1 of 3

What do you need help with?

1 of 3

Receive up to 3g of UOB Gold Bars worth more than S$900 with UOB eBusiness Account opening and online FX transactions. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

As issuing bank of the BG, UOB will pay your beneficiary upon receipt of a compliant demand.

An alternative guarantee instrument to support your contracts with suppliers/buyers.

| Services | Fees |

| Non-financial | Up to 2 years: min. 1% p.a. or S$150, whichever is higher, subject to bank arrangement Above 2 years: min. 1.5% p.a. or S$150, whichever is higher, subject to bank arrangement |

| Financial | Min. 2% p.a. or S$150, whichever is higher, subject to bank arrangement |

| Non-Standard Text | S$100 flat (this charge is in addition to Issuance fee) |

| Amount | Same fees as issuance |

| Tenor | Same fees as issuance |

| Other Amendments | S$75 flat |

| Services |

| Non-financial |

| Financial |

| Non-Standard Text |

| Amount |

| Tenor |

| Other Amendments |

Click here for other charges applicable to all trade products.

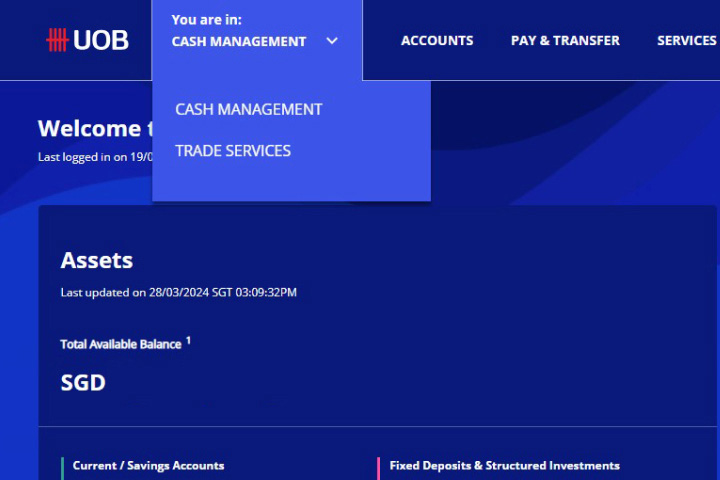

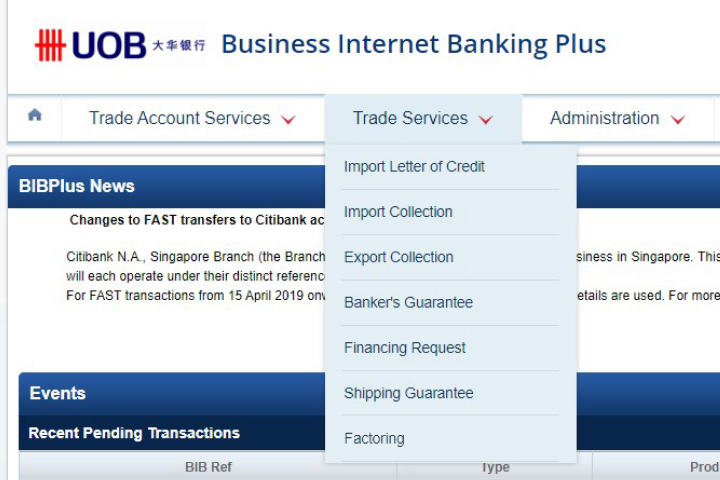

Select Trade Services.

Select trade product, complete & submit trade application or performing enquiry function.

A BG is a definite undertaking by the bank (guarantor) to pay the beneficiary a certain sum of money within a specified period if the applicant (principal) fails to fulfil his contractual or other obligations of an underlying transaction.

Like BG, SBLC is an independent payment obligation which is payable by Issuing Bank against beneficiary's compliant demand.

BG may be subject to the International Chambers of Commerce (ICC) ’s Uniform Rules for Demand Guarantees (“URDG758”). SBLC may be subject to ICC's Uniform Customs & Practice for Documentary Credits (“UCP 600”), or International Standby Practices ("ISP98”). BG / SBLC may be subject to country law as well.

There are generally the following parties in a BG / SBLC:

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.