A unique approach to wealth that puts you first

We recognise the importance of balancing risks and returns.

Our unique Risk-First Approach ensures that you understand your risk appetite as the starting point in your wealth journey. This means we first identify how much risk you are able and willing to take, before considering the returns you would like to achieve. This way, you avoid taking excessive risks in your journey towards your financial goals.

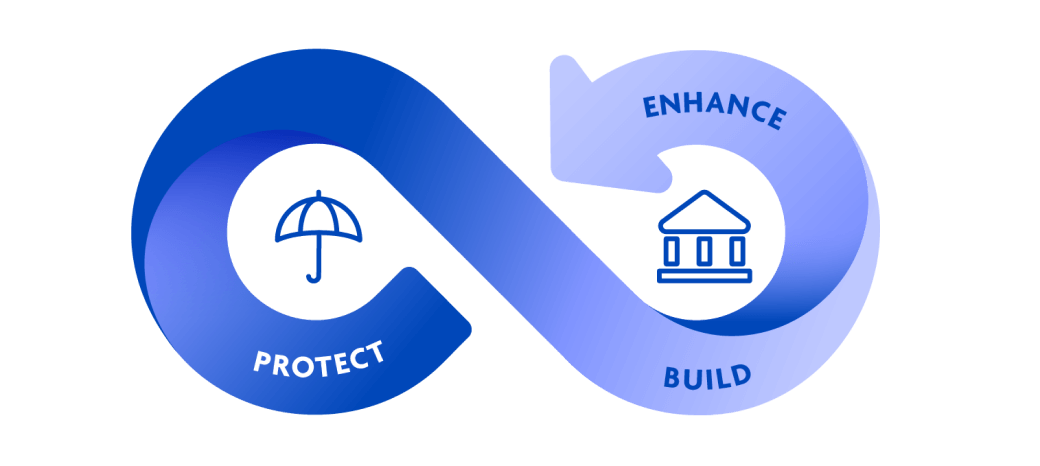

Our Risk-First Approach

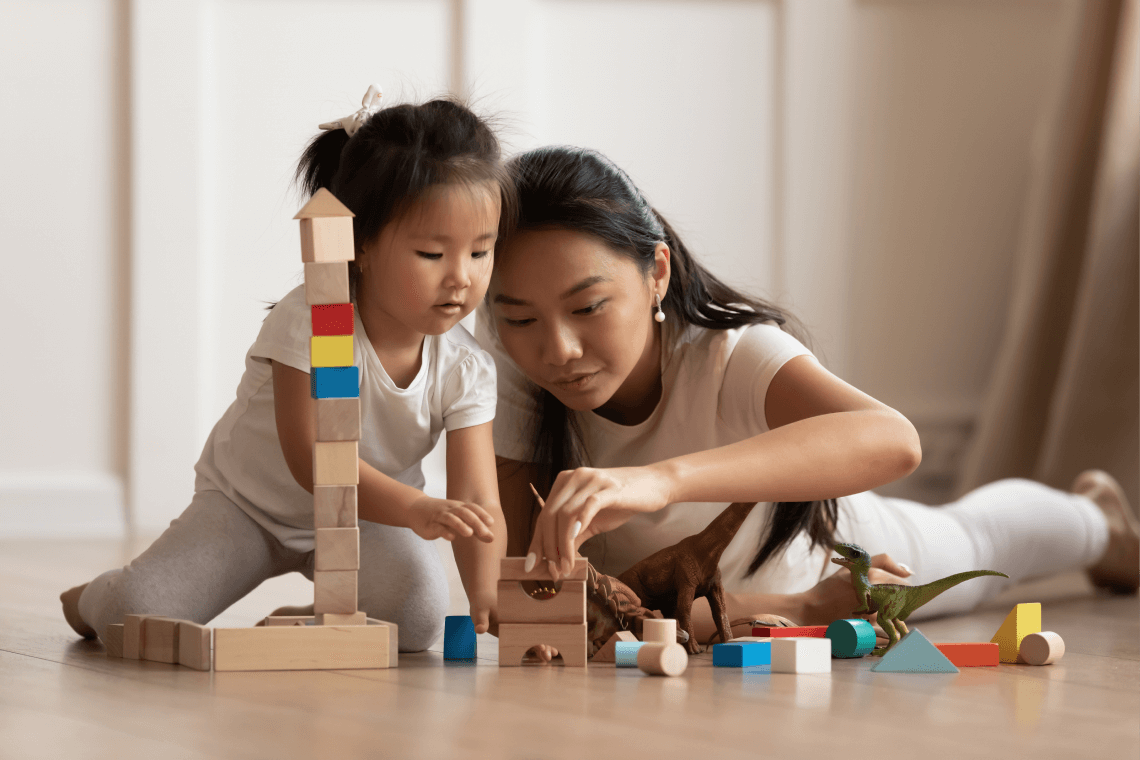

The first step in wealth planning is to Protect the wealth you have worked hard to accumulate![]() . Knowing you and your loved ones are protected then gives you peace of mind to Build and Enhance your wealth with the appropriate asset allocation

. Knowing you and your loved ones are protected then gives you peace of mind to Build and Enhance your wealth with the appropriate asset allocation![]() .

.

