Economic Outlook

Economy

Confidence in the global economy has strengthened over the past six months, driven by growth in the United States (US), stabilisation in the Eurozone and United Kingdom economies, and an economic recovery in China.

The International Monetary Fund (IMF) has raised its forecast for global economic growth to 3.2% for this year, citing strength in the US and emerging market economies.

Source: Bloomberg (31 May 2024)

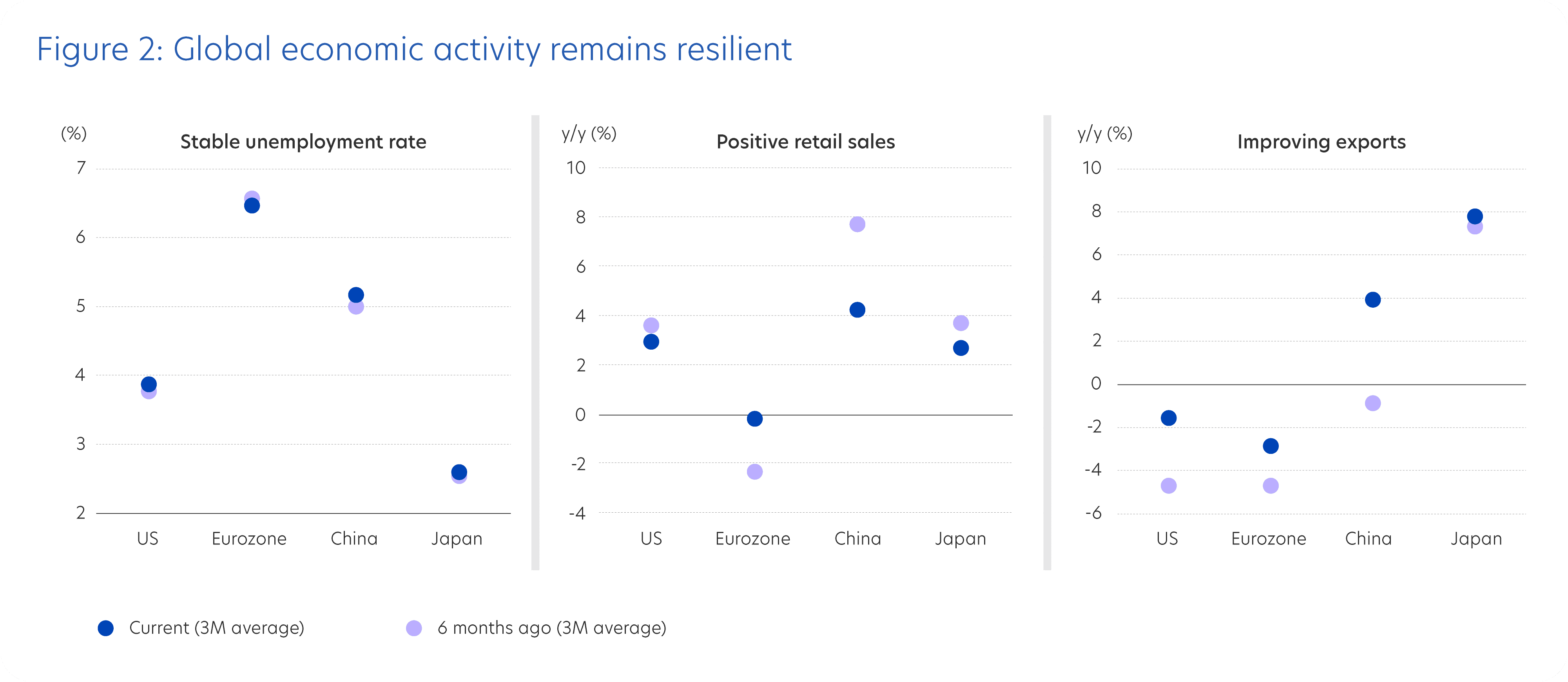

The global economy has proven to be more resilient than expected despite high interest rates, geopolitical tensions, and persistent inflation (Figure 2). A strong labour market with stable unemployment in all four major economies for the last six months is key. Wage growth continues to be elevated due to tight labour supply, supporting consumer spending which in turn helps the services sector to grow.

Recovery in global manufacturing has gathered momentum in the first half of 2024 and looks likely to continue for the rest of the year. This is due to robust global demand and an improvement in the semiconductor and electronics industries. US-China rivalry has also led to shifts in supply chain benefitting other countries with established production capabilities.

A brighter export outlook is likely to continue with global trade expected to pick up in the second half of this year once central banks cut interest rates. Risk of the US imposing fresh trade tariffs and restrictions on China after the US presidential election may also cause a pre-tariff surge in global trade as companies accelerate goods shipments to avoid higher tax duties. Export-dependent economies stand to benefit in the meantime, and we have already seen signs of improvement in parts of Asia.

We should still remain cautious of risks ahead. Persistent inflation and high interest rates will impact household disposable incomes over time. Companies with more debt may also postpone investments. Moreover, geopolitical tensions continue to linger while the US presidential election at the end of the year will be a distraction.

