The Travel Insider

Southeast Asia's first one-stop travel portal designed for UOB Cardmembers. Inspire, plan, and book your next adventure with UOB Cards.

Find out moreFeatured

Apply for UOB One Account online and get up to S$260 cash

Skip to higher interest of up to 3.4% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out moreCard Privileges

Cross over to your favorite deals in JB with UOB Cards

Tap your way to 0% FX fees, cashback on MYR spend and instant savings with UNI$ redemption.

Find out moreFeatured

Borrow services

Balance Transfer

Get instant cash at 0% interest and low processing fees. Choose from 3, 6 and 12-months tenor.

Find out moreFeatured Solutions

Your access to Private Bank CIO’s expertise

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

UOB TMRW

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

-

you are in Personal Banking

For Individuals

Wealth BankingPrivilege BankingPrivilege ReservePrivate BankingFor Companies

GROUP WHOLESALE BANKINGForeign direct investmentUOB Asean insightsIndustry insightsSUSTAINABLE SOLUTIONSAbout UOB

UOB GroupBranches & ATMsSustainabilityTech Start-Up EcosystemUOB WorldUOB Subsidiaries

UOB asset managementUnited overseas InsuranceUOB travel plannersUOB Venture managementUOB Global capital - SUSTAINABILITY

- Financial Literacy

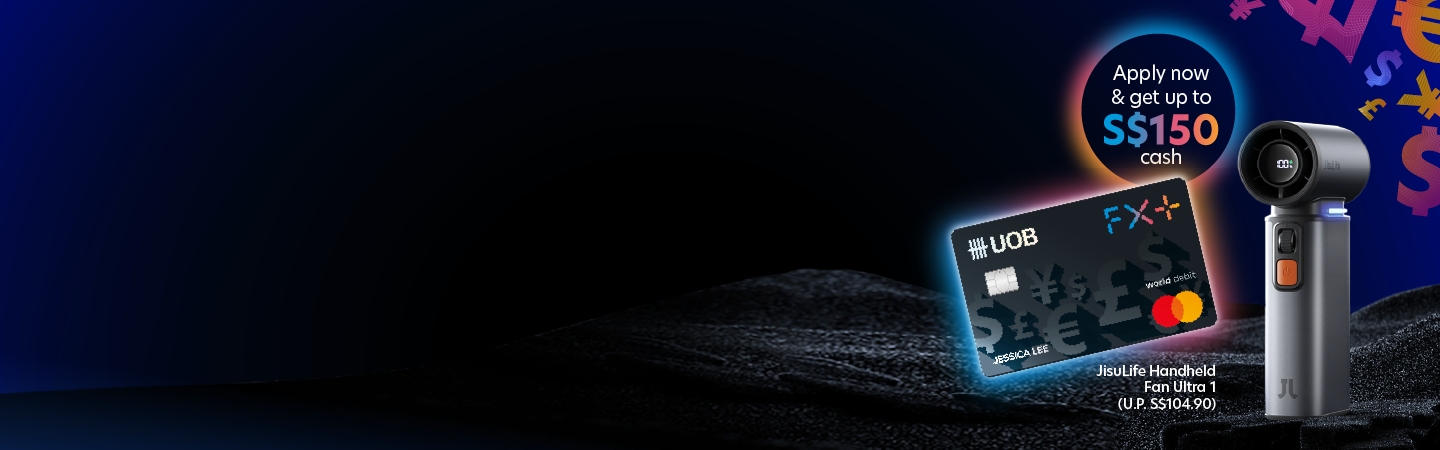

Don’t miss out on this exclusive offer. Apply for FX+ now.

Get rewarded when you sign up for FX+ Debit Card today

Singsaver Exclusive: JisuLife Handheld Fan Ultra1

Apply for UOB FX+ Debit Card via this page and get a JisuLife Handheld Fan Ultra1 (worth S$104.90)

For the first 200 sign-ups from 1 August 2025. T&Cs apply.

+

July to September special

Up to S$50 cash for new FX+ Customers: For the first 20 online sign-ups each promotion week![]() who also make at least one foreign currency transaction. S$20 cash for the next 30 sign-ups. T&Cs apply.

who also make at least one foreign currency transaction. S$20 cash for the next 30 sign-ups. T&Cs apply.

Up to S$150 cash for new UOB customers: Sign up for both One Account and FX+. Learn more here.

Why UOB FX+?

UOB FX+ Debit Card: More than a travel wallet

0% FX fees worldwide: Tap to spend instantly – no fuss or wallet top-ups needed.

Set rate alerts: Never miss your preferred conversion rates

Convert currencies in advance: Enjoy rates as good as what you see on Google

Extra travel perks: GrabTransport discounts, free travel insurance and cashback on overseas ATM withdrawals

Things you should know

Terms & Conditions apply. Please visit the UOB FX+ website to find out more about the UOB FX+ Debit Card.

UOB Debit Cardmember Agreement

UOB Terms and Conditions Governing Accounts and Services

UOB Debit Card Fees and Charges

UOB FX+ Debit Card Singsaver Promotion Terms and Conditions

SGD deposits are insured up to S$100k by SDIC.

For FX+ foreign currency accounts, interest rates are for USD, AUD, NZD and CNH accounts only.

FX fees are administrative fees applied on transactions in foreign currencies. Worldwide includes over 210 countries with MasterCard acceptance.

^Eligible Card spend transactions are based on the following: Eligible Visa/MasterCard local and foreign retail transactions subjected to the exclusions mentioned below; Insurance payments made on a recurring basis on selected credit or debit cards; Total posted retail transactions by the selected Credit Card(s) principal and supplementary holder plus any spending on the selected Debit card(s); and Transactions posted within a CALENDAR month. Visit UOB One Account website for full terms and conditions.

The information herein shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing herein constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information in this publication.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Sales representatives, if any, may be remunerated for the recommendation or sale of this account.

For Singaporeans and PRs

Sign up for FX+ online, get approval within minutes and start transacting instantly (where applicable).

How to apply:

- Retrieve with Myinfo using Singpass login – applicable to new-to-UOB customers, existing to UOB customers and joint applicants

- Personal Internet Banking login details – applicable to existing UOB customers

- Credit/Debit card number and PIN – applicable to existing UOB customers applying for single-named account application

For Foreigners and U.S. Persons

Please proceed to any UOB Branch for application. You will need to bring along original copies of:

- Your Physical Passport (Min 6 months validity is required)

- Proof of Residential Address (E.g. Utilities or Telecommunication bills)

- Employment Pass/S Pass/Dependent Pass

Please note that photocopied or digital copies of the above documents will not be accepted for processing.

Minimum 18 years old

Annual Fees:

S$18.34 yearly (First 3 years card fee waiver)

Annual fee wavier with 12 Mastercard transactions per year

Card replacement fee of S$20

Promotion Week

- 1 – 6 Jul 25

- 7 – 13 Jul 25

- 14 – 20 Jul 25

- 21 – 27 Jul 25

- 28 Jul – 3 Aug 25

- 4 – 10 Aug 25

- 11 – 17 Aug 25

- 18 – 24 Aug 25

- 25 – 31 Aug 25

- 1 – 7 Sep 25

- 8 – 14 Sep 25

- 15 – 21 Sep 25

- 22 – 30 Sep 25

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.