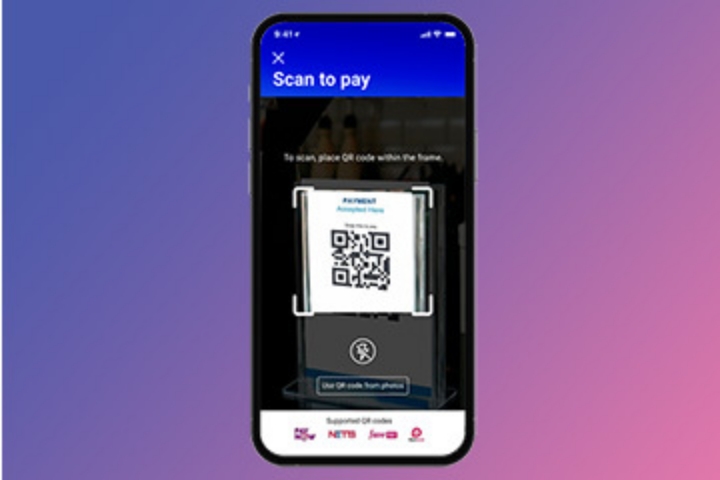

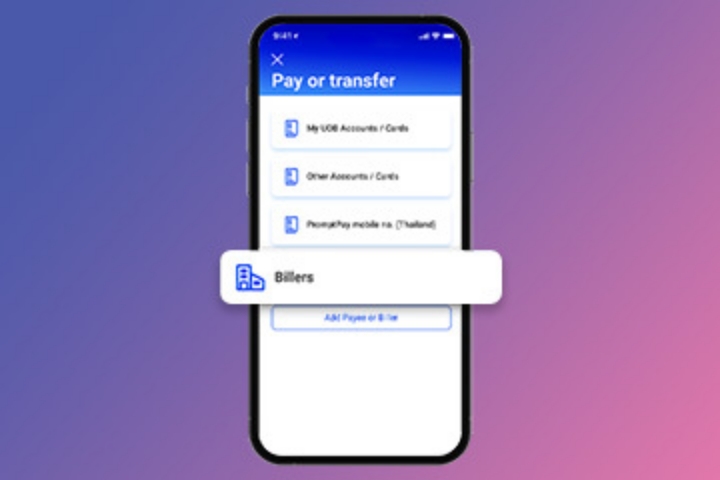

Make transfers to family, friends or businesses using their mobile number, NRIC/FIN or UEN – no bank account number required!

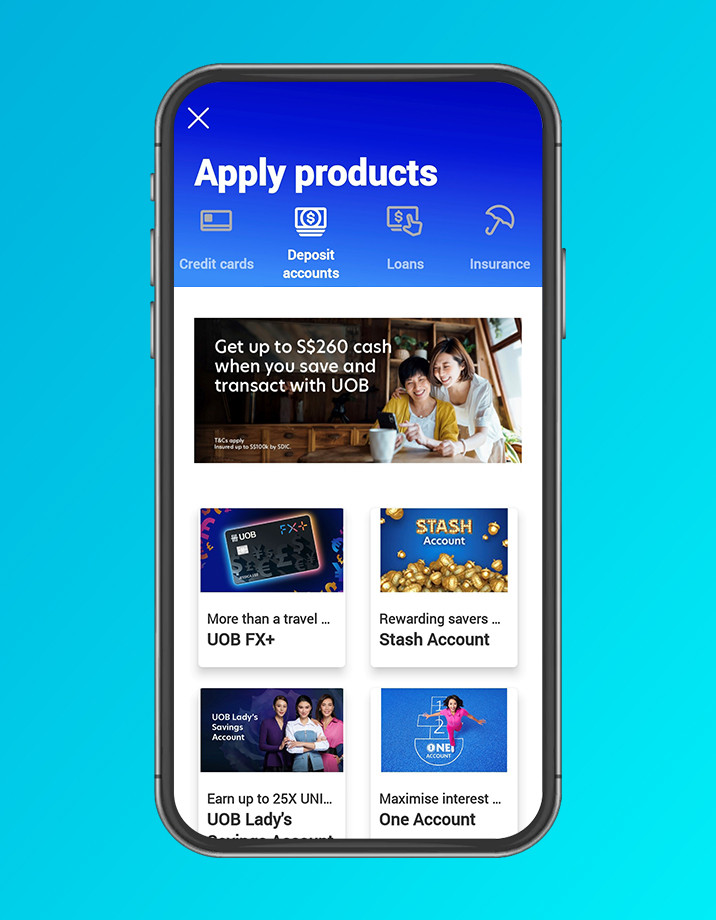

UOB FX+ Debit Card and Account – More than a travel wallet

• 0% FX fees on all worldwide spends – no cap, no minimum spend

• Convert currencies in advance on UOB TMRW, at rates as good as what you see online