However, the expectation of interest rate cuts later this year can mitigate some of the risks mentioned above.

Inflation

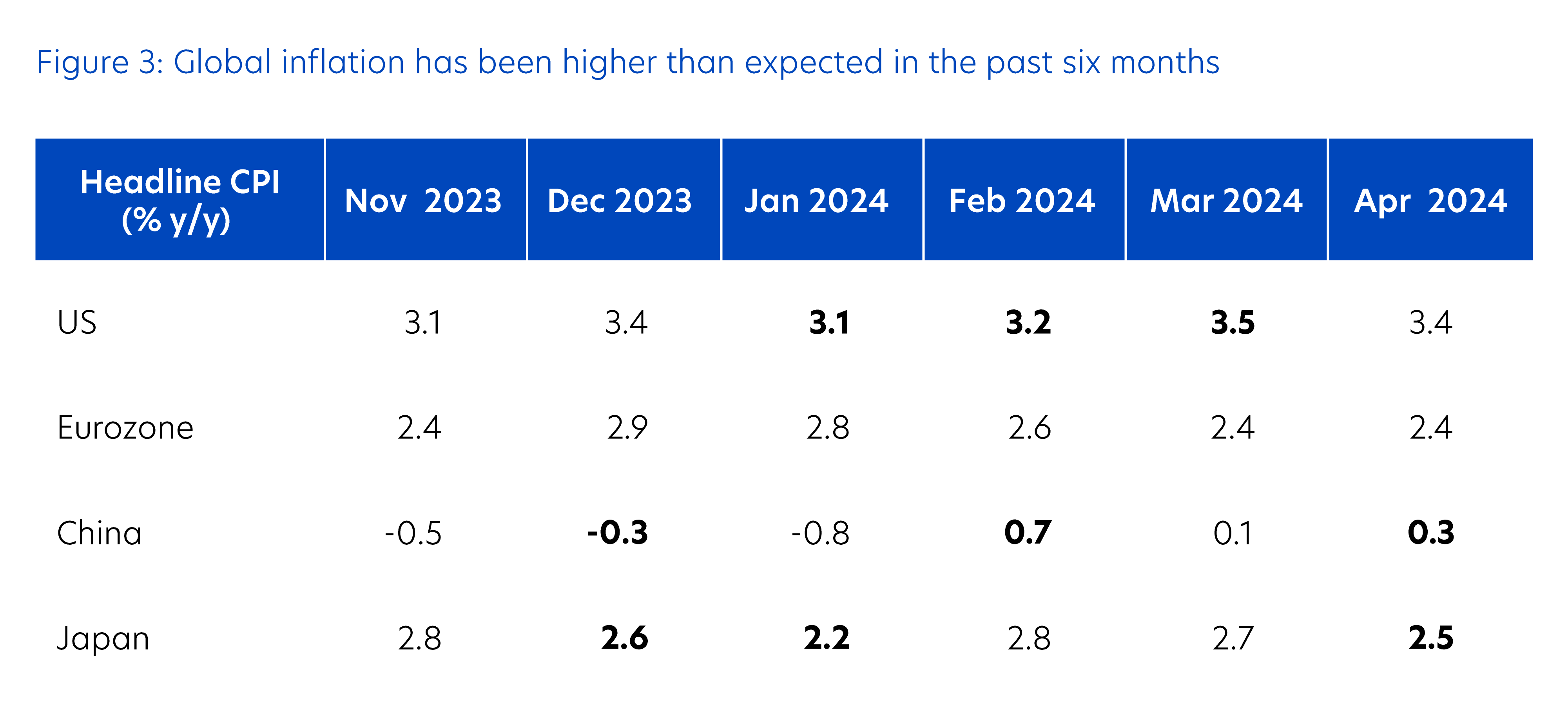

Inflation remains the most important part of the economic puzzle, impacting monetary policy. Investors headed into 2024 expecting inflation to ease further but progress has been slow.

Inflation has proven to be more persistent than expected over the first half of this year (Figure 3). A resilient economy and strong labour market have kept prices high. In some countries, shelter costs have also stayed elevated due to low supply. Manufacturing prices may also increase in the coming months if commodity prices rise.

Geopolitical conflicts, supply constraints and increased demand have raised oil prices, while abnormal weather patterns have caused supply disruptions and higher prices for agricultural commodities.

Numbers in bold show months when headline inflation was higher than expected.

Source: Bloomberg (31 May 2024)

In the second half of 2024, we expect inflation to ease slightly but remain above the 2% level that most central banks target. If the labour market remains resilient and wage growth stays high, services inflation will continue to be persistent. High commodity prices will also increase goods prices, compounding the difficulty in bringing inflation down towards 2%.

Considering these factors, while we expect inflation to gradually slow, achieving the 2% target may take longer than initially expected.

