News and announcements

Scam Alerts

Scam alert: 12 July 2025

Investment Scam

Red flags of an Investment Scam

- Promises of high returns at low or no risk.

- Involvement of pressure tactics (e.g. time-limited promotion)

- Dubious and unverified track record (i.e., not listed on MAS’s listing of registered financial institutions, representative and investor alert list).

- Offer of commissions and early profits as incentive to pursue investment opportunities.

Remember these tips to help you #BeCyberSavvy:

- Verify the investment opportunity.

- Check that the entity is regulated by referring to resources from MAS (e.g., Financial Institutions Directory, Register of Representatives, Investor Alert List).

- Do not immediately act on requests for sensitive and personal information without prior verification.

- Beware of unsolicited offers.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Scam alert: 17 Apr 2025 and 1 July 2025

Impersonation Scam

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 62550160. Listen carefully and select the appropriate option to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking/ UOB TMRW app or Credit & Debit Cards or Both.

Remember these tips to help you #BeCyberSavvy:

- Always verify the legitimacy of information by checking with official source.

- Always verify the website that you are browsing. Lookout from misspellings or unusual domain.

- Check out the reviews of the ecommerce seller / buyer.

- Do not accede to ecommerce seller / buyer’s request to click on links or sideload application into your device.

- Do not disclose your personal or banking information (card details, OTPs, credit card or ATM Pin) to anyone.

- Card or ATM pin is not needed for online purchases.

- Pay attention to any suspicious SMS OTPs received.

- Report any fraudulent transactions to your bank immediately.

- Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

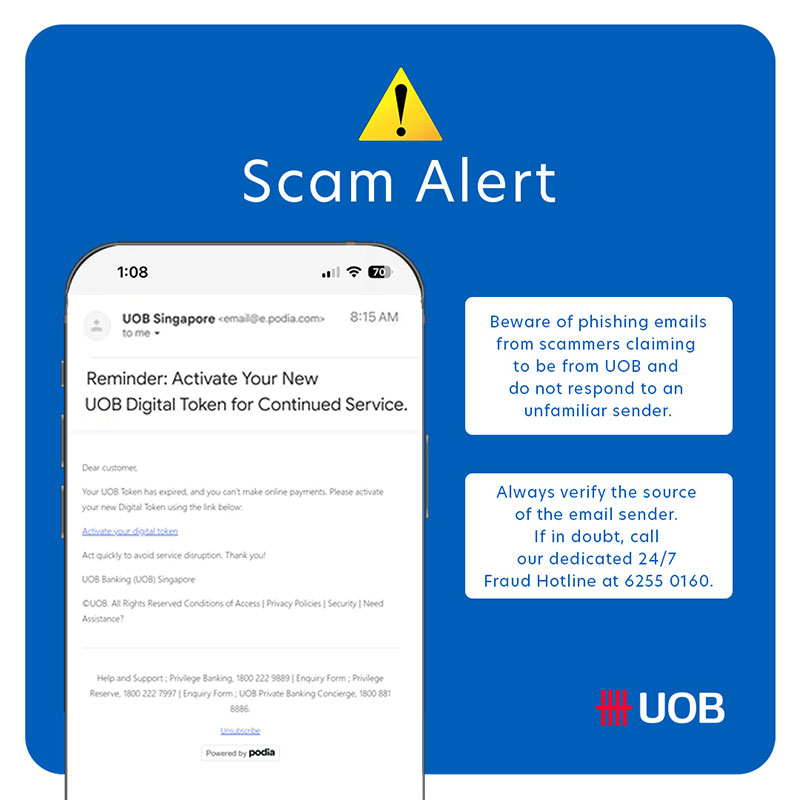

Scam alert: 14 Jan and 27 Jun 2025

Phishing Scam

Beware of phishing emails from scammers claiming to be from UOB requesting you to activate your Digital Token via email. As scammers may be spoofing our UOB official email address to trick you into clicking on the phishing link, ensure that you verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address.

Remember these tips to help you #BeCyberSavvy:

1. Do not click on suspicious links provided in unsolicited emails.

2. If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

3. Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

4. The Bank will not send email or clickable link to activate or reactivate digital token.

5. Activate Money Lock on UOB TMRW app to protect your account balances by restricting unauthorised withdrawals from being made on your account. Simply go to ‘Services’ tab > Select ‘Money Lock’.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.