• Save more on extra travel perks like cashback on overseas ATM withdrawals and up to 20% off GrabTransport

Subject to qualifying criteria. T&Cs apply

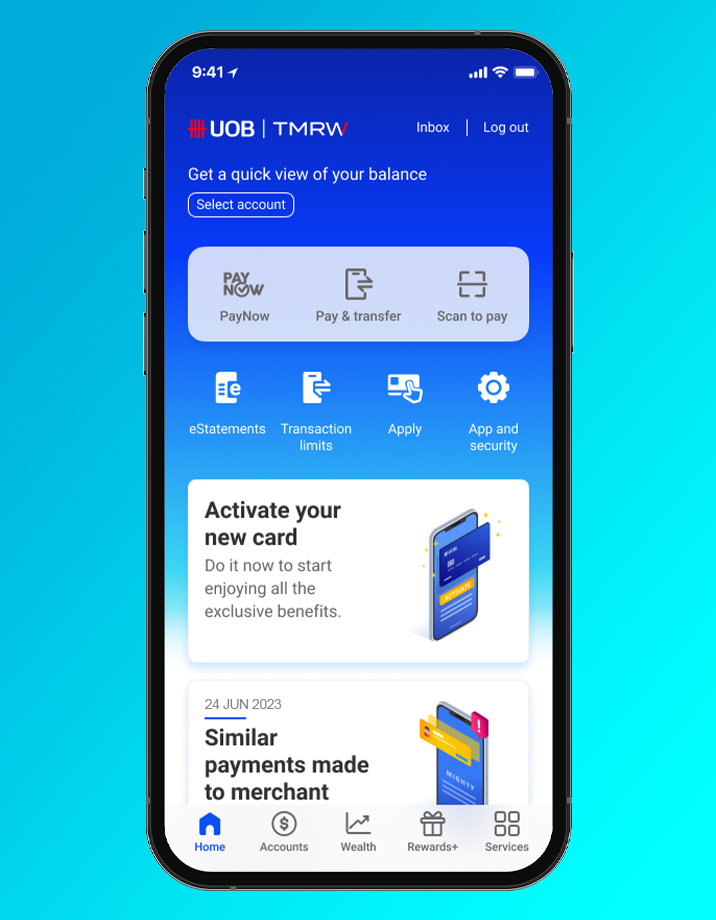

UOB TMRW, the app built around you

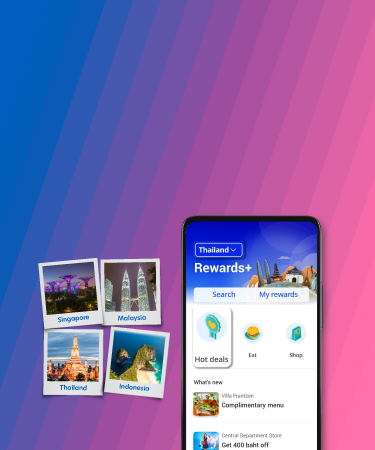

Meet UOB TMRW, the all-in-one banking app built around you and your needs. It features AI-driven insights, rewards personalised to you through Rewards+, and investing made simple through our expert wealth solutions.

Our app is optimised for a seamless banking experience anytime, anywhere.

Bank. Invest. Reward. Make TMRW yours. Download now

What's New

Make the most of UOB TMRW mobile banking app with the latest announcements, features and promotions, all in one app.