Central Bank Policies

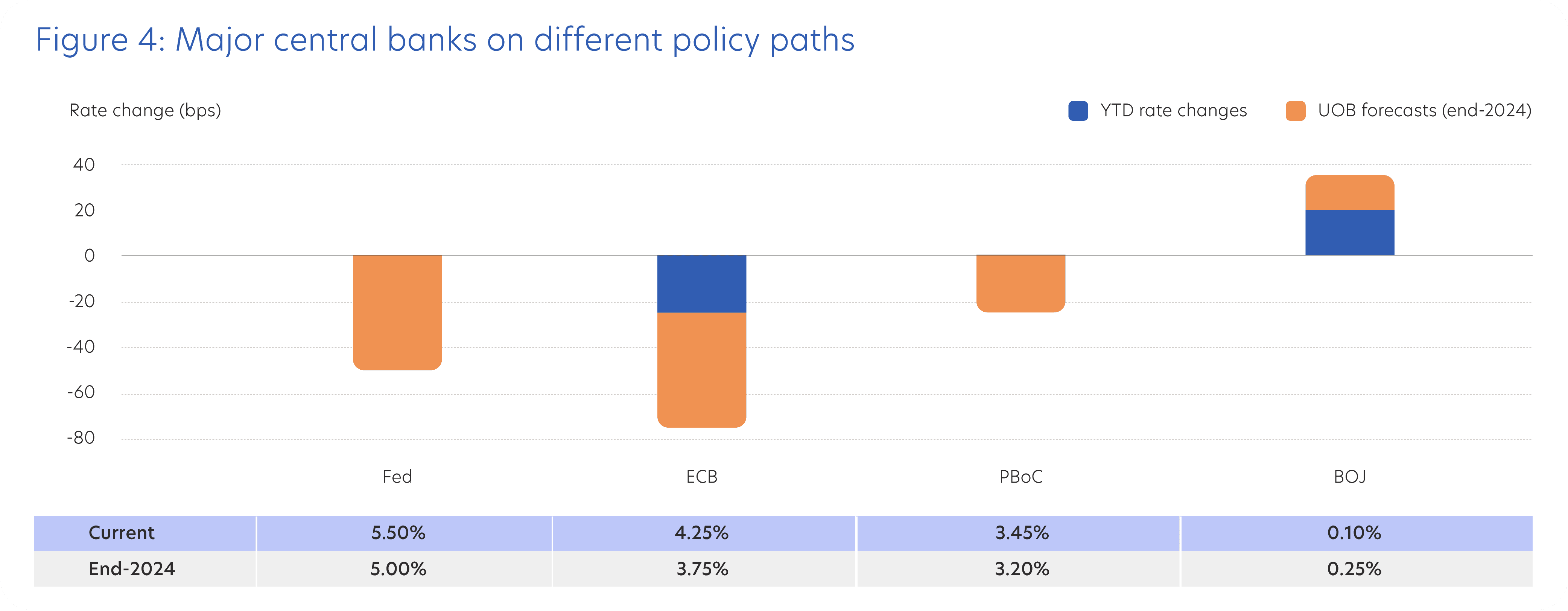

Central banks face difficult choices over the coming months. They would like to cut interest rates to ease the burden of high borrowing costs on companies and households. However, a strong labour market, resilient economy and persistent inflation have caused some central banks to become cautious about cutting rates.

Global central banks have adopted a data-dependent approach. For countries experiencing persistent inflation, central banks will find it challenging to cut rates soon, resulting in a prolonged high interest rate environment. However, for countries where inflation has slowed more noticeably, their central banks have been able to start cutting interest rates.

As such, central bank policy decisions will not be synchronised (Figure 4), and there may be a divergence in interest rate paths across different countries.

Fed refers to Fed Funds Target Rate – upper bound. ECB refers to main refinancing rate. PBoC refers to 1-year loan prime rate. BOJ refers to short-term policy rate – upper bound.

Source: Bloomberg, UOB Global Economics & Market Research (14 June 2024)

Japan, Taiwan and Indonesia have raised interest rates recently to combat stubborn inflation and bolster their local currencies.

On the other hand, the European Central Bank (ECB), Bank of Canada (BOC), Swiss National Bank (SNB) and Sweden’s central bank (Riksbank) have already cut interest rates. It is also expected that China’s central bank (PBoC) will need to cut interest rates this year, along with lowering the reserve requirement ratio (RRR) to support China’s economy.

Emerging market central banks, which were early adopters of interest rate hikes in 2021, have generally been more successful in controlling inflation, and some have begun cutting interest rates.

The US Federal Reserve (Fed) was previously anticipated to lead the rate cut cycle, but now appears likely to keep rates high for longer. Investors expect the first rate cut to only occur later this year due to persistent US inflation. We expect the Fed to cut interest rates by 50 basis points (bps) this year, through two 25 bps reductions in September and December.

Asian central banks will closely monitor the Fed’s policy moves and may choose to cut interest rates only after the Fed does so. This is to prevent further currency depreciation and unruly capital outflows that could trigger financial system instability.

