Scam Alert

Scam Alert

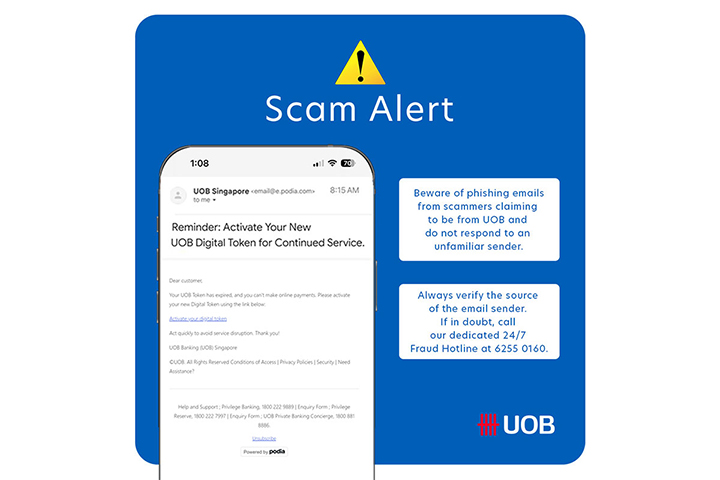

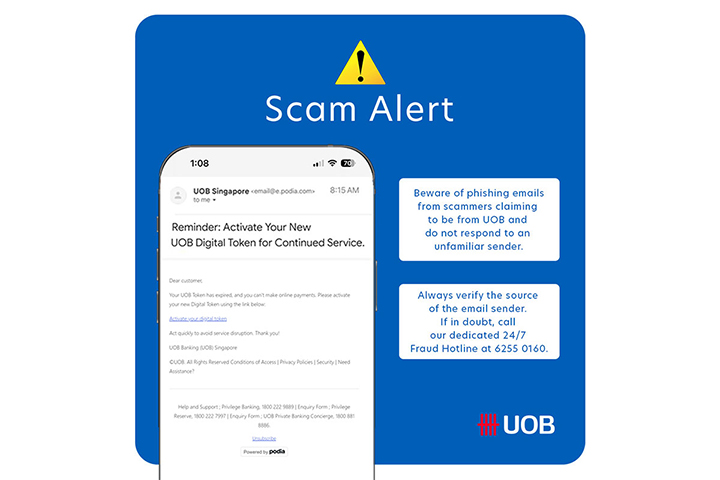

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. Do not respond to an unfamiliar sender. Click here for details. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest update and advice on scams.

Security

Your online banking security remains our top priority, and we are committed to protecting you from scams.

Latest alerts and announcements

Alert

Phishing scam

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. As scammers may be spoofing our UOB official email address to trick you into clicking on the phishing link, ensure that you verify the identity of the email sender by hovering over the sender's name. The sender's name may not match the email address.

Announcement

Enhanced real-time fraud surveillance to safeguard your transactions NEW!

As part of the Shared Responsibility Framework (SRF) issued by the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA) for phishing scams, UOB will enhance our real-time fraud surveillance system effective from 16 June 2025.

Some transactions may be temporarily held for up to 24 hours, which is a necessary measure to protect you.

If this transaction is not performed by you, please log in to UOB TMRW immediately to cancel this transaction by navigating to 'Accounts' tab > Transactions. Alternatively, you may contact our dedicated 24x7 Fraud Hotline 6255 0160 and press “1” to report a case.

For more information on SRF, please click here.

Note: Ensure that you have the latest version of UOB TMRW app to get updates.

