SGFindex

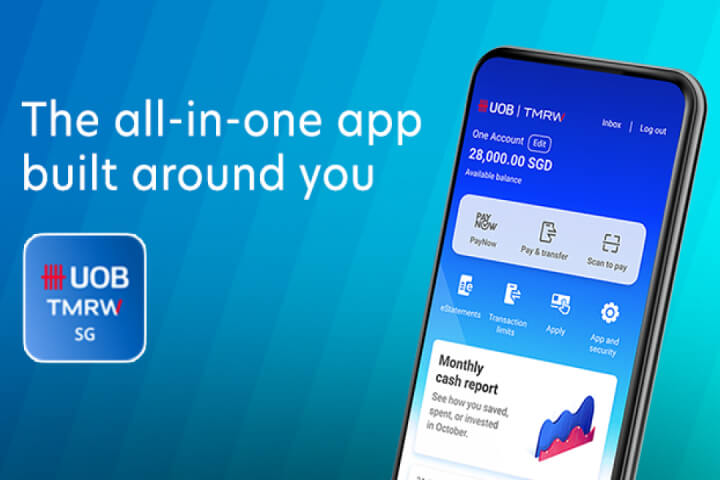

Get your financial snapshot, all-in-one view with UOB TMRW.

Manage your finances in one consolidated view across multiple bank accounts, insurance companies and government agencies on UOB TMRW.

DOWNLOAD UOB TMRW

How to get started

Download the UOB TMRW App

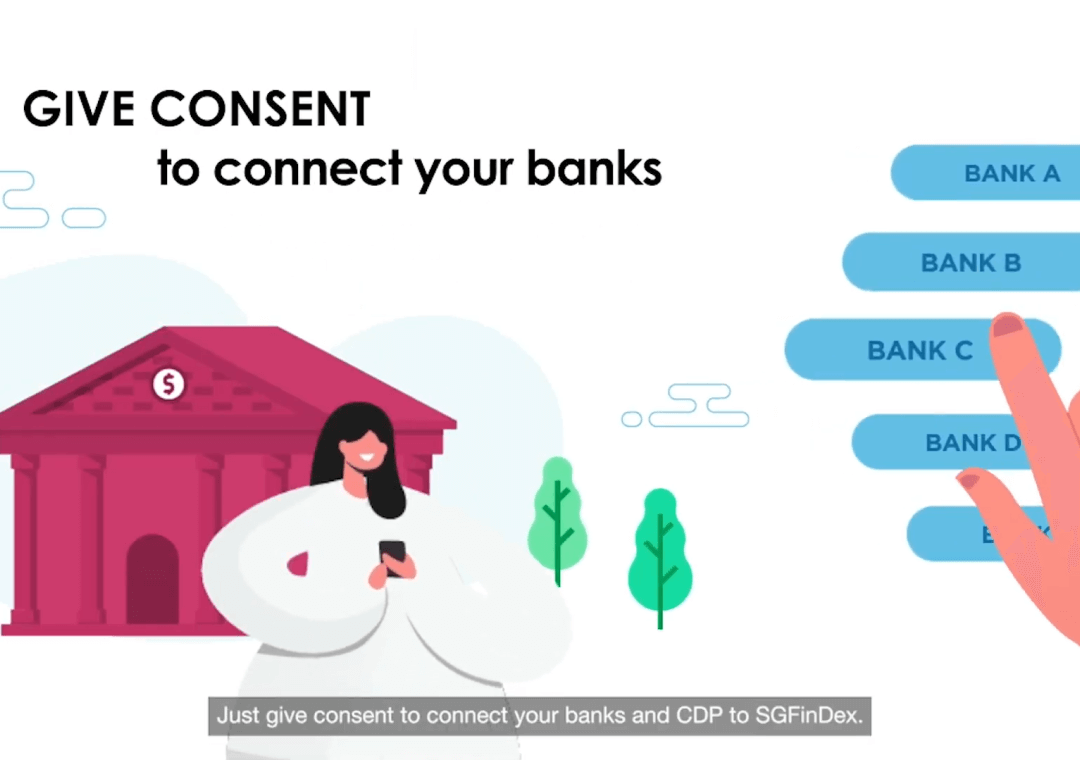

Authorise and link your selected organisation accounts to SGFinDex

Things you should know

Find out more about SGFindex

Please visit www.abs.org.sg/SGFinDex for more information.

Terms and conditions

Click here for terms and conditions governing digital services.

Frequently asked questions

Full list of FAQ

Please click here for the FAQs.