Earn points by recycling with us and redeem them with sustainable partners across Singapore

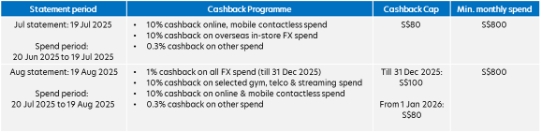

Existing UOB EVOL Cardmembers

To minimise disruptions for existing cardmembers, cardmembers with UOB EVOL Cards issued before 19 June 2025 will enjoy the enhanced cashback benefits from their next statement generated on or after 19 August 2025

Please click here for Frequently Asked Questions

FX Fees are administrative fees applied on transactions in foreign currencies.

Cashback illustration

See how easy it is to earn cashback on the things you love.

- Spend Amount

- Cashback Earned

| Spend | Spend Amount | Cashback Earned |

| Spend | Spend a minimum of S$800 in a statement month | |

| 1% cashback on all Overseas Foreign Currency SpendNEW (till 31 Dec 2025) + enjoy 0% FX FeesNEW! | ||

| Disneyland Admission in Tokyo charged in JPY | S$200 worth in SGD | S$2.00 (plus, no FX fees!) |

| 10% cashback on Selected Gym, Telco and Streaming SpendNEW | ||

| Classpass membership | S$99 | S$9.90 |

| Netflix subscription | S$23 | S$2.30 |

| Spotify subscription | S$18 | S$1.80 |

| Starhub bills | S$60 | S$6.00 |

| 10% cashback on Local Online and Mobile Contactless Spend | ||

| Shopping from Taobao | S$150 | S$15.00 |

| Grab rides | S$50 | S$5.00 |

| Dining spend via Mobile Contactless | S$60 | S$6.00 |

| Purchase from Sephora via Mobile Contactless | S$40 | S$4.00 |

| 0.3% cashback on all Other Spend | ||

| New headphones via Visa Paywave (paid using the physical card) | S$100 | S$0.30 |

| Total | S$800 | S$52.30 |

Overseas Foreign Currency Spend refers to spend that is processed outside of Singapore and successfully charged in a foreign currency. Selected Gym, Telco and Streaming Spend refers to all spend made at selected merchants only, please click here for terms and conditions. Online refers to all spend made via the internet. Mobile Contactless refers to in-store contactless spend made via Apple Pay, Samsung Pay, Google Pay and other mobile wallet services that accepts UOB EVOL Card. Cashback is capped at S$100 (S$20 for all Overseas Foreign Currency Spend, S$20 cap for Selected Gym, Telco and Streaming Spend; S$30 cap for Local Online and Mobile Contactless; and S$30 on all Other Spend) for each statement month if you met min. S$800 spend per statement month. FX Fees are administrative fees applied on transactions in foreign currencies. T&Cs and exclusions apply.

About UOB EVOL

Sustainability

Show your support and go green with Southeast Asia’s first bio-sourced card – the UOB EVOL Card. Enjoy a variety of sustainable deals, take your carbon footprint to zero with SP Group and more!

Rewards+

Access to Singapore’s personalised rewards programme on UOB TMRW app. Enjoy curated dining, shopping, travel deals and more, plus track and use your cashback and rewards points.

Digital Banking with UOB TMRW

Where’s your money really going? Take stock by using UOB TMRW to track your spending, score deals, invest and more. It’s the Spotify Unwrapped you needed, but for money.

Smart Money

Boost your savings with UOB One Account. What’s more, ease your cashflow when you buy now and pay later with UOB SmartPay.

Promotions

Others

ALBA STEP UP app – Turning Waste into Treasure

Things you should know

Eligibility and fees

Eligibility

Age: 21 years and aboveSingaporean/PR:

- Instant Card approval via Myinfo

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000^^

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000^^

^^Terms and conditions apply. Please visit UOB branches for more information on secured card applications.

Documents required: Click here.

