Car loans

How do I apply for a Car Loan?

You are required to apply through the Car dealership where you are purchasing the vehicle. You have an option to use the digital loan application using MyInfo for submission of the application at our participating dealerships island-wide and via leading mobile and online classified marketplace, Carousell.

You can also download the application form in the UOB Website and mail the form together with the vehicle sales agreement (VSA), a copy of the NRIC/Passport & Employment Pass and latest income document to:

United Overseas Bank Limited

80 Raffles Place #13-00 UOB Plaza 1 Singapore 048624

Attn: Car Financing Department

How long is my approval? And will I be notified?

The digital loan application and approval process can be completed within 15 minutes at your Car dealership. We will keep you and your car sales consultant informed at every step of the process via SMS and/or email.

How do I make payment for my car loan?

1. By Funds Transfer from your UOB account via UOB Personal Internet Banking or UOB TMRW mobile app.

> Login to UOB Personal Internet Banking or UOB TMRW app

> Go to: 'Pay and Transfer' > Billers > New Payment > Billing Organisation: UOB Car/Property Loans Payment

> Fill in: Bill Reference No: 10 digit Car Hire Purchase Agreement No. / Amount (SGD): Loan payment amount

> Review & confirm details are correct, then click on 'Confirm' to proceed with the payment.

2. By GIRO arrangement.

GIRO application form can also be found in UOB website or UOB branch.

3. By Cash / Cashier's Order / Cheque.

Cashier's Order or cheque should be made payable to UOB Ltd for A/C XXXX, where XXXX refers to the vehicle loan account number.The vehicle loan account number and car plate number should also be written on the reverse of the cheque. You can also deposit cheque at any UOB Branches or drop into Fast Cheque Deposit box.

4. By Telegraphic Transfer - Please see details required below:

Beneficiary Bank Name : United Overseas Bank Ltd, Singapore

Beneficiary Bank Swift BIC Code : UOVBSGSG

Beneficiary Name : ‹Borrower Name›

Beneficiary Account No. : ‹Borrower Account Number›

Payment Details : Ref: Payment of car loan for attention of RLOC Car Loan Redemption

Please note:

For full settlement of car loan, you can make payment via above mode of payment except GIRO arrangement.Confirmation Form on Redemption of Vehicle Loan sent to customer is required for payment made at UOB Branch*.*Please refer to UOB website for the list of full banking services branch.

5. By PayNow via UEN

| Instructions | |

|

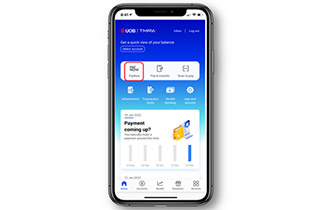

Step 1: Download UOB TMRW from App Store or Google Play, launch the app and log in. On the home page, tap on PayNow |

|

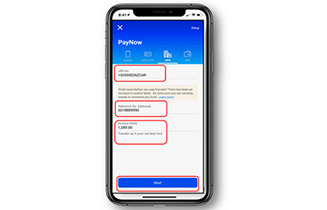

Step 2: Fill in: 1. UEN No: 193500026ZCAR 2. Reference No: 10-digit Car Hire Purchase Agreement No. / Car Loan Account No. 3. Amount (SGD): Loan amount 4. Click 'Next' |

|

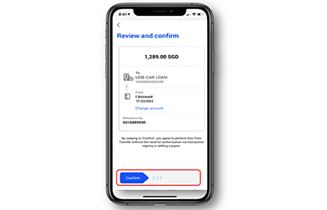

Step 3: Review & confirm details are correct, then slide Confirm to make the payment. |

6. By Scan and Pay

| Instructions | |

|

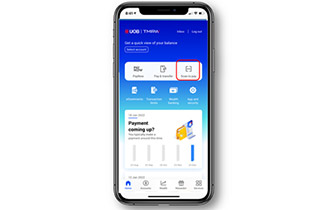

Step 1: Download UOB TMRW from App Store or Google Play, launch the app and log in. Tap on Scan to Pay. |

|

Step 2: Scan the UOB Car Loan QR Code.Note: If you have the image of the QR code in your phone photo library, you could also tap on "Use QR Code from Photos" and select the image. |

|

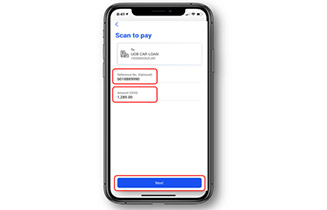

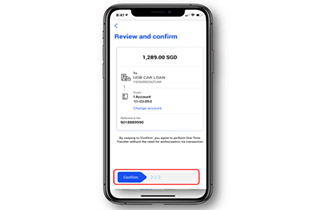

Step 3: Fill in: 1. Reference No: 10-digit Car Hire Purchase Agreement No. / Car Loan Account No. 2. Amount (SGD): Loan amount 3. Click 'Next' |

|

Step 4: Review & confirm details are correct, then slide Confirm to make the payment. |

Notes:

1. Any loan payment made before 10.30pm on a weekday or on a Saturday, Sunday or Public Holiday will be credited into your loan account on the next working day.