Country Focus

United States

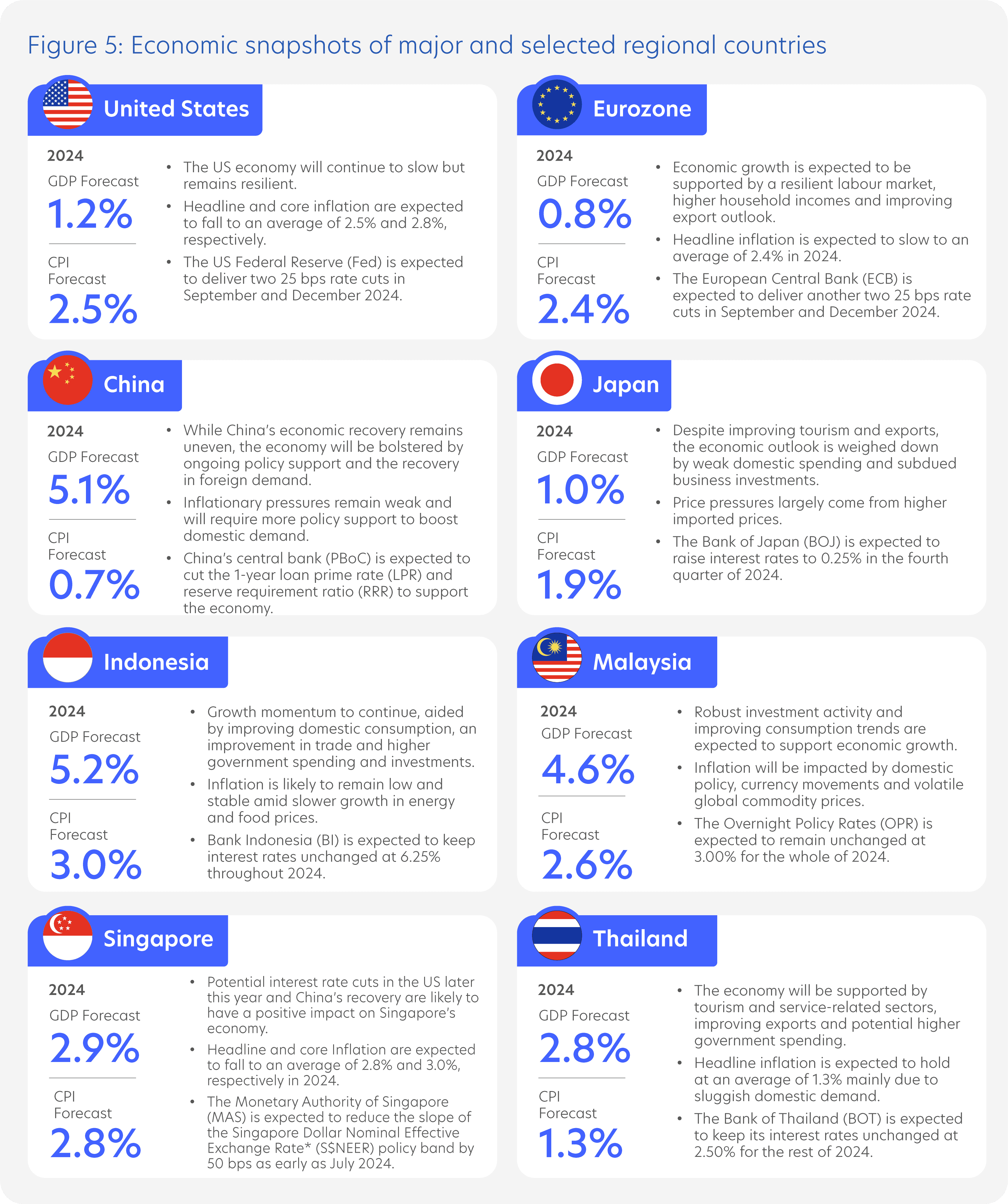

The United States (US) economy has slowed slightly but remains resilient, with a strong labour market offsetting the impact of high interest rates. While some moderation is expected in the second half of 2024, US growth is likely to stay robust. Economic growth is projected at 1.2% in 2024 before re-accelerating to 2.5% next year.

Although the labour market has cooled slightly, it remains robust. Layoffs have been stable over the past year, and job vacancies are still above pre-pandemic levels. Balance in demand and supply in the US labour market is returning to normal after pandemic-related distortions.

The outlook for the services sector remains positive, with growth expected to pick up in the summer months until the year-end holiday season. Despite high interest rates and the depletion of excess household savings, US consumption continues to expand. Spending is supported by positive real wage growth and healthy household finances with households seeing strong gains in net wealth post-pandemic.

Household debt to income remains relatively low, and consumption is less dependent on borrowing compared to the past. While consumer credit delinquency rates have increased, they are rising from extremely low levels seen during the pandemic and do not pose an immediate concern. Considering these factors, the outlook for US consumption remains positive in the near term.

Inflation has not slowed smoothly due to elevated wage growth, persistent services prices and high housing costs. Nonetheless, inflation is expected to cool, with headline Consumer Price Index (CPI) likely to average 2.5% this year compared to 4.1% in 2023.