Annual Fees:

- Enjoy no annual fee2 on your Principal Card when you make min. 3 transactions per month for 12 consecutive months prior to your card anniversary date

- Applicable for annual fee on your following card anniversary date from 1 Jan 2023 onwards

- With effect from 1 January 2024:

- Principal card: S$196.20

- 1st Supplementary Card: Free

- 2nd Supplementary Card onwards: S$98.10

Already an existing UOB Credit Cardholder?

Alternative, if you are already a Principal UOB Credit Card Holder, you can send an SMS application to 77672:

<YesEVOL>space<Last 4 digits of existing UOB Card>space<NRIC#>

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

What’s more, you can digitize your card to enjoy convenience of mobile contactless payment when you receive your card!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

For existing Principal UOB Credit Card holders

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77862:

‹YesEVOL›space‹Last 4 digits of existing UOB Card›space‹NRIC#›

SMS T&Cs apply.

Terms and Conditions

*The first 60 new-to-UOB Credit Cardmembers who successfully apply and obtain approval for a new UOB EVOL Card and register via SMS for the Promotion from 19 June 2025 to 31 July 2025 (both dates inclusive) and took the least total number of days to spend a min. of S$800 per month for the first 2 consecutive months from their card approval date, will be eligible to receive an Apple Watch SE 2nd Gen.

Click here for full terms and conditions

Apply & Pay within minutes is only valid for New-to-Bank applicants who use Myinfo to retrieve personal details and income information, pass all screening steps and income checks. Applications must be submitted from 7am - 8pm. You will be able to receive your physical card 5 working days upon card approval.

1EVOL Card benefits will be enhanced from 19 Jun 2025: To enjoy 10% cashback on Selected Gym, Telco, and Streaming Spend, Local Online Spend and Mobile Contactless Spend, a min. spend of S$800 per statement month on your card is required. If the min. spend is not met, only the base 0.3% cashback on Selected Gym, Telco, and Streaming Spend, Local Online Spend and Mobile Contactless Spend will be awarded. Cashback is capped at S$80 per statement month (S$20 cap for Selected Gym, Telco and Streaming Spend; S$30 cap for Local Online and Mobile Contactless Spend; and S$30 on all Other Spend). Exclusions and other terms and conditions apply.

2EVOL Card benefits will be enhanced from 19 June 2025: You do not need to meet the min. spend of S$800 per statement month to enjoy 0% FX Fees on all your Overseas Foreign Currency Spend. FX Fees are administrative fees applied on transactions in foreign currencies. Exclusions and other terms and conditions apply.

3Enjoy 1% cashback on all your Overseas Foreign Currency Spend till 31 December 2025 (S$20 cap), with a min. spend of S$800 per statement month. Exclusions and other terms & conditions apply.

4Enjoy no annual fees when you make min 3 transactions on your UOB EVOL Card every month for 12 consecutive months prior to your card annual fee charge date.

To minimise disruptions for existing cardmembers, cardmembers with UOB EVOL Cards issued before 19 June 2025 the cashback benefits will be updated from their next statement cycle on or after 19 August 2025, please click here for Frequently Asked Questions.

^You will be given My Green CreditsTM valued at 1% of your SP Utilities bill amount. These My Green CreditsTM by SP Group are provided to you free of charge, and can offset up to 100% of your electricity carbon footprint. A minimum SP Utilities bill amount of S$100 is required for conversion to My Green CreditsTM. My Green CreditsTM prices are dependent on the REC selling prices offered by each developer to UOB. These prices may change from time to time, depending on market factors. As of 12 October 2023, My Green CreditsTM are purchased by UOB at S$0.12 per 25 kWh. Click here for FAQs.

Bundle up for even more benefits

Earn higher interest on your savings with One Account – up to 5.3% p.a. in just two steps

Skip to the good part with UOB One Account. Simply spend min. S$500 monthly on your UOB EVOL Card AND credit your salary, OR make 3 GIRO transactions monthly.![]()

Enjoy more privileges when you pair the UOB One Account with UOB EVOL Card. Visit go.uob.com/online-exclusive for the latest sign-up offer!

Apply online and get up to S$260 cash credit+

Find out more.

Other useful links

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.