1 of 3

What do you need help with?

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

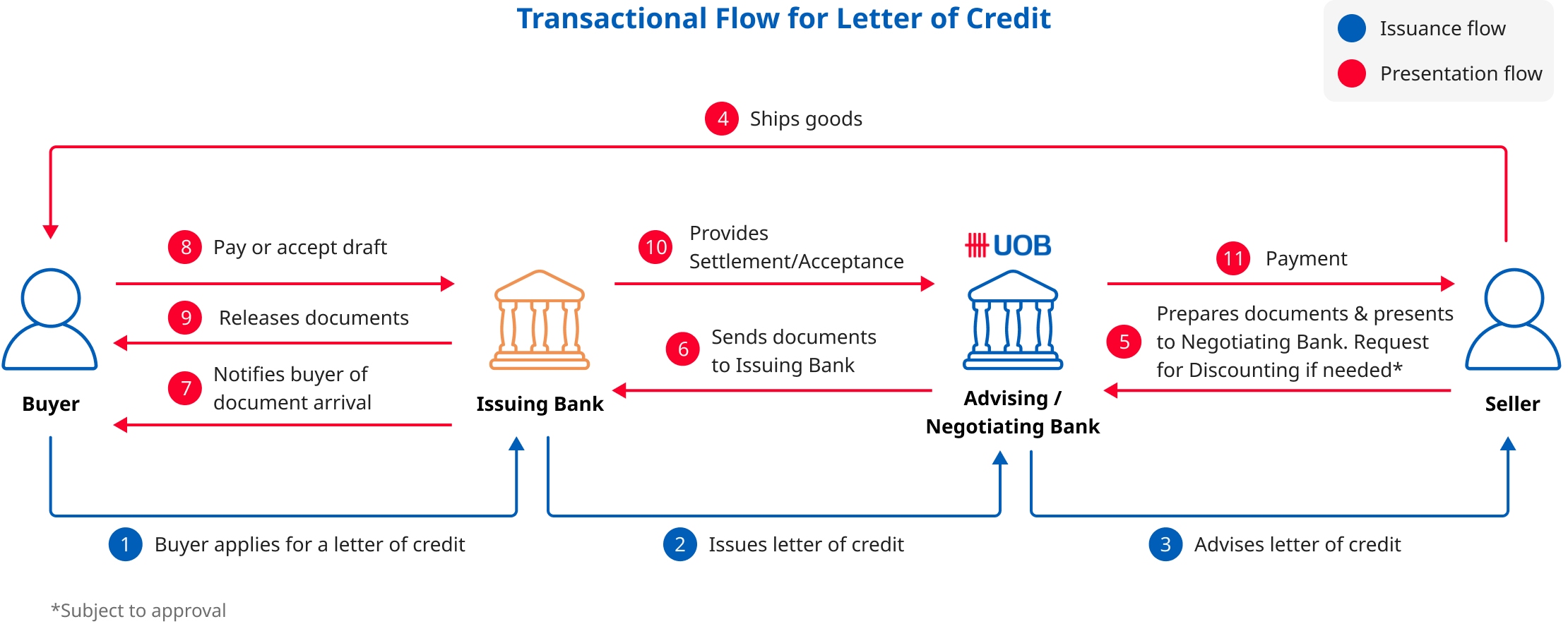

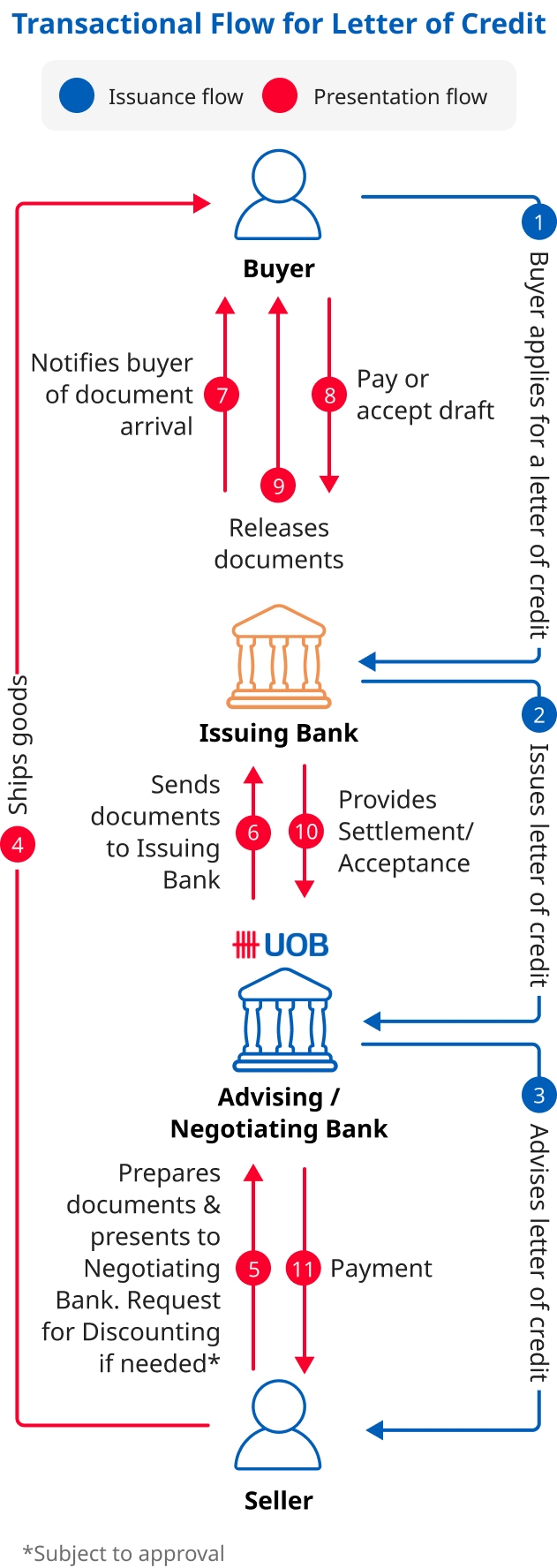

UOB will notify you upon receipt of Letter of Credit (LC) from the Issuing Bank. If confirmation is added, UOB will pay upon compliance with LC terms.

Seller ships goods and presents documents to UOB for handling and negotiation.

UOB presents documents to Issuing Bank for payment according to terms of the LC. Discounting can be arranged, subject to approval.

UOB will notify you upon receipt of Letter of Credit (LC) from the Issuing Bank. If confirmation is added, UOB will pay upon compliance with LC terms.

Seller ships goods and presents documents to UOB for handling and negotiation.

UOB presents documents to Issuing Bank for payment according to terms of the LC. Discounting can be arranged, subject to approval.

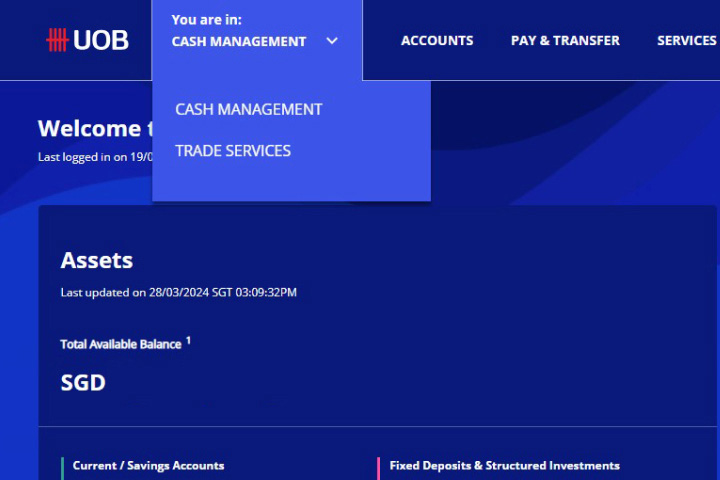

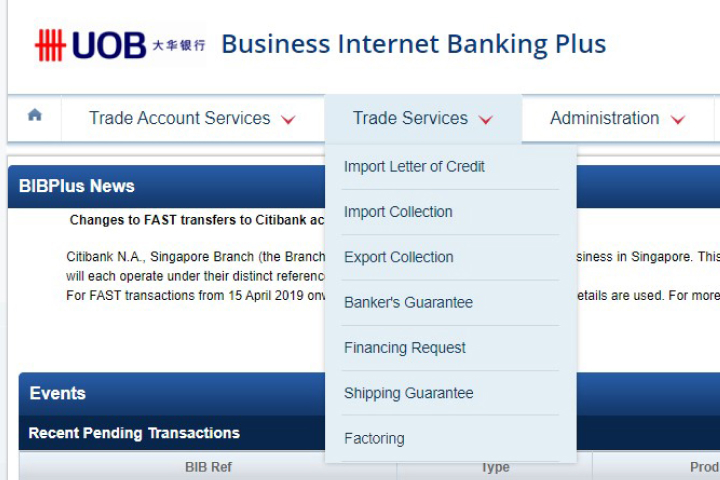

Select Trade Services.

Navigate to Trade Account Services > Transaction and Reports > Advices and Notifications to obtain a copy of your LC.

Applicant

Beneficiary

Issuing Bank

Advising Bank

Confirming Bank

Negotiating Bank

Apply for UOB eAlerts to receive real-time notifications on your document status.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.