Debit card

Application

You may submit your application through the following ways:

Debit Card

UOB One Debit CardUOB Lady’s Debit Card

UOB FX+ Debit Card

Card activation

You can activate your card via UOB TMRW app

Step 1: Log in to UOB TMRW and tap on “Received your new cards?”.

Step 2: Next, select the cards that you wish to activate.

Step 3: Tap on "Yes" to proceed with the activation. If you are activating a replacement card, your current card will be deactivated.

Step 4: Enter the SMS OTP.

Step 5: Tap on "OK" to proceed. You can start using your new card.

For more information, please refer to the step-by-step guide here.

Alternatively, you could activate via SMS ACTVC‹space›last 4 digits of Debit card number to 71423. E.g. ACTVC 1234 to activate your card

Card Replacement

You may follow the steps below to block your card and request for card replacement:

Step 1: Login to UOB TMRW and tap on “Accounts”

Step 2: Select your debit or credit card that you intend to report and replace

Step 3: Go to “Services’ and select ‘Block card or report lost card”

Step 4: Select “Permanently block and replace card" and tap "Next" to proceed.

Step 5: Review details and swipe right to confirm.

Step 6: Your request is completed. You will receive your replacement card soon.

Please note that all settings for this card will be disabled while we send you a new replacement card. You will not need to update your alert setting again. However if you wish to update your alerts setting for your transactions, please log in to UOB Personal Internet Banking > Account Services > Manage Notifications.

For more information, please refer to the step-by-step guide here.

Your card replacement is expected to be delivered within 2 to 5 working days for local address, and 2 to 25 working days for foreign address.

Your card is expiring soon. For your convenience, we have renewed your card replacement with new expiry dates.

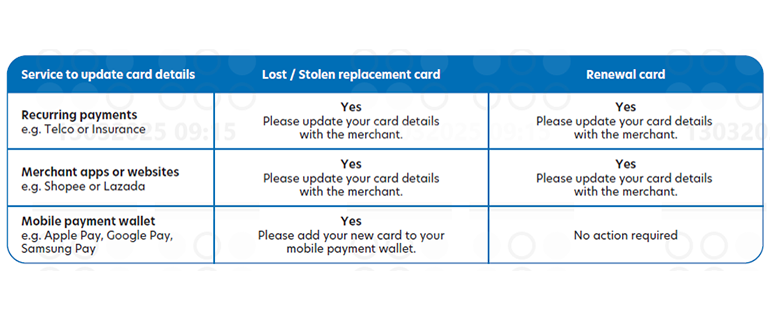

As your card details have changed, do update your card details for relevant services below to ensure smooth usage of your card.

Spending limit

You can adjust your Debit Card spending limit with any one of the following methods:

- UOB TMRW*

Step-by-step guide:

a. Tap on 'Accounts'

b. Select your Debit Card

c. Tap on 'Services'

d. Select 'Set Debit Card Limit' - UOB Debit Card Daily / Monthly Limit Form

- Complete and send us the UOB Debit Card Daily/Monthly Limit Form.

- Click here to download the form or you can request a copy by calling us at 1800 222 2121 or visit our branches.

*The minimum daily spending limit via UOB TMRW is S$1,000. To adjust your daily spending limit to less than S$1,000 or a minimum of S$1, please complete and mail the UOB Debit Card Daily / Monthly Limit Form to us.

eStatement

You may subscribe to eStatement via UOB TMRW app or UOB Personal Internet Banking.

Via UOB TMRW

Step 1

Log in to UOB TMRW and tap "eStatements". Alternatively, you could tap on "Services" and select "eStatements" under Transactions.

Step 2

Tap "Manage" found on the top right corner of the screen.

Step 3

Tap "Switch Now".

Step 4

Select the accounts, investments or cards that you wish to switch to electronic statement.

Step 5

Tap "Save".

Step 6

You have successfully enrolled for your eStatement.

For more information, please click here. Alternatively, you could also subscribe to eStatement on UOB Personal Internet Banking.

Once you have successfully signed up for the service; your eStatement will be available for viewing on your digital account from the next statement cycle onwards. This feature has 5 years of archival of your electronic statement; it will be from the date of subscription. Hence, the option for back dated statement prior to the time you sign up to the service is not available. Please be advised that eStatement option is only available for statement-based Current and Savings accounts (excluding Passbook Savings Account), Credit/Debit Cards and CashPlus accounts.

