1 of 3

What do you need help with?

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

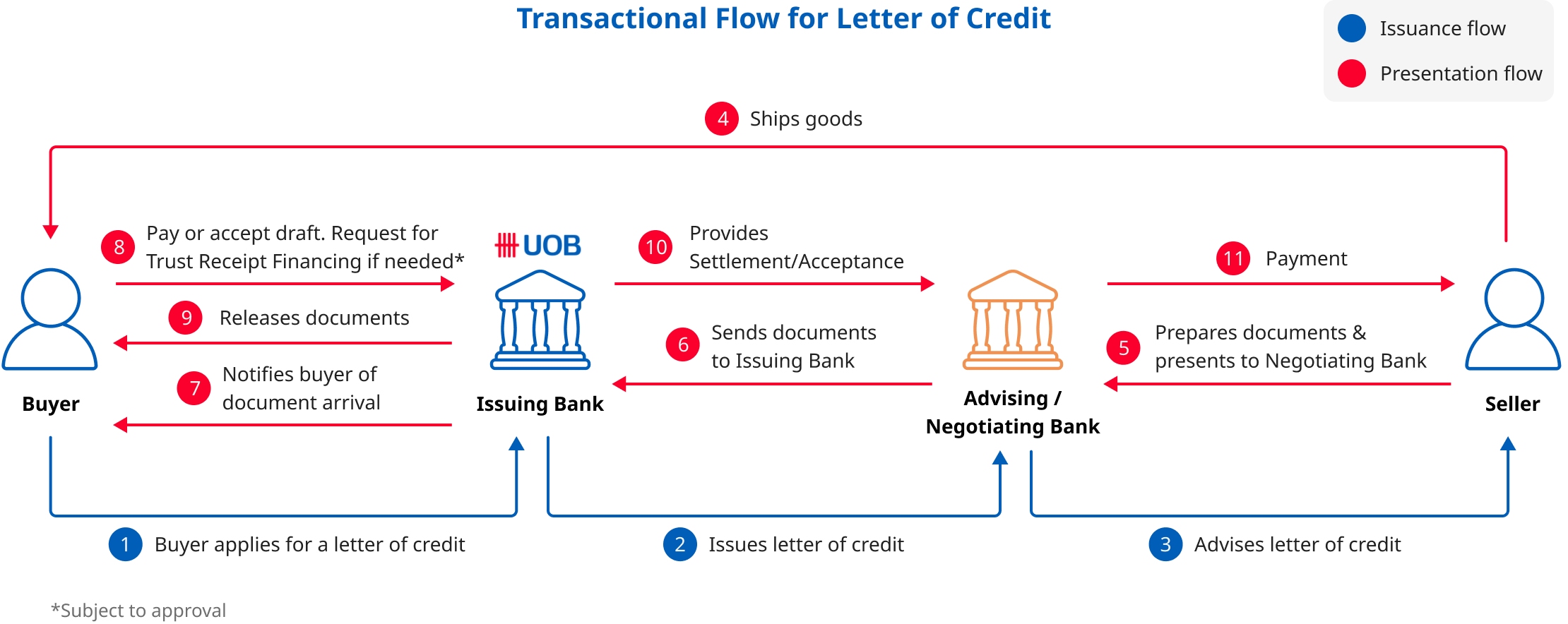

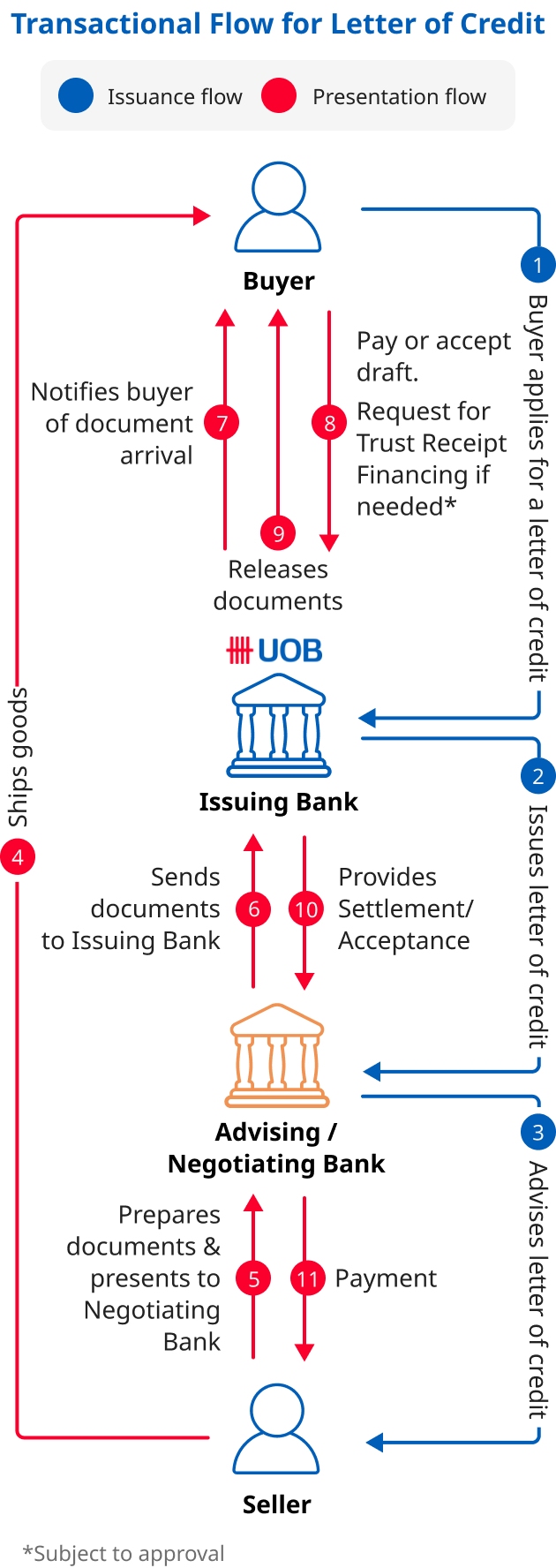

After the Buyer and Seller establish an agreement, Buyer applies for a Letter of Credit (LC). UOB issues the LC.

Once goods are shipped, Seller submits documents to their banker. Presenting Bank checks if documents are compliant and sends documents to UOB.

UOB checks documents for compliance to LC terms. Buyer to provide settlement instruction before documents are released.

After the Buyer and Seller establish an agreement, Buyer applies for a Letter of Credit (LC). UOB issues the LC.

Once goods are shipped, Seller submits documents to their banker. Presenting Bank checks if documents are compliant and sends documents to UOB.

UOB checks documents for compliance to LC terms. Buyer to provide settlement instruction before documents are released.

| Services | Fees |

| Issuance of LCs | 1/8% per month, min 1/4% or S$75 whichever is higher |

