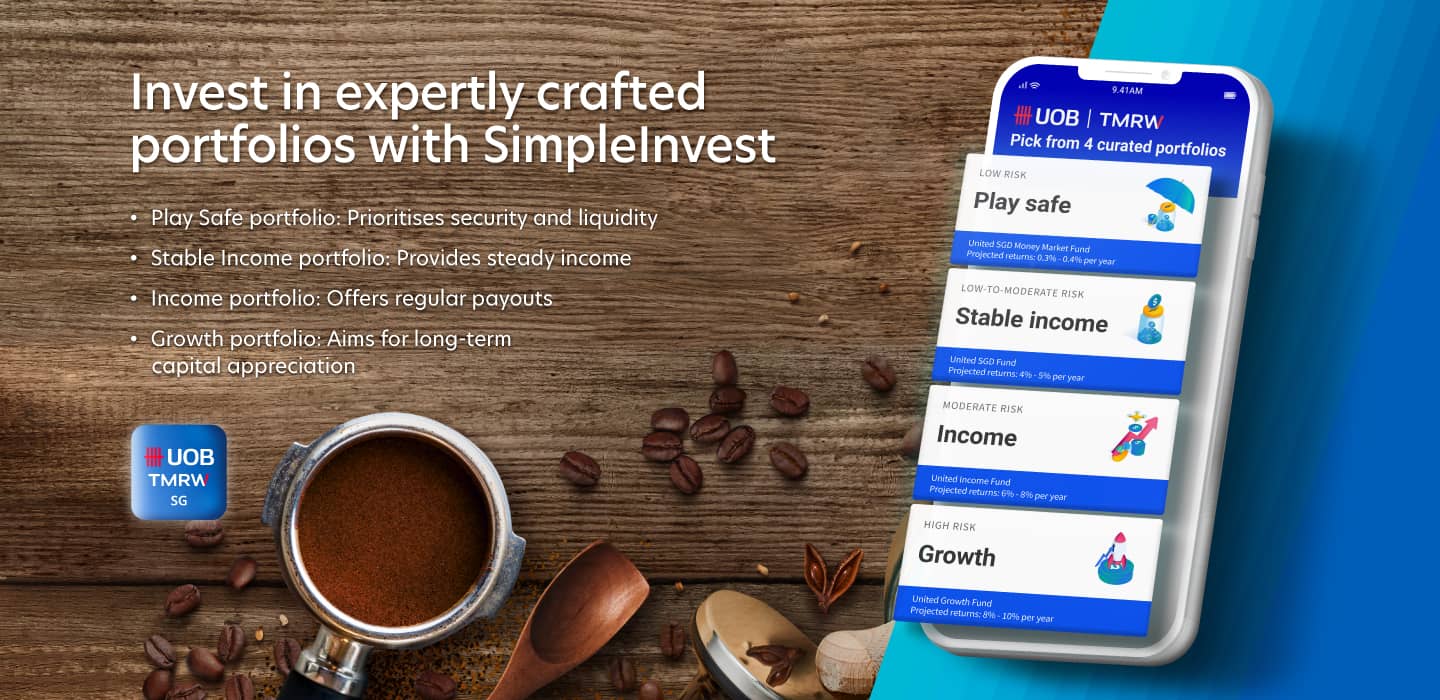

Meet UOB SimpleInvest

SimpleInvest is a digital investing platform that offers expertly crafted and actively managed investment solutions built with you in mind.

Built Around You, By Experts

World-class asset managers responsible for S$10 trillion in funds have crafted investing solutions built around your investment goals and risk appetite.

Not A Robo-Advisor

Investments are monitored and managed by human experts; not through automated algorithms.

Invest With Flexible Amounts

Start from S$500 – at one go or monthly recurring amounts.

One-Time Sales Charge

0.8% of investment amount at point of sale with no other platform fees. No sales charge for Play Safe portfolio.

Two simple ways to invest

With our unique Risk-First approach, we keep your risk appetite in mind and curate

portfolios that strike the right balance between Core and Tactical Allocations, creating an

effective investment strategy.

1) Choose from four curated portfolios depending on your

goals and risk appetite. Tap on insights and research from UOB Private Bank Chief Investment Office

(CIO) with Income and Growth portfolios.

2) Craft your own portfolio from a curated list

of over 100 Unit Trusts.

Changing the face of investing

Our Private Bank Chief Investment Office, which has a strong record of supporting our high-net-worth clients for decades, is now powering two funds.

Through the United Income Fund and United Growth Fund, you now have the opportunity to gain access to the very same views and expertise, usually reserved for the few.

Here's how

step 1

Get started on UOB TMRW

step 2

Choose from four portfolios or a curated selection of over 100 unit trusts

step 3

Complete Customer Knowledge Assessment

step 4

Decide how much to invest

step 5

Confirm details

step 1

Get Started on UOB TMRW

Log in to UOB TMRW and access SimpleInvest under the Wealth tab.

Need a UOB bank account to start your SimpleInvest journey?

Apply and get your account approved within three minutes. T&Cs apply. Visit go.uob.com/online-exclusive for the latest sign-up offer!

Everyday Use

UOB One Account

Skip to higher interest in just two steps with One Account – up to 5.3% p.a. interest on your savings.

- Spend min. S$500 on your UOB One Card and/or any other eligible UOB Cards to earn 0.65% p.a. interest

- Credit your salary or make 3 GIRO payments monthly to maximise the interest earned on your UOB One Account

- Plus, never miss out on your bonus interest when you track your progress monthly on the UOB TMRW app.

Consistent Saving

UOB Stash Account

Rewarding savers with up to 3.0% p.a. interest.