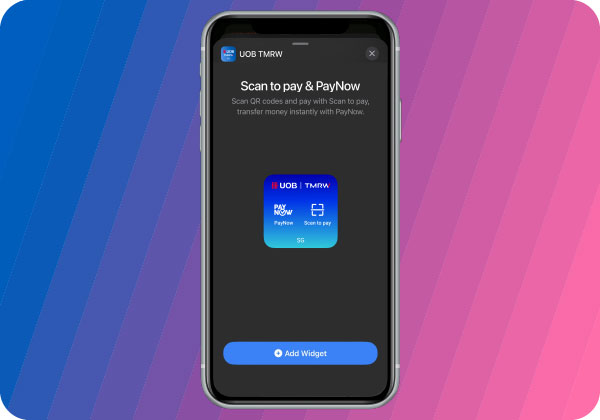

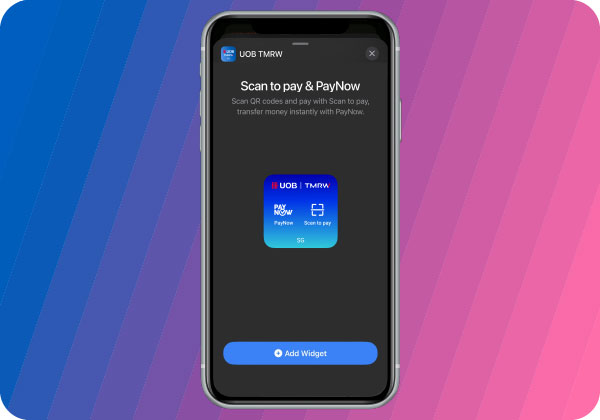

Pay faster with the new UOB TMRW widget

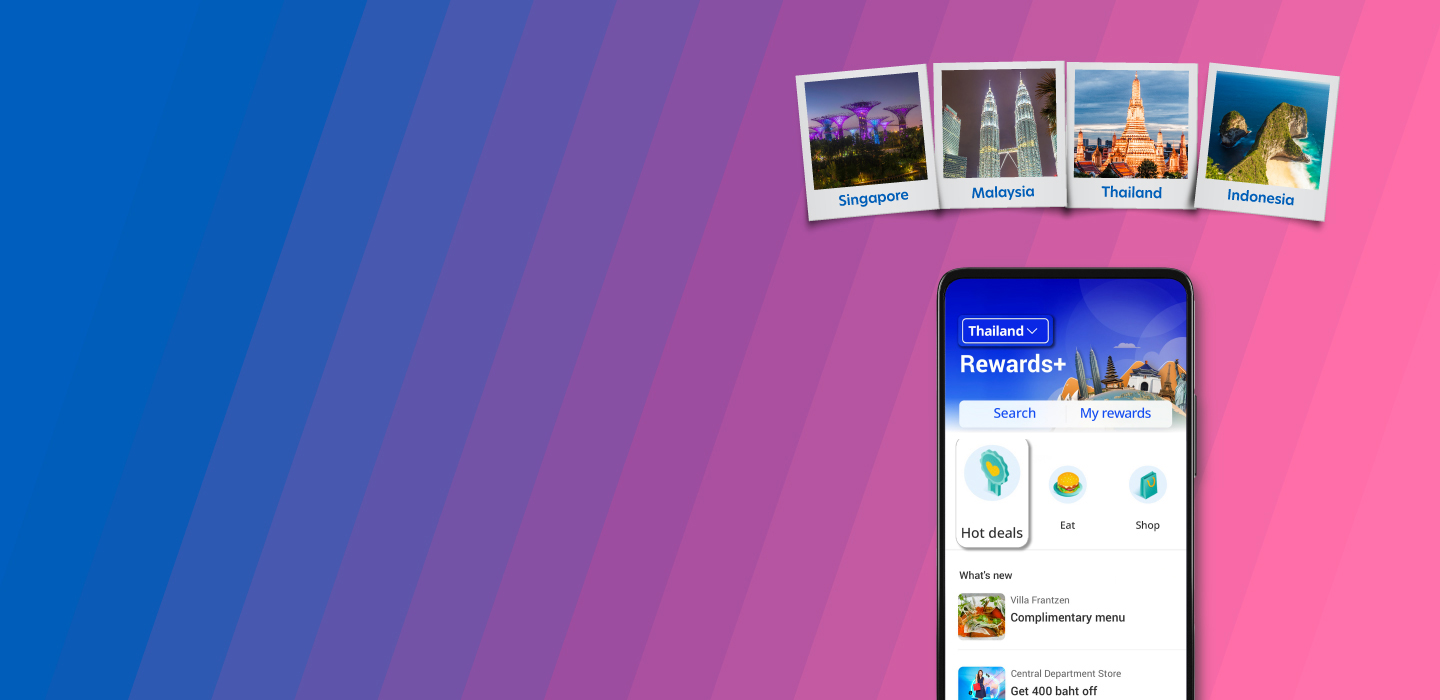

Enjoy quicker payments with the new UOB TMRW widget. Add it to your home or lock screen for instant access to PayNow and Scan to pay.

Gallop your way to good fortune with UOB TMRW

PayNow or Scan to pay on UOB TMRW to play and win exclusive prizes from now till 10 Mar 2026. Subject to qualifying criteria. T&Cs apply.

Your taxi ride just got more rewarding with UOB TMRW

Campaign has ended, thank you for participating.

Scan to pay across the region to get up to 20% cashback

Campaign has ended, thank you for participating.

Get more savings out of your travels with FX+

- Comes with the FX+ Debit Card that lets you spend worldwide at 0% FX fees – no cap, no minimum spend

- Convert currencies in advance on UOB TMRW, at rates as good as what you see online

- Enjoy extra travel perks like cashback on overseas ATM withdrawals and up to 20% off Grab Transport rides in the region.

- Receive S$60 cash when you sign up online. Promotion till 31 March 2026.

