Add a dash of glitter to your portfolio

Gold and silver have long been considered precious metals for their value and beauty. They also have a key role to play in your investment portfolio. They can help you:

- Diversify your portfolio by reducing dependence on any particular asset class.

- Add a "safe-haven" asset to your portfolio, as gold and silver are generally favoured in times of uncertainties.

Gold Savings Account Conversion

Seize the opportunity to turn your Gold Savings Account holdings* into 100g Argor physical gold bars at a physical conversion premium of S$100 per piece*.

To convert, visit the UOB Main Branch Gold Counter.

Benefits of Gold Savings Account Conversion

Rates and Fees

-

Product

-

Rates and fees

Check our indicative gold and silver prices

Apply now

Gold savings account

This account lets you buy and sell gold without taking delivery. The holding is in grams with a minimum transaction amount of 5 grams.

From 3rd July 2023, GSA account holders will have the option to convert their Gold Savings Account holdings* into 100g Argor physical gold bars at the UOB Main Branch Gold Counter.

Silver savings account

To start buying and selling silver, you will first need to open an account with UOB at any UOB branch during banking hours (excluding weekends and Singapore public holidays).

If you have an existing silver savings account, you can trade via UOB Personal Internet Banking or UOB TMRW app from Mondays to Fridays, 8am to 11pm (excluding Singapore public holidays).

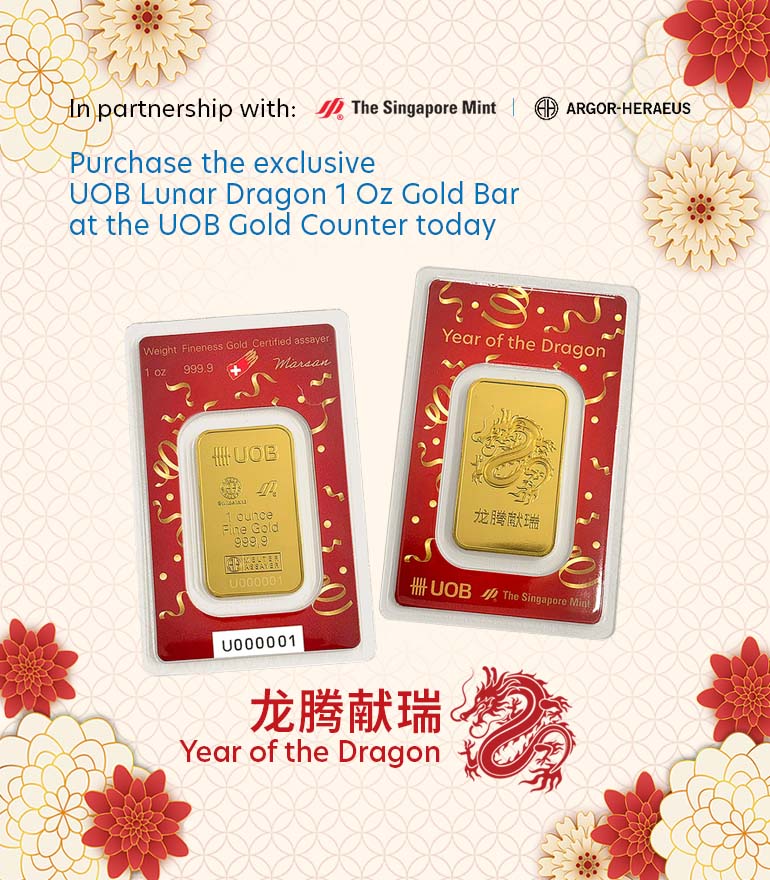

Gold bars / Gold bullion coins / Gold certificates

These can be purchased at UOB’s Main Branch from 9.30am to 4.30pm, Mondays to Fridays (excluding Singapore public holidays).

If you are an existing UOB Personal Internet Banking user, you can buy Gold bars/ Gold bullion coins online at your convenience, and collect the gold piece(s) at UOB’s Main Branch within 5 working days.

Risks

Gold and silver investments are not guaranteed by the Bank and are subject to risks. Their value and fees can fluctuate with international and/or local gold and silver markets, and foreign exchange markets.

Frequently asked questions

Gold Savings Account / Silver Savings Account

1. Where can I open a Gold Savings Account (GSA)/Silver Savings Account (SSA)?

Gold Savings Accounts (GSA)/Silver Savings Accounts (SSA) can be opened at any UOB branch in Singapore from Mondays to Fridays during banking hours.

You may choose to have a passbook or receive statements of accounts in respect of your GSA or SSA.

