UOB SmartPay

Benefits

Interest-free monthly instalments

Split your big purchases into interest-free monthly instalments with a one-time low processing fee from 3%

Flexible payments

Enjoy the flexibility of splitting your payments over 3, 6 or 12 months

More instalment payment plan options

Easily convert your outstanding balances or selected card transactions across all UOB Credit Cards or for a specific UOB Credit Card only.

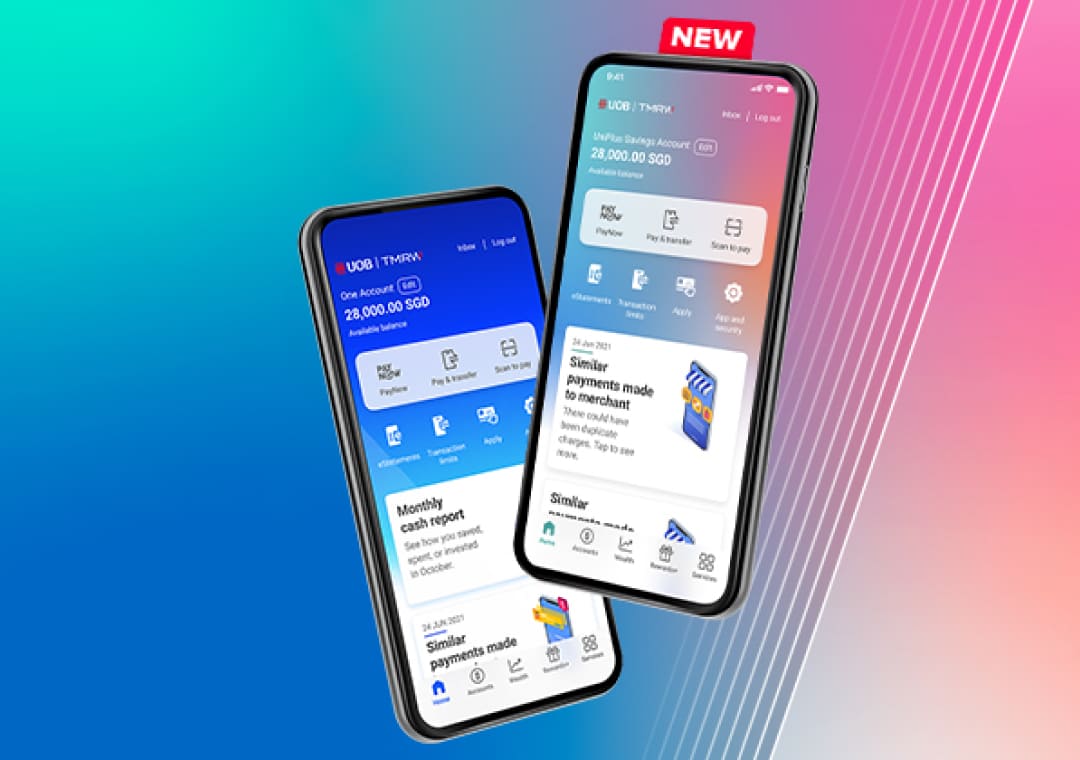

Fuss-free application

Enjoy fast and hassle-free application via UOB TMRW.

How it works

With UOB Cards, you have the flexibility to convert your purchases into manageable payments. Choose to split your full statement balances or up to 5 selected transactions across all or selected UOB Credit Cards.