The US Federal Reserve (Fed) is looking for more evidence of slowing inflation before they gain confidence to cut interest rates. It believes that the trend of slowing inflation has been delayed but not derailed and expects to lower borrowing costs this year. We expect the Fed to cut interest rates by 50 basis points (bps) this year, with two 25 bps reductions in September and December. However, rate cuts may be delayed if inflation does not slow as expected.

Eurozone

The Eurozone economy has recovered from a shallow recession, with growth prospects improving due to a manufacturing recovery in Germany and economic expansions in France, Italy and Spain. The labour market has been resilient, with the Eurozone unemployment rate at a record low.

Economic recovery is expected to continue throughout the year as household incomes rebound and the export outlook improves. We project Eurozone economic growth will accelerate to 0.8% this year and 1.4% in 2025.

The European Central Bank (ECB) reduced interest rates by 25 bps in June but did not commit to further rate cuts. Instead, the ECB will adopt a data-dependent and meeting-by-meeting approach for future policy decisions. The main concern is a potential re-acceleration in Eurozone inflation, particularly with wage growth elevated around 5%. If this trend persists, the ECB will be more cautious about additional rate cuts.

Assuming inflation slows as expected in the coming months, we anticipate the ECB to lower rates two more times this year by 25 bps in September and December each.

China

China’s economy appears to have stabilised due to improved exports and manufacturing production. Exports are likely to remain the main growth driver this year. Companies will also look to speed up overseas shipments in the near term ahead of the threat of higher US tariffs should Donald Trump return to the White House.

To stimulate the economy, the government has announced plans to promote large-scale equipment renewals and the trade-in of consumer goods. Funding will also be provided to spur semiconductor self-reliance and technological innovation, as well as boost education, healthcare and other areas of national importance.

The property sector continues to face long-term structural issues. However, the Chinese government has introduced support measures, including providing liquidity through state banks and launching a CNY300 billion program that allows state-owned enterprises (SOEs) to purchase unsold properties to convert to social housing. Many provincial governments have also lowered the minimum downpayment requirement for property purchases and removed the mortgage rate floor. Nonetheless, a full recovery in property sector sentiment may require more policy measures by the Chinese government.

A recovery in domestic consumption is seen to be the missing piece in China’s economic puzzle. The Chinese population has been avoiding big-ticket purchases and has prioritised spending on travel instead. As the Chinese have large household savings, domestic consumption should recover if the Chinese government unveils more stimulus measures, and if local stock market sentiment as well as the housing market improves.

We expect China’s 2024 economic growth to be 5.1%, matching the Chinese government’s growth target of “around 5%” for this year. The upcoming Third Plenary Session in July will be closely watched for potential policy announcements. China’s inflationary pressures remain weak, and a revival of price pressures will require more government measures to boost domestic demand.

In addition to fiscal policy support, we anticipate that China’s central bank (PBoC) will cut its 1-year loan prime rate (LPR) by 25 bps to 3.20% by year-end, along with a potential 50 bps reduction in the reserve requirement ratio (RRR) to support the economic recovery.

Japan

Japan’s economy has experienced mixed fortunes so far this year. The positives come from an improvement in exports, while the services sector has been supported by an influx of foreign tourists.

However, domestic consumption has disappointed with real wage growth negative since April 2022, weighing on household disposable income. Consumer confidence has also been dented by a weak Japanese Yen (JPY) contributing to higher imported prices, while an ageing and declining population is also impeding private consumption. While semiconductor companies have accelerated capital expenditure, other businesses have become less inclined to spend on investments given weak domestic demand and higher prices.

The growth outlook will continue to be clouded by weak domestic demand and we expect Japan’s 2024 GDP to be subdued at 1.0%. Japan’s price pressures will largely stem from higher imported prices.

In March, the Bank of Japan (BOJ) ended negative interest rate policy (NIRP) after eight years, ended its purchase programme of exchange-traded funds (ETFs) and Japanese real estate investment trusts (J-REITs), as well as yield curve control (YCC)![]() policy. At the 31 July policy decision, we expect the BOJ to reduce Japanese government bond (JGB) purchases from JPY6 trillion per month to JPY5 trillion per month. As for interest rates, we forecast the BOJ to gradually raise the short-term policy rate from 0.1% to 0.25% in the fourth quarter of 2024.

policy. At the 31 July policy decision, we expect the BOJ to reduce Japanese government bond (JGB) purchases from JPY6 trillion per month to JPY5 trillion per month. As for interest rates, we forecast the BOJ to gradually raise the short-term policy rate from 0.1% to 0.25% in the fourth quarter of 2024.

*Singapore Dollar Norminal Effective Exchange Rate (S$NEER) is a policy tool used by the Monetary Authority of Singapore (MAS) to manage the exchange rate of the Singapore Dollar.

Source: UOB PFS Investment Strategists, UOB Global Economics & Market Research (14 June 2024)

Asset Class Views

Stocks

Global stock markets have performed well over the first half of 2024 and are poised to continue their gains in the second half of the year. The S&P 500 Index has rallied 14.7% year-to-date due to strong corporate earnings. The MSCI Asia ex-Japan Index has also risen 7.9% so far this year.

