PayNow

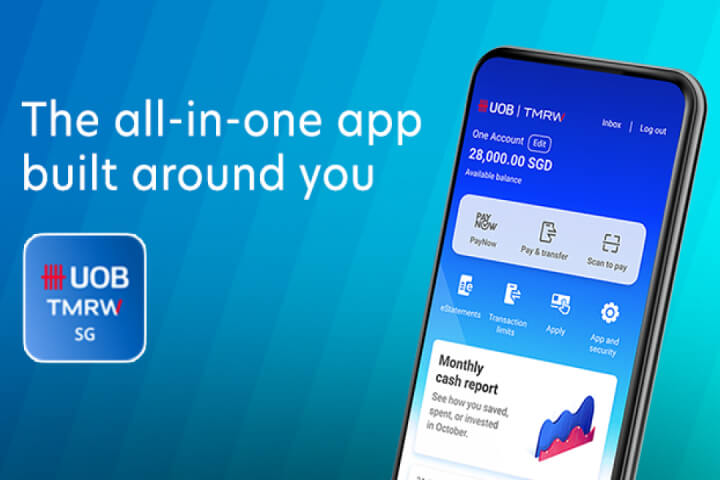

Enjoy convenience at your fingertips with PayNow. Register now to enjoy fast, seamless and secure payments with UOB TMRW.

Benefits

Instantly send and receive money

Send and receive money instantly into your PayNow-linked account, with just your mobile number, NRIC/FIN or UEN. No bank account number is required!

Faster payout

Receive faster payouts from the Government such as GST Voucher(s) when you link your NRIC/FIN to your PayNow!

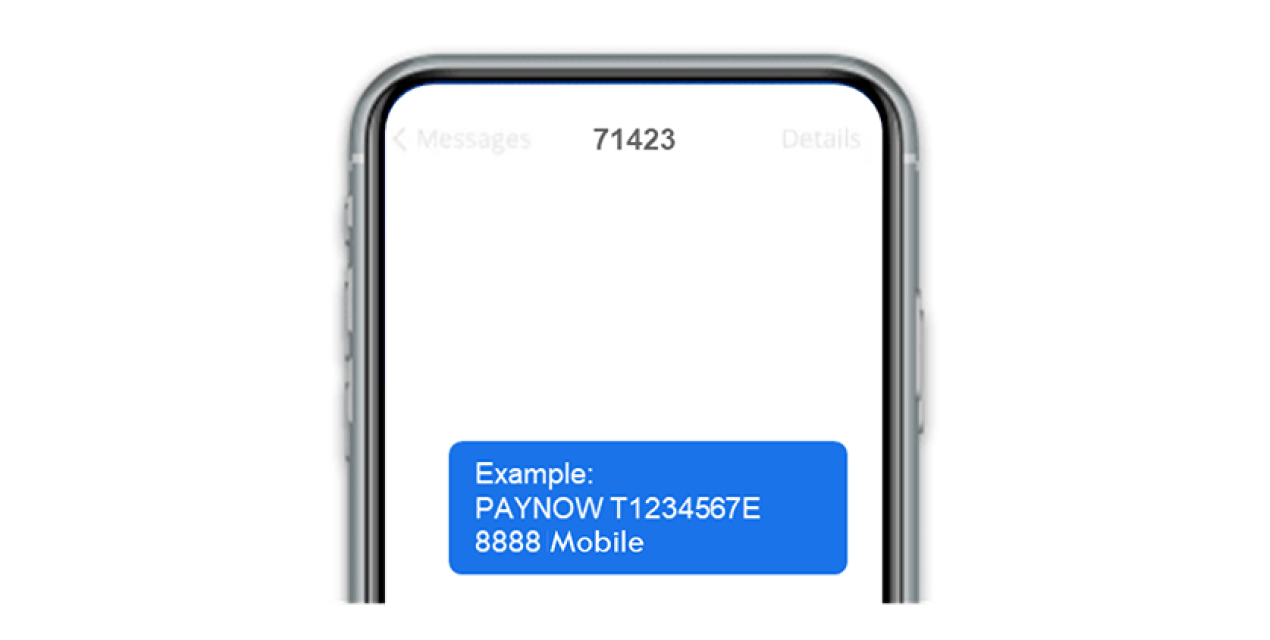

Get notification on email or mobile number

Receive notifications on your PayNow status via your bank-registered email or mobile number.

