1Enjoy up to 4% cashback on Grab transactions (excluding Grab wallet top-ups), Shopee Singapore transactions (excluding ShopeePay wallet top-ups), SimplyGo transactions (bus and train rides only, excluding SimplyGo top-up transactions), McDonald’s transactions and 1% cashback on Singtel and GOMO recurring transactions, Singapore Power utility bills (excluding payments via AXS) and Mobile Pay transactions such as Apple Pay, Google Pay and Samsung Pay. A minimum monthly spend of S$300 is required. Cashback is capped at S$30 per calendar month across all eligible transactions. Subject to qualifying criteria. Please click here for the full terms and conditions.

Get Up to S$308 cash credit:

1) Either S$128 or S$68 or S$28 cash credit

AND

2) up to S$180 cash credit

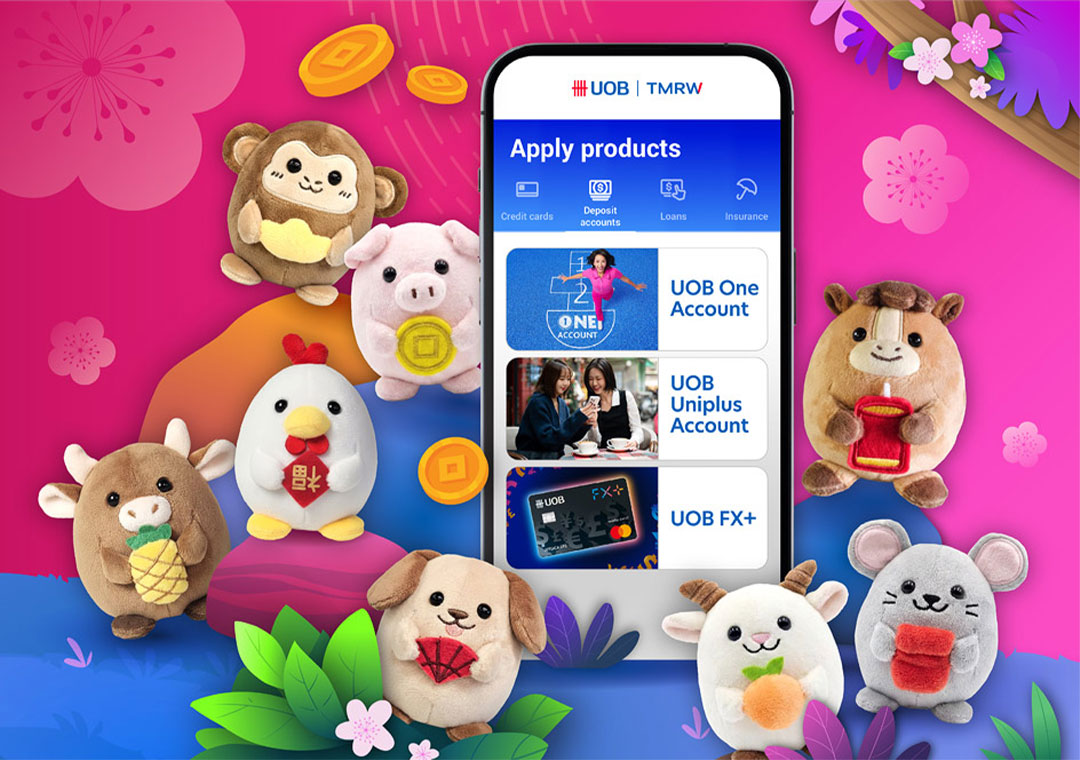

1) UOB Online Account Opening Weekly Promotion (1 January to 31 March 2026)

Valid from 1 January to 31 March 2026 (“Promotion Period”). Limited to the first 88 customers of each Promotion Week, namely the period between 1 and 11 January 2026 and every calendar week between 12 January 2026 and 22 March 2026 and the period between 23 and 31 March 2026, (i) who submit an online account opening application during a Promotion Week for a new Eligible UOB Account, and (ii) whose application is successfully approved during the Promotion Period, and (iii) deposit min. S$5,000 of Fresh Funds into their new Eligible UOB Account within the same calendar month as their new Account opening calendar month, and (iv) maintain a balance of at least S$5,000 in their new Eligible UOB Account till the end of the following calendar month. Additionally, for existing UOB deposit customers, the Fresh Funds deposited into their new Eligible UOB Account must result in a corresponding increase of at least S$5,000 when compared against the total month-end balance of all their other UOB current accounts and savings accounts as at 31 December 2025 and such increase must also be maintained till the end of the next calendar month following their new Account opening calendar month. Eligible new-to-UOB customers will be eligible to receive S$128 cash credit, eligible new-to-UOB deposit customers will be eligible to receive S$68 cash credit, and eligible existing-to-UOB deposit customers will be eligible to receive S$28 cash credit. “Fresh Funds” means funds (a) in the form of non-UOB cheques or non-UOB cashier’s orders; (b) that are not transferred from any existing UOB current/savings or fixed deposit account; and (c) that are not withdrawn from any existing UOB current/savings or fixed deposit account and re-deposited (whether part or all of the amounts withdrawn) into the new Eligible UOB Account at any time during the Promotion Period. T&Cs apply.

