Card payment modes

Here’s how you can make payment

UOB TMRW

Bill payments made convenient! ![]()

- Convenient: Pay swiftly and securely 24/7 from the comfort of your home, without the need to input your 16-digit card number. You can even schedule your bill payment!

- Secure: Bank anywhere and everywhere securely with a personalised digital token.

- Immediate: Avoid late payments. Pay your bills instantly anytime, anywhere.

Internet Banking / Phone Banking

Payment can be made via UOB Personal Internet Banking with your UOB Savings/Current account. ![]()

InterBank GIRO

Payment will be debited automatically 1 working day before the payment due date from your designated bank account as indicated in your InterBank GIRO (IBG) form. Please ensure sufficient funds in your bank account to avoid any returned GIRO fee. No payment reminder alerts will be issued for GIRO payment arrangements.![]()

S.A.M Machines / AXS

Payment may be made via NETS at Singapore Post Self-Service Automated Machine (S.A.M) or AXS.

For AXS, please note that payments on weekdays (after 5pm) or Saturday after 12 noon or Sunday/Public Holidays will be processed the next working day.

Cash

Cash payment is accepted at any of our local branches or UOB Cash Deposit Machines.

Please be informed that with effect from 1 Feb 17, all UOB branches will process credit card bill payments above S$2,000 only.

Here’s how you can make payment

UOB TMRW

Bill payments made convenient! ![]()

- Convenient: Pay swiftly and securely 24/7 from the comfort of your home, without the need to input your 16-digit card number. You can even schedule your bill payment!

- Secure: Bank anywhere and everywhere securely with a personalised digital token.

- Immediate: Avoid late payments. Pay your bills instantly anytime, anywhere.

Internet Banking / Phone Banking

Payment can be made via UOB Personal Internet Banking with your UOB Savings/Current account. ![]()

InterBank GIRO

Payment will be debited automatically 1 working day before the payment due date from your designated bank account as indicated in your InterBank GIRO (IBG) form. Please ensure sufficient funds in your bank account to avoid any returned GIRO fee. No payment reminder alerts will be issued for GIRO payment arrangements.![]()

S.A.M Machines / AXS

Payment may be made via NETS at Singapore Post Self-Service Automated Machine (S.A.M) or AXS.

For AXS, please note that payments on weekdays (after 5pm) or Saturday after 12 noon or Sunday/Public Holidays will be processed the next working day.

Cash

Cash payment is accepted at any of our local branches or UOB Cash Deposit Machines.

Please be informed that with effect from 1 Feb 17, all UOB branches will process credit card bill payments above S$2,000 only.

Eligible Banks:

- Citi Bank Bill Payment Organizations

- DBS/POSB Bank Bill Payment Organizations

- HSBC Bank Bill Payment Organizations

- OCBC Bank Bill Payment Organizations

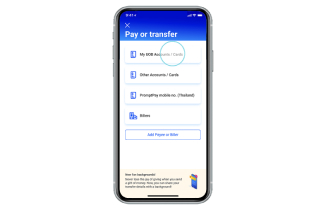

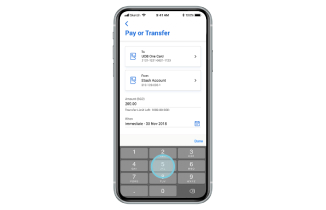

UOB TMRW

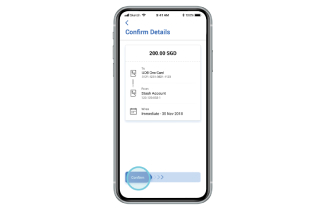

| How to pay via UOB TMRW: | |

|

Step 1: Login to TMRW and select "Pay/Transfer" |

|

Step 2: Select "My UOB Accounts / Cards" and select the card you would like to make payment for |

|

Step 3: Enter the amount you wish to pay, or choose between making a minimum or full payment. You can even schedule your payment |

|

Step 4: Review the details and slide the "Confirm" button to complete your payment |

Internet Banking / Phone Banking

Payment can be made via UOB Personal Internet Banking with your UOB Savings/Current account.

Here's how:

- Login to Personal Internet Banking

- Click on 'Pay Bills' under 'Pay and Transfer' from the panel on the right

- Click on 'My Credit Card Bills' tab and select the credit card you would like to make payment for

- Select the payment amount option from 'Pay min.' or 'Pay full' or 'Other amount' to enter an alternative amount.

- The payment date is defaulted as the date of request. For other dates selection, please tap on the calendar icon.

- Select the Debiting account and click on 'Continue'

- In the confirmation screen, check all details and click on 'Confirm' Your bill payment is completed!

Payment may also be made by UOB Phone Banking service at 1800 22 22 121 (24-hour) with your UOB Phone Banking PIN.

ATM

Payment may be made with your UOB Savings/Current account(s); or a DBS/POSB/OCBC ATM/Debit Card at any UOB ATM islandwide.

When using other banks’ card:

- Press any key and select “UOB Credit Card Payment”

- Select “UOB Account(s)” or “DBS/POSB/OCBC Account”

- Insert your UOB Credit Card or enter your UOB Credit Card number

- Follow the onscreen instructions to complete the transaction

InterBank GIRO

Note: If you wish to make any advance payment via other mode to release your available credit limit, please make the payment 5 working days before the payment due date to avoid the GIRO deduction.

Things you should know

Note:

If you have a total outstanding Card Account balance of S$10 and below, statement will not be generated for the month. Late charge and interest charge will not be levied.

Explore more with UOB

Explore more with UOB

Card services

Card services

Report lost / stolen card

Call 1800-222-2121 (local) or +65 6222 2121 (from overseas)

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.