You are now reading:

The benefits of investing early

Southeast Asia's first one-stop travel portal designed for UOB Cardmembers. Inspire, plan, and book your next adventure with UOB Cards.

Find out more

Skip to higher interest of up to 3.4% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Tap your way to 0% FX fees, cashback on MYR spend and instant savings with UNI$ redemption.

Find out more

Get instant cash at 0% interest and low processing fees. Choose from 3, 6 and 12-months tenor.

Find out more

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

You are now reading:

The benefits of investing early

As a young person starting your career or still figuring out your finances, the idea of investing may be daunting. Putting your hard-earned money into something that could be risky can be intimidating. However, starting to invest early is one of the most powerful financial decisions you can make for your future. Here is why:

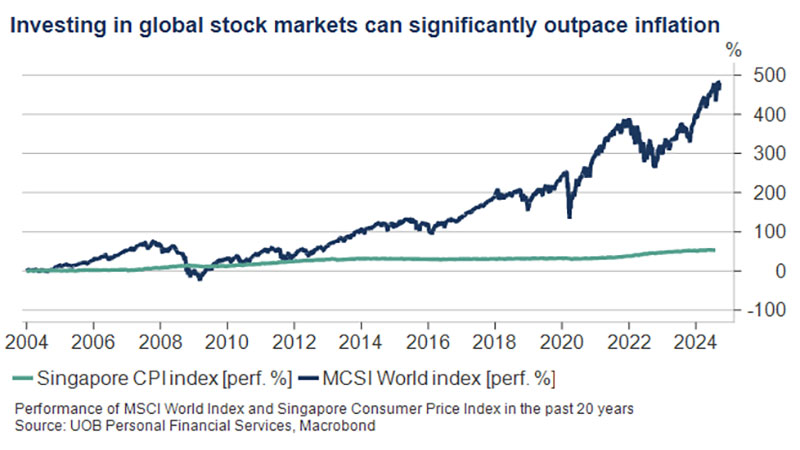

Inflation erodes the purchasing power of your money when prices increase over time. For example, with a 3% annual inflation, an item that costs in the following year. If your money is sitting in a low-interest savings account, you are essentially losing purchasing power every year.

Investing is an effective way to combat inflation. Over time, investments in assets such as stocks, bonds, and real estate typically yield returns that outpace inflation. While stocks can be volatile, the average annual returns of global stocks ranged from 7% to 10%1 over the past three decades, surpassing average inflation in Singapore. By investing, you give your money the potential to grow faster than inflation, helping maintain or even increase your purchasing power over time.

*Past performance is no guarantee of future results. Historical returns, expected returns, or probability projections may not reflect future performance. All investments involve risk and may result in significant losses.

Investing is not just about growing your money, it also helps you to develop strong financial habits. When you commit to regular investments, you are committing to paying yourself first. This practice fosters financial discipline, teaching you to prioritise your future over immediate gratification.

Developing the habit of regularly setting aside money for investments can spill over into other areas of your financial life as well. It encourages you to budget more effectively, avoid unnecessary debt and live within your means. Over time, these habits can lead to a more secure and stress-free financial life.

Investing is a key step towards achieving financial independence. By investing, you are working towards making your money work for you, rather than working for money all your life. This can eventually lead to financial independence, where you have enough assets to cover your living expenses without relying solely on a paycheck.

Financial independence gives you the freedom to pursue your passions, travel, or even retire early. When you start investing early, you are giving yourself a head start on this journey, allowing you to reach your financial goals sooner and with less stress.

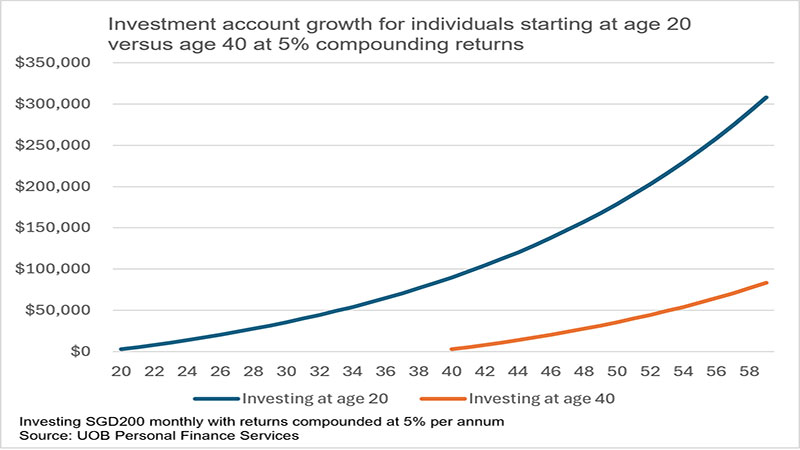

One of the biggest advantages of investing early is the magic of compounding. Compounding means that the returns on your investments generate their own returns over time. The earlier you start, the more time your money can grow exponentially.

For example, if you start investing SGD200 a month at 20 years old, by the time you are 60, you could have significantly more money invested compared to someone who started investing in their 30s. The impact of compounding grows over time, so the earlier your start, the higher the chance of a better result.

Remember that every investment comes with risk, so evaluate risks before potential returns before you start. Also ensure that the monthly investment amount is within your budget and one that you can afford comfortably.

This does not mean that it is too late to start investing in mid-life. The earlier you start investing, the longer your investment horizon, which enables you to better withstand market ups and downs through the years. Getting started now is still better than not doing anything at all. Most importantly, ensure that you invest within your budget and risk appetite.

*All investments involve risk and may result in significant losses.

This chart is for illustration and may not represent actual investment returns.

Investing is a unique and personal journey, tailored to your financial needs, priorities, and goals.

It is important to note that your needs, priorities, and goals will also evolve along with your financial plan. Find out more about our solutions here or speak to our bankers to start planning.

1Source: Total return of MSCI World Index since 1990

IMPORTANT NOTICE AND DISCLAIMERS:

This publication shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

15 May 2025 • 4 min read

10 Mar 2025 • 4 min read

10 Mar 2025 • 4 MIN READ

10 Mar 2025 • 4 min read