Although central banks may postpone or reduce the magnitude of interest rate cuts this year, high borrowing costs and sticky inflation are expected to have a smaller impact on stock markets over the next six months. Primary drivers of stock market returns will increasingly be fundamentals such as fiscal policy, economic growth and corporate earnings, rather than interest rate expectations. This is because a resilient economy leads to growing corporate profits, enabling stock markets to gradually rise.

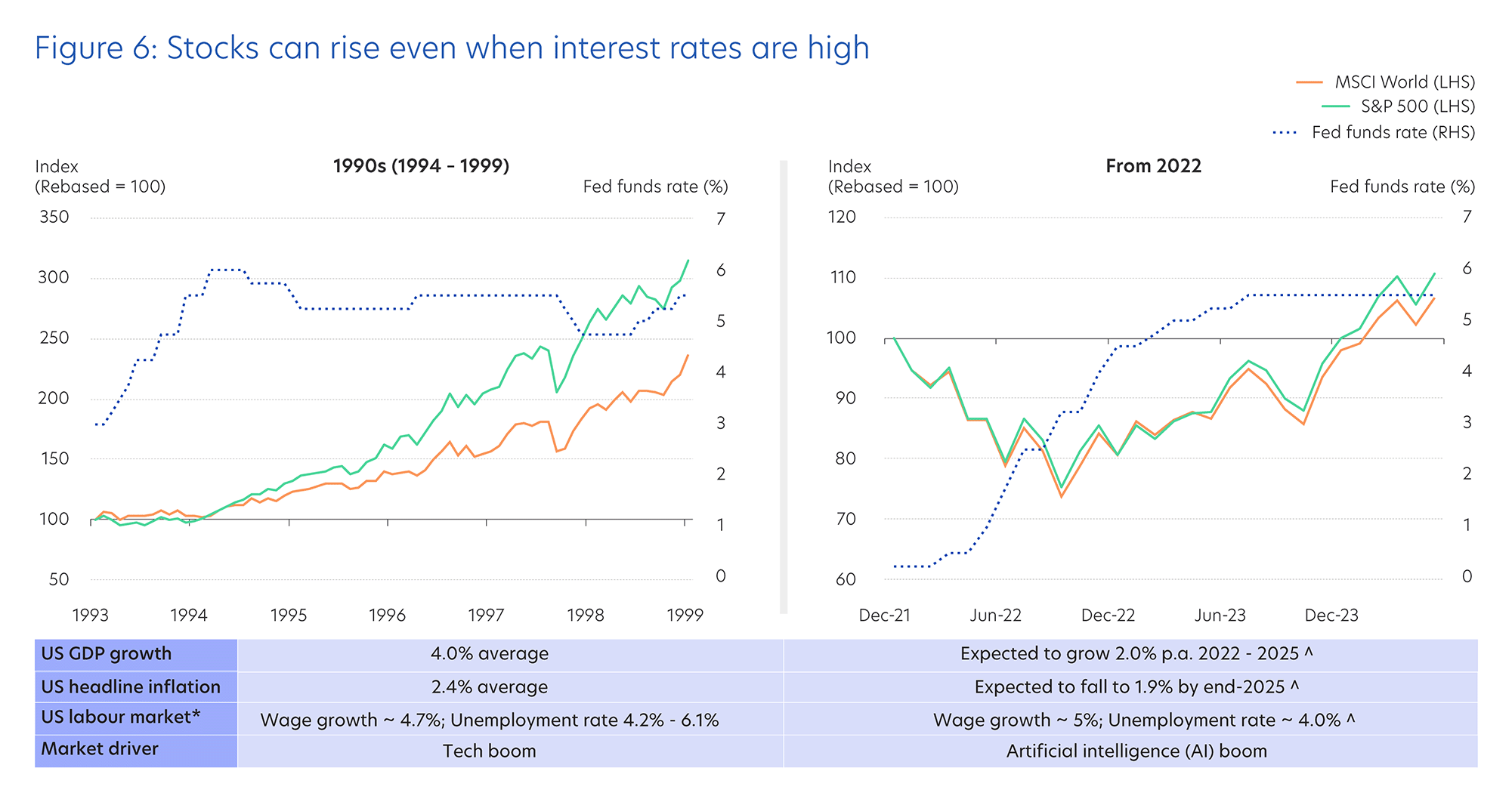

Parallels can be drawn with the 1990s, when global stocks rallied despite years of high inflation and high interest rates. There are similarities in economic growth, headline inflation, labour market indicators, as well as market drivers between the 1990s and today (Figure 6). They arise from economic strength, strong labour markets and technological advancements. Global stock markets rallied for most of the 1990s despite high interest rates, and this trend is likely to be repeated now for the same reasons.

* Due to data limitation, 1990s wage growth is based on Average Wage Index for 1994-1999. Wage growth from 2022 is based on average hourly earnings.

^ Based on UOB forecasts.