2. Where can I transact gold or silver?

You can transact at any UOB branch in Singapore from Mondays to Fridays during banking hours. Our banking hours are:

• For selected branches with extended hours: 9.30am to 6.00pm.

• For all other UOB branches: 9.30am to 4.30pm

You can also perform through UOB Personal Internet Banking and UOB TMRW, from Mondays to Fridays 8am to 11pm, excluding Singapore public holidays.

3. Where can I check the prices?

You can check prices:

• at our UOB website under Rates & Fees; or

• using UOB Personal Internet Banking by clicking onto 'Widgets' on the top right hand corner.

4. What are some of the risks involved in purchasing gold/silver products?

Before purchasing gold/silver products, the customer should understand and acknowledge that:

• the gold and silver market is volatile;

• losses, including the loss of your principal investment, can be incurred from such an investment;

• an investment in gold or silver provides no dividend yield or interest;

• prices would have to rise sufficiently over the investment period in order to yield a profit on sale; and

• investments in gold and silver are not guaranteed by the Bank nor insured under the Deposit Insurance Scheme.

5. What is the minimum age to open a GSA (including CPF GSA) or a SSA?

The minimum age is 18 years old.

6. Is there a minimum transaction amount?

The minimum transaction amount is 5 grams of gold for GSA and 10 ounces of silver for SSA.

7. Must the customer maintain a minimum balance in the GSA or SSA?

The minimum balance requirement is 5 grams of gold for GSA and it is 10 ounces of silver for SSA.

8. What are the charges for maintaining a GSA?

Monthly service charges on the GSA are payable. The monthly service charges are charged in grams of gold. The service charge for GSA is the higher of:

• 0.12 grams of gold per month; or

• 0.25% per annum on the highest gold balance recorded in your GSA in a calendar month.

The service charges will be accrued monthly and debited from the account annually at the end of the year or upon closure of the account. For account closure, the service charges would be calculated on a pro-rata basis. GST on the service charge is applicable.

For Illustration purpose only:

If you are holding on to 100 grams of gold throughout a year, the service charge would be the higher of:

• 0.12grams x 12 = 1.44 grams; or

• 0.0025 x 100grams = 0.25 grams.

This means that the annual service charge for 100 grams would be 1.44 grams of gold. GST chargeable on the service charge would be 0.1008 grams.

• If you are holding on to 1,000 grams of gold throughout a year, the service charge would be the higher of:

- 0.12grams x 12 = 1.44 grams; or

- 0.0025 x 1,000 = 2.50 grams.

This means that the annual service charge for 1,000 grams would be 2.50 grams of gold. GST chargeable on the service charge would be 0.175 grams.

9. What are the charges for maintaining a SSA?

Monthly service charges on the SSA are payable. The monthly service charges are charged in ounces of silver.

The service charge for SSA is the higher of:

• 0.2 ounces of silver per month; or

• 0.375% per annum on the highest silver balance recorded in your SSA in a calendar month

The service charges will be accrued monthly and debited from the account annually at the end of the year or upon closure of the account. For account closure, the service charges would be calculated on a pro-rata basis. GST on the service charge is applicable.

For Illustration purpose only:

• If you are holding on to 10 ounces of silver throughout a year, the service charge would be the higher of:

- 0.2 x 12 = 2.4 ounces; or

- 0.00375 x 10 = 0.0375 ounces.

This means that the annual service charge for 10 ounces would be 2.4 ounces of silver. GST chargeable on the service charge would be 0.168 ounces.

• If you are holding on to 1,000 ounces of silver throughout a year, the service charge would be the higher of:

- 0.2 x 12 = 2.4 ounces; or

- 0.00375 x 1000 = 3.75 ounces.

This means that the annual service charge for 1,000 ounces would be 3.75 ounces of silver. GST chargeable on the service charge would be 0.2625 ounces.

10. Do you charge GST on the sales and purchase of gold/silver through GSA/SSA?

There is no GST charged on the sale and purchase of gold and silver through GSA and SSA. However, the service charges for GSA and SSA are subject to GST and the GST is debited in grams of gold and ounces of silver from the accounts at the end of the year.

11. Are there additional costs in using CPF funds to purchase gold?

Yes, there is an additional charge of three cents per gram of gold (or such other amount that we may stipulate) on the amount quoted when customer buys. There is no additional charge when the customer sells the gold.

12. What are the acceptable types of payment for the purchase of gold and silver through GSA and SSA?

You may pay in cash or authorise us to debit the amount from your UOB Singapore account.

Alternatively, you may purchase gold using CPF funds.