For more information, please visit the UOB estatement website.

The service is free of charge

Depending on your alerts setting, you will receive notification via Push Notification to your UOB TMRW app and email alerts when your eStatement/eAdvice is ready for viewing.

Note that from April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions. Click here for details.

To update your alerts setting for your transactions, please log in to UOB TMRW app > Services > Notification settings or UOB Personal Internet Banking > Account Services > Manage Notifications.

Upon successful enrollment to eStatements/eAdvices, you will no longer receive physical copies of your statements from the following month.

There is no option for receiving both eStatements and physical copies of your statements.

You may choose to switch back to paper statement with these 3 steps:

Step 1: Login to UOB Personal Internet Banking (PIB).

Step 2: Click on Manage eStatement /eAdvice Subscriptions on the left menu bar.

Step 3: Uncheck the box for eStatement(s) or eAdvice(s) to unsubscribe.

You will enjoy easy access to 5 years of our eStatements/eAdvices commencing from the time you are enrolled for the service. However, you will not be able to see past bank statement(s) or eAdvice(s) prior to the enrolment.

Overseas usage

The exchange rates used to convert foreign currency transactions into Singapore dollars may vary from day-to-day and is also dependent on when the transactions are submitted for processing by the merchants.

In addition, foreign currency transactions are subject to a foreign currency administrative fee levied on the Singapore dollars amount converted. Please refer to the UOB Debit Cardmember Agreement for details of our fees and charges.

Particulars update

Change your contact details on UOB TMRW app instantly so you don't miss any important notifications and alerts. Simply follow these steps:

Step 1: Log in to UOB TMRW and tap on "Services" located at the bottom of the screen.

Step 2: Under Profile, select "Contact Details".

Learn more

Transaction Alert

Depending on your alerts setting, you will receive notification via Push Notification to your UOB TMRW app and email alerts when your eStatement/eAdvice is ready for viewing.

Note that from April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions. Click here for details.

To update your alerts setting for your transactions, please log in to UOB TMRW app > Services > Notification settings or UOB Personal Internet Banking > Account Services > Manage Notifications.

This transaction alert service is a security measure put in place to protect your UOB Card from being used by unauthorized parties. To ensure all our customers’ accounts and cards are protected, UOB has discontinued the option to unsubscribe from this transaction alert service.

Depending on your alerts setting, you will receive notification via Push Notification to your UOB TMRW app and email alerts for your relevant transaction.

Note that from April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions. Click here for details.

To update your alerts setting for your transactions, please log in to UOB TMRW app > Services > Notification settings or UOB Personal Internet Banking > Account Services > Manage Notifications.

Alternatively, you can download and submit the Threshold Limit for Credit/Debit Card Transaction Alert Service form available here or visit your nearest UOB branch. For mail-in requests, please allow up to 5 working days for your records to be updated.

The default threshold amount set by the Bank is S$500 for each card.

The default threshold amount set by UOB is S$500 and above.

To update your threshold amount, please log in to UOB TMRW app > Services > Notification settings or UOB Personal Internet Banking > Account Services > Manage Notifications. Alternatively, you can download and complete the Threshold limit for Credit/Debit Card Transaction Alert Service form available here or visit your nearest UOB branch. For mail-in requests, please allow up to 5 working days for your records to be updated.

The threshold amount for all your Principal UOB Credit/Debit cards will be the same.

a. Instalment Payment Plan (IPP)

You will receive a One-time SMS or Email alert when you make an IPP transaction, if the transaction amount is at or above the default threshold limit. There will be no SMS or

Email alert for each monthly instalment posted to your card, regardless of the amount.

b. Overseas transactions*

Yes, you will receive a Push Notification or Email alert when your credit/debit card overseas transaction amount is at or over the default threshold amount.

c. Monthly recurring billing of instalment for SmartPay/LuxePay/IPP/PL

You would need to subscribe to this separate alert via UOB Personal Internet Banking. This alert is different from the transaction threshold alert.

Note that from April 2025, the existing SMS alerts will be progressively changed to push notifications via UOB TMRW and email alerts for impacted digital, banking and card transactions. Click here for details.

