Take charge of your currency needs with our FX solutions

Foreign Exchange (FX) touches everyone’s daily life – the right FX solution is essential when you are travelling, sending your child to study overseas or when you are investing to grow your wealth.

Access

As many as 20 global currencies to help fulfil all your foreign currency needs

UOB FX Solutions gives you access to as many as 20 global currencies+

- Singapore Dollar

- US Dollar

- Euro

- British Pound

- Australian Dollar

- New Zealand Dollar

- Japanese Yen

- Canadian Dollar

- Swiss Franc

- Chinese Yuan (Offshore)

- Hong Kong Dollar

- United Arab Emirates Dirham

- Norwegian Krone

- Danish Kroner

- Indonesian Rupiah

- Indian Rupee

- South African Rand

- Philippine Peso

- Swedish Krona

- Thai Baht

+You can access 11 global currencies from as little as S$1 to a maximum of S$50,000 equivalent per transaction on UOB FX+. Our trading desk, on the other hand, gives you access to 20 global currencies with a minimum of S$50,000 equivalent per transaction.

You can buy your desired foreign currencies in the following ways:

- Buy at spot (current market) rates.

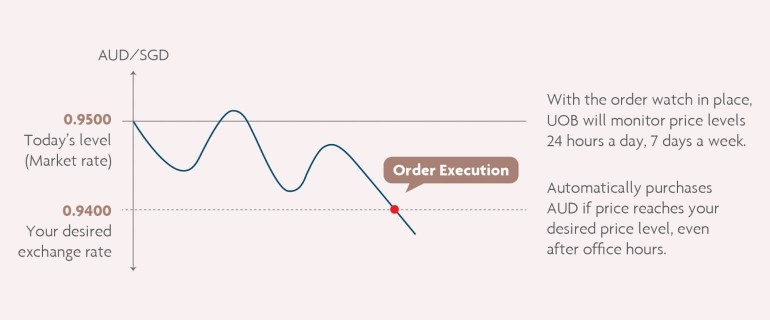

- Place an order watch, which allows you to set your desired FX rate. When the market trades at that rate, the conversion will be automatically executed – so you do not need to keep watching the market.

How it works:

For example, if you are trading in AUD and only want to buy at your desired exchange rate, you can place an FX order to buy AUD at your desired rate of 0.9400 (For illustration purposes only).

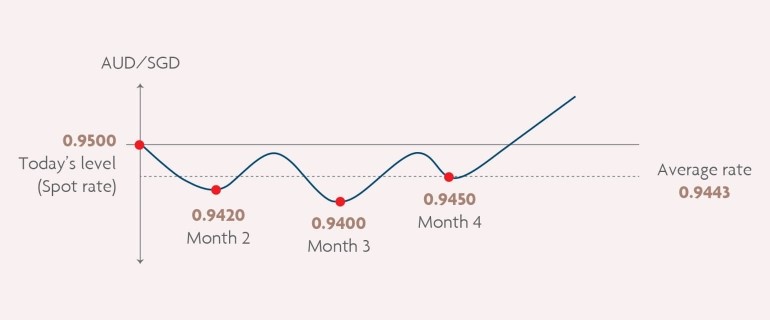

You can also spread out your orders to enjoy potentially lower exchange rates with dollar cost averaging.

How it works:

For example, if you are bullish about AUD in the medium to long term, but unsure about short-term movements, you can buy AUD in partial lots to average out the short-term price fluctuations (For illustration purposes only).

You can also gain FX exposure through our investment solutions including:

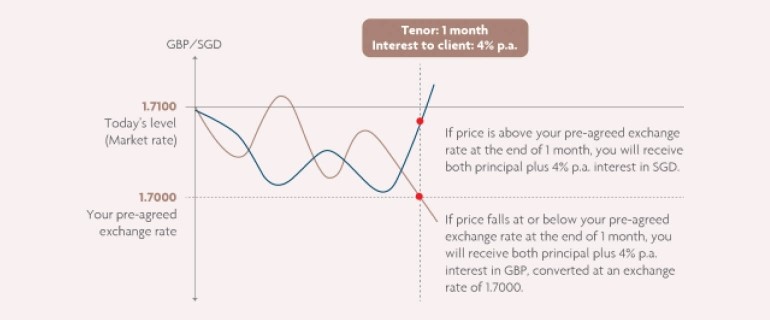

1. Dual Currency Investment, a short-term structured investment product that gives you the flexibility to choose a currency pair from a wide selection of currencies as well as the duration of the investment and your desired exchange rate. It is suited for you if you are indifferent to the two currencies chosen and you are comfortable receiving your money in either the base or the alternate currency (For illustration purposes only).