2. Any loan payment made after 10.30pm on a weekday or on a Saturday, Sunday or Public Holiday will be credited into your loan account on the next second working day.

3. If your loan account is in default, any payment received is on a "Without Prejudice" basis.

4. Any loan payment made without a valid Loan Account Number or Agreement Number in the Reference Number field will be rejected. Applicable charges/interests may be imposed on the loan account.

5. The bank may at its absolute discretion reject any loan payment made from a bank account that is not in the name of the borrower/hirer.

Can I change my car loan instalment due date?

Yes, change of due date is allowed. However, there is a processing fee of S$1,000 for changing monthly instalment due date.

How much can I borrow?

The loan amount is dependent on the Open Market Valuation (OMV) of the financing car

| Open Market Value (OMV) | Maximum Finance Account |

| ≤S$20,000 | 70% of the purchase price or valuation price, whichever is lower |

| >S$20,000 | 60% of the purchase price or valuation price, whichever is lower |

What is the maximum loan period?

The maximum loan period is 7 years.

What is my current outstanding amount for redemption of my car loan?

You may request for the car loan full settlement amount via the following mode of communication:

- Call UOB Contact Centre at 1800-388 2121

- Email the written request to RLOC Car Loan Redemption at CarRedemptionRLOC@UOBgroup.com

- Fax in written request to RLOC Car Loan Redemption at fax no. 6439 2604

Note: You may download a copy of the Car Loan Redemption Request Form from UOB website.

Existing UOB Home Loan customers

How do I request for housing loan statement?

You may request for your current and previous's years statement through our UOB Contact Centre at 1800 388 2121 or via our Home Loan Specialist at any UOB Group branches. Additional fees will apply for duplicate copies or statements dated more than one year ago.

Kindly also note that your latest annual loan statement (as at 31 December of the year) will be automatically sent to you registered mailing address with the Bank at the beginning of the each year.

If you wish to review your home loan, you may contact our Mortgage Relations team.

How do I check my home loan details?

You can find out more about your loan with the Bank through:

- UOB Personal Internet Banking;

- Call Centre from 8am - 8pm at 1800 388 2121; or

- Contacting our Home Loan Specialists at any UOB branches

What is my monthly installment amount and when do I start to pay?

After you have signed your Letter of Offer with UOB, your lawyer will proceed to complete the legal work on the purchase of your property. Upon loan disbursement, UOB will send you an advice with the following information:

- Loan amount disbursed

- Your monthly instalment

- Your monthly instalment due date

For completed properties, it takes approximately ten weeks from acceptance of the Letter of offer for the loan to be disbursed.

For uncompleted properties on the progressive/deferred payment scheme (for loans accorded the deferred payment scheme prior to 26 Oct 2007), you will receive a disbursement advice to commence monthly instalment for your housing loan when the Bank disburses the loan.

Hence, please ensure your mailing address is updated with the bank.

When is my monthly payment due?

- For Private Property Loan, it is due on the 1st day of each month.

- For HDB Home Loan, it is due on the 15th day of each month.

- Your due date will be rescheduled to the next business date if the payment due date falls on a Saturday, Sunday or Public holiday.

What are the ways of repaying my monthly mortgage instalments?

- CPF (not allowed for Property Equity Loan)

- Deduct from your pre-designated UOB bank account

How can I partially prepay my outstanding loan?

Please check your Letter of Offer for any prepayment penalty clause and charges before proceeding with the prepayment.

- You will have to:

- Submit Capital Partial Prepayment Form to the Bank.

- Serve a one month’s written notice.

- Prepay via Direct Debit from designated UOB account or CPF. Find out more about using CPF for monthly installment as outlined in the Frequently Asked Question 8.

How do I check if my loan is still within lock-in period?

You can:

- refer to your Letter of Offer;

- check with our Home Loan Specialist at any UOB Group branch; or

- contact our Call Centre from 8am - 8pm at 1800 388 2121.

If you wish to review your home loan, contact our Mortgage Relations team.

How do I request for a change of my existing loan tenor?