| Tenure | 3 months | 6 months | 12 months |

| One-time processing fee | 3% | 3% | 5% |

| Effective Interest Rate | 18.18% p.a. | 10.43% p.a. | 9.5% p.a. |

| For example, based on a retail purchase of S$3,600: | |||

| Monthly Instalment | S$ 1200 | S$ 600 | S$ 300 |

| One-time processing fee (Charged with first instalment) |

S$ 108 | S$ 108 | S$ 180 |

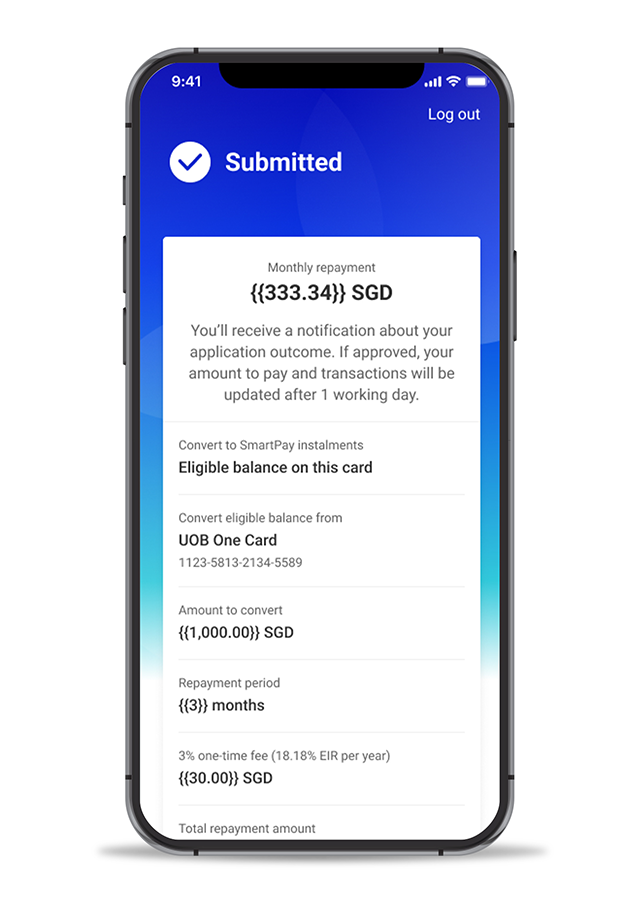

Experience the ease of applying for UOB SmartPay on UOB TMRW

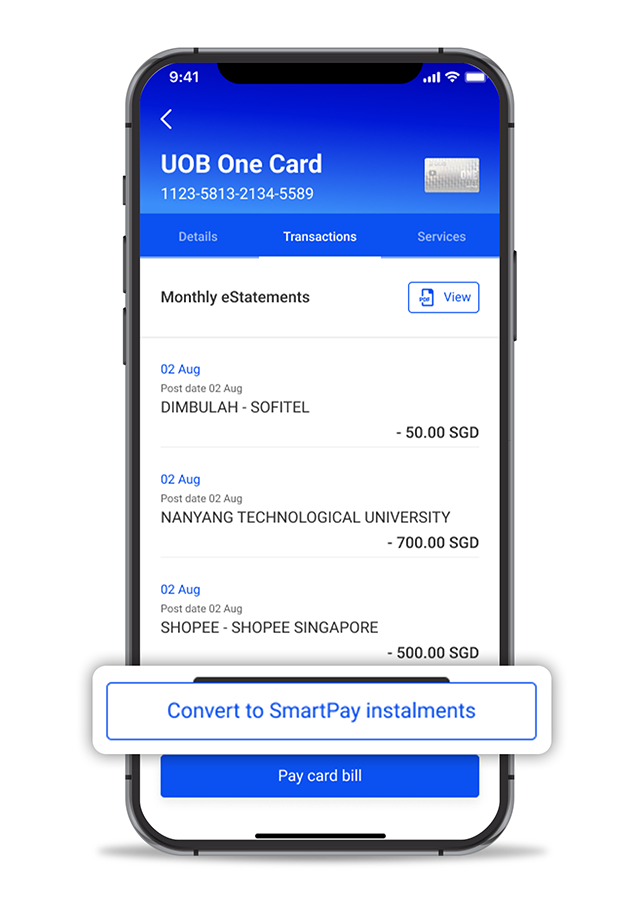

Step 1:

Tap ‘Convert to SmartPay instalments’ button in your Credit Card Transactions tab