13. Is there a penalty for closing GSA or SSA?

There will be an early account closure fee of SGD30.00 (subject to GST) charged if you close a UOB GSA or SSA within six months from the date you opened the GSA or SSA.

14. Can I exchange my gold or silver in my GSA or SSA into physical gold or silver?

From 3rd July 2023, GSA holdings may be converted into 100g physical gold bars with the payment of a physical gold conversion premium under the Gold Savings Account Physical Gold Conversion Programme. SSA holdings cannot be exchanged or converted to physical silver.

15. What is the difference between UOB’s gold price and the international gold price?

UOB gold prices are quoted in SGD while the international gold prices are quoted in USD. The UOB gold prices are based on international gold prices and will therefore be affected by the foreign exchange rates.

16. I am a foreigner. Can I open a GSA or SSA?

Yes, you are required to be present at the branch to open an account. New account openings are subject to the Bank’s approval. Please provide the following documents:

• identification card / original passport of account holder and work permit/student pass/other documents demonstrating your Residency status;

• proof of residential address (eg. bank statements, utility or phone bills bearing the account holder's name and address);

• banker's reference letter/letter of introduction in form and substance acceptable to the Bank may be required; and

• such other documents as the Bank may require.

17. Can I use my CPF funds to purchase gold?

Yes, you may use CPF funds to buy, subject to the rules of the CPF Investment Scheme, including your available gold limit. Your gold holdings with UOB will be reflected in your CPF Investment Account monthly statement.

You are responsible for ensuring that there are sufficient funds in your CPF Investment Account to buy the gold. If your request to use CPF funds to buy the gold is rejected or you do not have enough CPF funds to do so, you will have to pay cash for the gold. If you do not have sufficient cash to pay for the gold you will have to sell the gold to the Bank and pay for the difference in the price movement between the contracted price and the Bank’s prevailing purchase price.

18. Can I use my CPF funds to purchase silver?

No, you cannot use CPF for SSA transaction. SSA is not one of the products allowed by the CPF Investment Scheme.

19. I understand that previously customers were allowed to trade gold and silver on Saturdays. Why is it that I cannot do so now?

The Bank has ceased trading of GSA and SSA on Saturdays due to the closure of the market and the non-availability of gold/silver prices over the weekend.

20. How do I buy gold / silver on UOB Personal Internet Banking and UOB?

If you do not have a gold/silver savings account, you will first need to visit a UOB branch to open the account.

If you already have a gold/silver savings account, login to UOB Personal Internet Banking > 'Investments' > 'Gold and Silver'. Alternatively, you can login to UOB > 'Services' > 'Buy Gold/Silver'.

21. How do I sell gold/silver on UOB Personal Internet Banking and UOB?

Simply login to UOB Personal Internet Banking > 'Investments' > 'Gold and Silver'. Alternatively, you can login to UOB > 'Services' > 'Sell Gold/Silver'.

22. Can I check my balance on UOB Personal Internet Banking and UOB?

Simply login to UOB Personal Internet Banking and select > 'Account Information' > 'Account Summary'. Alternatively, you can login to UOB and select 'Accounts'.

23. Can I subscribe to eStatement for my GSA or SSA?

Yes, you may do so for the statement version (but not the passbook version) of the GSA or SSA account via Personal Internet Banking. Please refer to our website for more information on e-statements.

Gold Savings Account Physical Gold Conversion

1. Where can I perform a GSA Physical Gold Conversion?

GSA Physical Gold Conversion can only be performed at the Gold Counter of UOB Main Branch, which is located at 80 Raffles Place, UOB Plaza 1, Banking Hall Basement, Singapore 048624 (Opening Hours: Monday-Friday 9:30am – 4:30pm, excluding Singapore public holidays). No GSA Physical Gold Conversion can be performed at any other UOB branches. Customers are required to come personally and bring the necessary identification documents as required by the Bank and (for passbook-based accounts only) their passbook

2. Do I need to proceed to the UOB Plaza Banking hall to debit my GSA before heading to the UOB Main Branch Gold counter to receive my physical gold?

No, for physical gold conversion transactions, customers may proceed directly to the UOB Main Branch Gold Counter to debit their GSA, make payment of the physical gold conversion premium and receive their physical gold.

3. Are GSA holdings purchased with CPF funds eligible for the GSA Physical Gold Conversion Programme?

No. You can only participate in the GSA Physical Gold Conversion Programme with holdings in your GSA purchased with non-CPF funds.

4. Can physical gold conversion be done for other types of bars or coins?

No. You can only convert your GSA holdings into 100g Argor physical gold bars.