To update your alerts setting for your transactions, please log in to UOB TMRW app > Services > Notification settings or UOB Personal Internet Banking > Account Services > Manage Notifications.

Alternatively, you can download and submit the Threshold Limit for Credit/Debit Card Transaction Alert Service form. For mail-in requests, please allow up to 5 working days for your records to be updated.

Please call our 24/7 Fraud Hotline at 6255 0160.

Transaction

Cardholders are to check their statements and report any unauthorized transactions within 14 days of the statement date, otherwise the transactions will be deemed valid.

If you notice any unauthorized transactions in your credit or debit card statements, or if you receive an SMS notification alert for a transaction which you did not perform, please contact UOB Contact Centre immediately at 1800 222 2121 (or +65 6222 2121 if you are calling from overseas) for further assistance.

(Note: If you encounter any unauthorised transactions, do contact the Bank immediately to freeze your card for security reasons. Alternatively, you may block the card yourself immediately via the UOB TMRW mobile app. Select the card to block > Settings > Block card or Report fraud. Refer here for more details.)

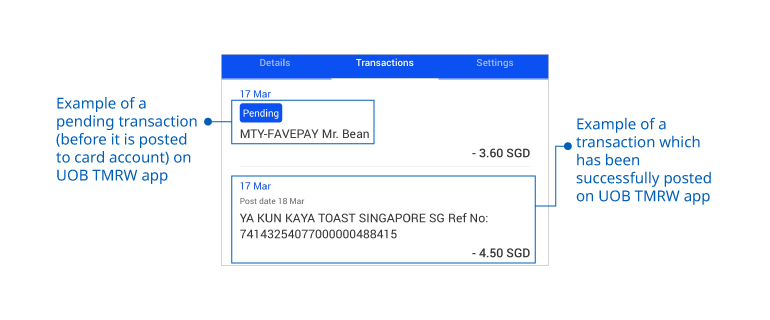

As we may only file chargeback requests for transactions that have been posted, transactions which are still in “pending” status will need to be posted before we proceed with the chargeback request.

Please note that there are no chargeback rights for fully authenticated transactions e.g. transactions authorised with One Time Password (OTP) input.

The Bank will assist you to report unauthorised transactions to the relevant card schemes e.g. Visa or Mastercard in accordance with their respective rules. Please note that you may be required to submit further information or supporting documents

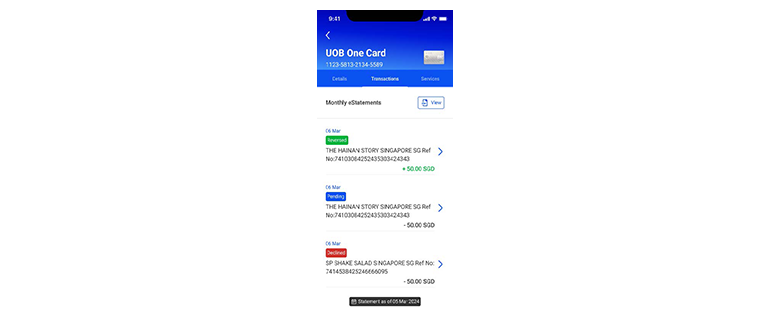

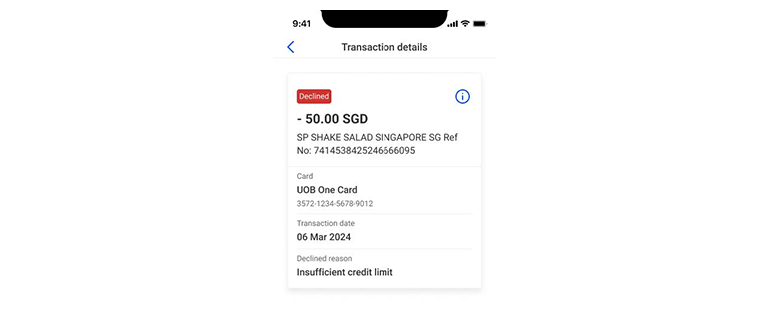

You can refer to the UOB TMRW app > select the UOB Card > Select “Transactions” to view your list of transactions which are declined and reversed.

