You are now reading:

4 uncommon insights on why investing or owning a business property can help SMEs

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

You are now reading:

4 uncommon insights on why investing or owning a business property can help SMEs

Growth is the top priority of any SME. If your current lease is about to expire and would like to take your business to new levels or understand the benefits of buying a commercial space despite the higher upfront cost – Read on to find out why buying should be considered as not only a long term investment but as an inevitable part of the growth journey.

Besides taking advantage of asset appreciation when the value of your property increases over time and the rental potential where remaining space can be rented out to tenants or co-sharing spaces, ownership actually provides more liquidity and cash flow in the long run.

How is that so?

This existing commercial property that you own can be used as equity collateral to obtain extra funds and capital for various business needs when required, such as hiring additional manpower, buying / upgrading new equipment and vehicles, or going for bulk inventory purchase to gain bulk discounts, etc.

The additional capital could even be used to adopt new digital capabilities or upgrade employees' skill sets so SMEs can work faster and smarter.

This should be pondered especially with the current ongoing disruption of various industries as highlighted in the Prime Minister's May Day message; the need for more capital to explore new digital ways of working has become more important.

When owning a property, you have the luxury of selling it for more capital once the value has gone up. More capital can then be used to grow your business in a countless number of innovative ways.

While there is a higher upfront cost when it comes to buying, sometimes rental agreements might have monthly rentals that are more expensive than the repayments of a property loan, causing the total cost of rental fees to actually be higher than cost of purchase.

Plus rental rates are subject to potential increments annually. In the first quarter of this year, office rental prices have already risen by 2.6 percent.

Buying offers multiple upsides on the other hand. SMEs can pay the mortgage back in predictable monthly instalments, giving them control over their expenses. Interest costs can also be lower than rental costs in some cases.

Weigh the pros and cons of buying and renting with UOB's Buy vs Rent calculator, and calculate to find out which option provides you with more savings over time.

While rental fees might be commonly perceived as a more sustainable form of payment, the reality is that it might cost SMEs in the long run.

An SME's property should be as dynamic as its business. New business requirements can arise in the matter of days and weeks and new facilities and adjustments will need to be met.

For instance, a logistics company might need more storage space to hold onto new inventory. A web development business might need to break down a wall to make way for an additional server room that will enhance its computing power and data storage for IT innovation plans. The possibilities are numerous.

A rental contract will serve as an obstacle for SMEs' ability to operate quickly and flexibly in this instance. Making changes to the property will require multiple layers of approval from landlords. Contractual clauses might also prevent specific changes from being made.

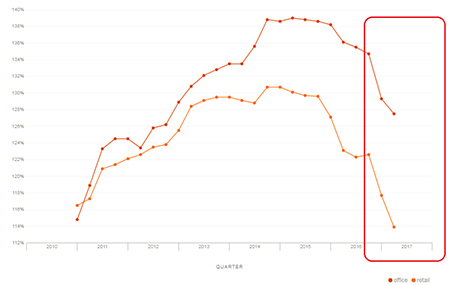

Another piece of good news for buyers is the declining property prices. In 2017, the prices for office and retail spaces fell drastically.

Source: data.gov.sg

Moreover, prices are drastically lower than the peaks in 2014 – 2015. With this general decline in mind, it is an opportune time to consider buying a commercial property.

According to the Urban Redevelopment Authority (URA), office space prices showed just a slight upturn in the first quarter of 2018 where prices rose by 1.3 percent on the back of Singapore's strong economic growth of 4.3 percent YoY.

Therefore, SMEs looking to get the best value out of their property investment should seize the moment and start planning on how best to finance the purchase.

With the right support from a trusted business banking partner, loans such as the UOB Business Property and Equity Loan are available to finance various kind of business premises and can fund a significant portion of the property's valuation or purchase price, lowering the barrier of high upfront payments.

Request for a call back at your convenience to discuss competitive rates and subsidies to legal and valuation fees. The journey becomes more rewarding and hassle-free too when you can get an approval status shared via SMS as fast as 1 business day^.

*^Terms and conditions apply, visit here for more information.

20 Nov 2025 • 5 mins read

12 Aug 2025 • 7 mins read

30 May 2025 • 3 mins read

29 Apr 2025 • 3 mins read