Secure your future needs such as to finance your child's overseas education, or to achieve your desired retirement lifestyle.

Privilege Banking Solutions

Insure

Legacy Planning

Insure

Wealth accumulation

We all hope for a bright future but that is often the result of what we do today. Set aside enough savings to be ready for life’s moments as they unfold.

Insure

Protection

You cannot predict life’s unforeseen circumstances, but you can secure the financial future of your loved ones today.

Insure

Retirement

Retirement can be the best years of your life. Embrace your golden years by setting a vision for the future and planning for it today.

Invest

Gold Solution

Invest in gold with the widest range of options.

Stay resilient through bull and bear markets.

Backed by decades of trusted expertise, UOB offers the widest range of gold investment solutions - from the Gold Savings Account, physical gold and certificates, XAU, and structured products – giving you options that cater to your needs.

Start your gold journey today.

Speak to your Client Advisor to find out more.

Card

UOB FX+ Debit Card

Get more savings out of your travels with FX+

- 0% FX fees on all worldwide spends – no cap, no minimum spend

- Convert currencies in advance on UOB TMRW, at rates as good as what you see online

- Enjoy extra travel perks like cashback on overseas ATM withdrawals

- Receive up to S$80 cash when you sign up online. Promotion till 31 December 2025.

- From 1 July 2025 till 31 January 2026, be the top FX+ Debit Card spender of the month and receive a pair of Singapore Airlines Business Class tickets to Paris and Mastercard Priceless™ Experiences.

T&Cs apply.

Invest

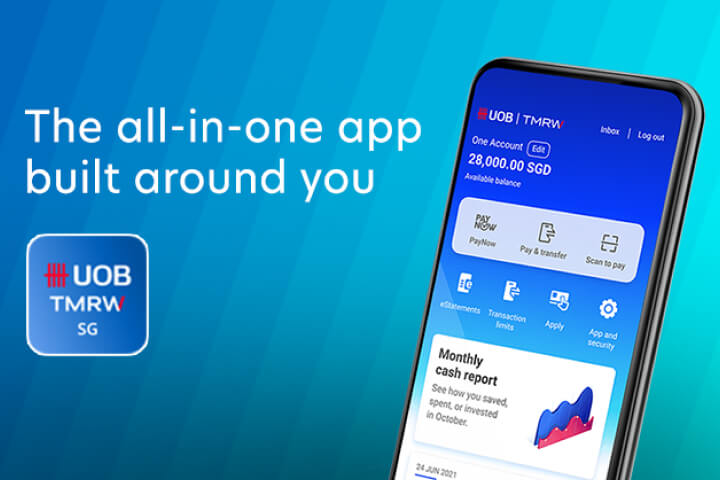

Wealth on UOB TMRW

View and manage all your wealth holdings in one app. Set and track your goals and capture timely investment opportunities with relevant insights.

- Choose from four expertly curated fund portfolios on UOB TMRW based on your goals and risk appetite

- Or build your own portfolio from a curated list of over 100 unit trusts

Invest

United CIO Funds

Tap on insights and research from UOB Private Bank Chief Investment Office

- United CIO Income Fund: Receive regular income from equities and bonds

- United CIO Growth Fund: Capital growth from equities and downside protection with fixed income

Save

Privilege Account

Enjoy preferential interest rates with no lock-in period as a Privilege Banking client.

Insured up to S$100k by SDIC.

Invest

Sustainable Investing

Better manage risks, unlock unrealised value and capture new opportunities with our sustainable investing solutions – all while playing a part in creating a better world.

Borrow

Private Home Loan

Buying and owning a property is an exciting experience. It can also be a daunting one.

That is why at UOB Privilege Banking, we offer you our helping hand every step of the way — whether you are looking to finance your dream home, invest in a local or overseas property or simply refinance your loan.

Card

Privilege Banking Card

Earn up to 2 miles per S$1 spent and 1-for-1 dining privileges with the UOB Privilege Banking Card

Digital Banking

UOB TMRW

The all-in-one banking app built around you. Bank, invest and be rewarded.

Borrow

UOB Home Solutions

Secure your dream home with Singapore’s first digital home solution.

Digital Banking

Email Oral Indemnity

Authorise the Bank to accept and carry out your transaction requests^ communicated via email or telephone.

Invest

Foreign Exchange (FX) Solutions

Leverage on our comprehensive suite of FX solutions to fulfil your foreign currency needs.

Save

Global Currency Premium Account

Enjoy greater flexibility over your funds while earning daily interest on major foreign currencies.

Borrow

International Property Loans

Investing in overseas properties is now easier with UOB

Invest

Equity Trading Service

Markets are constantly moving, so don’t get left behind. Get an edge with UOB Equity Trading Service for a trading advantage.

Save

KrisFlyer UOB Account

The only account that earns you interest and miles as you spend and save

Digital Banking

Personal Internet Banking

Streamline the way you bank with a dynamic range of digital banking features, designed to let you manage your finances with greater accessibility and simplicity.

Invest

Bonds

First used to guarantee the payment of grain by principal, the modern-day bond market has become one of the world’s largest and most robust.

Save

Singapore Dollar Time/Fixed Deposit

Work your money harder with promotional interest rates. You can now open a UOB Fixed Deposit account online and get instant approval.

Digital Banking

PayNow

Send and receive money instantly, just by using your mobile number.

Invest

Unit Trusts

Professionally managed by various fund managers, we have just the right fund designed to meet your specific investment needs.

Save

Foreign Currency Time/Fixed Deposit

Maximise your returns on foreign currency deposits with our higher interest rates

Digital Banking

UOB PromptPay

Now you can send money instantly, easily and securely to family and friends in Thailand via their Thailand mobile number (enabled with PromptPay) and receive money equally effortlessly.

Invest

Structured Products

Structured products are investment instruments with derivative components that offer the potential to achieve better returns.

Digital Banking

Electronic Deferred Payment

A digital alternative for deferred payments.

Get in touch

Get in touch

Call our 24-hour UOB Privilege Concierge at 1800 222 9889 (Singapore) or +65 6222 9889 (overseas).

For existing Privilege Banking clients

Tap on the Privilege Banking icon on your home page on the UOB TMRW app for your Client Advisor's name and contact details.

Start a Privilege Banking relationship with us

Sign up as a Privilege Banking client with a minimum of S$350,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Client Advisor will contact you.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.