Review transaction

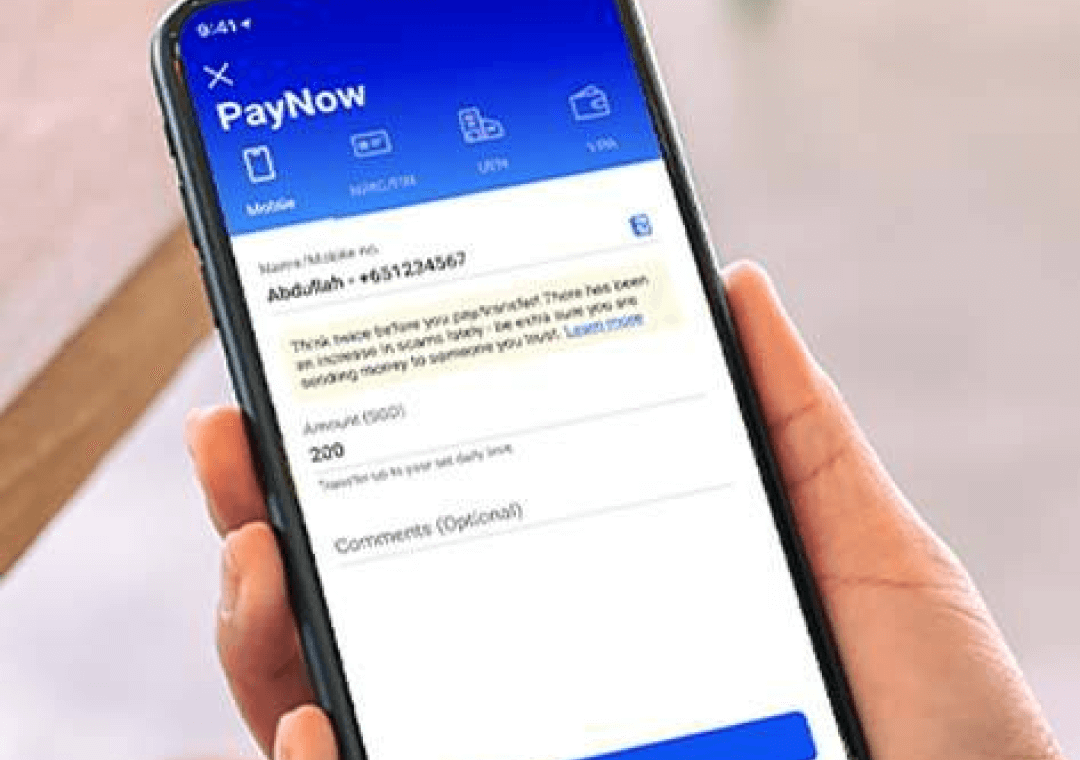

You can review your transaction details by ensuring that you send to the correct recipient before transferring.

Things you should know

Important Notes

PayNow Terms and conditions

Please note revisions at Clauses 4.6, 4.7, 6.4(j)-(k), 6.6 and definitions of “Overseas Service” and “Overseas Service Participating Institution” at Clause 16.

With effect from 14 November 2023, PayNow transfers for gambling related activities to the registered PayNow proxies of the following entities will not be allowed if UOB CashPlus is the source of funds for such transfer:

- Singapore Pools (Private) Limited

- Marina Bay Sands Pte Ltd.

- Resorts World At Sentosa Pte. Ltd.

Frequently asked questions

For more FAQs

Click here to read more.