- Earn up to 3.0% p.a. interest simply by maintaining or increasing your Monthly Average Balance (MAB)

- 40x higher interest vs. a regular savings account

- Receive a UOB One Debit Mastercard when you open a UOB Stash Account and enjoy up to 4% cashback on dining, online shopping, transport, telco, utilities, mobile payments and more.

Consistent Saving

UOB Lady's Savings Account

The only savings account that gives you unstoppable rewards – unlock up to 25X UNI$ (10 miles per S$1) on preferred rewards category(ies) when you pair your Lady’s Savings Account with your Lady’s Credit Card.

Things you should know

Fees & Charges

Are there any fees for investing into SimpleInvest?

Investors will only be required to pay a sales charge of 0.8% of the investment amount at the point of sale. This is deducted when you place your order.

There is no sales charge for the Play Safe portfolio, also known as the United SGD Money Market Fund.

Do I need to pay a platform fee when I invest via the SimpleInvest platform?

There is no annual platform fee.

Besides the sales charge, are there any other fees to be paid for my investment?

Besides the sales charge that is charged upfront at subscription, the asset manager of the fund will also charge an Annual Management Fee for managing the fund.

Other fees include administrative costs of maintaining the fund such as custodian, trustee and accounting fees.

These fees would be deducted from your fund’s Net Asset Value (NAV) and of no additional cost to you.

Getting Started

How do I get started?

First, make sure you have a single-name UOB savings or checking account. Next, download the UOB TMRW app to explore our investments options.

You need to be 21 years old and above to invest.

How is SimpleInvest different from robo-advisors?

SimpleInvest is not a robo-advisor, which manages underlying portfolios by automation and algorithm, with little to no human intervention.

SimpleInvest is a digital platform built to provide you with a simple way of investing and managing your portfolio. SimpleInvest offers you 4 specially curated solutions that are professionally managed by experienced asset managers that address different investment objectives.

I am not Singaporean/PR; can I invest?

Yes, foreigners are allowed to invest with the exception of U.S Persons, Canadians residents and residents of the EEA countries.

I have already completed a Customer Knowledge Assessment (CKA) at another institution. Do I need to do it again?

Yes, you will need to. This allows us to assess your level of financial knowledge.

Investing

How often should I monitor my investments?

Anytime you like on the UOB TMRW app! The Net Asset Value (NAV) of each fund is updated every business day, with the exception of fund holidays, which are determined by the fund managers and usually fall on public holidays in countries where the fund has significant exposure.

Even if you do not monitor your investments daily, rest assured that our fund managers do, 24/7. They will proactively manage your funds and rebalance the underlying investments when necessary. You will also get monthly portfolio updates via the SimpleInvest Dashboard.

Will I receive payouts for my investments made? If so, where do my payouts go to?

Only the United Enhanced Income Select Fund provides monthly payouts to investors. You can choose to either reinvest the payout or credit the payout into your preferred account.

Will I receive investment updates?

Yes, you will get monthly market and fund reviews in the individual solutions' pages within SimpleInvest. Find out what the asset managers say about the solutions before deciding on your next course of action.

I accidentally submitted my order as ‘Reinvest’ my dividends. However, my intention was to ‘Get a cash payout’, what do I do now?

Please visit a UOB branch to change your dividend instructions.

I don’t want to redeem the full amount of my investments. Am I allowed to redeem part of it?

Yes, you can redeem the full amount or part of your investments. For partial redemptions, you must leave a minimum holding of 10 units.

After redeeming my investments, it is stated that my recurring orders will continue until I terminate them. How do I terminate my recurring orders?

To terminate, follow these steps:

Step 1: On the first screen you see after tapping on SimpleInvest (if you have invested), look for the "Orders" section and tap on "View all"

Step 2: Swipe left on your order and tap ‘Terminate’.

Step 3: Follow the instructions to complete your termination.

Can I switch my funds?

You can only switch between the United Enhanced Income Select and United Enhanced Growth Select funds. You can switch all or part of your units (subject to minimum fund holdings requirement).

My transaction was ‘Unsuccessful’. What do I do now?

Check that you have a stable internet connection. If there is a scheduled maintenance, try again later.

I have successfully submitted my order requests, how can I view the status of my order?

Tap ‘View order status’ on your submitted screen.

Alternatively, you can view your orders on the first screen you see after tapping on SimpleInvest. You will also be able to view the statuses of your past orders here.

If your order is completed or unsuccessful, you will also receive an in-app notification. Do remember to set your mobile phone settings to receive notifications from UOB TMRW.

Will I be receiving notifications in other forms for my SimpleInvest orders?

We will mail you hard copy statements for every successful purchase. You can also view your order status on UOB TMRW.

I would like to make changes to my SimpleInvest recurring order, how do I do so?

To make changes, follow these steps:

Step 1: Tap ‘View orders’ on the first screen you see after tapping on SimpleInvest

Step 2: Swipe left on your order and tap ‘Edit’.

Step 3: Follow the instructions to edit your order.

I changed my mind and would like to cancel the buy order that I submitted yesterday. How can I cancel the buy order?

You can cancel it within 7 calendar days and the investment proceeds will be credited to your UOB account within 7 business days after trade date.

I have submitted my order for a few days, and my holdings is still not reflecting. When can I see the fund that I have bought?

Holdings will be reflected within 3 business days if the transaction is executed on a trading day where the fund is available for subscription and redemption.

Important Notice & Disclaimers

The information contained on this webpage shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing on this webpage constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein. The information contained on this webpage, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of 1 May 2021, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained on this webpage , United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained on this webpage.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

We're here to help