Security

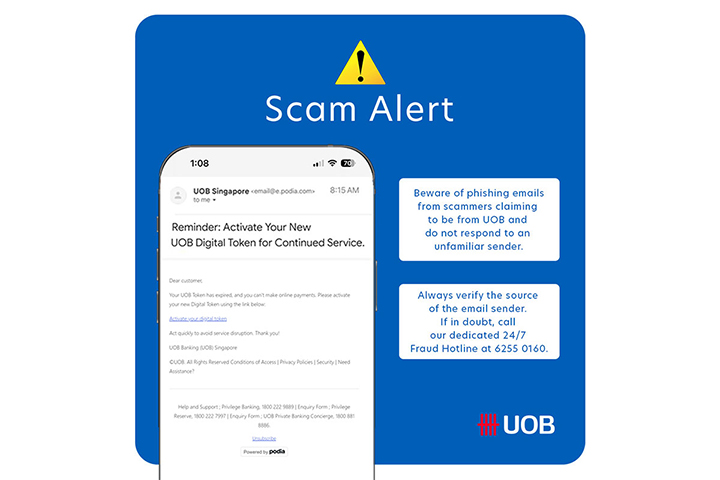

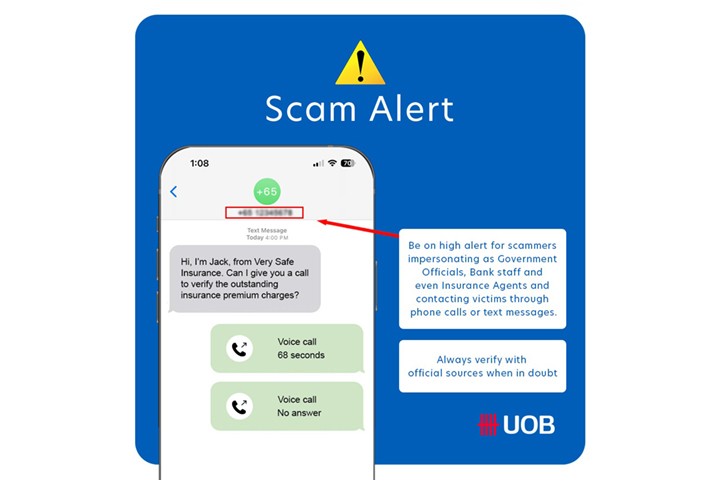

Your online banking security remains our top priority, and we are committed to protecting you from scams.

Digital banking made safe

How UOB protects you

Enjoy full convenience and peace of mind when you bank online with our multi-layered security programme. Learn more about how we keep your transactions safe.

How you can protect yourself

Stay safe with extra measures that you can do simply from anywhere - at home, at work, from your phone.

Kill Switch

(Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your UOB Debit/Credit cards instantly. Note that Kill Switch does not suspend these services. Learn more.

2 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

Upon activating our self-service "kill switch" feature, you will receive two SMS notifications confirming the activation of the Kill Switch, which disables your digital access and blocks all your UOB Debit/Credit cards.

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.If you wish to re-enable all your UOB Debit/Credit cards, please unlock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Things you should know

Our security best practices and policies

- UOB Group Internet Banking Privacy Practices

-

The United Overseas Bank Group (UOB Group) is committed to maintaining best Privacy Practices to create, as far as possible, a secure Internet banking environment for our customers. We encourage our customers to similarly observe best practices that are within their control.

Our best practices include:

- Collection Of Customer Information

We will not make unsolicited requests for customer information through email or the telephone, unless customers initiate contact with us. We will use any information collected as minimally as possible, mainly to assist us in customising and delivering services and products that are of interest to our customers. Under no circumstances will we ask customers to reveal their Personal Identification Numbers (PINs) or Passwords. - Handling Of Customer Information

We have established strict confidentiality standards for safeguarding information on our customers. - Disclosure Of Customer Information

Unless we have the customer's agreement or are required by law, we will not disclose customer information to external parties. - Compliance By External Parties

External parties who, in the course of providing support services to us, may come into contact with customer information, are required to observe our privacy standards.

- Collection Of Customer Information

-

- UOB Group Internet Security Technology

-

We understand customer concerns for security when they transact over the Internet. We have therefore built a security system for online banking that safeguards the confidentiality of our customers' account information and their banking transactions.

We employ several different methods to protect customers' account and personal information:

- Firewalls

We have multiple levels of firewalls in place between our internal computer systems and the Internet. - Encryption

Strong encryption protects customer information as it travels over the Internet. We use the 128-bit Secure Sockets Layer (SSL) encryption to protect the confidentiality of customers' account details and transaction data. This 128-bit SSL encryption is the commercially available security protocol for encrypting or scrambling data transmitted over the Internet. It is also currently recognised internationally to be of the highest standard in encryption technology commercially available and is generally adopted by banks in Singapore and financial institutions worldwide. - Username and Password

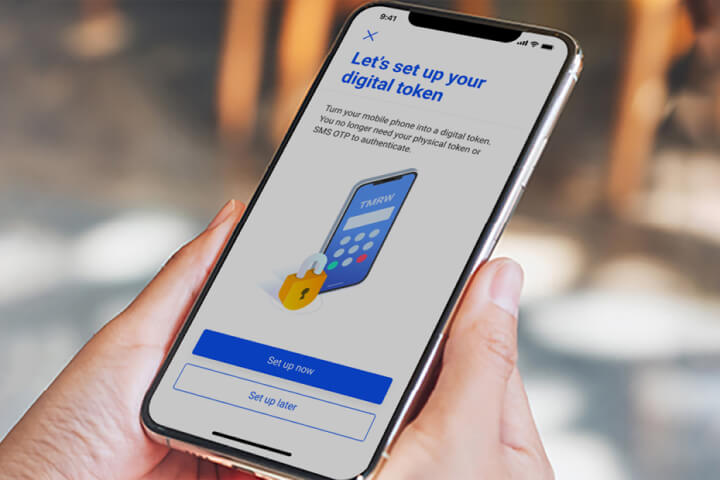

Only your valid Username and Password which identify you uniquely, will allow you to log in to our secure website(s). This ensures that messages from authorised users only are admitted into our secure site(s). - Technology Devices

UOB may, from time to time, issue Devices and/or establish security procedures that you may need to execute in order to use certain UOB Internet Banking services related to the Devices.

You may use the Devices (whether or not in conjunction with the Username and/or Password or otherwise):- To initiate, effect, perform and/or dispatch any instruction or any communication to UOB;

- To obtain or utilise any service that may be offered or made available by UOB through the Website or UOB Internet Banking service;

- To access and obtain information as may be permitted by UOB (whether relating to your Account(s), service or otherwise); and

- To effect any transaction with UOB which may be made available by UOB, subject to the terms of this Agreement and to other restrictions, limitations, terms and conditions of UOB then applicable

- Automatic Log Out

As an additional security measure, our system may log you out of your Internet banking session after a period of inactivity

We are committed to monitoring our Internet security system constantly for potential situations that could compromise the security or the privacy of our customers and to exploring new technology continually to enhance our Internet security system.

- Firewalls

-

- List of Official UOB Group Website Addresses

- Customer Choices in the Event of Unavailability of the UOB Group Internet Banking/Transaction Website(s)

- E-Payments: User Protection Guidelines and FAQs

Frequently asked questions

Click here to read more.