- Reversed transactions will be displayed until the merchant completed the settlement

- Declined transactions are unsuccessful transactions and will be displayed till next statement cycle.

Here are some of the common reasons for declined/failed transactions:

- Insufficient balance (debit card limit or bank account balances)

Please log in to UOB TMRW to check your balances of the linked bank account. You may top up the balances of your link bank account for the transaction to go through.

If your linked bank account have sufficient limit, you can request for change in Debit Card spending limit via UOB TMRW app. Click here for Spending Limit FAQ for step-by-step guide on how to adjust this limit. - Card not activated

Simply activate your UOB Card via UOB TMRW app and try again. Click here to find out more - Card expired

If your in-store transaction is declined:

Please check if you are using the recently received renewal card to transact and be reminded to activate your renewal card before trying again.

If your online transaction is declined:

Please check that the card expiry date and card security code (or typically known as CVV) is updated to the details on your recently received renewal card for online purchases to go through. - Wrong information

Please check the card security code (or typically known as CVV) or expiry date of the card for your purchase to go through.

- Online/recurring transaction is declined (token expired)

Please update the Merchant with the latest card details (such as expiry date).

You may tap on the reversed transactions to find out more details or click here for step-by-step guide on how to manage your card services on UOB TMRW app.

Example of a declined transaction:

You will receive push notifications and emails on selected declined transactions.

Please note that some of the listed transactions may be pending charges, which are temporary and are subject to change (for instance, pre-authorisations at restaurants and hotels).

To view or download your card transaction statement, please follow these simple steps:

- Log in to UOB TMRW

- Select your respective card and tap "Services". Under "Others", tap on "View eStatement" and select the month of the statement you would like to view or download. Your eStatement will appear on your screen.

- You may tap on the "Download" button on the top left hand corner of the screen to save a copy of your eStatement.

If you suspect that there has been fraudulent activity on your account, click here for immediate steps to take to prevent further losses or call our dedicated 24/7 Fraud Hotline at 6255 0160 if unsure.

Your transactions are still pending as these are not posted onto your card account yet. The transaction will be successfully posted onto the account after the merchant completes their settlement with the settlement bank.

You may tap on the pending and posted transactions to find out more details:

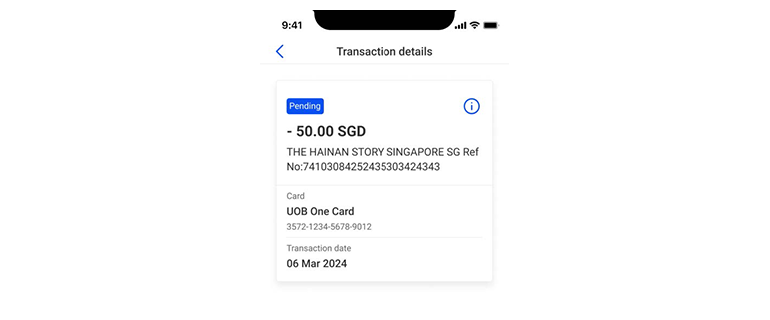

Example of a pending transaction:

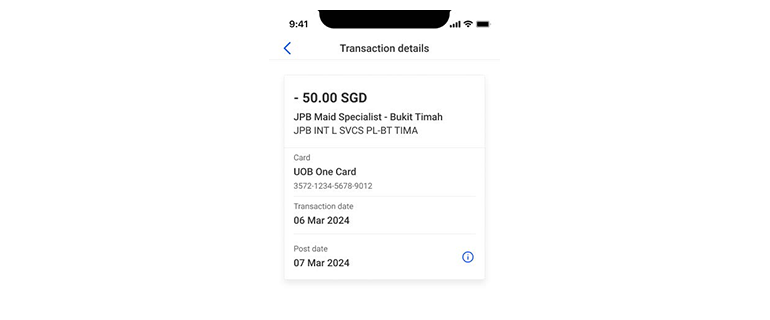

Example of a posted transaction:

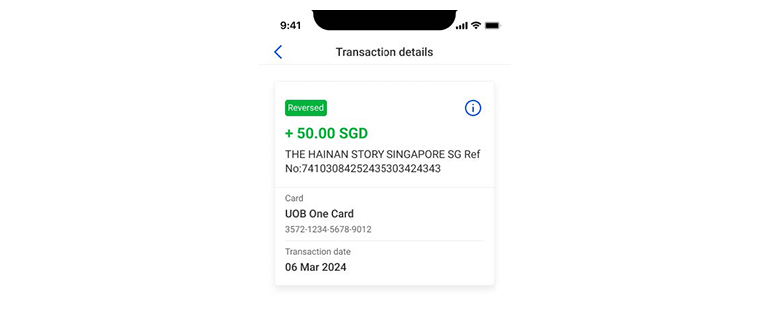

Reversed transactions occur when the merchant performed a reversal of the transaction before the transactions are posted onto your card account. You may tap on the reversed transactions to find out more details or contact the merchant directly to find out more.

Example of a reversed transaction:

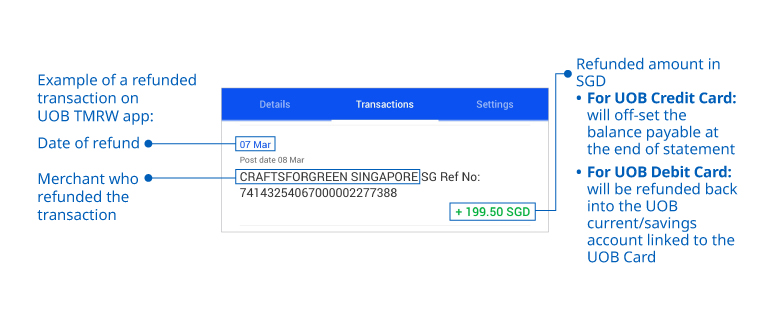

Refunded transaction happens when the merchant did a reversal of the transaction after the transactions has been posted onto your card account. You may contact the merchant directly to find out more.

Duplicated transaction happens when the same transaction was processed more than once by the merchant. Please contact the merchant for a reversal/refund.

Card Renewal

You can refer to the date next to “GOOD THRU ”, “VALID THRU” or “EXP. DATE” on your card.

You may use your card until the last day of expiry month. For example, if the expiry date indicated is 10/28, the card is usable till 31 October 2028. The card will not be usable on 1 November 2028.

After your card has expired, you will need to activate and use your renewal card to perform your payment transactions.

No, your renewal card will be sent to you automatically.

You can expect to receive your renewal card one month before the card expiry date indicated on your current card. For example, if the expiry date indicated is 10/28, you can expect to receive your card by end of September 2028.

No, the renewal card is free of charge.

Yes, the renewal card will be sent to your overseas address that is registered with the bank.

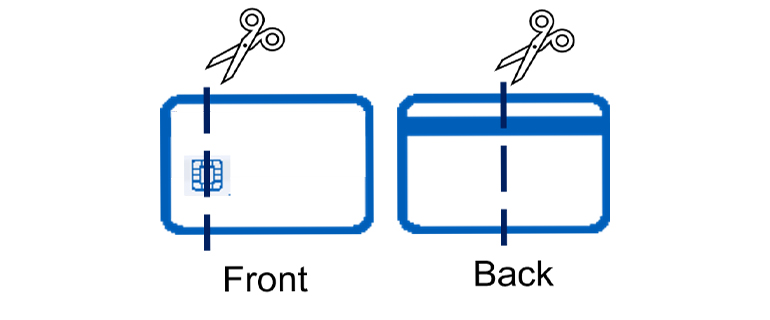

For security reasons, you should cut the card in half and cut through the card chip. After cutting the card, you can dispose it.

Your UOB card has an expiry for a few reasons. Firstly, it is to cater for normal wear and tear of the physical card. Secondly, it is to prevent fraud as the expiry date is an additional data point to check that the card information is valid and that you are the legitimate user.

To ensure your recurring bill payment is not affected, it is recommended to update your card information with your payee entity once your debit card has expired.

Yes, you can call our contact centre or visit any of our branches to request for an early renewal card.

Yes, you may use your existing card till your renewal card is activated.

Yes, you may use your existing card which has yet to expire.

As your card expiry has changed, do update your card details for recurring payments (e.g. Telco or Insurance) and merchant apps or websites (e.g. Shopee or Lazada) to ensure smooth usage of your card.