- From now till 30 March 2026, simply deposit and maintain US$2,000 to US$50,000 in your UOB FX+ Account for up to 3 months to earn 3.3% p.a. on USD fresh funds. Please register here to participate in the promotion.

Subject to qualifying criteria. T&Cs apply.

Pay faster with the new UOB TMRW widget

Enjoy quicker payments with the new UOB TMRW widget. Add it to your home or lock screen for instant access to PayNow and Scan to pay.

Gallop your way to good fortune with UOB TMRW

PayNow or Scan to pay on UOB TMRW to play and win exclusive prizes from now till 10 Mar 2026. Subject to qualifying criteria. T&Cs apply.

Your taxi ride just got more rewarding with UOB TMRW

Campaign has ended, thank you for participating.

Scan to pay across the region to get up to 20% cashback

Campaign has ended, thank you for participating.

Get more savings out of your travels with FX+

- Comes with the FX+ Debit Card that lets you spend worldwide at 0% FX fees – no cap, no minimum spend

- Convert currencies in advance on UOB TMRW, at rates as good as what you see online

- Enjoy extra travel perks like cashback on overseas ATM withdrawals and up to 20% off Grab Transport rides in the region.

- Receive S$60 cash when you sign up online. Promotion till 31 March 2026.

- From now till 30 March 2026, simply deposit and maintain US$2,000 to US$50,000 in your UOB FX+ Account for up to 3 months to earn 3.3% p.a. on USD fresh funds. Please register here to participate in the promotion.

Subject to qualifying criteria. T&Cs apply.

3 ways to switch colour themes:

• Access before you log in to the app

• Access via your dashboard

• Access via Services

Enjoy the following benefits:

- Public Conveyance Personal Accident coverage of up to S$300,000

- Emergency Medical Assistance, Evacuation & Repatriation of up to S$50,000 due to an accident or illness.

- Medical Expenses due to accident and illness of up to S$2,000

- Luggage Delay of up to S$200 for each full 6 hours while overseas

- Travel Delay of up to S$200 for each full 6 hours while overseas

The specific details applicable to this insurance are set out in the Insurance Certificate and Agreement which is the operative document. Terms, conditions and exclusions apply. Please seek advice from a qualified advisor if in doubt.

Digital Payments and Transfers

- All

- Local

- Overseas

Compare accounts

Bank with ease

Everything at a glance

The new app has never been more user-friendly, with one-tap access to your most used features.

Manage your accounts and transactions on the go

Get quick account updates on your deposits, bonus interests, investments, credit cards' deals and rewards.

Lock in rates as good as what you see online in advance with FX+

Convert SGD to the foreign currency you need at competitive rates before your trip. Your transactions will be deducted from your FX+ account at 0% FX fees. Find out more here.

Supported currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD

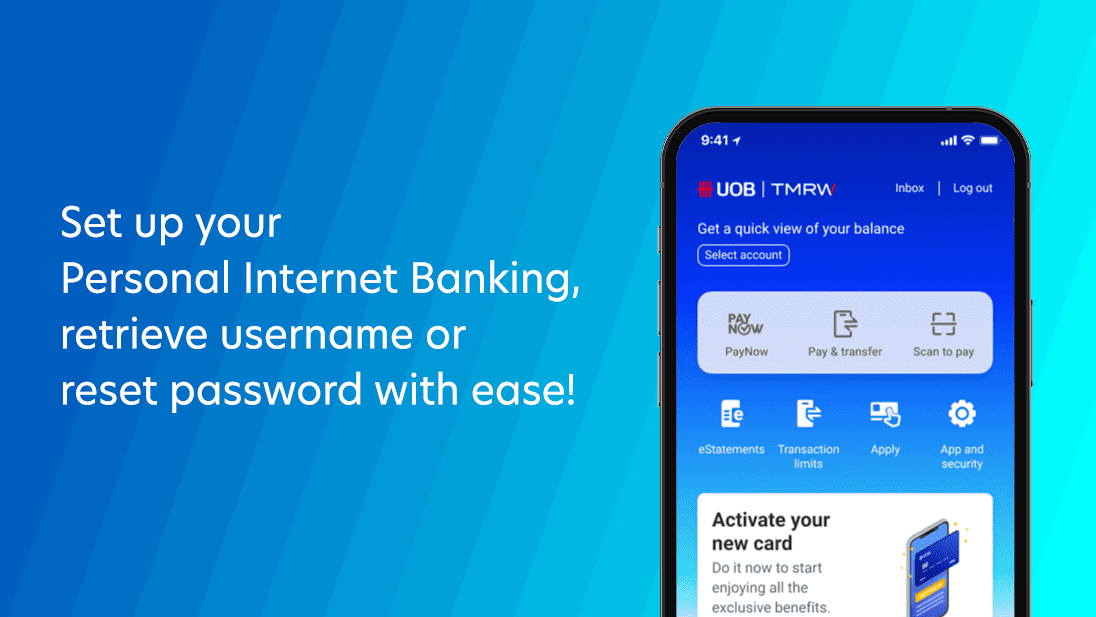

Quick and easy account set up

Wave goodbye to long waiting hours at the bank! You can now open a bank account via UOB TMRW or online, get approval within minutes*, and start transacting instantly in the comfort of your home![]()

SGD deposits are insured up to S$100k by SDIC.