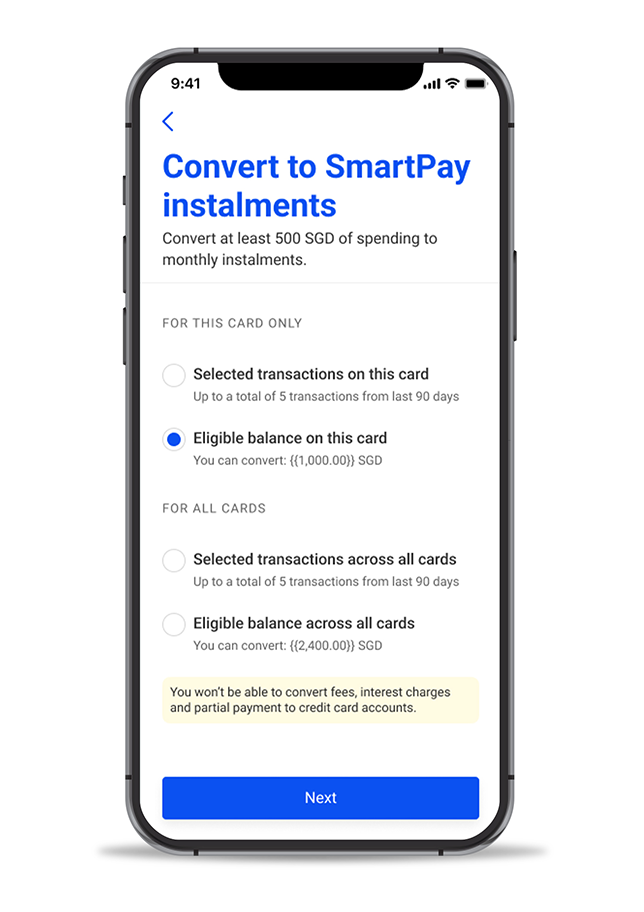

Step 2:

Choose:

• Selected transactions on a specific UOB Credit Card or across all UOB Credit Cards

(Note: A total min. amount of S$500 is required)

• Eligible balance on a specific UOB Credit Card or across all UOB Credit Cards

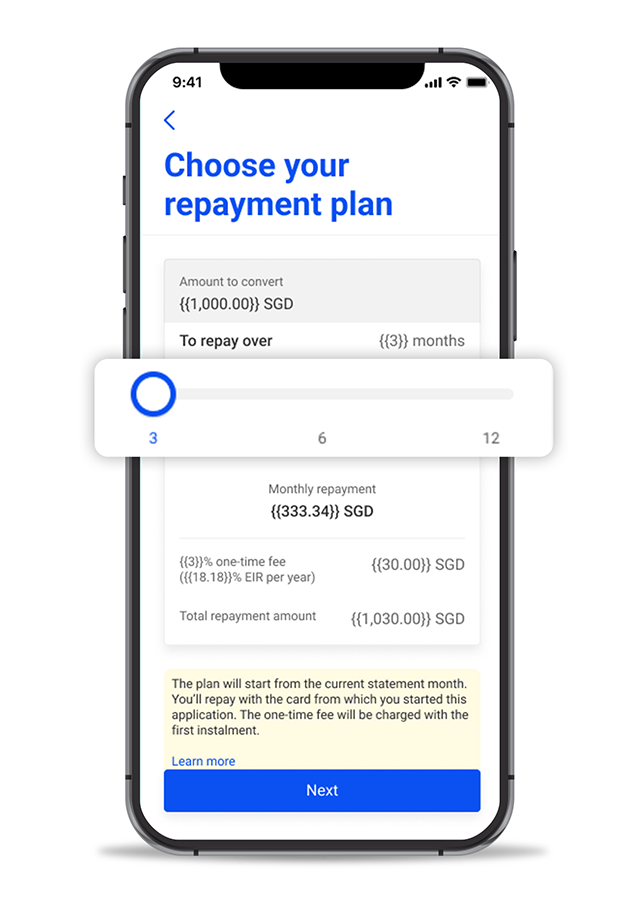

Step 3:

Slide to select instalment period (i.e. 3, 6 or 12 months)

