What are the Preferred Rewards Categories available for selection?

2. Where can I choose my Preferred Rewards Category(ies)?

You may visit uob.com.sg/ladys-enrol to select your preferred rewards category(ies).

For more assistance, you can also reach our Call Centre at 1800 222 2121 (Local) and 6222 2121 (overseas).

3. When can I choose/change upcoming quarter’s Preferred Rewards Category(ies)?

You may choose or change your preferred rewards category(ies) anytime within current quarter. It has to be made by 2359 hours (Singapore time) before the first calendar date of the following calendar quarter.

Please refer to the calendar quarters here:

| Quarter | Month |

| Quarter 1 | January, February, March |

| Quarter 2 | April, May, June |

| Quarter 3 | July, August, September |

| Quarter 4 | October, November, December |

4. Can I change my Preferred Rewards Category(ies) after I’ve selected them?

Yes. If you have already chosen your preferred categories, and wish to subsequently change your preferred categories, you may visit uob.com.sg/ladys-enrol to update your preferred rewards category(ies). Please be informed that any change will only take effect from the next calendar quarter. Bonus UNI$ will be awarded based on the preferred categories chosen for that quarter. If you have chosen your preferred categories multiple times, the bank will take the last entry of your chosen preferred categories to take effect the next calendar quarter.

If you have not chosen your preferred categories, your first choice will take effect as of date of choice.

First entry: Takes effect as of date of category chosen

Subsequent entries: Takes effect the next calendar quarter and the bank will take the last entry of category(ies) for the new quarter

5. Do I need to choose my Preferred Rewards Category(ies) every quarter?

No, you do not need to choose your preferred rewards category(ies) every quarter if you have already registered your selection before. However, if no selection is made, the previous quarter’s selection will remain.

Please refer to the calendar quarters here:

| Quarter | Month |

| Quarter 1 | January, February, March |

| Quarter 2 | April, May, June |

| Quarter 3 | July, August, September |

| Quarter 4 | October, November, December |

6. I’ve chosen my category(ies) for the next quarter, can I change them again?

Yes, as long as you have chosen before the start of the next new calendar quarter. The bank will take the last entry chosen before the start of the new quarter to determine that preferred category(ies) choice of the new quarter.

For illustration purpose only, for UOB Lady’s Classic/ Platinum/ World Mastercard Cardmembers:

15 April: Selected “Fashion” category.

21 June: Selected “Dining” category.

➔ Category for Quarter July – Sept will be effected as “Dining” as UOB Lady’s Classic/ Platinum/ World Mastercard Cardmembers may choose one (1) preferred rewards category only.

For illustration purpose only, for UOB Lady’s Solitaire Cardmembers:

15 April: Chose “Fashion” and “Dining” categories.

21 June: Chose “Travel” and “Entertainment” categories.

➔ Categories for Quarter July – Sept will be effected as “Travel” and “Entertainment” as UOB Lady’s Solitaire Cardmembers may choose up to two (2) preferred rewards categories.

7. Can a Lady’s Solitaire Cardmember choose just one category instead of two?

Yes, but the bonus 9X UNI$ that you may earn will be shared amongst your two chosen preferred rewards categories.

If you would prefer to choose only one preferred rewards category, it means you will only be able to earn the bonus 9X UNI$ for that category. However, you will still continue to earn a base of UNI$1 for every S$5 spent on your UOB Lady’s Card.

Note: With effect from 1 August 2025,

For UOB Lady’s Solitaire Cardmembers only (excluding UOB Lady’s Solitaire Metal Cardmembers):

The spending cap eligible for bonus 9X UNI$ on your preferred rewards category(ies) will be revised from S$2,000 to S$1,500, with the bonus 9X UNI$ for each preferred rewards category capped at S$750 in spending.

If you only choose one preferred rewards category, it means you will only be able to earn bonus 9X UNI$ on up to in S$750 spending on that rewards category per calendar month. If you have selected two preferred rewards categories, you will be able to earn bonus 9X UNI$ on up to S$750 spent per preferred rewards category per calendar month.

