Get the highest cashback1 on your Singtel spend and more

Simply spend a min. of S$800 in a statement month to qualify

-

Spend Category

-

Cashback

-

Cashback Cap

| Spend Category | Cashback | Cashback Cap |

| Singtel / GOMO spend | 12% | S$30 |

| Local Online and Mobile Contactless spend | 10% | S$30 |

| All other local and overseas spend | 0.30% | S$20 |

| Total monthly cashback | - | S$80 |

| Spend Category |

| Singtel / GOMO spend |

| Local Online and Mobile Contactless spend |

| All other local and overseas spend |

| Total monthly cashback |

Cashback illustration

Here’s how easy it is to earn cashback with the Singtel-UOB Card

- Spend Amount

- Cashback Earned

| Examples of spend | Spend Amount | Cashback Earned |

| Spend | Spend a minimum of S$800 in a statement month | |

| 12% on Singtel and GOMO spendNEW | ||

| Singtel/GOMO bills | S$80 | S$9.60 |

| Accessories from Singtel Shop | S$20 | S$2.40 |

| New iPhone (monthly payment via Singtel PayLater) | S$150 | S$18.00 |

| 10% cashback on Local Online and Mobile Contactless spendNEW | ||

| Purchases from Shopee | S$100 | S$10 |

| Dining spends via Apple / Google Pay | S$30 | S$3 |

| Purchase from Fairprice Xtra via Apple / Google Pay | S$120 | S$12 |

| 0.3% cashback on All other spendNEW | ||

| Disneyland Admission in Shanghai charged in CNY | S$300 worth in SGD | S$0.90 (plus, no FX fees!) |

| Groceries purchase in Johor Bahru charged in MYR | S$200 worth in SGD | S$0.60 (plus, no FX fees!) |

| Purchase of headphones via Visa Paywave (tapped to pay using physical card) | S$100 | S$0.30 |

| Total | S$1,100 | S$56.80 |

Things you should know

Eligibility and fees

Eligibility

- Applicant must be an individual (non business) Singtel Customer

- Age: 21 years and above

Singaporean/PR:

Instant Card approval via Myinfo

- Minimum annual income of S$30,000 (55 years old and below)

- Minimum annual income of S$15,000 (56 years old and above)

- Fixed Deposit collateral of at least S$10,000^^

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000^^

^^Terms and conditions apply. Please visit UOB branches for more information on secured card applications.

Documents required: Click here.

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77672:

<Yesst>space<Last 4 digits of existing UOB Card>space<NRIC#>space<Singtel Account#>

Fees

Principal card- S$196.20^ yearly

- First year card fee waiver

Supplementary card

- FREE first card

- S$98.10^ subsequent card

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

What’s more, you can digitize your card to enjoy convenience of mobile contactless payment when you receive your card!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

Frequently Asked Questions (FAQs)

Terms and Conditions

1”Highest cashback” refers to the 12% direct cashback (capped at S$30) awarded on Singtel spend (including Singtel one-time bill payments, Singtel recurring bill payments, and purchases made at Singtel stores and Singtel exclusive retailers), when compared against other major personal credit cards in Singapore offering direct cashback on telco bill payment and telco purchases with a minimum income requirement of S$30,000 as at 1 August 2025.

*New-to-UOB Credit Cardmembers who successfully apply for the Singtel-UOB Card between 27 August 2025 and 30 September 2025 (both dates inclusive), successfully registered via SMS and successfully charge at least one eligible Singtel/GOMO recurring bill within 2 months from their Card approval date, will receive up to S$10 per month for 12 months. Click here for full terms and conditions.

^The first 200 new-to-UOB credit card customers in September 2025 who successfully apply for an eligible UOB Credit Card between 1 September 2025 and 30 September 2025 (both dates inclusive) and spend a min. of S$1,000 per month for 2 consecutive months from their card approval date, will receive S$350 cash credit. Click here for full terms and conditions.

