Why it matters today

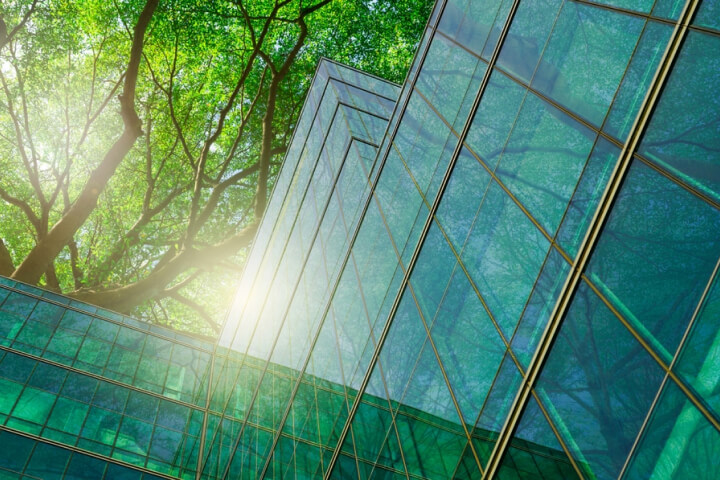

We are living in times of environmental and sustainability changes, from climate change to income inequality. This makes sustainable investing more important than ever. As investors, we have the power to use our capital to make a positive difference.

How it adds value to your portfolio

Sustainable investing is a way of future-proofing your portfolio. It can help you:

Why invest with us

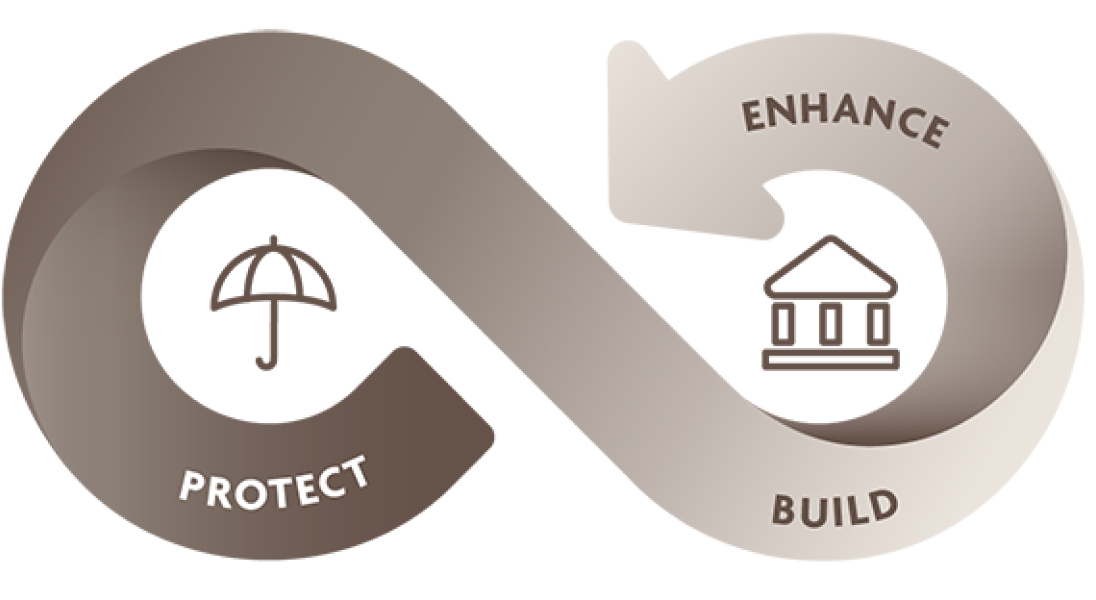

Our unique Risk-First Approach ensures you understand your risk appetite as the starting point in your wealth journey. This means we first identify how much risk you are able and willing to take, before considering the returns you would like to achieve.

Sustainable investing is well-aligned with our Risk-First approach.

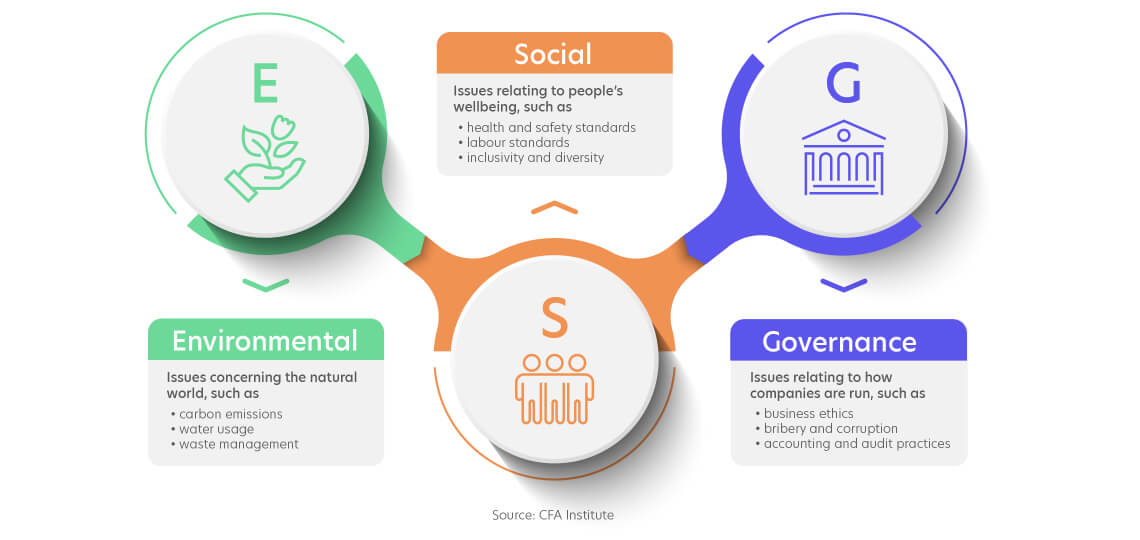

Developed in consultation with industry specialists, our sustainable investing framework is a methodology that enables us to screen, score and monitor each investment to sieve out suitable offerings for you.

In partnership with ESG specialists, we bring you sustainable investment solutions that are suited to your needs, preferences and values.

Get in touch

Get in touch

Call our 24-hour UOB Wealth Banking hotline at 1800 222 1881 (Singapore) or +65 6222 1881 (overseas).

For existing Wealth Banking clients

Tap on the Wealth Banking icon on your home page on the UOB TMRW app for your Relationship Manager’s name and contact details.

Start a Wealth Banking relationship with us

Sign up as a Wealth Banking client with a minimum of S$100,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Relationship Manager will contact you.

Things you should know

Important notice and disclaimers

The above information shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein. The information contained herein, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the article, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information provided.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Articles for you

Sustainable living with Charlotte Mei

April 2023 • 2 min read

Understanding unit trusts: What they are and how they work

June 2020 • 7 min read

3 things you need to know before you start investing

June 2020 • 6 min read