The base earn rate of UNI$1 for every S$5 spent on your UOB Lady’s Card remains unchanged.

8. What happens when I upgrade my UOB Lady’s Classic/ Platinum/ World Mastercard to UOB Lady’s Solitaire Card?

Please visit uob.com.sg/ladys-enrol to choose TWO (2) of your preferred rewards categories. This will take effect the next calendar quarter. However, you may start enjoying the higher cap of S$2,000 spend based on your existing chosen ONE (1) preferred rewards category in the calendar month of your card upgrade.

For existing UOB Lady’s Classic/Platinum/World Mastercard cardholders applying for the UOB Lady’s Solitaire Card, once your UOB Lady’s Solitaire Card application is approved and the UOB Lady’s Solitaire Card has been issued to you, you will no longer enjoy the benefits or privileges of your existing UOB Lady’s Classic/Platinum/World Mastercard.

Note: For existing UOB Lady’s Classic / Platinum / World Mastercard customers whose card upgrade takes place from August 2025, you will start to earn bonus 9X UNI$ on up to S$750 spend on your existing selected preferred rewards category in the calendar month of your card upgrade. Please be reminded to visit uob.com.sg/ladys-enrol to select two of your preferred rewards categories. Your selection will only be effective the next calendar quarter. Once your selection takes effect, you will be eligible to earn bonus 9X UNI$ on up to S$750 spent per preferred rewards category per calendar month.

9. How can you earn up to 25X UNI$ per S$5 spent (10 miles per S$1) on your preferred rewards category(ies)?

By maintaining at least S$10,000 Monthly Average Balance (MAB) in your UOB Lady’s Savings Account, you can now earn additional bonus UNI$, called the Lady’s Savings Bonus UNI$, for all eligible transactions in your preferred rewards category(ies) charged to your UOB Lady’s Credit Card in each calendar month. The Lady’s Savings Bonus UNI$ eligible will be determined based on your account MAB. This Lady’s Savings Bonus UNI$ will be awarded in addition to the Lady’s Credit Card Base 1X UNI$ as well as the Lady’s Credit Card Bonus 9X UNI$.

UNI$ you can earn per S$5 spend on your UOB Lady’s Credit Card when you save in your UOB Lady’s Savings Account:

| Bonus UNI$ earned on your preferred rewards category(ies) on your UOB Lady’s Credit Card | 9X |

| Base UNI$ earned on your UOB Lady’s Credit Card | 1X |

| Lady’s Savings Bonus UNI$ earned on your preferred rewards category(ies) on your UOB Lady’s Credit Card | |

| Monthly Average Balance (MAB) of your Lady’s Savings Account | UNI$ earn rate |

| ‹S$10,000 | - |

| S$10,000 to S$49,999 | 5X |

| S$50,000 to S$99,999 | 10X |

| S$100,000 & above | 15X |

UOB Lady's Card Notices

Lucky Draw Winners

UOB Lady’s International Women’s Day 2025 Lucky Draw

Congratulations to the winners of the UOB Lady’s International Women’s Day 2025 Lucky Draw (8 March 2025 to 30 April 2025)!

Find out if you are one of the lucky winners here. Winners will be notified via SMS/email sent to their mobile number/email address as per the Bank’s record.

Related products

Personal Loan

Extra help, extra fast approval! UOB Personal Loan gives you the financial boost you need with rates from 1.85% p.a. (EIR from 3.40% p.a.).

Balance Transfer

Stress less with UOB Balance Transfer! Enjoy 12 months of 0% interest at low one-time 4.28% processing fee on your approved loan amount! (EIR from 4.69% p.a.)

Other useful links

UOB Cardmembers’ Agreement

Click here for a copy of the UOB Cardmembers’ Agreement.

UOB Debit Cardmembers’ Agreement

Click here for a copy of the UOB Debit Cardmembers’ Agreement.

General Information On UOB Cards

Click here for general information on UOB Credit Cards.

UOB Debit Card Fees and Charges

Click here for a copy of the UOB Debit Card Fees and Charges.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.