Alert

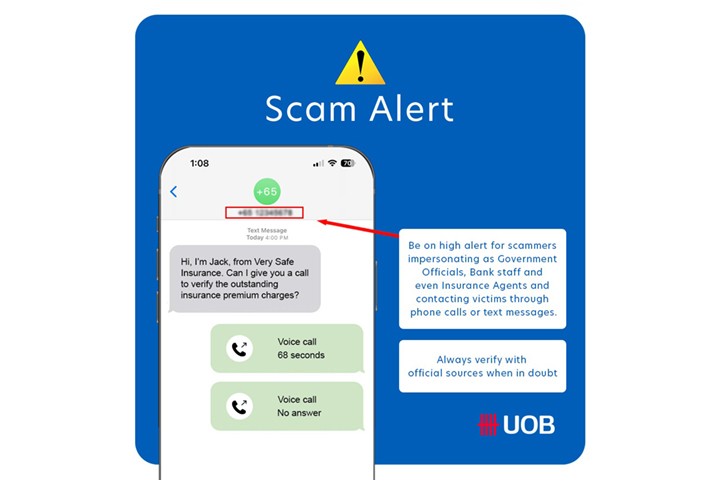

Beware of impersonation scams

Bank staff and Singapore Government officials will NEVER ask members of the public to do the following over the phone:

- Ask you to transfer money, withdraw cash or buy physical commodities such as gold and pass to another person;

- Ask you to disclose banking details, including sharing the details on your mobile phone screen;

- Ask you to install mobile apps from unofficial app stores;

- To expect a call from or transfer your call to a person with another organization, for example from a bank staff to Police or government officials.

Staying vigilant against these scams is crucial to protect yourself from financial loss and identity theft. Click on the button to find out how.

Alert

Impersonation Scam

Be on high alert for unsolicited calls from local mobile numbers, with scammers impersonating WeChat, UnionPay, or Alipay staff. Typically, the scammer informs victims that fees will be automatically deducted from their bank accounts linked to WeChat, UnionPay, or Alipay unless they cancel the subscriptions associated with these services. To cancel these subscriptions, victims must verify their identities by providing personal information, make transfers to bank accounts purportedly opened for the victim, withdraw cash or buy gold bars and pass to the caller or associates.

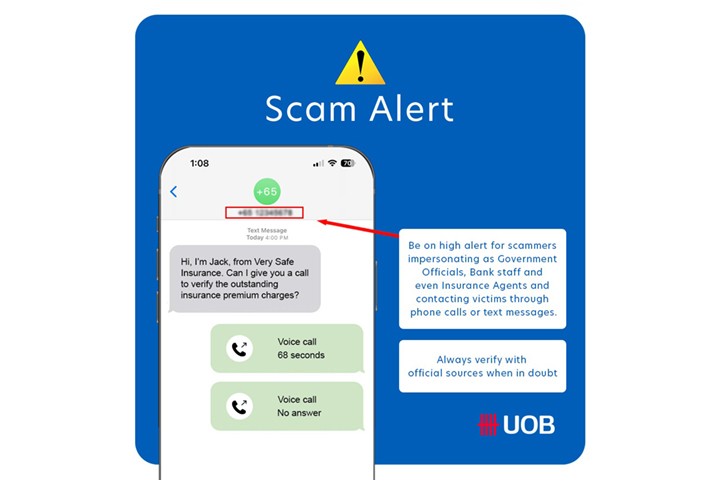

Alert

Impersonation Scam

Beware of scammers impersonating as government officials, bank staff, and insurance agents contacting victims via phone or video calls for payments. Scammers, who speak with local accent, may wear government uniforms and display official logos to deceive victims. They may also show bank accounts opened for victims, fake identity card or arrest warrants to intimidate victims to comply. Victims may be asked to pay outstanding charges, or transfer funds to a bank account which the authorities have supposedly set up for the victims. While the bank account will show the victim’s name, it does not belong to the victim but to a person controlled by the scammers.

Announcement

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Announcement

New ScamShield Suite to block scam calls and SMSesNEW!

The ScamShield app has been enhanced with features such as scam message and call checks, AI-powered call blocking and SMS filtering, and scam reporting across WhatsApp, Telegram, SMS, calls and other channels.

Enhance your scam protection with the ScamShield app today!

ScamShield is a joint effort by the Ministry of Home Affairs, the Singapore Police Force, Open Government Products, and the National Crime Prevention Council. Click the button to find out more.