Source: Bloomberg, US Social Security Department, UOB Global Economics & Market Research (7 June 2024)

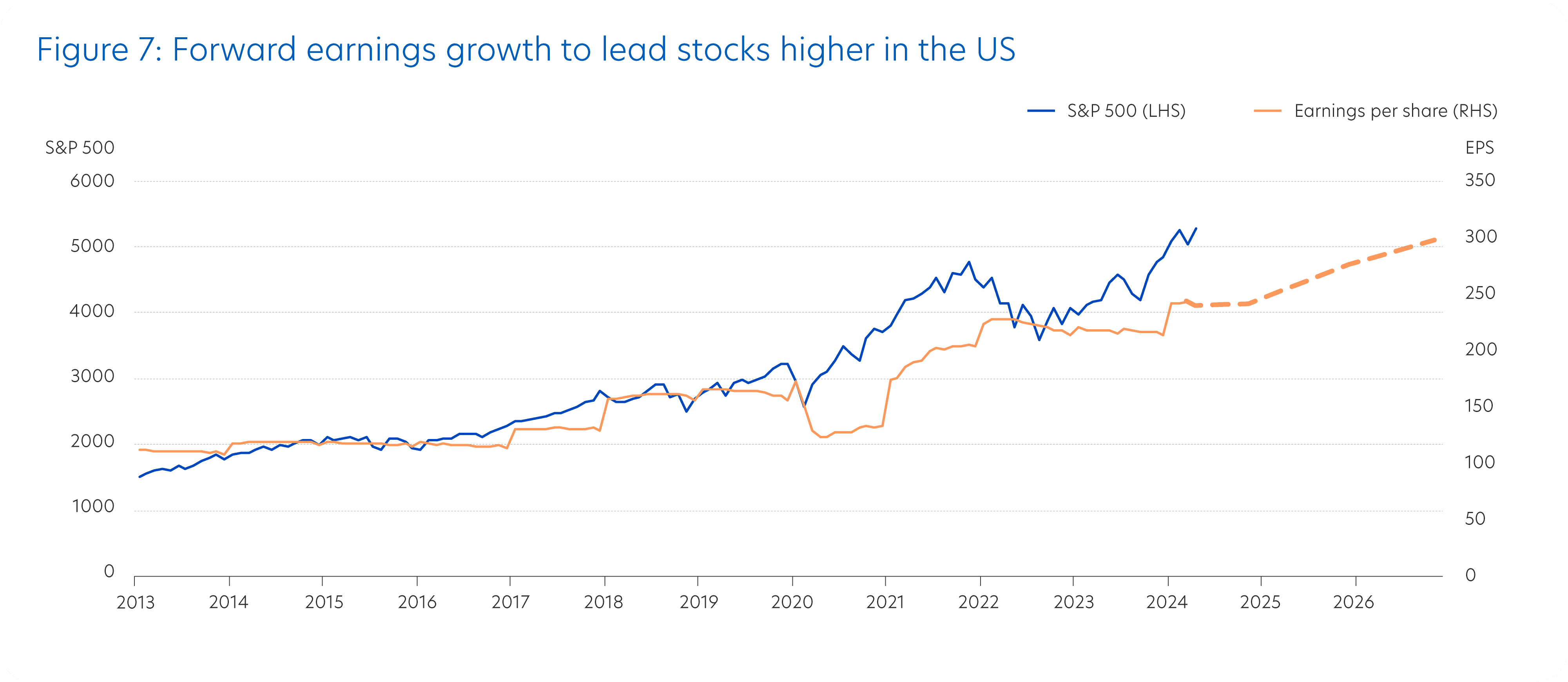

In the United States (US), earnings per share (EPS) growth is expected to improve until the first quarter of 2025 (Figure 7). Financial conditions![]() have also loosened since November 2023

have also loosened since November 2023 ![]() . Potential interest rate cuts, a manufacturing recovery and the artificial intelligence (AI) investment cycle can also potentially support US stocks.

. Potential interest rate cuts, a manufacturing recovery and the artificial intelligence (AI) investment cycle can also potentially support US stocks.

Earnings per share (EPS) is a key indicator to measure a company's financial health and profitability for each stock. Dotted line represents forecast data by analysts.

Source: Bloomberg (31 May 2024)

High interest rates are a reflection of resilient economic growth and rising corporate earnings are expected to support global stock markets. Given this backdrop, it is important to be invested to stay ahead of inflation.

However, portfolio diversification is becoming increasingly crucial to capture shifts in market trends. While the AI theme has been a key driver of stock market gains over the past year, there are opportunities in other attractively valued stocks whose earnings growth is expected to accelerate in a resilient economy.

Diversifying across regions can also be beneficial.

European stocks have delivered solid performance in recent months, supported by attractive valuations and a higher proportion of value stocks. There may be short-term market volatility associated with the French legislative election that ends on 7 July, but we do not expect sustained impact. A recovery in the Chinese economy provides a boost, since China is a significant market for European luxury goods, automakers and miners. An improving outlook for the Eurozone economy is expected to further support European stock markets. Moreover, stock valuations are currently below their 10-year average, while earnings projections are improving.

