UOB TMRW, the app built around you

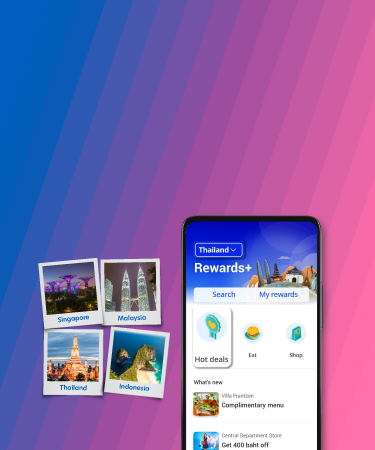

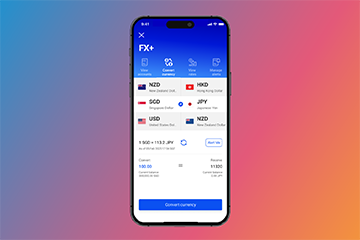

Meet UOB TMRW, the all-in-one banking app built around you and your needs. It features AI-driven insights, rewards personalised to you through Rewards+, and investing made simple through our expert wealth solutions.

Our app is optimised for a seamless banking experience anytime, anywhere.

Bank. Invest. Reward. Make TMRW yours. Download now

Bank with ease

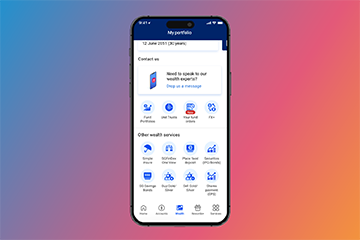

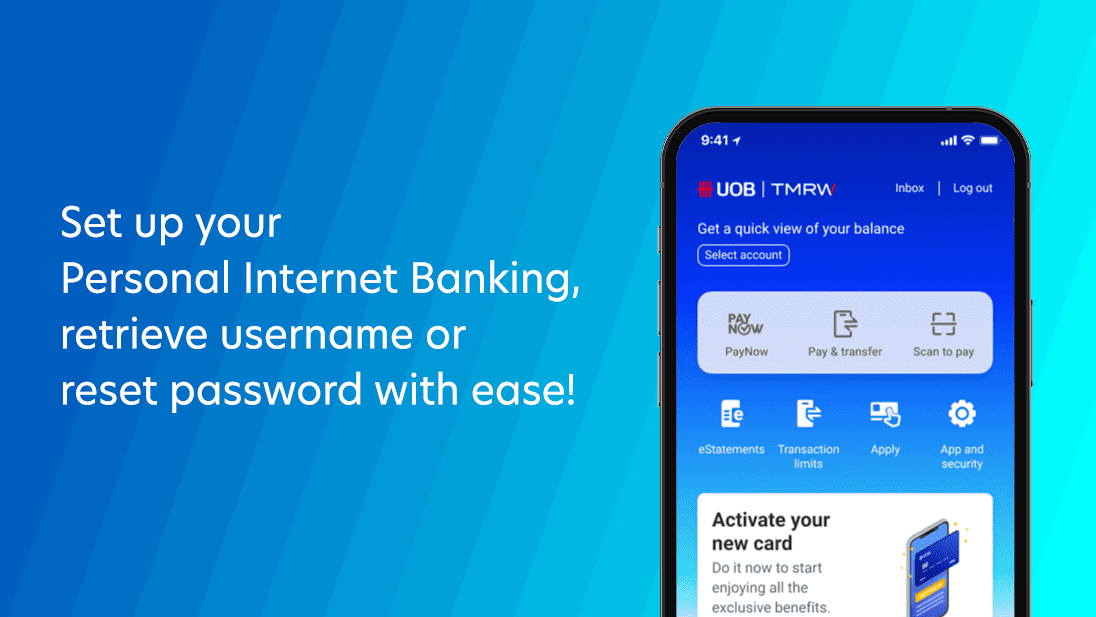

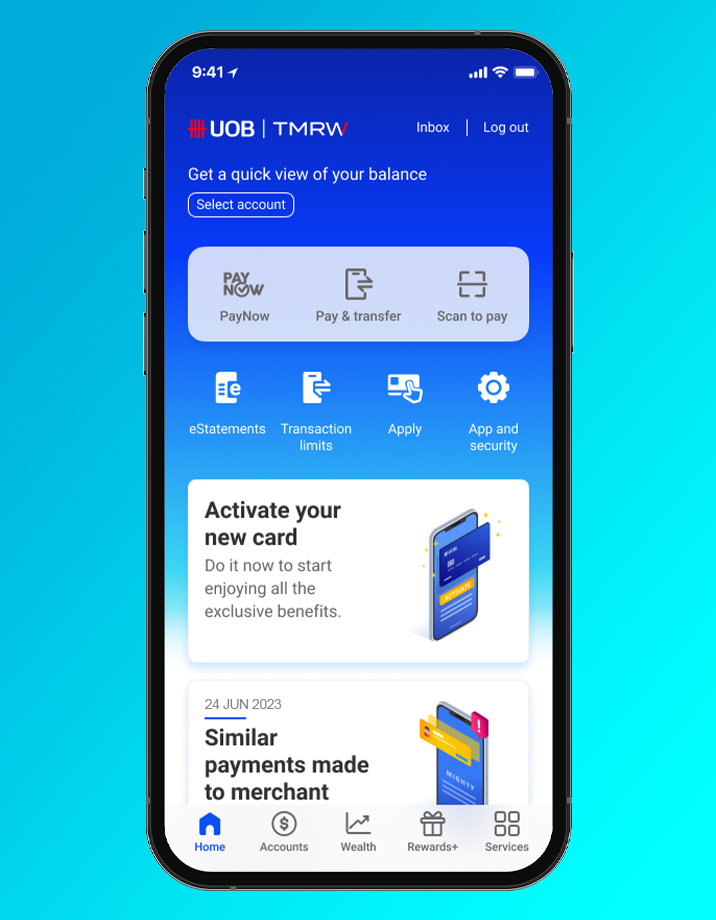

Everything at a glance

The new app has never been more user-friendly, with one-tap access to your most used features.

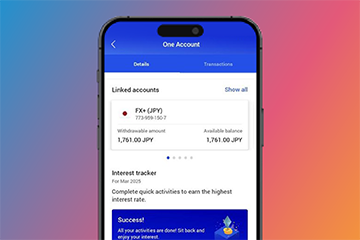

Manage your accounts and transactions on the go

Get quick account updates on your deposits, bonus interests, investments, credit cards' deals and rewards.