Announcement

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Latest alerts and announcements

Alert

Phishing scam

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. As scammers may be spoofing our UOB official email address to trick you into clicking on the phishing link, ensure that you verify the identity of the email sender by hovering over the sender's name. The sender's name may not match the email address.

Announcement

Enhanced real-time fraud surveillance to safeguard your transactions NEW!

As part of the Shared Responsibility Framework (SRF) issued by the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA) for phishing scams, UOB will enhance our real-time fraud surveillance system effective from 16 June 2025.

Some transactions may be temporarily held for up to 24 hours, which is a necessary measure to protect you.

If this transaction is not performed by you, please log in to UOB TMRW immediately to cancel this transaction by navigating to 'Accounts' tab > Transactions. Alternatively, you may contact our dedicated 24x7 Fraud Hotline 6255 0160 and press “1” to report a case.

For more information on SRF, please click here.

Note: Ensure that you have the latest version of UOB TMRW app to get updates.

Alert

Beware of impersonation scams

Bank staff and Singapore Government officials will NEVER ask members of the public to do the following over the phone:

- Ask you to transfer money, withdraw cash or buy physical commodities such as gold and pass to another person;

- Ask you to disclose banking details, including sharing the details on your mobile phone screen;

- Ask you to install mobile apps from unofficial app stores;

- To expect a call from or transfer your call to a person with another organization, for example from a bank staff to Police or government officials.

Staying vigilant against these scams is crucial to protect yourself from financial loss and identity theft. Click on the button to find out how.

Alert

Impersonation Scam

Be on high alert for unsolicited calls from local mobile numbers, with scammers impersonating WeChat, UnionPay, or Alipay staff. Typically, the scammer informs victims that fees will be automatically deducted from their bank accounts linked to WeChat, UnionPay, or Alipay unless they cancel the subscriptions associated with these services. To cancel these subscriptions, victims must verify their identities by providing personal information, make transfers to bank accounts purportedly opened for the victim, withdraw cash or buy gold bars and pass to the caller or associates.

Alert

Impersonation Scam

Beware of scammers impersonating as government officials, bank staff, and insurance agents contacting victims via phone or video calls for payments. Scammers, who speak with local accent, may wear government uniforms and display official logos to deceive victims. They may also show bank accounts opened for victims, fake identity card or arrest warrants to intimidate victims to comply. Victims may be asked to pay outstanding charges, or transfer funds to a bank account which the authorities have supposedly set up for the victims. While the bank account will show the victim’s name, it does not belong to the victim but to a person controlled by the scammers.

Announcement

Enjoy secure banking with instant notifications NEW!

From April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions.

The threshold for transaction alerts will also be set to the bank’s default settings for these impacted transactions![]()

To ensure your transaction notifications are not disrupted, please enable push notifications in your phone settings and update your email address today.

Announcement

New ScamShield Suite to block scam calls and SMSesNEW!

The ScamShield app has been enhanced with features such as scam message and call checks, AI-powered call blocking and SMS filtering, and scam reporting across WhatsApp, Telegram, SMS, calls and other channels.

Enhance your scam protection with the ScamShield app today!

ScamShield is a joint effort by the Ministry of Home Affairs, the Singapore Police Force, Open Government Products, and the National Crime Prevention Council. Click the button to find out more.

Announcement

Access to UOB TMRW app will be restricted if USB/Wireless debugging is enabled on your Android device NEW!

To protect your exposure to scams, access to the UOB TMRW app will be restricted once we detect USB/Wireless debugging is enabled on your device, as it might be used by fraudsters to enable remote screen viewing and execute unauthorised transactions.

Funds from the UOB LockAway Account can only be withdrawn in person and not by any other means, including but not limited to online transactions, Personal Internet Banking, Mobile Services, cheque, ATM withdrawals and debit instructions given through the Call Centre Service. For the avoidance of doubt, debit instructions will only be accepted for the UOB LockAway Account if you provide the debit instruction in person at any of our branches in Singapore. Watch this space for more information and refer to our FAQs

Digital banking made safe

How UOB protects you

Enjoy full convenience and peace of mind when you bank online with our multi-layered security programme. Learn more about how we keep your transactions safe.