Terms and Conditions governing Singtel-UOB Card

Terms & Conditions for UOB Credit Card September 2025 Acquisition Promotion

Terms and Conditions for Singtel x Singtel-UOB Card Exclusive Mobile Plan Promotion

Terms and Conditions for Singtel-UOB Card – Recurring Bill Rebate Acquisition Promotion

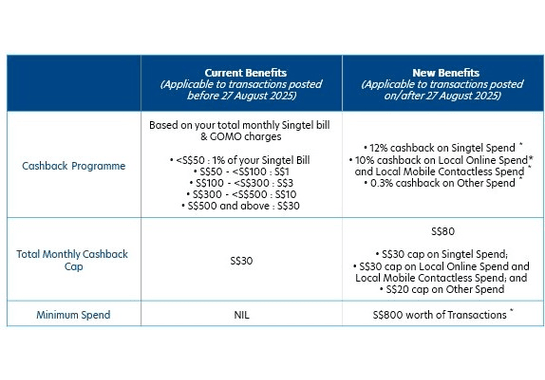

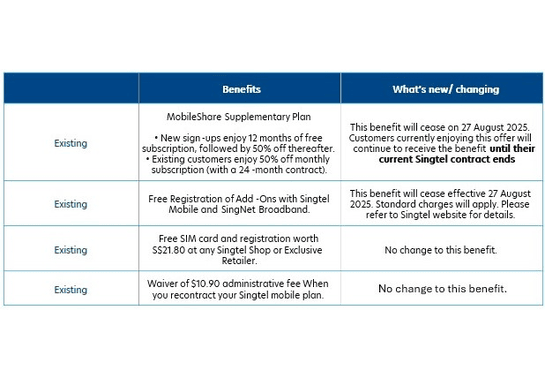

Existing Singtel-UOB Cardmembers (issued before 27 August 2025)

Cashback

For existing Singtel-UOB cardmembers holding a card issued before 27 August 2025, you will enjoy the enhanced benefits from 27 August 2025.![]()

If you do not meet the minimum spend of S$800, you will earn 0.3% cashback on all Transactions successfully charged to your Card account in that statement month.

Other Singtel Privileges

We are refreshing your Singtel experience with the following exciting updates to Singtel privileges. In addition to the following changes to the existing benefits, please look out for details of other new benefits on our website on 27 August 2025.

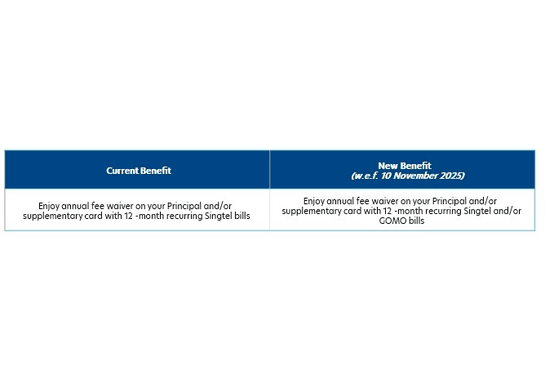

Annual fee waiver (effective 10 November 2025)

As a Singtel-UOB Cardmember, you currently enjoy annual fee waiver with Singtel bills charged to the Card on recurring basis for 12 months. With effect from 10 November 2025, you will also enjoy annual fee waiver with GOMO bills charged to the Card on recurring basis for 12 months.

No administrative fee on foreign currency spend (“FX fees”) on the Card

With effect from 27 August 2025, enjoy 0% fees on your Overseas Foreign Currency Spend on the Card.

*Refer to Terms and Conditions Governing Singtel-UOB Card for full details.

Compare credit cards

Can’t decide which card to apply for? Here’s an easy way to find the one for you.

Related products and services

UOB One Card

You're a savvy spender and getting the most out of your card is your forte. The UOB One Card gives you the most cashback and helps you grow your savings. It's the smarter way to spend.

Metro-UOB Card

The card for your shopping desire. Get the most out of your shopping at Metro with Metro-UOB Card.

UOB EVOL Card

Every choice you make helps you curate the life you want. Own it with UOB EVOL Card and enjoy cashback on local and overseas spend!

Other useful links

UOB Cardmembers’ Agreement

Click here for a copy of the UOB Cardmembers’ Agreement.