Effortless payments

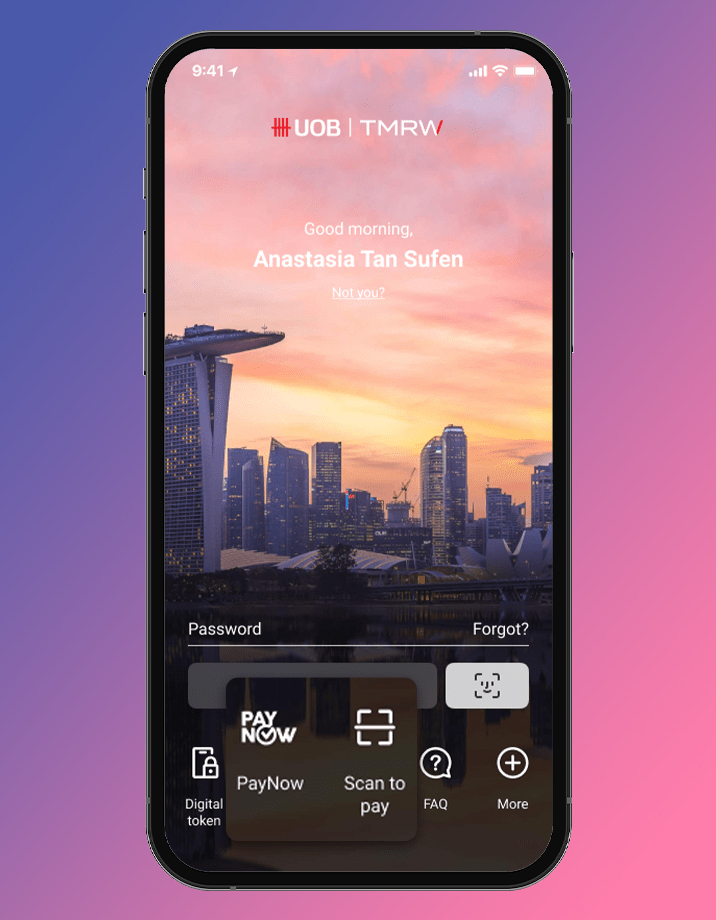

Easier access to your daily payments with PayNow on UOB TMRW

Conveniently make purchases or payments securely and receive earlier government payouts when you register for PayNow on UOB TMRW with your NRIC/FIN.

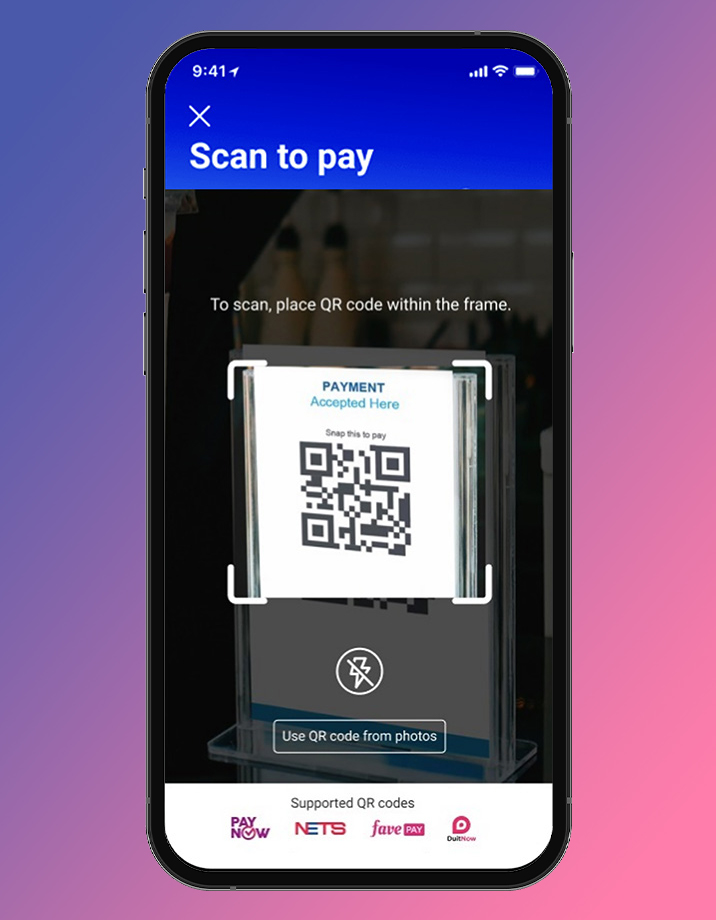

Easy payments with Scan To Pay

Pay at hawker centres, convenience stores and retail shops easily with Scan To Pay. Supported QR codes: PayNow QR, NETS QR, FavePay QR locally and DuitNow QR in Malaysia.