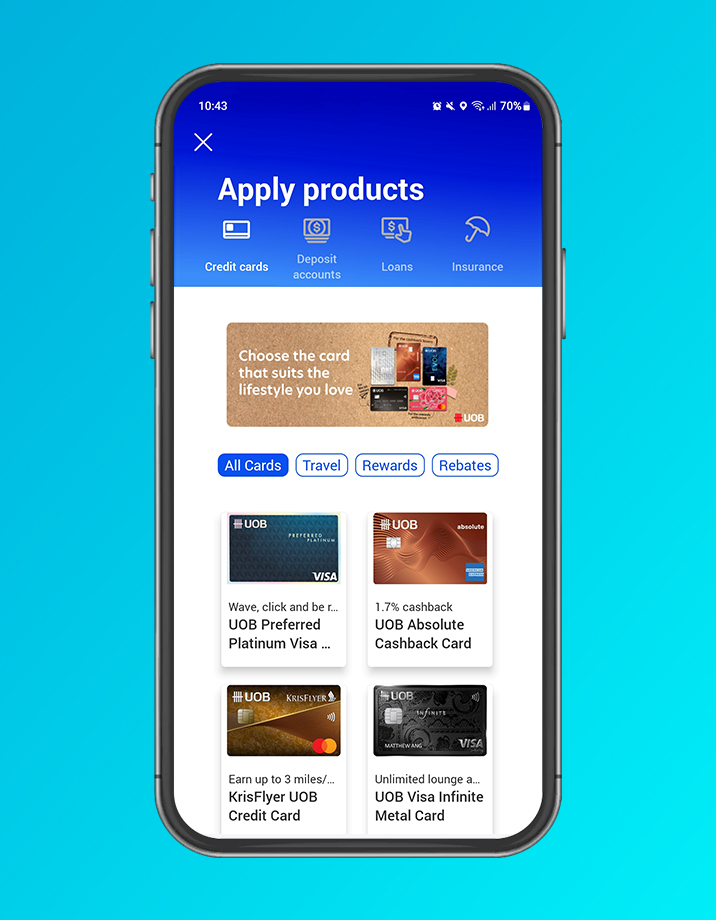

One App For All Your Banking Needs

With smart insights that empower you to take control of your finances, wealth features designed to grow your portfolio, and instant applications that get you what you need fast – this is the one banking app built designed to help you stay ahead.

Access a world of rewards at your fingertips with Rewards+

Get personalised and exclusive deals on dining, shopping, travel and more. Plus, view, track and redeem your cashback and rewards points.

Here’s how to access your Rewards:

Step 1: Go to Rewards+ tab on UOB TMRW

Step 2: Tap on “My Rewards”

Step 3: Manage your available rewards at a glance!

Other UOB TMRW Services

Discover more of what TMRW brings

- Make quick transactions via PayNow with just the Company Unique Entity Number (UEN) or Virtual Payment Address (VPA)

- Check your balance, pay bills and transfer funds

- Manage your pay and transfer limits

Bank Securely

Your online banking security is our top priority. We are committed to protecting your personal information and keeping you updated on the latest security tips and information. Click here to learn about the latest scam threats, tips to safeguard your online banking activities and how UOB puts in place measures to protect you.

Digital Banking

Enhanced real-time fraud surveillance to safeguard your transactions

To better safeguard your accounts against fast‑evolving scams, UOB has enhanced our real‑time fraud detection measures as required under the Monetary Authority of Singapore’s (MAS) and Infocomm Media Development Authority’s (IMDA) Guidelines on Shared Responsibility Framework (SRF).

Transactions* may be held for at least 24 hours. This safeguard gives you extra time to review or cancel a transaction if unauthorised.

If you are unsure about a held transaction, you can cancel it before the funds are processed.

- For UOB TMRW, go to the Accounts tab > select relevant account > ‘On Hold’ transaction > Cancel

- For Personal Internet Banking, select the relevant account > Accounts Summary > Transactions On Hold > select the transaction > Actions > Cancel

If you suspect fraud, call our 24/7 Fraud Hotline at 6255 0160 and press “1” to report a case.

For assistance on held transactions, please call us at 6355 2211.

For more information on the SRF, please refer to the MAS website.