How you can protect yourself

Stay safe with extra measures that you can do simply from anywhere - at home, at work, from your phone.

Kill Switch

(Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Upon activating our self-service "kill switch" feature, you will receive two SMS notifications confirming the activation of the Kill Switch, which disables your digital access and blocks all your UOB Debit/Credit cards.

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.If you wish to re-enable all your UOB Debit/Credit cards, please unlock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Things you should know

Our security best practices and policies

Frequently asked questions

Click here to read more.

| Category | Impacted Transactions | Default notification mode | Default Threshold (S$) |

| Online transfers and payments | Digital transactions including all types of fund transfer, telegraphic transfer, QR payment (local and overseas), bill payments, online cash advance, eNETs payments | Push notification and email | 100 |

| Adding of payee, biller or beneficiary | No threshold | ||

| GIRO setup approval | SMS and Email | No threshold | |

| GIRO payments and standing orders (including Electronic Direct Debit Authorisation) | Unsubscribe | 1,000 | |

| No threshold | |||

| Upcoming GIRO payments and standing orders reminders (including Electronic Direct Debit Authorisation) | |||

| Card activity* | Card charges (includes payments and cash advances) | SMS and email | 500 |

| SmartPay, LuxePay, Instalment Payment Plan and UOB Personal Loan monthly instalments | 1,000 | ||

| NETS chip payments | 1,000 | ||

| NETS contactless and online payments | 1,000 | ||

| NETS transaction made on the CDA account | 0.1 | ||

| Low credit limit reminder | Unsubscribe | No threshold | |

| Upcoming card bill payment reminders | |||

| Confirmation of card bill payments received | |||

| Investments, fixed deposits and insurance | Instructions for securities, bonds, unit trusts and insurance products (includes Electronic Payment for Shares (EPS) and Share payments via ATMs) | Push notification and email | No threshold |

| Fixed or structured deposits placements | |||

| CPF or SRS accounts top-ups. | |||

| Buy/sell gold and silver | 1 | ||

| Securities and bonds allocation and redemption updates | Unsubscribe | No threshold | |

| eStatement | eStatement is ready for viewing | Push notification and email | No threshold |

| Security and money lock | Transfer and payment limit updates | Push notification and email | No threshold |

| Money lock limits update | |||

| When available balance is lower than money lock limit, and when transactions fail due to money lock | |||

| Mailing address update | |||

| ATM | Cash withdrawal in Singapore and Overseas | SMS and email | 500 |

| ATM transactions - funds transfer, bill payment | 1,000 | ||

| Top-ups to CashCards or NETS FlashPay cards/ Apply rights application/Apply SGS/Apply SSB/Apply T-bills | No threshold | ||

| Cheques, cashier's orders and demand drafts | Demand drafts and cashier’s orders | Push notification and email | 1,000 |

| Adding of beneficiary for cashier’s orders and demand drafts. | No threshold | ||

| When cheques are cashed in | SMS and email | 1,000 | |

| Others | Certain payments, refunds, and payment reversals made outside of UOB TMRW and Personal Internet Banking | Unsubscribe | 1,000 |

* For Card activity alerts, customers’ preferred alert mode of “SMS” or “Email” will be upgraded to “SMS and Email”, Customers’ preferred alert threshold, where applicable, will be retained.

Below is the list of transaction alerts which customers are unable to change their notification mode.

| Impacted Transactions | New notification mode (after 26 April 2025) |

| FX+ currency conversion (via UOB TMRW) | Push notification and email |

| Contact details update (via UOB PIB and UOB TMRW) | Push notification and SMS |

| Unsubscribe from GIRO and Standing Order alert, and certain payments alert via PIB/TMRW | Push notification and email |

| Change eStatement subscription | Push notification and SMS |

| 1 |

Push notification, SMS and email |

| Block/Unblock card (via UOB TMRW) | Push notification and email |

| Kill Switch (disable digital access and block cards) | SMS and email |

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.