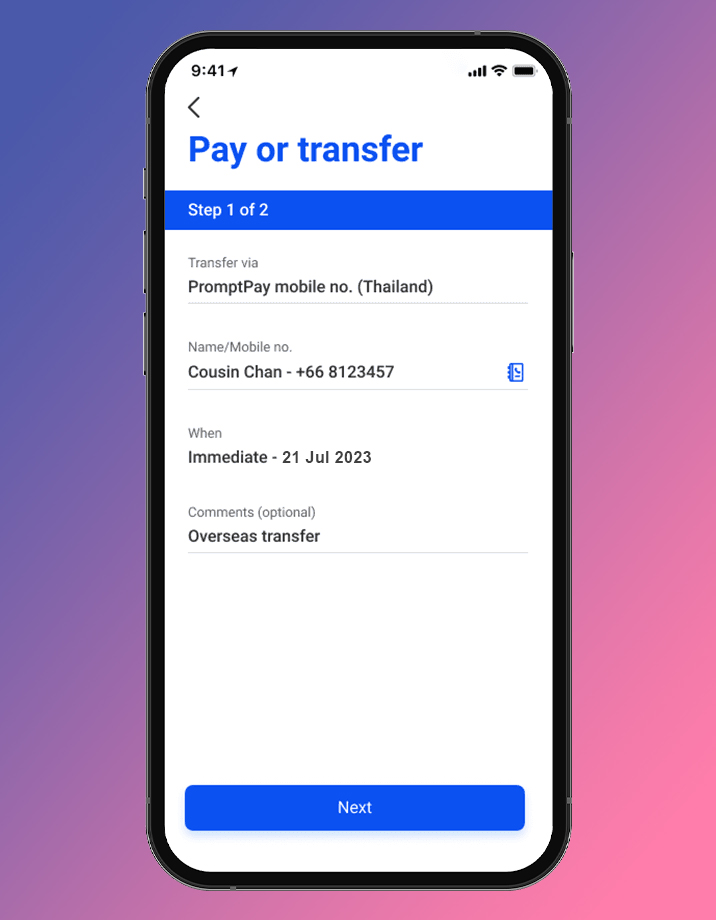

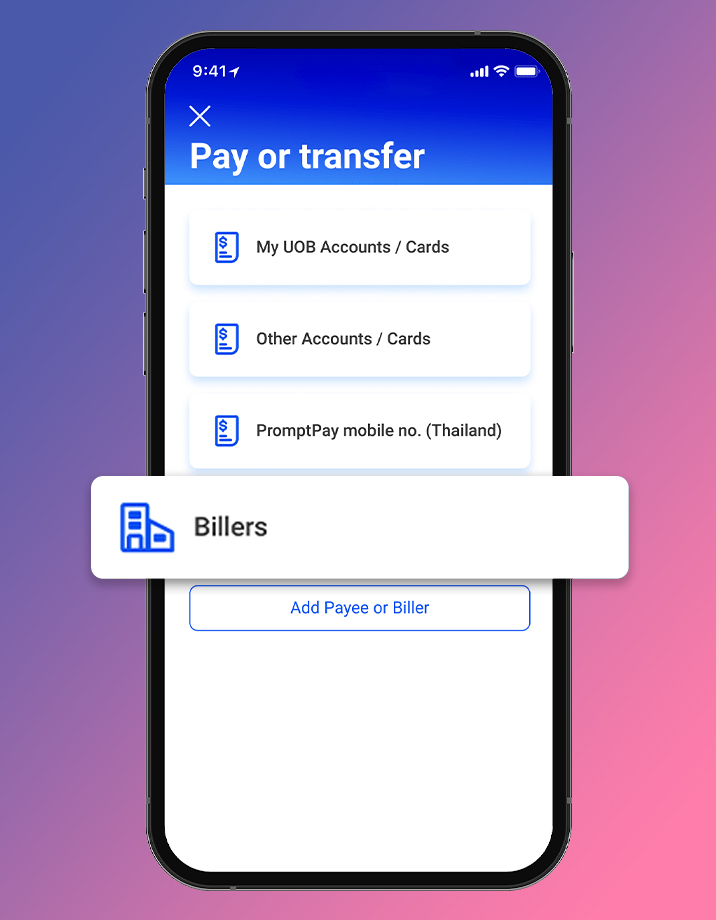

Pay anyone via mobile locally and in Thailand

Send and receive funds easily using a mobile number or NRIC via PayNow. Have friends in Thailand? You can now send money easily via PromptPay.

Pay bills easily

With our extensive list of close to 200 billing organisations, pay your bills instantly and securely. Add them as billers so you need not input the bill details each time you pay.

