Our Unique Risk-First Approach

Investors may face uncertainties in their investment journey, as financial markets will likely stay volatile as global growth slows.

Our proprietary Risk-First Approach ensures that you understand your risk appetite as the starting point in your wealth journey, before considering the returns you would like to achieve. This way, you avoid taking excessive risk in the journey towards your financial goals.

In practice, our Risk-First Approach helps you protect the wealth you have worked hard to accumulate, then Build and Enhance your wealth with the appropriate asset allocation.

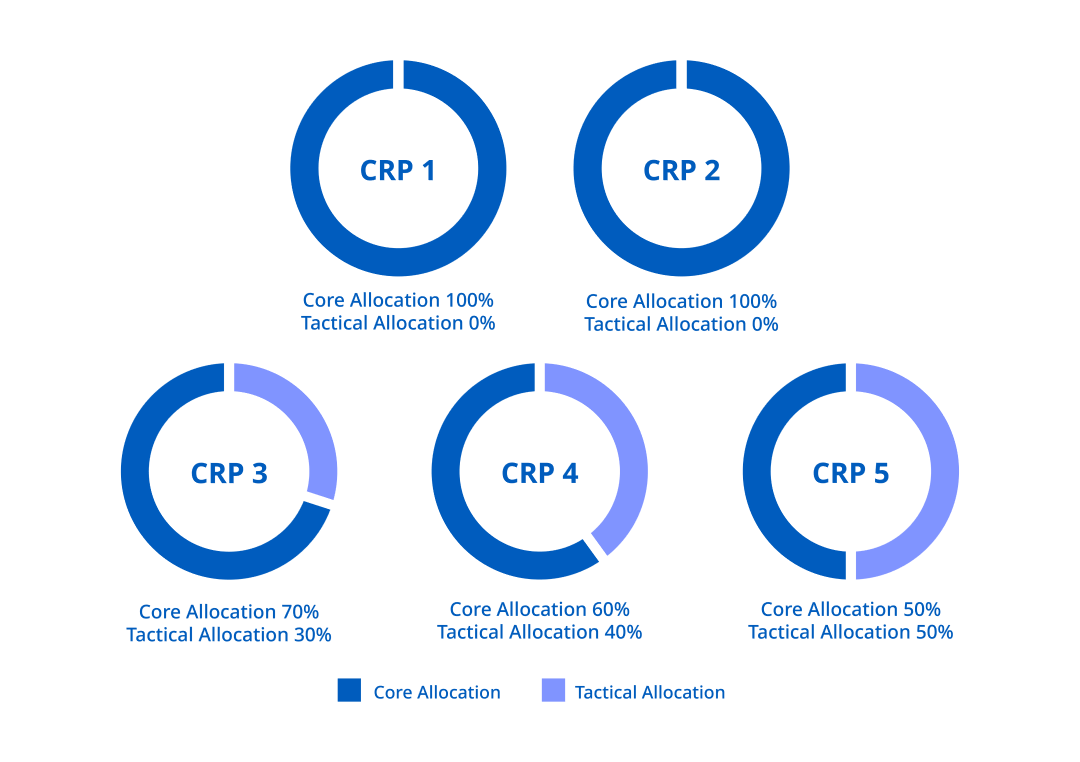

Optimal portfolios are recommended according to your Client Risk Profile (CRP). Depending on your risk profile, a maximum of 30%, 40%, or 50% is allocated to Tactical investing while the rest is anchored in Core investing.

Core allocations tend to be of lower risk and are designed to help you progress towards your long-term goals. By nature, they are held through market cycles and can provide regular income. They tend to be diversified across asset classes, sectors, and regions.

Tactical allocations focus on capturing targeted short-term opportunities. These aim for capital growth but can also incorporate income strategies.