Asian stock markets are also well positioned to benefit from attractive valuations and robust regional economic growth, as well as a brighter export outlook and higher corporate earnings potential. As China’s outbound travel numbers are projected to rebound to 84% of pre-pandemic levels this year, tourism-related stocks across Asia stand to benefit.

Sentiment towards Chinese and Hong Kong stocks has improved since late January, underpinned by attractive valuations and dividends. Furthermore, with the US Federal Reserve (Fed) delaying rate cuts, investors may shift their focus to Chinese stocks that trade at deep discounts to their US peers, especially considering that investor allocation to Chinese stocks is relatively low. Chinese stocks are also less affected by the Fed’s policy decisions since China’s central bank (PBoC) is expected to ease monetary policy.

Following China’s State Council guidelines in April, Chinese large-cap companies have started placing greater emphasis on increasing shareholder returns through stock buybacks and higher dividends. China has specifically been aiming to boost valuations of state-owned enterprises (SOEs), with the government’s SOE value-up program being a key component of this approach. There is growing evidence that SOE managements are making efforts to comply, which has led to the outperformance of Chinese SOE stocks this year.

Enhancing investment income is one key strategy in the coming months, and you can complement investment grade bonds with quality dividend-paying stocks. Notably, Asia ex-Japan dividend-paying stocks have outperformed their global peers year-to-date while offering the highest dividend payouts. We believe this trend will continue for the remainder of the year.

Bonds

The bond market outlook heavily depends on economic trends. If the economy remains resilient and inflation stays elevated, the Fed and other central banks will need to delay or deliver fewer interest rate cuts. In this scenario, bond yields may remain high or even increase in the short term.

Bond market volatility may also increase towards the end of this year if Donald Trump wins the US presidential election. Since Donald Trump will likely pursue expansionary fiscal policies and tax cuts, the US Treasury Department may need to issue more bonds to fund an expanding budget deficit.

Despite potential short-term volatility, bonds provide attractive total returns over a long-term investment horizon due to appealing bond yields and the possibility of capital appreciation when more central banks lower interest rates.

We continue to favour investment grade (IG) bonds in both developed markets (DM) and emerging markets (EM). They offer consistent and attractive income, and can stabilise portfolios if unexpected economic weakness occurs.

Foreign Exchange and Commodities

The US dollar (USD) may stay supported until the Fed lowers interest rates. However, we anticipate the USD to weaken by year-end as it loses its interest rate advantage once the Fed begins easing monetary policy. Moreover, rate cuts will lead to a broadening of global economic growth momentum, ultimately weakening the USD.

Asian governments have been worried about weaker domestic currencies due to the USD’s unexpected strength. Certain Asian countries even intervened in the foreign exchange market to defend their currencies. For example, Indonesia’s central bank increased interest rates to bolster the Indonesian Rupiah (IDR). We expect Asian currencies to recover moderately in the second half of 2024 as China’s improving economic outlook should support the Chinese Yuan (CNY) and Asian currencies.

Gold price has climbed this year despite headwinds from a strong USD and high interest rates. Ongoing geopolitical tensions, central bank purchases and strong demand from Chinese investors have contributed to the rally of the precious metal.

We retain a positive outlook on Gold as it benefits when the Fed cuts interest rates. We expect Gold to rise to USD2,500 per ounce by the fourth quarter of 2024 and USD2,600 per ounce by the first quarter of 2025. In periods of heightened geopolitical tensions and higher volatility, Gold can serve as a portfolio stabiliser due to its safe-haven status. Gold is also often seen as a diversifier as it historically tends to move independently of stocks and bonds, and can help lower portfolio risk. Furthermore, Gold can serve as a hedge against the loss of purchasing power during currency depreciation or economic instability.

As for crude oil, we maintain a modestly positive outlook given ongoing geopolitical tensions. Brent crude oil is forecast at USD85 per barrel for the fourth quarter of 2024 and USD90 per barrel for the first quarter of 2025. OPEC+![]() reached an agreement to continue its supply cut of two million barrels per day in the third quarter of 2024, but oil production will be gradually restored over the following 12 months starting from October. Nonetheless, this supply restoration is aspirational and non-binding, and OPEC+ may retain their production cuts if oil prices fall.

reached an agreement to continue its supply cut of two million barrels per day in the third quarter of 2024, but oil production will be gradually restored over the following 12 months starting from October. Nonetheless, this supply restoration is aspirational and non-binding, and OPEC+ may retain their production cuts if oil prices fall.

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management

Personal Financial Services

Editorial Team

- Abel Lim

Singapore Head,

Wealth Management

Advisory and Strategy - Michele Fong

Head, Wealth Advisory and Communications

Editorial Team (cont’d)

- Tan Jian Hui

Investment Strategist,

Investment Strategy and Communications - Low Xian Li

Investment Strategist,

Investment Strategy and Communications - Zack Tang

Investment Strategist,

Investment Strategy and Communications - Sarah Sng

Intern

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.