Foreword by CIO

This year’s evolving macro landscape has tested investor conviction, with elevated policy uncertainty and persistent market volatility shaping the sentiment. Yet, beneath the surface, the global economy continues to expand and this reinforces our constructive view on equities.

Meanwhile, the gradual erosion of US dollar dominance has prompted many countries to diversify their foreign reserves into gold. However, the dollar’s supremacy remains intact for now, backed by its liquidity, convertibility, and related financial infrastructure.

Against this backdrop, these developments introduce both headwinds and opportunities. In response, investors should consider strategies that balance resilience with agility, ensuring portfolios remain aligned with long-term goals while adapting to a changing environment.

In our 2H 2025 Investment Outlook, we highlight the themes we believe will be most influential in the months ahead. We also explore how a forward-looking and diversified approach can help investors capture upside potential while strengthening portfolio resilience.

To make the most of these opportunities, I highly encourage you to speak with your Senior Client Advisor for tailored advice on managing your investment portfolio and positioning for emerging market trends.

We hope this provides clarity on the opportunities we see—and how we continue to help you stay one step ahead.

Dr Neo Teng Hwee

Chief Investment Officer and

Head of Investment Products and Solutions

UOB Private Bank

Outlook at a glance

Key themes to watch

Trump 2.0

President Trump’s fiscal expansion plans including domestic tax cuts and deregulations could lift US corporate earnings. With tariff receipts, President Trump can use these duty revenues to fund the corporate tax cuts.

Mid-cycle pause

Despite de-escalations, tariffs and policy volatility could continue to affect global trust and market dynamics in the near term. Seasonal volatility can be expected in 3Q 2025 but investors should take this opportunity to build positions into a historically strong 4Q 2025. Diversification and currency risk management will be key to building portfolio resilience.

AI rising diffusion

The investment in AI technologies today can yield robust returns, especially as costs fall and applications expand from digital realms into physical spaces. This transition to embodied AI creates an exciting frontier that could transform how we live and work, and entails lucrative investment opportunities down the road.

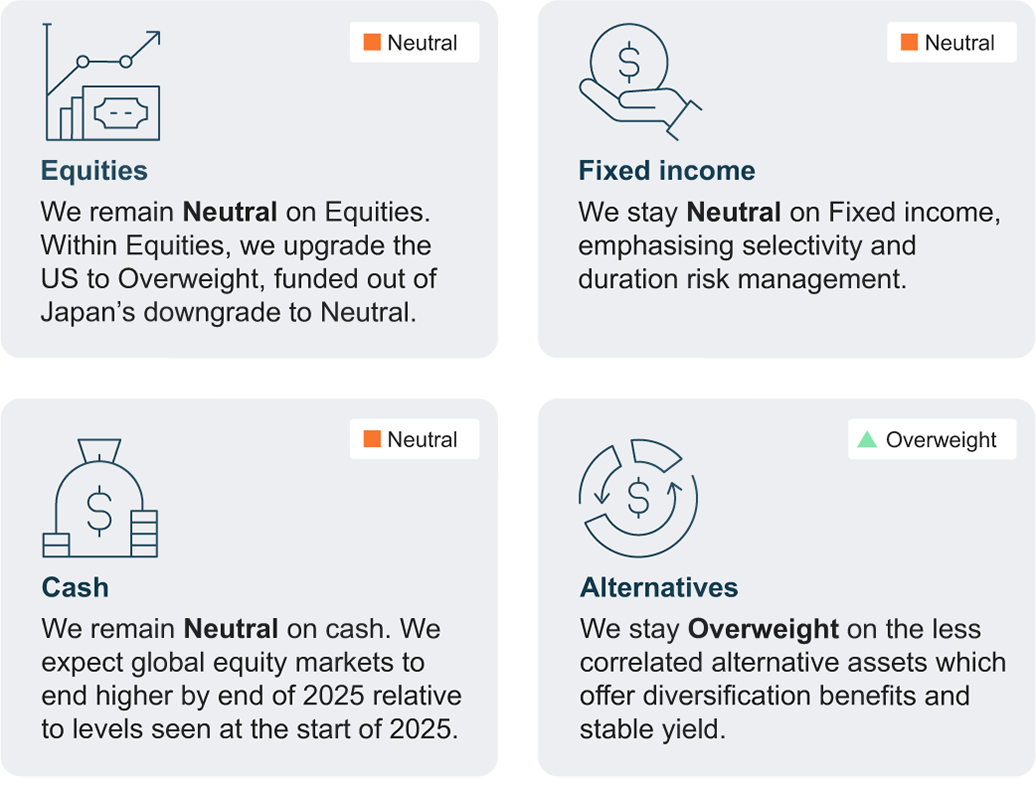

Asset allocation for 3Q 2025

Discover more insights

Report

From Depths to Dawn

Dive into our 2H 2025 Investment Outlook for a comprehensive analysis of macroeconomic trends, asset class perspectives, and actionable strategies to help you navigate today’s evolving landscape.

Podcast

From Depths to Dawn: Navigating 2H 2025

Markets have rebounded from the Liberation Day sell-off but uncertainty still lingers.

In this episode, our Head of Investment Strategy, Kelly Chia, distils the key investment themes for the second half of 2025 and shares how you can position your portfolio for resilience and growth.

Article

The dollar’s shifting sands: Navigating the future of global reserve currency

With global realignments gathering pace, the US dollar’s role as the world’s reserve currency is being re-examined.

Read Dr Neo Teng Hwee's full analysis in this article with The Business Times to understand the implications and opportunities ahead.

Things you should know

Important notice and disclaimers

The information contained in this publication (and any articles, materials or video content relating to this publication) is given on a general basis without obligation and is strictly for information purposes only. This publication (including any articles, materials or video content relating to this publication) is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication (including any articles, materials or video content relating to this publication) constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed therein.

The information contained in this publication (and any articles, materials or video content relating to this publication), including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the publication date of the relevant materials or content, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained therein, United Overseas Bank Limited ("UOB") and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. The views expressed in this publication (and any articles, materials or video content relating to this publication) are solely those of the authors', reflect the authors' judgment as at the relevant date of publication and are subject to change at any time without notice. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/ damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication (and any articles, materials or video content relating to this publication).

Any opinions, projections and other forward looking statements contained in this publication (and any articles, materials or video content relating to this publication) regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information provided should not be construed as research or advice and has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.

Copyright © 2025 United Overseas Bank Limited All Rights Reserved United Overseas Bank Limited Co Reg No 193500026 Z