Our VTAR Methodology

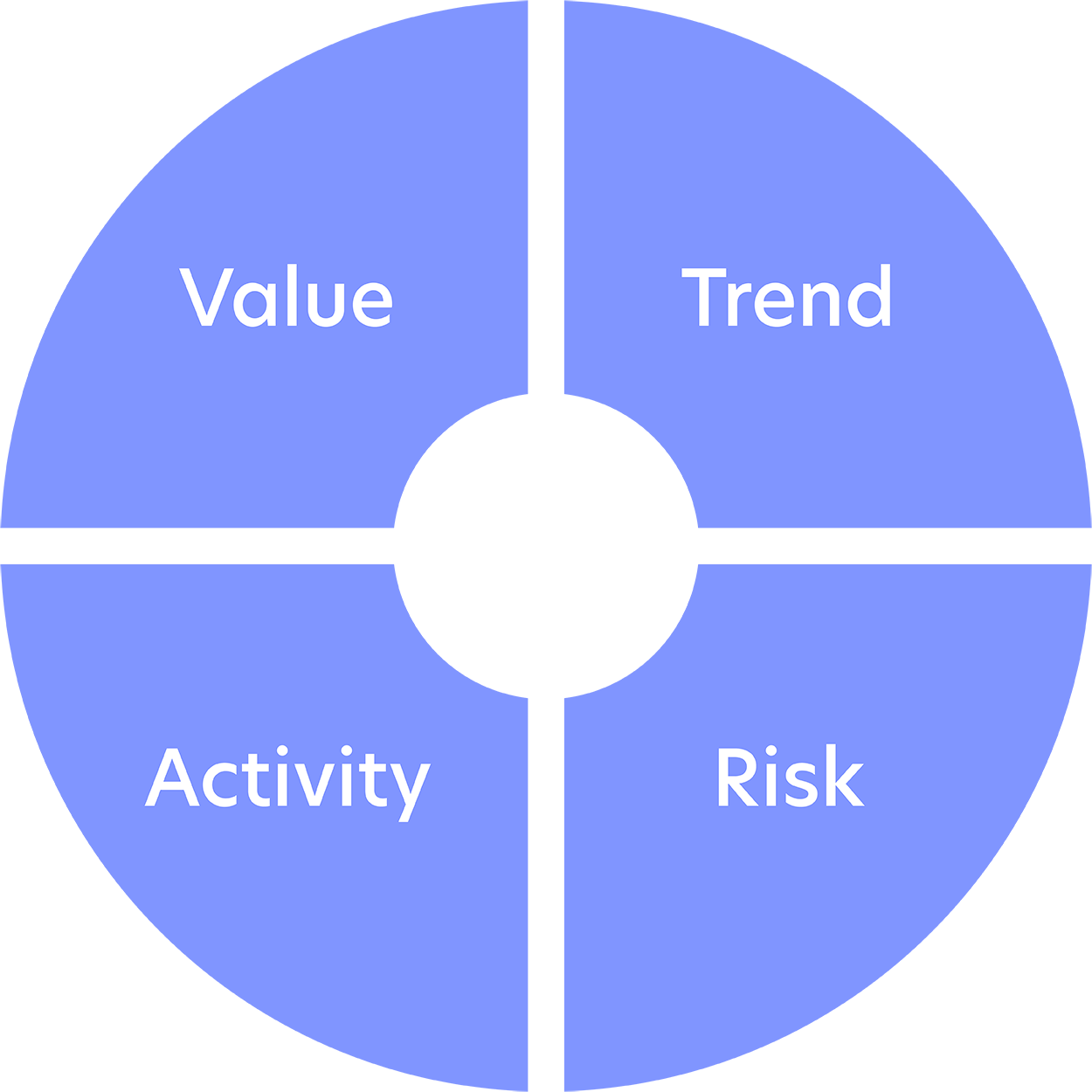

Our VTAR framework focuses on analysing large volumes of financial data in the four components of Value, Trend, Activity, and Risk (VTAR). This framework provides a holistic view of financial markets and identifies investment opportunities across asset classes, sectors, geographical regions, and time periods.

The UOB Personal Financial Services Investment Committee examines these insights based on market and asset class views from our Chief Investment Officer, in tandem with key risks, and comes to a consensus to determine the attractiveness of each potential investment idea.

-

-

Purpose

-

Common Indicators

| Purpose | Common Indicators | |

| Value | Identifying investments with attractive valuations and earnings potential. | • Price-to-Earnings Ratio (P/E Ratio) • Earnings Growth (EPS Growth) • Option-Adjusted Spreads (OAS) |

| Trend | Understanding the trend of the investment. | • Simple Moving Averages (MAs) • Relative Strength Indicator (RSI) • Fund flows |

| Activity | Understanding the macro environment and business activities that may affect performance. | • Central bank policies • Composite Purchasing Managers Index (PMI) • Industrial Production (IP) and Retail Sales |

| Risk | Identifying key market risks and potential mitigating factors. | • Geopolitical events • Industry- or region-specific events • News flows |

| Value |

| Trend |

| Activity |

| Risk |

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management

Personal Financial Services

Editorial Team

- Abel Lim

Singapore Head,

Wealth Management

Advisory and Strategy - Michele Fong

Head, Wealth Advisory and Communications - Tan Jian Hui

Investment Strategist

Investment Strategy and Communications - Low Xian Li

Investment Strategist

Investment Strategy and Communications - Zack Tang

Investment Strategist

Investment Strategy and Communications - Nicholas Bryan Chia

Intern

UOB Personal Financial Services Investment Committee

- Singapore

- Abel Lim

- Ernest Low

- Michele Fong

- Tan Jian Hui

- Low Xian Li

- Zack Tang

- Jonathan Conley

- Alexandre Thoniel, CAIA

- Chen Xuan Wei, CFA

- Chia Hong Wei

- Daphne Chan

- Marcus Lee, CFTe, CMT

- Ivan Hu

-

Malaysia

- Ryan Tan

- Mow Wei Sern

- Thailand

- Suwiwan Hoysakul

- Boonnisaed Thanyaworaanan

- China

- Huang Li Li

- Indonesia

- Diendy

Important notice and disclaimers

The information contained herein is given on a general basis without obligation and is strictly for information purposes only. Such information is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing contained herein constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained herein, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained herein.

Any opinions, projections and other forward looking statements contained herein regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.