Overseas QR payments

Shop and pay cash-free when you travel

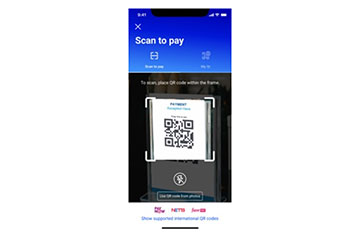

Now, you can enjoy more convenience and safety on your trips to Indonesia, Malaysia and Thailand. Simply look out for the participating QR logos (QRIS for Indonesia, DuitNow QR for Malaysia and PromptPay QR for Thailand) at the merchants in their respective countries and use UOB TMRW Scan to pay for your shopping and services.

What’s more, you get to enjoy zero transaction fees.

Benefits

Here are the benefits you’ll enjoy:

Zero transaction fees

Perform cross-border payments in participating countries with no transaction or admin fees

Convenience

Skip the queue! Save yourself the time and hassle of having to exchange currency before your trip to any of the participating countries

Cashless and safe

Just use Scan to pay on the app at merchants in the participating countries

Track your spending

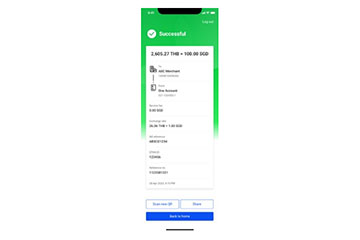

Keep up-to-date on all your foreign transactions with the UOB TMRW app

Going on a holiday? Skip the money changer and pay with UOB TMRW

Get up to 20% cashback* when you Scan to pay overseas

Scan to pay on your purchases at over 40 million touchpoints using UOB TMRW in Malaysia (via DuitNow QR), Thailand (via PromptPay QR) and Indonesia (via QRIS). No fuss, no fees!

Here’s how you can get up to 20% cashback*:

Step 1: Register your participation here

Step 2: Make a min. of three (3) Scan to pay QR payments with UOB TMRW in Malaysia, Thailand and Indonesia within a 3-month period.

*T&Cs apply. Valid till 31 Dec 2025. Capped at S$50 per customer.

Terms and conditions

Frequently asked questions

Frequently asked questions

Is the 20% cashback earned only applicable on the 4th overseas Scan to pay transaction?

No, it applies to all overseas Scan to pay transactions you’ve made on UOB TMRW so long as you’ve completed a min. of 3 of them.

Will the cashback be credited in the foreign currency of the overseas transaction(s) I made?

No, it will be in SGD and according to the amount you see deducted from your chosen account that was used to make the overseas transaction.

Do I need to notify the Bank once I meet the requirements?

No further action is required from you. Once we’re able to successfully verify your qualifying transactions, the UOB account(s) from which you made the overseas transaction(s) will be credited.

Are cross-border peer-to-peer transfers included in this campaign?

No, they are not part of the scope. Only peer-to-merchant transactions via UOB TMRW Scan to pay are.

What is overseas QR Payment?

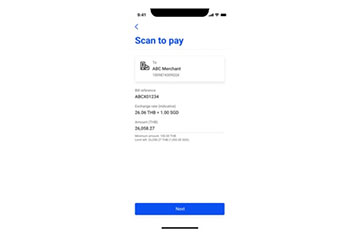

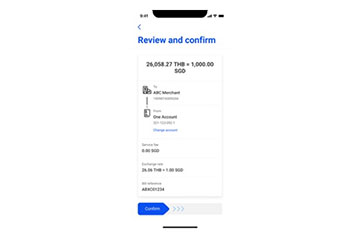

It is a service that allows UOB TMRW app customers to conveniently scan the respective QR code in participating countries (i.e. Indonesia, Malaysia and Thailand) to allow instant, secure and seamless payment to merchants when overseas.

Are there any fees payable to use the overseas QR Payment?

No fee is applicable for this service besides the foreign conversion charges.

Is there a transaction limit with overseas QR Payment?

There is a separate daily maximum limit of SGD 1,000 for each participating country. The daily remaining limit will be displayed on the app when a payment is initiated.

For overseas QR payment to Indonesia and Thailand, there is a minimum amount of IDR 1,000 and THB 100 respectively.

How do I know which are the merchants in Indonesia that will accept overseas QR Payment?

Please look out for the QR code with the QRIS acceptance mark on display at the merchant store front.

How do I know which are the merchants in Malaysia that will accept overseas QR Payment?

Please look out for the QR code with the DuitNow acceptance mark on display at the merchant store front with any of the 8 participating partners' logos.

How do I know which are the merchants in Thailand that will accept overseas QR Payment?

Please look out for the QR code with the PromptPay acceptance mark on display at the merchant store front with any or the 5 supporting partners (i.e. Bangkok Bank, Bank of Ayudhya, Kasikorn Bank, Krungthai Bank and Siam Commercial Bank).

I received an error message “This QR code is not supported.” while scanning the QR code.

This means the QR code is invalid or not supported by a participating partner. Please make sure you are scanning the right QR code acceptance mark.

Overseas funds transfer

Need to transfer funds to family and friends living abroad? Do it instantly on your phone with UOB TMRW.