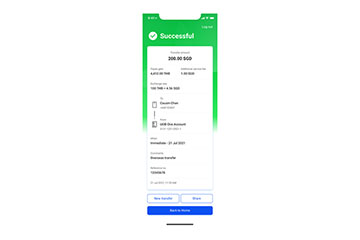

Overseas funds transfer

Send money overseas to family and friends instantly

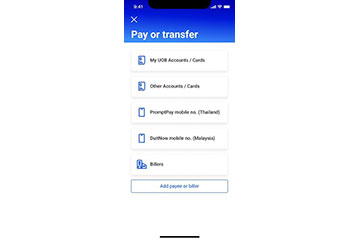

All you’ll need are UOB TMRW and your recipient’s phone number to send money instantly and securely to loved ones in Malaysia (with DuitNow) or Thailand (with PromptPay). No fuss, no fees.

Benefits

Here are the benefits you’ll enjoy:

Zero transaction fees

Perform cross-border funds transfer in participating countries with no transaction or admin fees

Instant

Send and receive funds instantly between participating banks in participating countries

Secure

Strong security measures for all transactions

Convenience

Transact using the app on your phone, anytime, anywhere!

Overseas QR payment

Use UOB TMRW to scan a participating QR code and pay with your phone when you shop overseas, just like you do at home!

Frequently asked questions

What is an overseas funds transfer?

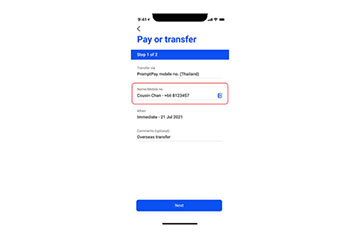

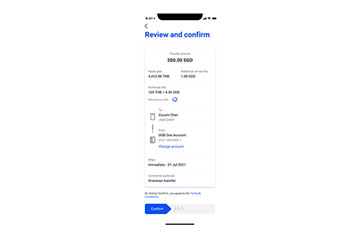

Through cross-border gateways built and operated by Singapore and participating countries (i.e. Malaysia and Thailand), these linkages enable our customers to transfer funds quickly and securely between Singapore and the participating countries. Customers simply need to only key in the recipient’s mobile phone number, mirroring a domestic PayNow transfer. The transfer is real-time and recipient will receive the funds near instantly.

Are there any fees payable to use the overseas funds transfer service?

Charges are currently waived for customers.

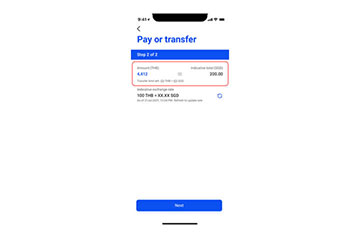

Is there a transaction limit with the overseas funds transfer service?

There is a separate daily maximum limit of SGD 1,000 for each participating country. The minimum transaction amount is MYR 10 and THB 100. The daily remaining transfer limit will be displayed on the app when a payment is initiated.

Is a country code required for overseas funds transfer service?

Yes. Please request for your recipient’s local registered mobile number for the Cross-border Instant Transfer with the respective country code.

How do I know if my recipient can accept the overseas funds transfer?

The Cross-border Instant Transfer is only applicable to participating banks from the respective participating countries. Recipient must have registered with one of the banks that participated in the Cross-border Funds Transfer service. Please refer below for more information:

- Malaysia (DuitNow) - There are currently 3 participating banks and they are CIMB Bank Berhad, Maybank Berhad and TNG Digital Sdn Bhd (receipt of funds will be enabled at a later date).

More Singapore PayNow members and Malaysia DuitNow members may be onboarded to offer this service to their customers in the future. - Thailand (PromptPay) - There are currently 5 participating banks and they are Bangkok Bank, Bank of Ayudhya, Kasikorn Bank, Krungthai Bank and Siam Commercial Bank.

What is the error message if the recipient's mobile number is invalid? What if the recipient insists the mobile number is correct?

A pop-up on the app will appear with the message “Unable to pay or transfer”. Please make sure the recipient has registered the mobile number with one of the supported partners.

Can I also receive funds into my UOB account in Singapore from my counterparts of the participating countries?

Yes, you can. Simply ensure you are registered for PayNow via the mobile number on any of your UOB current or savings account.

Can I make an overseas funds transfer using the recipient's National ID number?

The Cross-border Fund Transfers service is only applicable for transfers via the mobile number.

Will I receive a notification on the overseas funds transfer transaction I have made?

Yes, you will receive notification via Push Notification to your UOB TMRW app for all incoming Cross-border Funds Transfer transactions.

Notification via email or SMS will be sent for all outgoing Cross-border Fund Transfers transactions, depending on your alerts setting. To update your alerts setting for outgoing transfer transactions, please login to PIB > Manage Alerts.

How is the foreign exchange rate determined?

You will be able to view the applicable foreign exchange rates prior to the transfer. The foreign exchange rates are closely benchmarked to prevailing market rates, converted to US Dollar before being converted to Singapore Dollar.