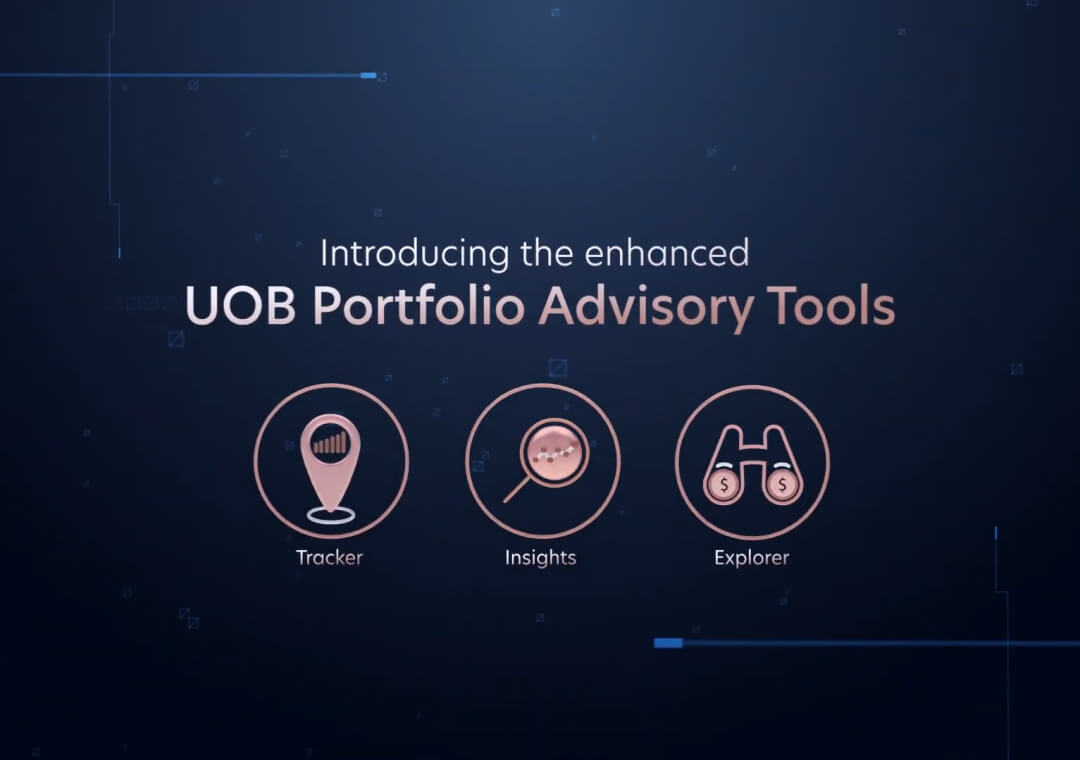

Our digital advisory tools

These complementary tools are designed to help monitor, manage and optimise your wealth portfolio.

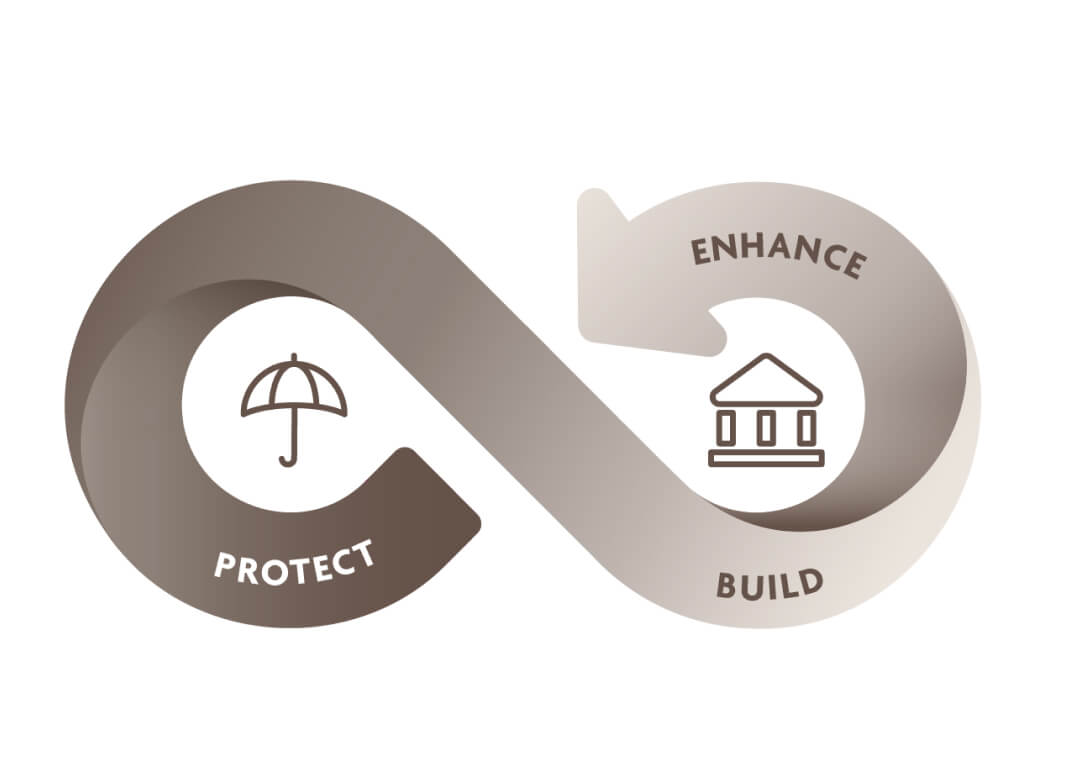

Anchored on our unique Risk-First Approach

With Portfolio Advisory Tools, the recommendations you receive are anchored upon UOB’s proprietary Risk-First Approach to wealth management, which is about helping you ensure that the risk you take is appropriate to your risk profile and the wealth goals you seek to achieve.

Portfolio Advisory Tools have been awarded with industry recognition and are designed to support our Advisors in delivering advice that is:

- Comprehensive

- Relevant

- Actionable

Get in touch

Get in touch

Call our 24-hour UOB Wealth Banking hotline at 1800 222 1881 (Singapore) or +65 6222 1881 (overseas).

For existing Wealth Banking clients

Tap on the Wealth Banking icon on your home page on the UOB TMRW app for your Relationship Manager’s name and contact details.

Start a Wealth Banking relationship with us

Sign up as a Wealth Banking client with a minimum of S$100,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Relationship Manager will contact you.

Things you should know

Eligibility

To qualify for UOB Wealth Banking, you will need to maintain a minimum balance of S$100,000 (or its equivalent in a foreign currency) in deposits and/or investments with us.

Disclaimers

*SGFinDex, or the Singapore Financial Data Exchange, is a joint initiative by the Monetary Authority of Singapore (MAS) and the Smart Nation and Digital Government Group (SNDGG), with the support of the Ministry of Manpower (MOM).Source: https://www.mas.gov.sg/development/fintech/sgfindex.

This above information should not be regarded as an offer, recommendation, solicitation or advice to buy or sell any investment product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment products is qualified in its entirety by the terms and conditions of the investment product and if applicable, the prospectus or constituting document of the investment product. Nothing above constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained above, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the articles, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained above, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accepts no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information above.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts/products that are covered under the Scheme.