Please submit your written instruction to:

- Your Home Loans Specialist

- Any UOB Group branch

- Alternatively, you may contact us here

A processing fee will be charged by the Bank and your request is subject to approval.

How do I use my CPF for paying my monthly instalment?

Please ensure that you have informed your lawyer of your intention to use CPF funds for home loan repayment at the point of loan application.

If you missed this at the point of your loan application, please engage a lawyer to write to the CPF Board for approval and obtain approval from the Bank that you will be using your CPF funds to service your monthly instalments through your Home Loans Specialist at any UOB branches.

Please also be aware that all legal costs will be borne by you and there will also be a processing fee that will be charged by the Bank. For more information, consult CPF Board or visit www.cpf.gov.sg for further clarifications.

Once this is done, you may follow the steps below to revise your CPF monthly instalment:

- Visit the CPF Website and login with your Singpass.

- Select My Request.

- Under Property, select Use CPF for my Property.

- Select Property details.

- Select Revise Monthly Instalment.

- Update Monthly Instalment amount and effective date.

- Submit request.

What happens if there is a shortfall in CPF contribution?

After deducting the CPF contribution received, any balance outstanding will be deducted from your pre-designated UOB bank account.

How do I use CPF to partially prepay my outstanding loan?

You will have to:

- Submit the completed Capital Partial Prepayment Form to Bank.

- Submit the CPF Form 4B (private property loan) or HBL/4 Form (HDB loan) to the CPF Board.

- Serve a one month written notice to the Bank.

- The Bank reserves the right to refund the CPF monies if there is no prepayment instruction.

Please also check your Letter of Offer for any prepayment penalty clause and charges before proceeding with the prepayment.

How do I redeem my loan?

Follow these steps if you are selling your property or paying off with your own funds:

- Check your Letter of Offer for any applicable fees/refunds to be made to the Bank

- For Singapore property loans, you can choose to serve the Bank two months’ written notice or pay two months’ interest in lieu of notice. For overseas property loans, you can choose to serve the Bank three months’ written notice or pay three months’ interest in lieu of notice

- Appoint a lawyer to discharge the mortgage (note that all legal fees are to be borne by you)

- Liaise with your Insurance provider if you wish to terminate your Fire Insurance policy

Do note that any prepayment requests pending or served will be cancelled.

It has been our pleasure serving you and we hope to assist you in your next home ownership journey.

If you are refinancing to another bank, save time and effort of refinancing and contact our Mortgage Relations Managers for a customised solution.

What happens after I have finished paying my monthly instalments?

Please instruct your lawyer to write to the Bank to discharge the mortgage. Your title deed/e-title deed will be returned and all legal fees are to be borne by you.

It has been our pleasure serving you and we hope to assist you in your next home ownership journey.

Keen to tap on the equity in your property to help you achieve your financial needs and goals?

You may consider a property equity loan. Contact us for an assessment today.

How do I update my address or contact details?

Change your contact details on UOB TMRW app instantly so you don't miss any important notifications and alerts. Simply follow these steps:

Step 1: Log in to UOB TMRW and tap on "Services" located at the bottom of the screen.

Step 2: Under Profile, select "Contact Details".

Learn more

Besides contact details update, it’s now easier than ever to update your address on UOB TMRW app using MyInfo. Simply tap on Services > Address details to get started

Alternatively, you could also change your contact details and address on UOB Personal Internet Banking or In-person at any UOB Branch.

-For Change of Residential Address, one of the following documents as proof of residence (within last 6 months) is required:

- Singapore NRIC

- Utility Bill

- Telephone Bill

- Tax Assessment

- A non UOB bank statement

- Rental agreement

Note:

For Home Loans with more than 1 registered borrower, please proceed to any UOB Branch to update your Mailing Address and/or Contact Details in-person. Please note that ALL borrowers will need to be present to proceed with this request

How frequent will I receive a loan statement from UOB?

You will receive an annual loan statement (as at 31 December of the year) at the beginning of the following year. For duplicate copies, additional fees will apply.

In the event that you do not receive your annual loan statement, please call our Call Centre from 8am - 8pm at 1800 388 2121 or check with our Home Loan Specialist at any UOB Group Branches.

New home loan customers

How to apply for housing loan?

Click on "APPLY NOW" to apply for a new UOB Home Loan with forms pre-filled by retrieving your personal information with MyInfo. Applications submitted between 8.30am to 9pm daily will be processed instantly. Applications received outside these times will be processed the next working day.

For Foreigners and U.S. Persons:

Please leave us with your details so we can contact and assist you.