*This excludes recurring standing instructions, recurring GIRO/ eGIRO deductions, bill payments to billing organizations maintained by the Bank, debit card transactions, and intrabank transfers to your other account(s) within the Bank.

Digital Banking and Cards

Enjoy secure banking with instant notifications

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions.![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Digital Banking

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Digital Banking

12-hour cooling period for transfer limit change

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Digital Banking

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

General Banking

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest. Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Digital Banking and Cards

Kill Switch (Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how.

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.

If you wish to re-enable all your UOB Debit/Credit cards, please unblock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Bank Securely

Your online banking security is our top priority. We are committed to protecting your personal information and keeping you updated on the latest security tips and information. Click here to learn about the latest scam threats, tips to safeguard your online banking activities and how UOB puts in place measures to protect you.

Digital Banking

Enhanced real-time fraud surveillance to safeguard your transactions

To better safeguard your accounts against fast‑evolving scams, UOB has enhanced our real‑time fraud detection measures as required under the Monetary Authority of Singapore’s (MAS) and Infocomm Media Development Authority’s (IMDA) Guidelines on Shared Responsibility Framework (SRF).

Transactions* may be held for at least 24 hours. This safeguard gives you extra time to review or cancel a transaction if unauthorised.

If you are unsure about a held transaction, you can cancel it before the funds are processed.

- For UOB TMRW, go to the Accounts tab > select relevant account > ‘On Hold’ transaction > Cancel

- For Personal Internet Banking, select the relevant account > Accounts Summary > Transactions On Hold > select the transaction > Actions > Cancel

If you suspect fraud, call our 24/7 Fraud Hotline at 6255 0160 and press “1” to report a case.

For assistance on held transactions, please call us at 6355 2211.

For more information on the SRF, please refer to the MAS website.

*This excludes recurring standing instructions, recurring GIRO/ eGIRO deductions, bill payments to billing organizations maintained by the Bank, debit card transactions, and intrabank transfers to your other account(s) within the Bank.

Digital Banking and Cards

Enjoy secure banking with instant notifications

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions.![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Digital Banking

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Digital Banking

12-hour cooling period for transfer limit change

From December 2024, there may be a 12-hour cooling period* when you submit a request to change your limit (3rd party local and overseas fund transfer). This is to combat online banking fraud and protect your accounts.

*This is in addition to the 12-hour cooling period for the activation of your new digital token.

Digital Banking

Introducing Singpass Face Verification (SFV) to protect you against phishing scams

As part of the latest industry move to strengthen the resilience against phishing scams, we have introduced Singpass Face Verification (SFV) as part of the Digital Token set-up.

This additional layer of authentication will be prompted if there is any unusual or suspicious activity detected during the Digital Token setup process, which will make it harder for scammers to gain access to your accounts.

General Banking

Protect your savings from digital scams with Money Lock

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals.

Rest assured, your money continues to earn the same interest. Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Digital Banking and Cards

Kill Switch (Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how.

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.

If you wish to re-enable all your UOB Debit/Credit cards, please unblock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Funds from the UOB LockAway Account can only be withdrawn in person and not by any other means, including but not limited to online transactions, Personal Internet Banking, Mobile Services, cheque, ATM withdrawals and debit instructions given through the Call Centre Service. For the avoidance of doubt, debit instructions will only be accepted for the UOB LockAway Account if you provide the debit instruction in person at any of our branches in Singapore. Watch this space for more information and refer to our FAQs

Stay updated on your incoming PayNow transactions

From 1 Mar 2023, we will phase out SMS notifications for incoming PayNow transactions. Customers will be notified via email and push notifications on UOB TMRW. To ensure your PayNow transactions notifications are not disrupted, please enable your push notification on your phone settings and update your email address today. Visit here for more information.

Protecting your transactions on Personal Internet Banking and UOB TMRW

From 13 December 2022, we will be implementing an extra layer of authentication by sending a One-Time Password (OTP) to your registered email to complete selected high-risk transactions on Personal Internet Banking and TMRW.

If you have not provided/updated your email address with us, a SMS OTP will be sent to your mobile number as a temporary alternative.

To ensure your online transactions are not disrupted, update your email address today. Login to your UOB TMRW app and select Services > Contact details or UOB Personal Internet Banking and select My Profile under your name.

Alerts for your GIRO transactions

We are committed to ensure that you have a safe and secure banking experience without compromising on convenience. With effect from 22 October 2022, you will no longer receive any alerts of GIRO debit transactions unless you have made a preferred SMS or email alerts through UOB Personal Internet Banking before this date. To update or review your personalised GIRO alert options, please log in to UOB Personal Internet Banking.