5. What type of physical gold bars are offered in this GSA Physical Gold Conversion Programme?

Argor Heraeus Swiss 100g physical gold bars.

6. Will I be able to sell back the converted physical gold bars back to UOB?

Yes, the converted physical gold bars are eligible to be purchased by UOB subject to the prevailing terms and conditions for buy-back at the then current Argor 100g buy-back price listed on UOB’s website. Customers will need to produce the original receipt/invoice issued by UOB for those converted physical gold bars at the time of their buy-back request. The UOB packaging of the converted physical gold bars must also be intact and not tampered with at the time of buy-back by UOB.

7. What mode of payments can be used to pay for the physical gold conversion premium?

You can either pay with cash or by debiting from your UOB bank account. No other modes of payment will be accepted.

8. If I hold exactly 100g in my GSA, will I be able to convert my entire account holdings into a 100g physical gold bar?

You must have a minimum holding of 5 grams in your GSA after conversion to maintain your GSA. Accordingly, in order to perform a 100g physical gold conversion from your GSA, you must have a minimum GSA balance of 105g immediately prior to conversion. You will not be eligible to close your GSA and convert all remaining holdings into the physical gold bars in connection with your GSA closure under the GSA Physical Gold Conversion Programme.

9. Is there a limit on the amount or number of conversions that can be done?

There is no limit on the amount or number of conversions that can be done, subject to the prevailing terms and conditions.

10. Will GST be chargeable on the physical gold conversion premium?

No GST will be chargeable.

Gold Coins & Gold Bars

1. Where can I buy gold coins and gold bars?

Gold coins and gold bars can be purchased at UOB Main Branch from 9:30 am to 4:30 pm, Mondays to Fridays excluding public holidays.

You can also buy gold coins and gold bars online through UOB Personal Internet Banking. For orders made on Personal Internet Banking, please collect your gold piece(s) in person at UOB Main Branch within 5 working days. There will be a late collection charge thereafter.

Banking Hall Basement

80 Raffles Place, UOB Plaza 1

Singapore 048624

2. What kind of coins and bars can I buy?

We have a range of gold coins and gold bars for your selection, subject to availability. More information is available online under Rates and Fees/Gold Prices. You can also check the availability of gold coins and gold bars online through UOB Personal Internet Banking, under Investment/Gold and Silver.

3. Do I need an account at UOB in order to buy gold coins and gold bars?

With effect from 30 November 2023, you need to be a UOB account holder in order to buy gold coins and gold bars.

4. Where can I check the prices?

You can check gold coin and gold bar prices on our website. The prices are indicative and may be different at time of actual transaction.

5. What forms of payment are acceptable?

• Debit from your UOB Singapore account.

• Pay by cash up to a maximum of S$20,000.

6. Are there any taxes applied to my purchase of gold coins and bars?

Purchases of gold coins and gold bars are exempted from Goods & Services Tax (GST) with effect from 1 October 2012.

7. Can I sell back my gold coins and bars to UOB?

UOB accepts gold coin or gold bars originally bought from UOB Singapore or OUB Singapore. Customers are required to produce invoices of purchase satisfactory to UOB.The gold coins or bars must be in good condition (to be solely determined by UOB which decision shall be final). For the gold kilobar, the seal must be intact.

8. Why is there a difference in the price of gold kilobars and the international gold price?

Prices for the gold kilobar and international gold are different because of the differences in the type of gold and market conditions.

UOB’s price for gold kilobars reflects the price of gold kilobars of 99.99% fineness quoted in SGD/kg The international gold price reflects the price of 'large' gold bars of 99.5% fineness quoted in USD/troy ounce which are deliverable in London before any tax or duty.

9. I am a foreigner. Can I buy physical gold?

You can buy physical gold if you are an existing UOB account holder.

Gold Certificates

1. Where can I buy UOB Gold Certificates?

Gold Certificates are sold at the Gold Counter of UOB Main Branch, which is located at UOB Plaza, 80 Raffles Place. The Gold Counter is open on Mondays to Fridays, from 9:30 am to 4:30 pm (except public holidays).

2. What kind of Gold Certificates are available?

Certificates are sold in multiples of 1 kilobar of 999.9 fineness. One Certificate is subject to a maximum of 30 kilograms.

3. What forms of payment are acceptable?

Debit from your UOB Singapore account.

4. Where can I check the prices?

You can check prices on our website under rates and fees. The prices are indicative and may be different at time of actual transaction.

5. Is there risk involved in purchasing a gold certificate?

In purchasing a UOB gold certificate, the customer should understand and acknowledge that:

• The gold market is volatile;

• Losses can be incurred from such an investment;

• An investment in gold provides no dividend yield or interest; and

• Prices would have to rise sufficiently over the investment period in order to yield a profit on sale.