Eligible UOB Account means for the period from 1 January 2026 to 31 March 2026 (both dates inclusive), a UOB Stash Account, UOB Uniplus Account, KrisFlyer UOB Account, UOB Lady’s Savings Account or UOB One Account.

Click here for full terms and conditions.

And

2) UOB SalaryPlus Promotion (1 January 2026 to 31 March 2026)

(i) Participate in the UOB SalaryPlus Promotion (1 Jan 2026 to 31 Mar 2026) by successfully submitting an online participation form (available at the official UOB website) between 1 Jan 2026 to 31 Mar 2026, both dates inclusive, to receive the following cash rewards:

(ii) S$100 cash credit for customers who successfully credit their monthly salary of min. S$1,600 (for all customers other than full time National Serviceman) or at least S$500 (for customers who are full time National Serviceman) into their designated Eligible UOB savings account for this Promotion via GIRO or PayNow^ within the next two calendar months from the date of submission of the online participation form; and

(iii) S$50 cash credit for customers who successfully credit their CDP dividends of min. S$50 per transaction into their designated Eligible UOB savings account for this Promotion via Direct Credit Service~ within the next two calendar months from the date of submission of the online participation form; and

(iv) S$30 cash credit for customers who successfully perform a bill payment of min. S$30 per transaction from their designated Eligible UOB savings account in this Promotion via GIRO#, or who successfully perform a loan repayment transaction for their UOB car loan# or UOB home loan# from their designated Eligible UOB savings account for this Promotion, in each case, within the next two calendar months from the date of submission of the online participation form.

Eligible UOB savings account: UOB Passbook Savings Account, UOB Uniplus Account, UOB Stash Account, UOB One Account, UOB Lady’s Savings Account or KrisFlyer UOB Account.

Customers must not have received any prior reward (whether in the form of cash credit or otherwise) in similar UOB promotions, or have the respective transaction history in any UOB current or savings account during the period between 1 Jun 2025 to 31 Dec 2025.

Full terms and conditions apply and can be accessed here.

^Salary must be credited with the transaction description as "GIRO-SALA" or "PAYNOW SALA" to be eligible.

~CDP dividends must be credited from the Central Depository with the transaction description “CDP Dividend” to be eligible.

#Bill payment via GIRO must be reflected with the transaction description “GIRO-Inward Debit” to be eligible. Repayment of your UOB car and home loan instalment must be reflected with the transaction description “Misc Debit” and bank reference of "Trf. Wd. Loans” to be eligible.

3Total interest is equivalent to Base Interest plus Bonus Interest; where current Base Interest is 0.05% p.a., Bonus Interest is paid up to S$150,000 in your One Account. Base Interest is calculated at the end of each day based on each day-end balance and Bonus Interest is calculated at the end of each calendar month based on the monthly average balance. Monthly average balance is the summation of each day end balance for each month divided by the number of calendar days for that month.

Maximum effective interest rate (EIR) on the One Account is 0.65% p.a. for deposits of S$75,000, provided customers meet criterion of S$500 eligible card spend in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 1.40% p.a. for deposits of S$125,000, provided customers meet both criteria of S$500 eligible card spend AND 3 GIRO debit transactions in each calendar month.

Maximum effective interest rate (EIR) on the One Account is 1.90% p.a. for deposits of S$150,000, provided customers meet both criteria of S$500 eligible card spend AND a min. S$1,600 salary credit via GIRO/PAYNOW (with the transaction reference “SALA” / “PAYNOW SALA”) in each calendar month.

4There is no transaction fee charged for withdrawing cash at UOB ATMs in Malaysia, Indonesia and Thailand. A S$5 service charge per cash withdrawal will be charged for cash withdrawals on non-UOB ATMs. The amount of cash drawn is subject to foreign exchange rates. For the foreign exchange rate used for your cash withdrawal transaction, please refer to your statement of accounts for the Foreign and home currency withdrawal details. For more information, please click here.

6Valid for new-to-UOB Debit Cardmembers whose UOB One Debit Mastercard application is approved from 1 January 2026 to 31 March 2026. Eligible customers will enjoy 2X cashback — up to 8% for 3 months, starting from the month after card approval. For example, if your card is approved in January, the 2X cashback period will be from February to April. A minimum spend of S$600/month is required. The 2X cashback applies to eligible transactions under the UOB One Debit Card Cashback Programme. Total cashback cap during promotion months: S$60/month (comprising of S$30 from the standard UOB One Debit Card Cashback Programme and additional S$30 from this promotion). Cashback will be credited monthly according to the Programme schedule. Terms and conditions apply. Click here for the full terms and conditions.

![]() when you travel with your UOB One Debit Card:

when you travel with your UOB One Debit Card: