FX solutions that meet SME needs

At a glance

-

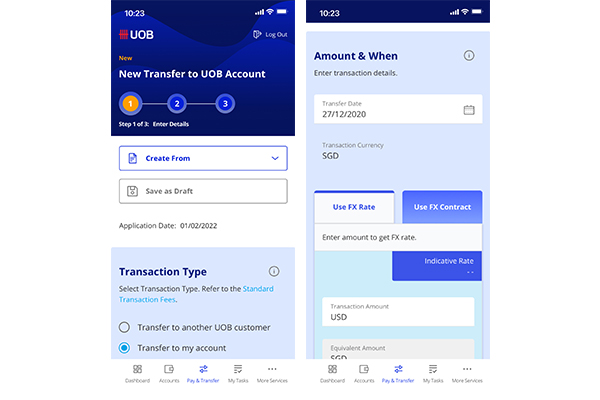

Type of FX Contracts

-

Benefits

| Type of FX Contracts | Benefits |

| FX Spot | Convert your currency at an agreed-upon rate to use immediately or within 2 business days. |

| FX Forward | Convert your currency at an agreed-upon rate for us within an agreed time frame, as stated in the contract. |

| Type of FX Contracts |

| FX Spot |

| FX Forward |

Need more info? Watch video

Frequently asked questions

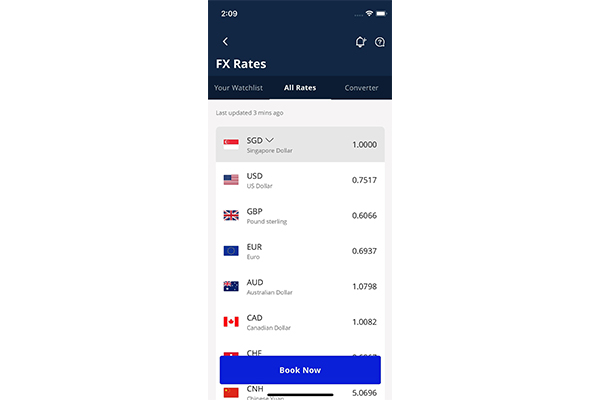

What are the available currencies and their latest rates?

We currently support 33 global currencies:

- Australian Dollar (AUD)

- Bruneian Dollar (BND)

- Canadian Dollar (CAD)

- Euro (EUR)

- British Pound (GBP)

- Kuwaiti Dinar (KWD)

- New Zealand Dollar (NZD)

- US Dollar (USD)

- South African Rand (ZAR)

- UAE Dirham (AED)

- Angolan Kwanza (AOA)

- Bangladesh Taka (BDT)

- Brazilian Real (BRL)

- Swiss Franc (CHF)

- Chinese Renminbi (Offshore) (CNH)

- Danish Kroner (DKK)

- Egyptian Pound (EGP)

- Hong Kong Dollar (HKD)

- Indian Rupee (INR)

- Japanese Yen (JPY)

- Sri Lankan Rupee (LKR)

- Mexican Peso (MXN)

- Malaysian Ringgit (MYR)

- Norwegian Kroner (NOK)

- Philippines Peso (PHP)

- Pakistani Rupee (PKR)

- Polish Zloty (PLN)

- Russian Ruble (RUB)

- Saudi Riyal (SAR)

- Seychelles Rupee (SCR)

- Swedish Krona (SEK)

- Thai Baht (THB)

- Turkish Lira (TRY)

- New Taiwan Dollar (TWD)

- CFA Franc Beac (XAF)

- CFA Franc West (XOF)

- Korean Won (KRW)

- Vietnamese Dong (VND)

Visit our FX Rates page for the latest rates.1

Is there a minimum amount I need to start trading?

To enjoy our preferential rates, you need to book a FX contract with a minimum amount of S$20,000 or equivalent.

Are there any fees or charges?

Remittance fees apply, except for the following currencies:

- Vietnamese Dong (VND)

- Taiwan Dollar (NTD)

- Burmese Kyat (K)

- Korean Won (KRW)

- CFA Franc Beac (XAF)

- CFA Franc West (XOF)

- Mexican Peso (MXN)

- Russian Ruble (RUB)

- Turkish Lira (TRY)

- Angolan Kwanza (AOA)

- Egyptian Pound (EGP)

- Kuwaiti Dinar (KWD)

- Bangladesh Taka (BDT)

- Seychelles Rupee (SCR)

- Polish Zloty (PLN)

- Pakistani Rupee (PKR)

- Brazilian Real (BRL)

- Sri Lanka Rupee (LKR)

- MYR-AOO**

**For conversion amount of S$100k/US$100k, please contact us for more details

Disclaimers/Terms & Conditions

1 Preferential rate is applicable only for FX contracts amount equivalent to S$20,000 and above, enquired via our FX hotline or eFX platform.

- Product terms and conditions apply.

- The information is given on a general basis and does not constitute an offer, an invitation to offer, a solicitation or a recommendation by UOB to enter into or conclude any transaction.

- UOB does not warrant the accuracy, adequacy , timeliness or completeness of the information contained herein for any particular purpose and thus assumes no responsibility of it.

- Investors may wish to seek advice from a professional or an independent financial adviser before investing in any investment product.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

You may also like

Accounts & Transact

UOB Global Currency Account

Manage payments in foreign currencies efficiently.

- Best for businesses with multi-currency needs

- Available in major foreign currencies

- Earn daily interest on your account balances (for selected currencies)

Invest & FX

Dual Currency Investments

Get potentially higher return with a structured investment with an embedded FX option.

- Available in 10 global currencies

- Minimum tenure of 1 week

- No upfront costs

Accounts & Transact

UOB eBusiness Account

Start your UOB eBusiness account today, and enjoy zero fees* and more than S$500 of annual savings on FAST and GIRO transaction fees.

- No minimum balance and fall below fees*

- FREE outgoing FAST/PayNow FAST transactions

- FREE outgoing GIRO payment and collection transactions

- FREE GIRO payroll transactions