Mandating transaction alert for Cashier's order and Demand Draft

For security reasons, we have mandated transaction alerts for Cashier’s Orders and Demand Drafts. The unsubscribe option of the transaction alerts will no longer be available. For customers who have previously unsubscribed, we will automatically subscribe you back to the SMS option with the default alert trigger amount of S$1,000. To customise the alert mode and trigger amount, log in to UOB Personal Internet Banking to select the alert mode and new amount.

Revision of funds transfer limit

If you have not made any changes to your transfer limit before, your transfer limit will remain at the default limit of S$5,000.

To update your transfer limit, please have your digital token code ready and click here for the step-by-step guide.

With the UOB TMRW mobile banking app, you’re able to bank whenever and however you want. It’s loaded with features that allow you to pay bills, schedule fund transfers, and instantly withdraw cash from the comforts of your home.

Mobile banking saves significant amounts of time and energy. Imagine going to a nearby bank branch. You have to make preparations to go out, drive, and possibly wait when you get to the bank. There’s no need for any of this with online banking.

You’re more secure using our online banking app than you are going out with physical cards. With extra security options like multi factor authentication, your money will be safe and inaccessible to anyone but yourself.

Additionally, digital banking gives you the ability to go cashless. Physical cash, both coins and paper, can carry germs and viruses. It can also easily be stolen. Going cashless significantly reduces your risk of harm.

Mobile banking gives you more control over your finances. Our banking app gives you real time access to your money and allows you to easily manage your investments. This is also without any of the restrictions physical banking has when you can perform tasks like moving money between accounts.

| Affected Transaction alerts | Can I unsubscribe? | What will happen after July 2024? |

| UOB card bill payment | N | The unsubscribe option will be disabled.

Customer will receive the default email or SMS

notification on the relevant transaction. If you wish to select your preferred alert mode and threshold amount, log in to UOB Personal Internet Banking for the selection. |

| Funds transfer to your own UOB account/using the ATM to another bank account | ||

| Cash Advance to own UOB account | ||

| Mobile cash transaction | ||

| Securities Application | ||

| NETS contactless or online payment/In-store payment using NETS | ||

| Cashcard/Nets Flashpay top-up | ||

| Rights/SSB/SGS/T-Bills Application | ||

| EPS payment |

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Choose the coupon you wish to grab

- Step 3: Use grabbed coupon immediately or view all coupons in the Rewards+ tab

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Select the country you’re travelling to

- Step 3: Browse the list of deals available in the country

- Step 1: Go to Rewards+ tab on UOB TMRW

- Step 2: Tap on “My Rewards”

- Step 3: Manage your available rewards and redeem rewards points at your favourite merchants.

| Category | Impacted Transactions | Default notification mode | Default Threshold (S$) |

| Online transfers and payments | Digital transactions including all types of fund transfer, telegraphic transfer, QR payment (local and overseas), bill payments, online cash advance, eNETs payments | Push notification and email | 100 |

| Adding of payee, biller or beneficiary | No threshold | ||

| GIRO setup approval | SMS and Email | No threshold | |

| GIRO payments and standing orders (including Electronic Direct Debit Authorisation) | Unsubscribe | 1,000 | |

| No threshold | |||

| Upcoming GIRO payments and standing orders reminders (including Electronic Direct Debit Authorisation) | |||

| Card activity* | Card charges (includes payments and cash advances) | SMS and email | 500 |

| SmartPay, LuxePay, Instalment Payment Plan and UOB Personal Loan monthly instalments | 1,000 | ||

| NETS chip payments | 1,000 | ||

| NETS contactless and online payments | 1,000 | ||

| NETS transaction made on the CDA account | 0.1 | ||

| Low credit limit reminder | Unsubscribe | No threshold | |

| Upcoming card bill payment reminders | |||

| Confirmation of card bill payments received | |||

| Investments, fixed deposits and insurance | Instructions for securities, bonds, unit trusts and insurance products (includes Electronic Payment for Shares (EPS) and Share payments via ATMs) | Push notification and email | No threshold |

| Fixed or structured deposits placements | |||

| CPF or SRS accounts top-ups. | |||

| Buy/sell gold and silver | 1 | ||

| Securities and bonds allocation and redemption updates | Unsubscribe | No threshold | |

| eStatement | eStatement is ready for viewing | Push notification and email | No threshold |

| Security and money lock | Transfer and payment limit updates | Push notification and email | No threshold |

| Money lock limits update | |||

| When available balance is lower than money lock limit, and when transactions fail due to money lock | |||

| Mailing address update | |||

| ATM | Cash withdrawal in Singapore and Overseas | SMS and email | 500 |

| ATM transactions - funds transfer, bill payment | 1,000 | ||

| Top-ups to CashCards or NETS FlashPay cards/ Apply rights application/Apply SGS/Apply SSB/Apply T-bills | No threshold | ||

| Cheques, cashier's orders and demand drafts | Demand drafts and cashier’s orders | Push notification and email | 1,000 |

| Adding of beneficiary for cashier’s orders and demand drafts. | No threshold | ||

| When cheques are cashed in | SMS and email | 1,000 | |

| Others | Certain payments, refunds, and payment reversals made outside of UOB TMRW and Personal Internet Banking | Unsubscribe | 1,000 |

* For Card activity alerts, customers’ preferred alert mode of “SMS” or “Email” will be upgraded to “SMS and Email”, Customers’ preferred alert threshold, where applicable, will be retained.