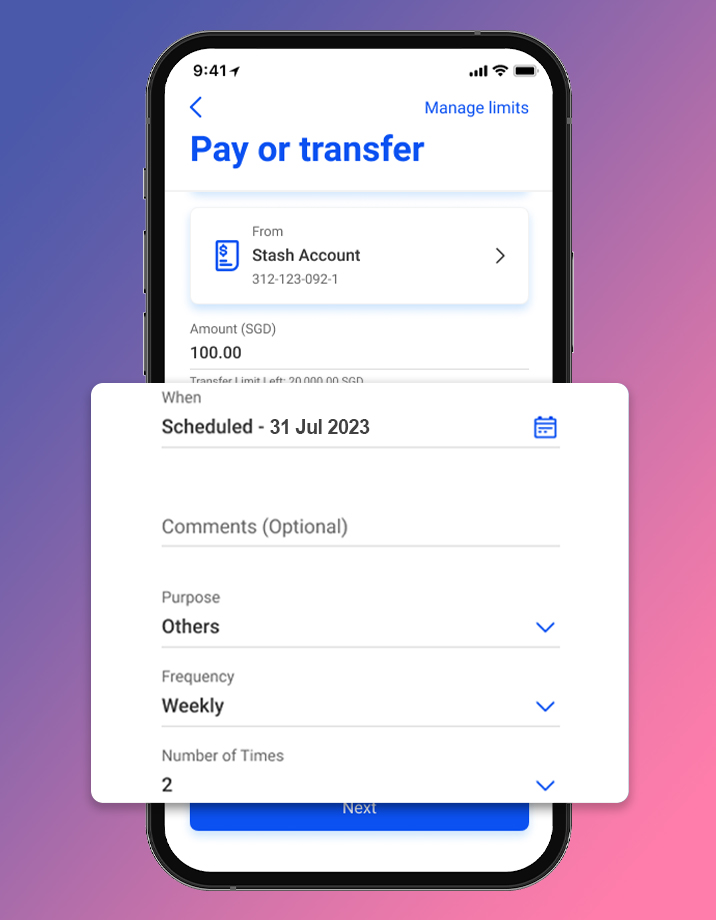

Never miss a scheduled transfer

With scheduled funds transfer, you can setup a recurring fund transfer based on amount, date and frequency of transfer.

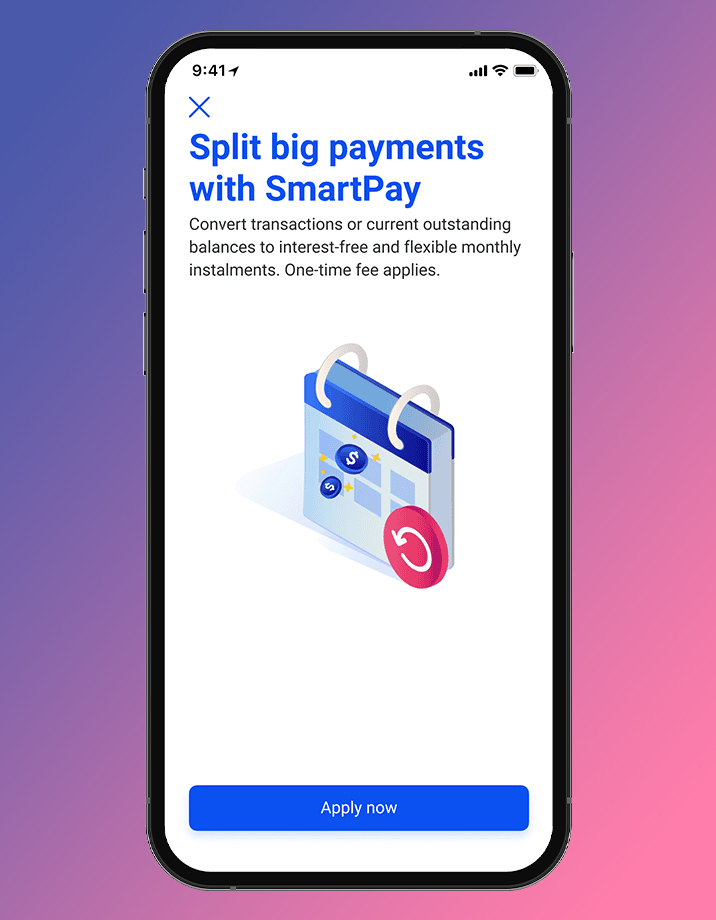

Buy now, pay later with UOB SmartPay

Split your bills into bite-sized payments on UOB TMRW. Enjoy interest-free monthly instalment with 1-time low processing fee and flexible payments over 3, 6, 12 months with UOB SmartPay.