6. What is the minimum age to transact in gold products?

The minimum age to transact in gold certificate is 18 years.

7. Are there any taxes applied to my purchase of Gold Certificates?

Gold Certificates are not subject to Goods & Services Tax (GST). However, charges are subject to GST. Conversion of the Gold Certificate into physical Investment Precious Metal gold is exempted from GST with effect from 1 Oct 2012.

8. Are there any fees for Gold Certificates?

There is a S$5 certificate fee for the purchase of a Gold Certificate. There is also an annual administration fee of S$72 per kilobar for Gold Certificates holders (with effect from 1 Jun 2013). Both the certificate fee and administrative fee are subject to the prevailing Goods & Services Tax (GST). Customers are required to maintain a savings or current account with UOB in Singapore and to authorise the bank to debit the annual administration fee from the account.

9. Can I use CPF to buy Gold Certificates?

Yes, subject to your available gold limit and rules of the CPF investment scheme. In addition to an annual administration fee of S$72 per kilobar (with effect from 1 Jun 2013) and certificate fee of S$5 per certificate, there is a quarterly service charge of S$2.00, subject to prevailing Goods & Services Tax (GST). The Gold Certificates will not be passed onto CPF investors. The certificates have to be safe kept by UOB, the agent bank under the CPF Investment Scheme.

10. Can the Gold Certificate be held by 2 holders?

A Gold Certificate may be held by a maximum of two holders. Both holders must be present during the purchase of the Gold Certificate. In the case of a loss of the Gold Certificate, both holders must be present to report the loss. For an “and/or” account, either holder is allowed to sell the Gold Certificate.

However, if you are using CPF, the Gold Certificate can only be issued to CPF account holder.

11. Can I add, replace or remove the holder(s)?

In the event of adding, replacing or removing the holder(s), all the parties involved must be present, and the existing Gold Certificate must be presented. A new Gold Certificate will be issued and a certificate fee of S$5 per certificate will be charged.

If you had used CPF to purchase gold certificate you cannot replace or remove holders. The Gold Certificate holder must be the CPF account holder.

12. What should I do if I lose my Gold Certificate?

Customers should inform the Bank immediately in writing if the Gold Certificate is lost, misplaced or stolen. A new Certificate may be issued upon satisfactory explanation being given to Bank, payment of the cost of issuing a new Certificate and the holder signing the Bank’s prescribed indemnity form. The Bank may also require an advertisement to be placed in the local newspapers at the holder’s cost and expense in respect to the loss, misplacement or theft.

Important Notices and Disclaimers

Important Notices and Disclaimers

The above is not to be used or considered as an offer, or invitation to offer, to sell or to buy the above product or any of the securities or other investment products referred to herein, and does not constitute a recommendation by the Bank to enter into any transaction or any form of commitment by the Bank to enter into any transaction.

The Bank has not taken any step to ensure that the product is suitable for any particular investor and unless the Bank otherwise agrees, the Bank is not acting as your adviser or in any fiduciary capacity in respect of any proposed transaction in relation to the above product, or any other transaction.

Nothing herein constitutes investment, legal, accounting or tax advice, or a representation that any investment is suitable for or appropriate to your investment objectives, financial situation and particular needs, or otherwise constitutes a personal recommendation to you.

The above does not purport to identify or suggest all the risks or material considerations which may be associated with the proposed product.

As such, it is recommended that before entering into any transaction, you should take steps to ensure, without reference to the Bank, that you have a full understanding of the terms, conditions and risks thereof and are capable of and willing to assume those risks in the light of your own investment objectives, financial situation and particular needs.

If you are in doubt as to any aspect of any transaction in respect of the above product, please consult your own legal, regulatory, tax, business, investment, financial and accounting advisers.

While based on information believed to be reliable, this document and its contents are provided on an "as is" basis. The Bank does not make any representation or warranty as to the accuracy, timeliness or completeness of the information contained in this document.

The Bank and its affiliates, connected or related companies, directors, employees or clients may have an interest in the above product or its related products or other financial instruments, or derivatives (collectively, the "Products") including, in relation to the Products, marketing, dealing, holding, acting as market-makers, performing financial or advisory services, acting as a manager or co-manager of a public offering.

The Bank, its affiliates, connected or related companies, directors or employees may also have alliances, contractual agreements, or broking, investment banking or other relationships for the provision of financial services, with any product provider mentioned in this document.

Investments in gold and/or silver are not deposits. This product is therefore not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Terms and Conditions