Below is the list of transaction alerts which customers are unable to change their notification mode.

| Impacted Transactions | New notification mode (after 26 April 2025) |

| FX+ currency conversion (via UOB TMRW) | Push notification and email |

| Contact details update (via UOB PIB and UOB TMRW) | Push notification and SMS |

| Unsubscribe from GIRO and Standing Order alert, and certain payments alert via PIB/TMRW | Push notification and email |

| Change eStatement subscription | Push notification and SMS |

| 1 |

Push notification, SMS and email |

| Block/Unblock card (via UOB TMRW) | Push notification and email |

| Kill Switch (disable digital access and block cards) | SMS and email |

Link FX+ to any of these eligible SGD accounts:

- One Account

- Wealth Premium Account

- Privilege Account

- iAccount

PRUCancer 360

- Coverage up till age 1001

Provides cancer coverage from age 1 up till 100.1 - Hassle-free, easy application

Simply answer 3 health questions. No medical examination required. - Affordable, customisable protection

From as little as S$16 per month2, you can customise your cancer protection coverage based on your unique needs, with a sum assured ranging from S$10,000 to S$300,000.4 - 100% payout for all cancer stages3

Receive a 100% payout of your sum assured for all cancer stages.

Footnote

1Maximum renewal age is 95.

2Based on sum assured

of S$100,000, 25 year old female, non-smoker. The amount is rounded off to the nearest

dollar.

3Payout is subject to definition and conditions found in the product

summary that can be obtained from your UOB qualified Financial Adviser Representative. For

certain medical conditions, there is a waiting period of 90 days from the date of issue or

reinstatement whichever is later. Survival period is applicable before a claim can be

made.

4Increments of sum assured are in multiples of $10,000. Maximum sum

assured for age 1 – 16 is S$100,000.

Gold savings account

Transactions can be carried out at any UOB branch during banking

hours excluding Saturdays, Sundays and Singapore public holidays.

You can also

perform through UOB

Personal Internet Banking and UOB TMRW, from Mondays

to Fridays, 8am to 11pm, excluding Singapore public holidays.

To open an account,

please visit any UOB branch.

Applicable to new UOB customers who are Singaporeans/ PRs with MyInfo login and existing UOB customers applying as a single-named applicant with MyInfo login or bank details online. Applications submitted between 8.30am to 9pm will be opened instantly. Applications received outside of these timings will be processed the following work day. Applications are subject to UOB’s approval.

Instant card application is available for new-to-bank applicants who use MyInfo to retrieve personal details and income information (CPF and Notice of Tax Assessment information), pass all screening steps and income checks are eligible for Instant Account Opening. The application must be submitted after 7am and before 8pm.

- Existing-to-Bank applicants (with a UOB Principal Credit Card & Account) who apply via Internet Banking. Applicants will receive a SMS notification to inform them that the Credit Card/Cashplus application(s) has/have been approved within minutes from submission.

- *For Credit Card applicants, you can login to UOB TMRW (Android version only) to digitise your credit card for contactless purchases. The physical card will be ready 2 working days after approval and will be sent via normal mail.

Updated 1 April 2025.

IMPORTANT NOTICE AND DISCLAIMERS:

The information contained on this webpage shall not be regarded as an offer, recommendation,

solicitation or advice to buy or sell any investment product and shall not be transmitted,

disclosed, copied or relied upon by any person for whatever purpose. Any description of

investment products is qualified in its entirety by the terms and conditions of the investment

product and if applicable, the prospectus or constituting document of the investment product.

Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other

advice. If in doubt, you should consult your own professional advisers about issues discussed

herein.

The information contained on this webpage, including any data, projections and underlying

assumptions, are based on certain assumptions, management forecasts and analysis of known

information and reflects prevailing conditions as of the date of the article, all of which are

subject to change at any time without notice. Although every reasonable care has been taken to

ensure the accuracy and objectivity of the information contained in this publication, United

Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind,

express, implied or statutory, and shall not be responsible or liable for its completeness or

accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission

or any consequence or any loss/damage howsoever suffered by any person, arising from any

reliance by any person on the views expressed or information in this publication.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.