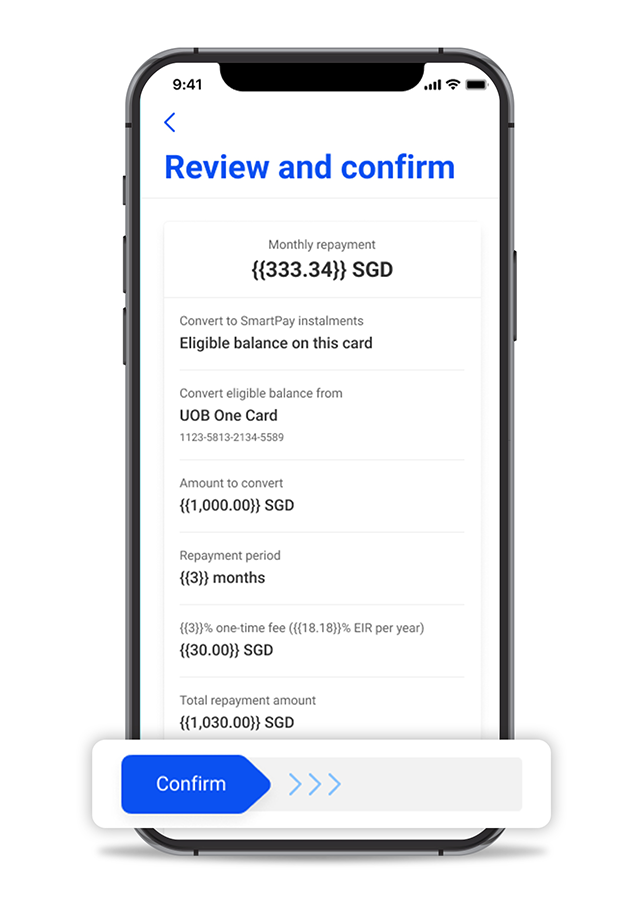

Step 4:

Review and confirm your application’s details

Step 5:

Approval status will be sent via Push Notification, E-mail and SMS after one (1) working day

Alternatively, you may apply via UOB Personal Internet Banking .

.

UOB TMRW

Manage your card with UOB TMRW

Pay bills at over 300 billing organisations

Real time view of your card transactions

Manage your Credit Card limit

Report & block a lost card quickly

Things you should know

Eligibility Requirements

Who can apply:

- UOB Personal Credit Cardmembers

Types of eligible transactions:

- Any posted retail transaction, excluding: (A) any partial payment made to your credit card account(s); (B) outstanding balances brought over from your credit card statement(s) for the previous month(s); and (C) credit balances on your credit card account(s).

Minimum conversion amount:

- S$500

Commonly Asked Questions

Is there a minimum amount and/or tenure to take up UOB SmartPay?

Yes, you can apply for UOB SmartPay if your total credit card outstanding balance, outstanding balance on a selected credit card or the total amount of your selected transaction(s) is a minimum of S$500 and choose an instalment plan with a minimum tenure of 3-months.

How do I know if my UOB SmartPay application has been approved?

A push-notification and email will be sent to your mobile device and registered email address one (1) working day from your time of application to inform you if your application has been approved or rejected.

How do I calculate my new Current Statement Due if my UOB SmartPay application has been approved before my Statement Due Date?

If SmartPay is approved between Statement Generation and your Statement Due Date (E.g. Statement generated on 12 Apr with Due Date on 2 May, SmartPay approved on 18 Apr), your amount due by your Due Date will be less the amount you have converted to SmartPay. You may refer to the “Amount to pay” indicated in your UOB TMRW app for the amount due for payment by your Due Date.

Where can I view the details of my SmartPay plan after it has been approved?

Login to UOB TMRW > tap on the ‘Accounts’ tab > choose the credit card > tap on ‘View instalment plans’ under the ‘Services’ tab

For frequently asked questions, click here.

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this service.

Terms and conditions

- Amounts spent by way(s) of cash advance, balance transfer, instalment payment plan, interest free loan, SmartPay, fee or interest-related transactions and such other promotions and transactions as the Bank may determine from time to time shall be excluded from the Total Amount and cannot be converted into SmartPay.

- SmartPay is not available to transactions incurred with UOB Purchasing Cards, UOB Corporate Cards, UOB Private Label Cards and all UOB Debit Cards.

- Reward Points (UNI$) / Cash Rebates will not be awarded for successful SmartPay applications. Any Reward Points (UNI$) / Cash Rebates awarded will be reversed upon successful SmartPay application.

- Administrative fee of S$150 will be levied for the processing of voluntary card account closure, termination or early repayment of the SmartPay instalment amount. No Reward Points (UNI$) will be refunded in such cases.

- For UOB SmartPay’s full general terms and conditions, please click here.

Related products

UOB One Card

The highest cashback of up to 10% on your daily favourites from food deliveries to daily essentials and more!

UOB EVOL Card

Up to 10% cashback on online, mobile and overseas in-store FX spend! No annuals fees.

UOB PRVI Card

Get started with the highest miles card with 1.4 miles per S$1 spend locally (UNI$3.5 per S$5 spend) or up to 3 miles per S$1 spend overseas (UNI$7.5 per S$5 spend). Plus, enjoy 8 miles per S$1 spend on your hotel and airlines bookings (UNI$20 per S$5 spend).