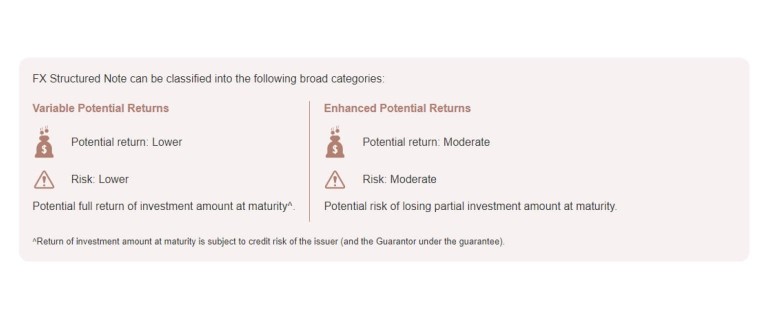

2. FX Structured Note, a type of structured product where the performance is based on its underlying FX currency pair or a basket of currency pairs. It can be customised according to your risk-return profile and view of the market. If you hold a longer-term view on a specific currency pair or a basket of currency pairs, you can gain exposure through this at your preferred tenor.

Convenience

Convert and transfer FX at your convenience

Make FX conversions and transfers at your convenience across a variety of channels, including UOB FX+ and UOB Personal Internet Banking.

Whether you are trading in FX or making foreign currency payments, you can do so at your convenience across a variety of channels. You can log in to UOB Personal Internet Banking or choose to use UOB FX+, via the UOB TMRW app for all your FX needs. If you prefer to speak to someone, you can call your dedicated Client Advisor or a FX Specialist.

UOB FX+ Debit Card

Now with no FX fees, it all adds up!

- No FX fees when you spend worldwide

- No mark-ups when you convert currencies

- Auto-convert currencies at your preferred rate

- S$5 cashback on overseas ATM withdrawals

T&Cs apply.

Expertise

Tap on the expertise of our Treasury Specialists

- You will have access to our team of Treasury Specialists, who have an average of more than 10 years of experience, and receive regular insights to help you stay informed on the latest market trends.

Get in touch

Get in touch

Call our 24-hour UOB Privilege Concierge at 1800 222 9889 (Singapore) or +65 6222 9889 (overseas).

For existing Privilege Banking clients

Tap on the Privilege Banking icon on your home page on the UOB TMRW app for your Client Advisor's name and contact details.

Start a Privilege Banking relationship with us

Sign up as a Privilege Banking client with a minimum of S$350,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Client Advisor will contact you.

Things you should know

Important notice and disclaimers

This document is prepared for general information only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any particular person who may receive this document. The information in this document shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any banking product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisors about issues discussed herein.

Foreign Currency Investments

There are inherent risks involved in any investment, such as foreign exchange risk, sovereign risk and interest rate fluctuations. Adverse foreign exchange rate movements could erase your deposit interest earnings completely, reduce the original capital amount or increase the quantum of loan payment substantially. The value of your redemption amount/returns on deposits at maturity may be less than your principal investment amount on conversion if the prevailing exchange rate moves against your favour. Exchange controls may also apply from time to time to certain foreign currencies that may affect the convertibility or transferability of that currency.

Dual Currency Investment

Dual Currency Investment (also known as UOB MaxiYield) has risk and investment elements and is not a fixed deposit. It is also not an insured deposit within the meaning of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011. This investment product offers premium interest rates as may be agreed between you and United Overseas Bank Limited (“UOB”) with an embedded option granted by you to UOB. In the event that UOB exercises the said option, the value of your investment in the Base Currency will be converted into the Alternate Currency, regardless of whether you wish to be paid in this currency at that time. The value of your redemption amount at maturity may be less than your principal investment amount on conversion if the prevailing exchange rate moves against your favour.

Exchange controls may also apply from time to time to certain foreign currencies that may affect the convertibility or transferability of that currency. It is advisable for you to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase the product. In the event that you choose not to have a licensed or an exempt financial adviser, you should consider carefully whether the product is suitable for you in light of your financial needs, investment goals and objectives and risk appetite. UOB MaxiYield is an investment product that requires you to hold the product to maturity with a right given to UOB to terminate prematurely upon occurrence of certain Extraordinary Events stipulated in the MaxiYield Facility Agreement. Unless UOB otherwise agrees, the investment amount cannot be withdrawn by you, whether partially or in whole, prior to its maturity. If UOB allows for any early withdrawal, UOB shall be entitled to deduct from the investment amount, any loss, costs, charges and/or expenses incurred by UOB (including but without limiting to UOB’s unwinding or termination of its hedging and/or funding position) and such other administrative and other charges as UOB may impose. In such instances, you may receive less than the principal investment amount.

The UOB MaxiYield will be governed by the MaxiYield Facility Agreement and the related Confirmation Note as agreed between you and UOB.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

United Overseas Bank Limited Co. Reg. No. 193500026Z

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.