| LC Amendments | Increase of LC value: 1/8% per month, min. 1/4% or S$75 whichever is higher Extension of LC Expiry: 1/8% per month of outstanding balance, min. S$75 Other Amendment: S$75 |

| Non SWIFT/Paper LC Issuance to Other Banks | S$100 flat (this charge is in addition to Issuance/Amendment fee) |

| Inward Documentary Bills | Usance LC acceptance: 1/8% per month from LC expiry date to due date, min S$75 LC overdrawn: 1/8% per month, min 1/4% or S$75 whichever is higher Discrepancy Fee: S$100 flat |

| Services |

| Issuance of LCs |

| LC Amendments |

| Non SWIFT/Paper LC Issuance to Other Banks |

| Inward Documentary Bills |

Click here for other charges applicable to all trade products.

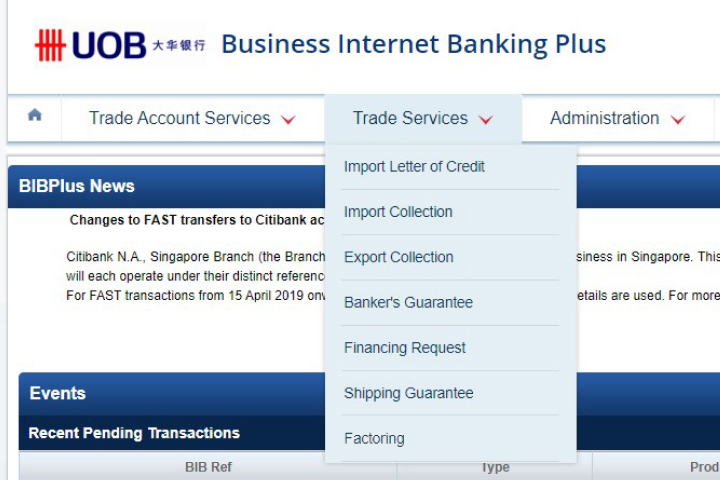

Select Trade Services.

Select Import Letter of Credit, complete the application and press submit

Applicant

Beneficiary

Issuing Bank

Advising Bank

You may submit your application or collect your trade documents at any of our Trade Counters. Click here to find the Trade Counter nearest to you.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.