1 of 3

What do you need help with?

1 of 3

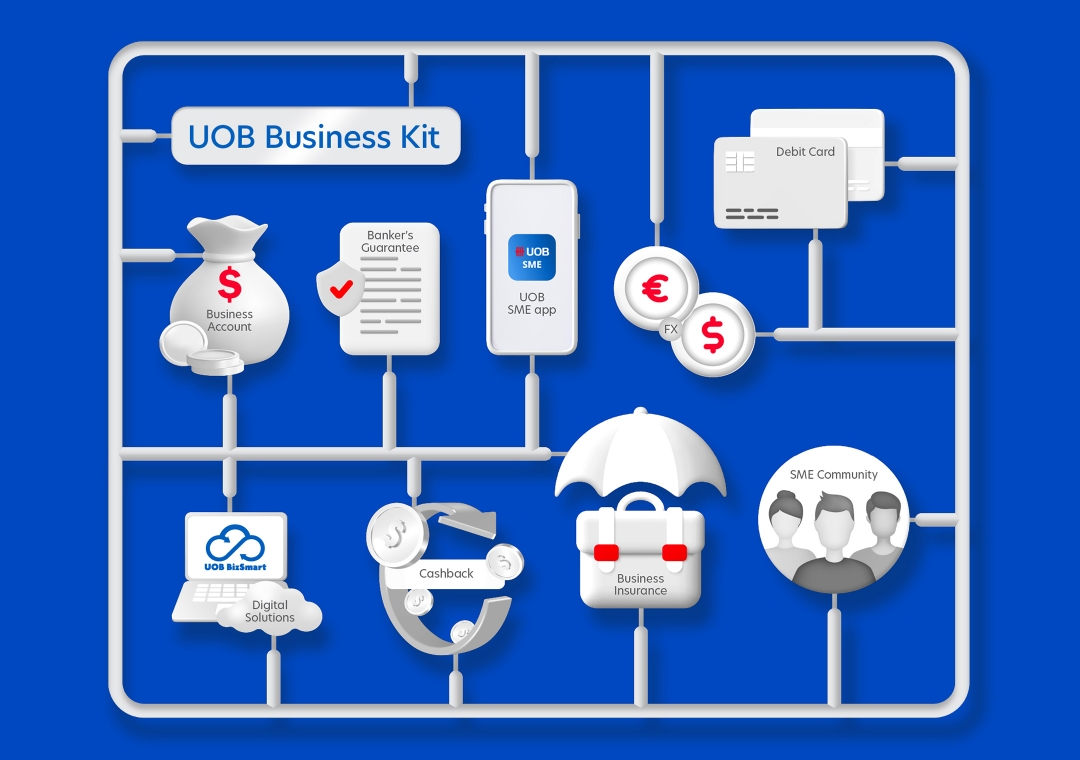

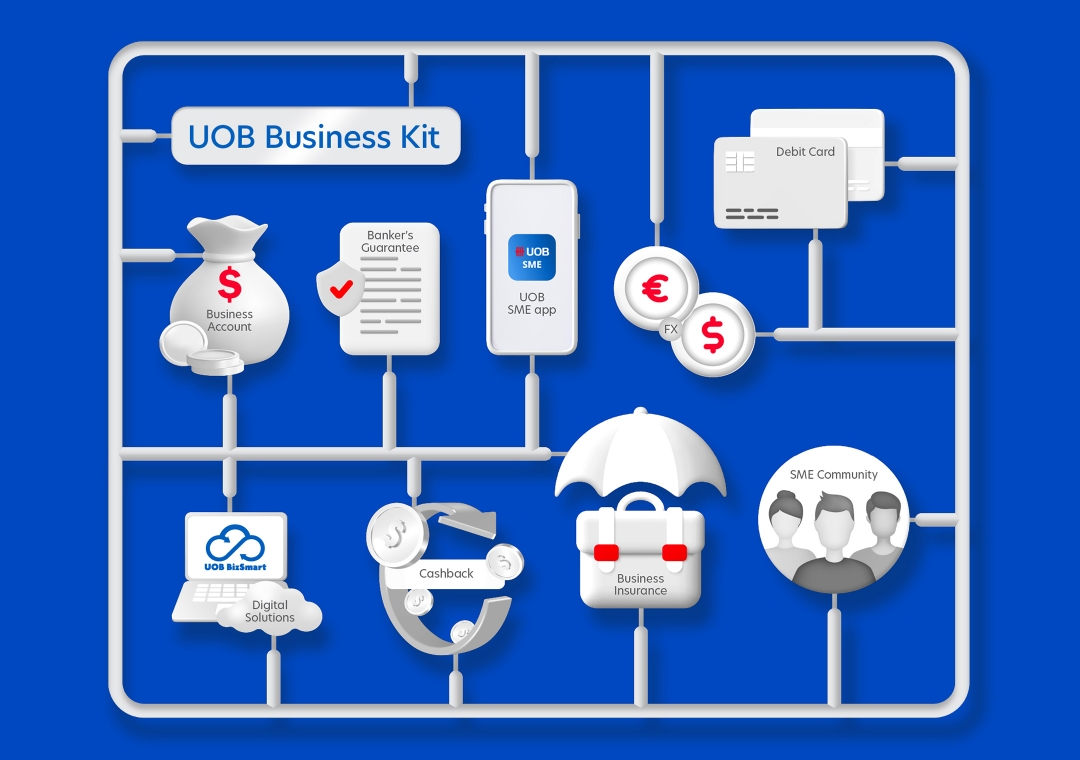

Enjoy more than S$4,000 worth of savings with essential solutions. T&Cs apply.

Explore UOB Business Kityou are in GROUP WHOLESALE BANKING

Get UOB Business Kit – an all-in-one suite of essential solutions for businesses to enjoy more than S$4,000 savings, maximise productivity and expand your network.

Apply now to enjoy this exclusive offer for UOB BizCare.

T&Cs apply.

Get UOB Business Kit – an all-in-one suite of essential solutions for businesses to enjoy more than S$4,000 savings, maximise productivity and expand your network.

Apply now to enjoy this exclusive offer for UOB BizCare.

T&Cs apply.

Add-on premium for Public Liability (to maximum limit $2,000,000):

Add-On Premium for All Risks (maximum sum insured $1,000,000):

Includes coverage for:

The included coverages will not exceed the overall sum insured of $25,000.

You've put your heart and soul into your business and your people. Guard them.

Watch Ms. Hazel Hok of Megumi Japanese Restaurant realising the importance of protecting what matters.

You've put your heart and soul into your business and your people. Guard them.

Watch Ms. Hazel Hok of Megumi Japanese Restaurant realising the importance of protecting what matters.

| Underwritten by | Distributed by |

|

|

BizCare provides coverage for nine types of common business risks, including public liability and cyber security risks – it is more affordable than buying standalone insurance.

It is important to have a business insurance plan that provides wide coverage against unforeseen accidents, as the financial consequences of such unforeseen events could easily wipe out the assets of a small business.

Choose from 3 plans depending on how much coverage you want and pay online. Get a quote here.

BizCare does not include WIC.

You can now purchase BizCare online instantly – simply select your industry type, choose from 3 plans depending on how much coverage you want and pay online. Instant approval, no underwriting required.

You can reach us via the Business Banking hotline (+65) 6259 8188 or drop us a message here.

The above is provided for general information only and is not a contract of insurance. Full details of the terms, conditions and exclusions of this insurance are provided in the policy contract and will be sent to you upon acceptance of your application by United Overseas Insurance Limited (“UOI”). You may wish to seek advice from a qualified adviser before making a commitment to purchase the product. In the event that you choose not to seek advice from a qualified adviser, you should consider carefully whether this product is suitable for you. United Overseas Bank Limited (“UOB”) does not hold itself out to be an insurer, insurance broker or insurance agent. The insurance products and services stated herein are provided by UOI. This advertisement has not been reviewed by the Monetary Authority of Singapore.

BizCare may only be purchased by selected customers of the Business Banking segment of UOB.

While all information provided herein is believed to be correct and reliable at the time of publishing or posting online or, where applicable, printing, UOB and UOI make no representation or warranty whether express or implied, and accept no responsibility or liability for its completeness and accuracy.

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for the policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the General Insurance Association (GIA) or SDIC websites.

United Overseas Bank Limited Co. Reg. No. 193500026Z

United Overseas Insurance Limited Co. Reg. No. 197100152R

Please refer to the applicable policy contract for the full details of the terms, conditions and exclusions of this insurance product.

Click here for full BizCare Promotion Terms and Conditions.

1BizCare will cater for most of types of businesses in the "small business" segment, with the following exceptions: Bar, discotheque, KTV; Business activities involving Explosives, Furnace and Kiln (brickworks, iron works, coal and steel mills); Catering and food delivery services; Containers and/or paper board boxes; Courier services; Flammable and hazardous products; Foams and plastics; Jewellery, timepieces, antiques, work of arts, sculptures, stamps, precious stones / metals, coins and currency notes; Joss sticks and incense paper; Kiosk and push cart outside shopping mall; Livestock; Money changers, pawn shops; Motor and repair workshops; Nurseries and landscape; Paints and varnish; Petrol Stations; Soho office; Spray painting / Varnishing / Paint retail shop; Wordworking risks; Manual work involved outside of insured’s own premises except for the purpose of delivery of goods only; Risks outside of Singapore; Premises not of brick / tile / concrete construction and/or with properties kept in the open or without perimeter fence; Shops / stores situated in a wet/ dry market.

This list is not exhaustive, UOI reserves the rights to exclude any other trades/ businesses that are not stated in the list.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.