As you progress in life, your needs and goals will evolve, and so should your wealth plan. We help you review your insurance and investment portfolios periodically, and we complete an updated risk assessment when needed.

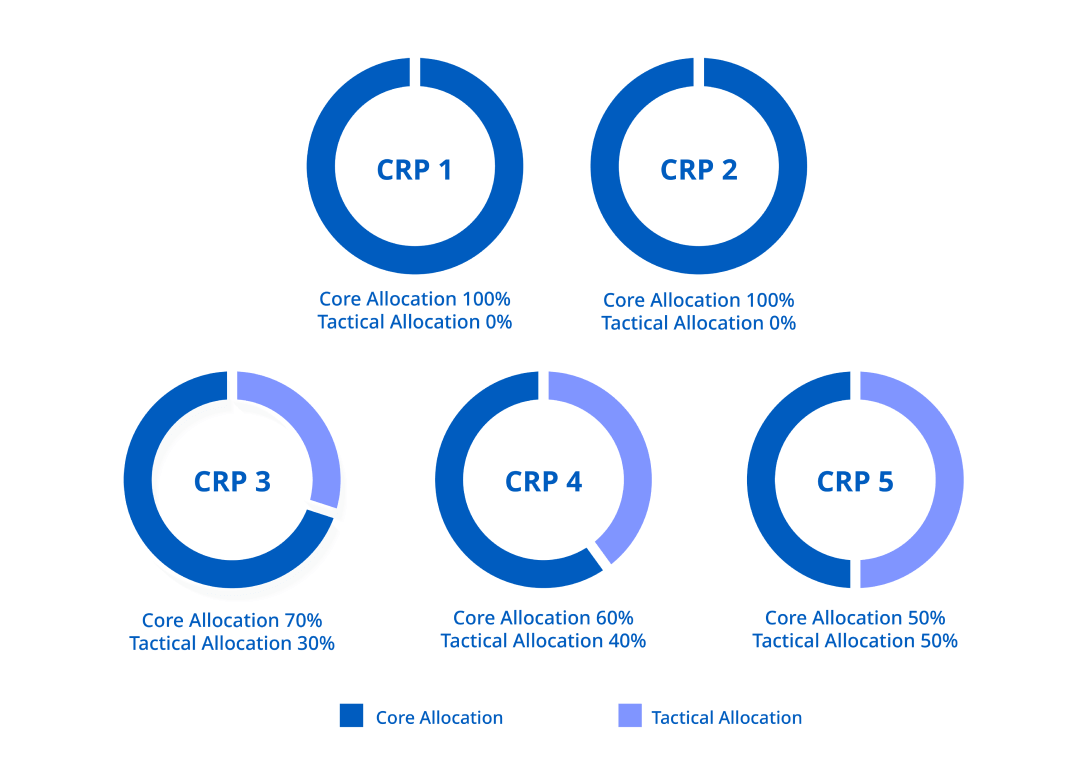

Core and Tactical asset allocations

Based on your Client Risk Profile (CRP), we apply Core and Tactical asset allocation strategies and help you build your wealth portfolio according to how much risk you are comfortable taking.

Core allocations tend to be of lower risk and are designed to help you progress towards your long-term goals. By nature, they are held through market cycles and can provide regular income. They tend to be diversified across asset classes, sectors and regions.

Tactical allocations focus on capturing targeted short-term opportunities. These aim for capital growth but can also incorporate income strategies.

Manage your wealth the way it suits you

Our omnichannel approach gives you the choice of how you would like to engage with us on your wealth journey.

Our bankers are equipped with award-winning digital tools to serve you with personalised advice and recommendations, if you prefer to meet face to face. At the same time, our wide range of wealth solutions and timely insights are available digitally for you to access whenever and wherever you wish.

We strive to provide a seamless experience, as we work together with you to help you achieve your wealth goals sustainably.

UOB Portfolio Advisory Tools

Like many other investors, you may often have pressing questions about your portfolio:

Are my investments keeping pace with the evolving market? Are they too risky for me?

Our Advisors are equipped with our award-winning UOB Portfolio Advisory Tools,

three complementary tools designed to help you monitor, manage and optimise your wealth portfolio.

Our Portfolio Advisory Tools are now enhanced with SGFinDex data to analyse your consolidated wealth holdings in real time.

data to analyse your consolidated wealth holdings in real time.

This makes UOB the first bank to integrate SGFinDex data into our digital advisory tools.

Get a holistic overview of your portfolio and its exposure across asset classes, currencies, geographies, risk levels and more.

Enhanced with SGFinDex data, our tools can analyse your consolidated wealth holdings across multiple bank accounts and government agencies in real time.

Receive insights on the projected risk levels and possible returns of your wealth holdings, based on historical market data. With scenario analyses, you can simulate how well your portfolio can withstand different market conditions.

Design a simulated portfolio with our recommended solutions using our Portfolio Explorer tool. Stress-test the allocations under various market conditions using historical data, so you can make informed decisions based on your risk appetite.

Gain certainty on the insurance coverage you need with our Insurance Explorer tool. Get a consolidated view of all your insurance policies, identify your protection gaps and see how our customised solutions can help you bridge them.

Things you should know

Important notice and disclaimers

The information stated herein shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein. The information contained herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained herein, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information herein.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z