Foreword

As we stepped into 2025, we anticipated that sweeping global changes would bring both challenges and opportunities, and that outlook has certainly held true.

Looking ahead, we expect market turbulence to persist until there’s more clarity around US tariff policies and their ripple effects on growth, inflation, and interest rates. That said, amidst the uncertainty, the global economy has shown remarkable resilience. Growth may be slower, but it’s steady. With signs that the peak of US policy uncertainty may be behind us, alongside tax cut initiatives and more supportive stances from central banks, there’s reason to be cautiously optimistic about the second half of the year.

The road ahead has its bumps. But it also offers meaningful opportunities. That’s why staying diversified is more important than ever, to help balance potential gains with stability. We encourage investors to stay nimble, actively manage their portfolios, and ensure their strategies align with their risk appetite and long-term goals.

We hope our 2H 2025 Investment Outlook not only offers valuable insights but also equips you with strategies to seize what’s next. We’re here to support you on your wealth journey and build a stronger financial future together.

Jacquelyn Tan

Managing Director

Head, Group Personal Financial Services

Overview

Key themes to watch

Impact of Trump 2.0

President Trump’s return has resulted in more unpredictable US policies. Aggressive tariffs are disrupting global trade and raising inflation risks. Despite volatility, markets are adjusting, and resilience suggests peak uncertainty may be behind us. Looking ahead, proposed tax cuts and deregulation could support corporate earnings.

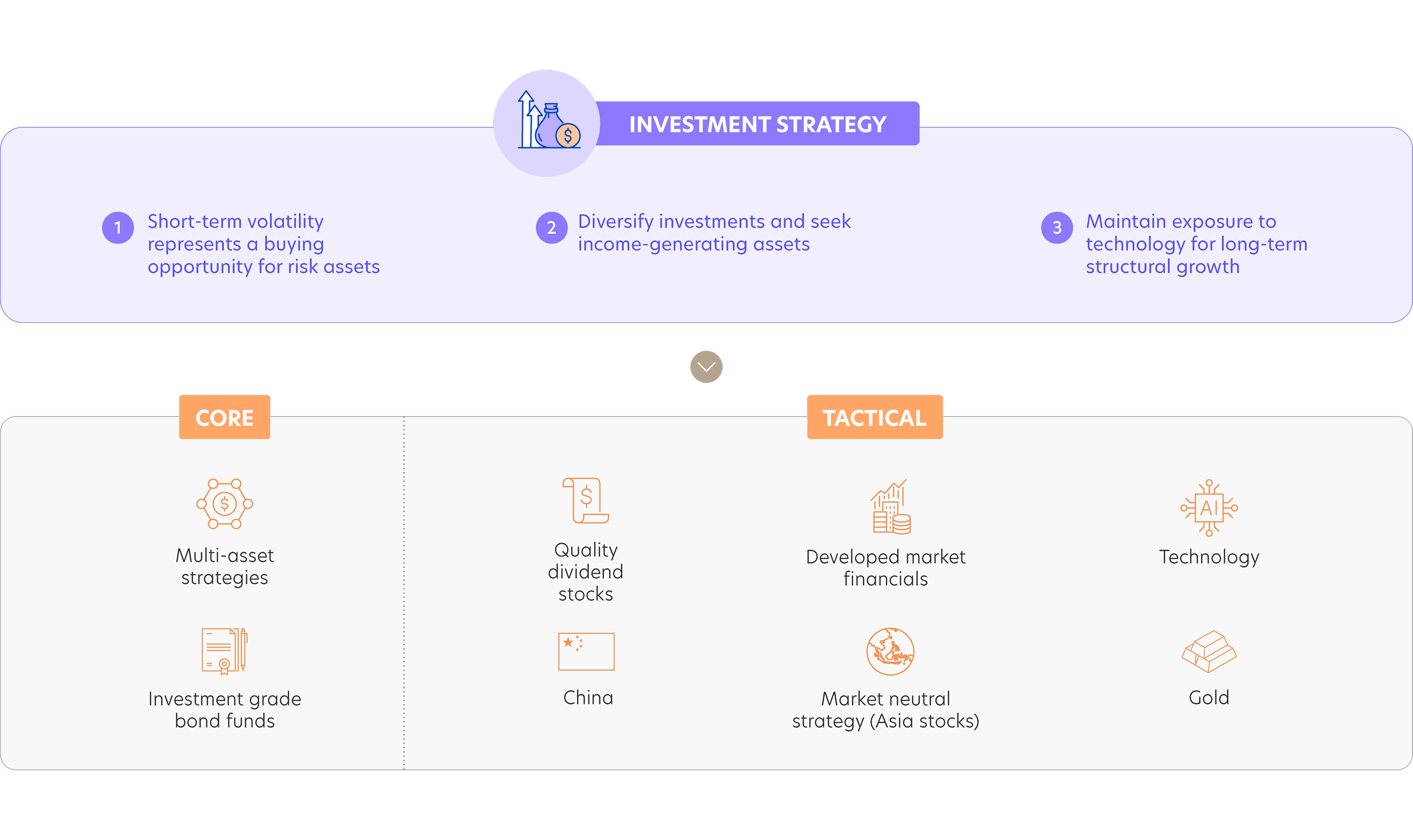

Brief phase of slower economic growth

Global growth is moderating due to trade disruptions, policy shifts, and evolving consumer behavior, but a recession is not expected. Seasonal volatility can be expected in 3Q 2025, but this may be an opportunity to accumulate Core and Tactical investments to position for potential strength in 4Q 2025. Diversification remains key to navigating this transitional phase.

Rising artificial intelligence (AI) adoption

AI has evolved into a structural growth engine, moving beyond hype to widespread adoption across industries. As costs fall and applications expand, investment is shifting from hardware to real-world AI solutions. Despite global uncertainties, AI remains a compelling structural theme for investment portfolios.

What you can do

Source: UOB PFS Wealth Management Advisory (20 June 2025)

Credits

Credits

Managing Editor

- Gidon Jerome Kessel

Singapore and Regional Head,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team

- Abel Lim

Head of Wealth Management Advisory and Strategy,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team (cont’d)

- Tan Jian Hui

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Low Xian Li

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Zack Tang, CMT, CFTe

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Low Jia Ling (Intern)

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.